Payrolls Nov 25: Into the Weeds

Weak employment showing fewer pockets of strength with health care payroll the main source of support.

Health care needs to stay healthy in payroll numbers.

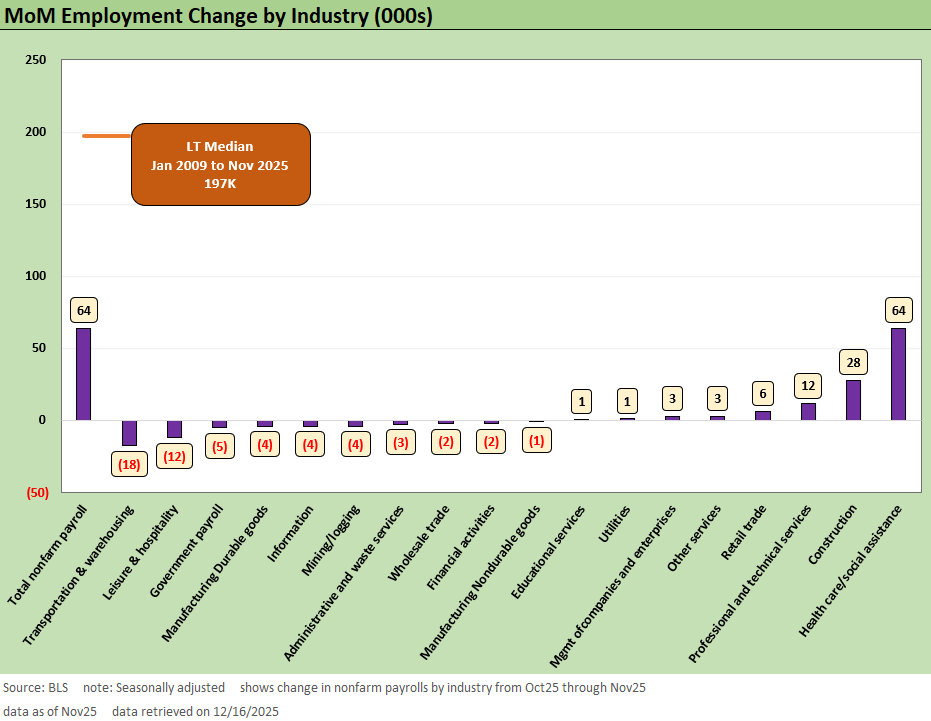

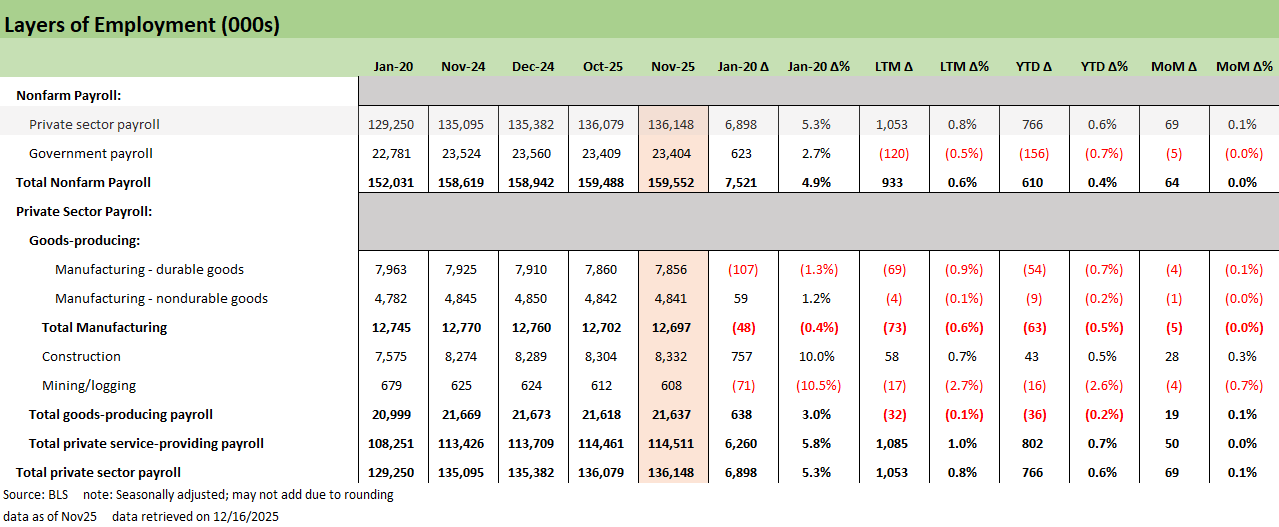

November nonfarm payrolls rose +64K with private up +69K and Government at -5K. The headline came in positive, but the composition is not favorable.

Job growth remained concentrated in Health Care (+64K), with construction a strong runner up at +28K. Those gains offset notable declines in Transportation & Warehousing and Leisure & Hospitality.

The Employment Situation report skipped the October Household data due to the shutdown, but the Establishment data showed a -105K loss in October. The Government payrolls were most of that story (-157K).

The new two months of data do not change the story of the year much, as Healthcare job adds of +695K are above the net gains in the entire year (+610K). The construction bump this month is encouraging as to where the narrow AI capex investments are translating into hiring activity, but that is a small blip compared to the composition of the labor market.

Overall, the payroll story is a negative even if the 4.6% employment rate is not a scary number by any stretch in longer term historical context (see Employment Nov 2025: Bad News is Bad News 12-16-25).

The November MoM employment change shown above reads weak on net adds and composition. The +64K healthcare vs. +64K net adds this month underscores the reality the healthcare industry dominates the job adds in 2025. The growth in healthcare reflects the demographics supporting that services line. Within the “Goods” sector, Construction is a distant second at +28K as nonresidential construction activity picked up considerably in November.

The biggest drags on the month are from Transportation & Warehousing (-18K) and Leisure & Hospitality (-12K). Contracting ahead of the holiday season does not bode well on the level of leisure spending, though this morning’s retail sales print still shows core retail sales expanding. The major concern is whether or not the breadth of today’s print continues a trend of increasingly late-cycle payroll activity, as cyclical industries continue to lag behind.

We added the above chart to provide context for October after the shutdown disruptions. This data is from the Establishment data solely. The standout is the decline of -157K for Government. That drove a negative net payroll number, but even excluding that expected drop, net adds ex-Government were only +52K total. The mix above is skewed even more negative vs. November, and once again Healthcare jobs drove the majority of adds with Leisure & Hospitality at only +16K, a double-digit gain on the month.

The chart above helps to clarify where the payroll growth slowdown is unfolding. The average payroll adds in the last 3M now sits just over +22K, and the 6M average is just under +20K. With healthcare supporting so much of that mix, it is hard to remain positive on the direction of employment in the coming months.

The above chart provides the big split across private vs. public and services vs. goods-producing. The private sector remains the source of job growth, with the shutdown now driving a negative YTD public payroll adds figure. As covered already, the private growth is heavily driven by services rather than goods, with the more cyclically sensitive portions of the labor market being soft.

