Durable Goods Sep 2025: Quiet Broadening of Core Capex

A positive September durable goods print in the wake of the shutdown is made more encouraging by broader underlying improvement.

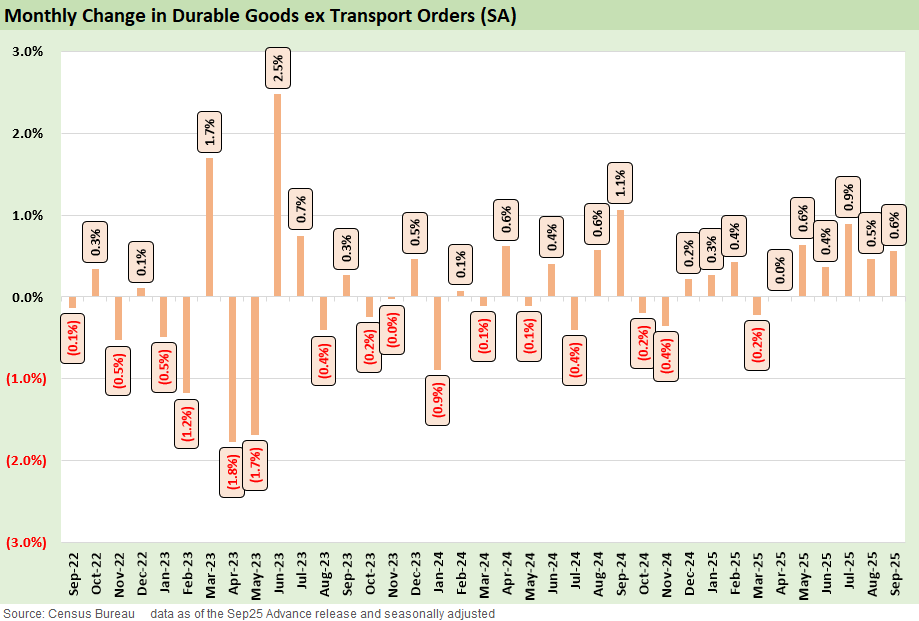

Headline durable goods orders rose +0.5% MoM in September after a strong