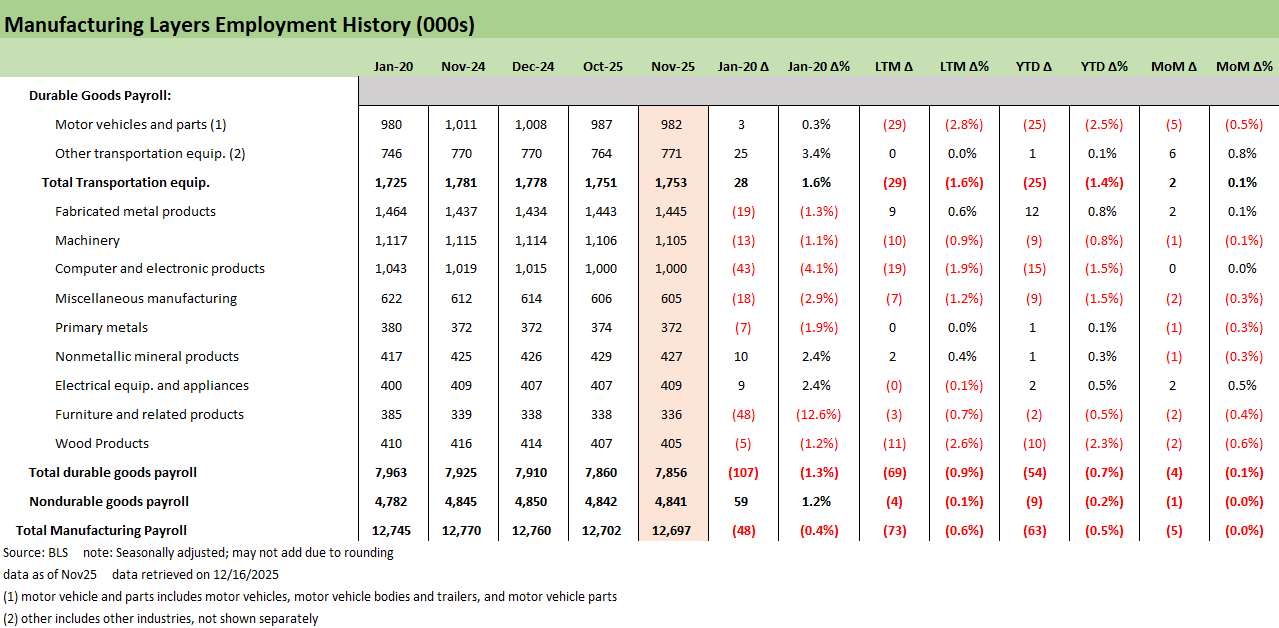

The durables manufacturing payroll mix above shows a slow bleed again in November, with only Other transportation equipment (+6K), Fabricated metal products (+2K), and Electrical equipment and appliances (+2K) expanding this month. The overall pattern for 2025 mirrors that trend with very few areas of growth set against some pretty large declines.

Record AI capex investment narratives and the labor data above give some pause around where those benefits will be realized. The employment growth will show up most clearly in data center adjacent supply chains and construction, not in broader durable goods hiring. We will be watching in the coming months to see where that boom in a narrow set of tech-linked categories might show up while the rest of the manufacturers look like a slow grind or decline in the data above.

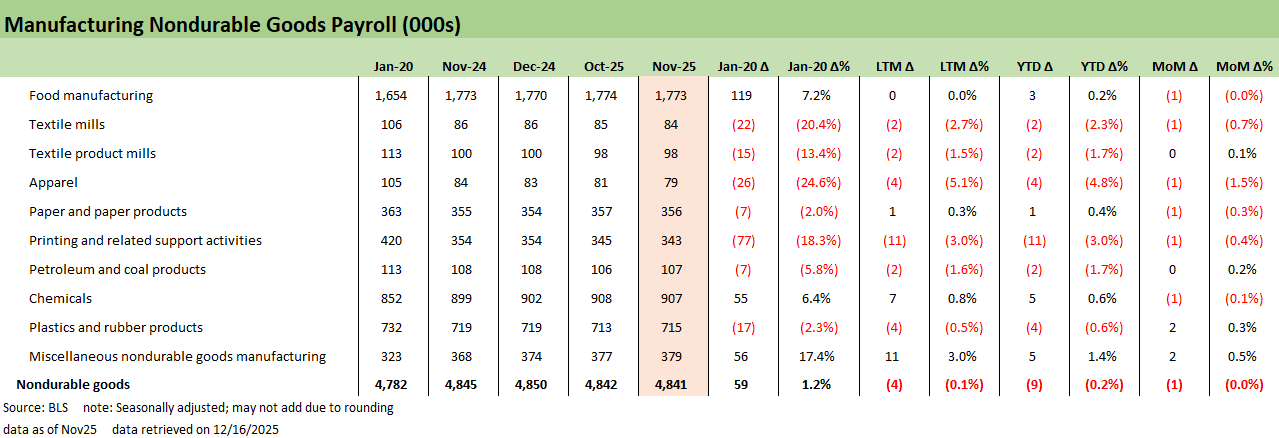

Nondurables reinforce the same manufacturing story but with a lot more secular decline across the longer time horizons. As domestic production for the above continues to soften, there appears to be very little a tariff regime can do in order to bring these back. Reshoring across many of the above is not economically viable but the tariffs do inflate prices in the supply chains. We have seen more inflation pressure in nondurables in reporting.

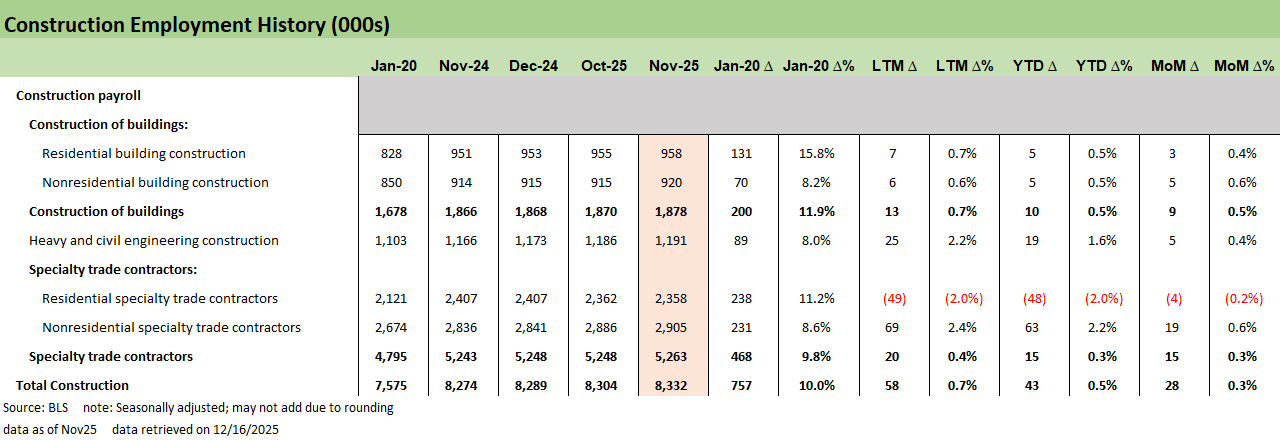

Construction is one of the only clear bright spots away from services with a clear jobs focus on nonresidential activity. The month-to-month move reflects the year’s trend with residential contractors shifting to nonresidential contractors. Whereas durables have not seen the pickup due to infrastructure spending, the pattern above strongly suggests where that power grid and data work is impacting the payrolls numbers.

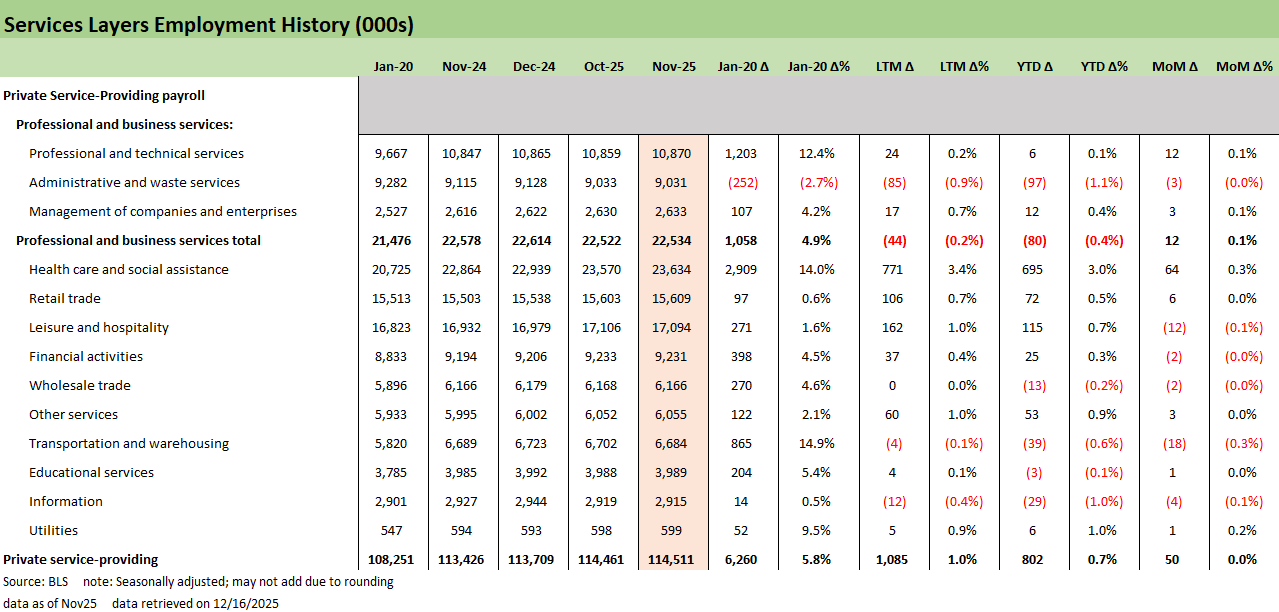

Services payroll numbers shown above continue to be the core of the gains in the report, with Healthcare still the main engine. We’ve looked at the composition in previous pieces, but the Healthcare line is only 15% of the broader employment picture that is driving more than the entire net payroll adds on the year. That is clearly not a labor market firing on all cylinders.

For the healthcare sector in particular, the lack of resolution on the ACA subsidies leaves big questions about forward risk as margins become squeezed with policy and funding uncertainties. The mega trend of healthcare adds does not need a collapse, but even just the lower visibility on reimbursement and weaker payer mix could lead to a slowdown here.

Elsewhere in services, we see more potential late-cycle markers. Leisure and Hospitality and Transport and Warehousing are key goods and shipping lines that were down in November. Leisure and Hospitality in particular has been another strong contributor in 2025, but the small setback this month ignites debates around the sustainability of the K-shaped economy themes. Whether or not this section of services bounces back in December, or if this month is the start of a trend, will be important to watch in future releases.

Finally, the Government lines above show the shutdown carnage from the October numbers with Federal now down 268K YTD with 157K of the decline in October alone. Local hiring has acted as a stabilizer for public payrolls growth until the shutdown with +147K on the year. We see the practical way to look at this report is to exclude these government lines above, as the cyclical signals are elsewhere and the shutdown numbers act as more of a relic of the shutdown period.

See also:

Employment Nov 2025: Bad News is Bad News 12-16-25

The Curve 12-15-25

Market Commentary: Asset Returns 12-14-25

Market Lookback: FOMC Fragments, Rate Debates Murky 12-13-25

FOMC: Dot Plot Scatters for 2026 12-10-25

Employment Cost Index 3Q25: Slowing but Above CPI 12-10-25

JOLTS: Goldilocks’ Ugly Twin 12-9-25

Mini Market Lookback: Data Digestion 12-6-25

PCE, Income & Outlays: Calendar Gap Closing 12-5-25

Credit Markets 12-1-25

Mini Market Lookback: Back into the June 2007 Zone 11-29-25

Durable Goods Sep 2025: Quiet Broadening of Core Capex 11-26-25

Retail Sales September 2025: Foot off the Gas 11-25-25

The Curve: Flying Blind? 11-24-25

Mini Market Lookback: FOMC Countdown 11-23-25

Employment Sept 2025: In Data We Trust 11-20-25

Payrolls Sep25: Into the Weeds 11-20-25

Mini Market Lookback: Tariff Policy Shift Tells an Obvious Story 11-15-25

Retail Gasoline Prices: Biblical Power to Control Global Commodities 11-13-25

Simplifying the Affordability Question 11-11-25

Mini Market Lookback: All that Glitters… 11-8-25

Mini Market Lookback: Not Quite Magnificent Week 11-1-25

Synchrony: Credit Card Bellwether 10-30-25

Existing Home Sales Sept 2025: Staying in a Tight Range 10-26-25

Mini Market Lookback: Absence of Bad News Reigns 10-25-25

CPI September 2025: Headline Up, Core Down 10-24-25

General Motors Update: Same Ride, Smooth Enough 10-23-25

Mini Market Lookback: Healthy Banks, Mixed Economy, Poor Governance 10-18-25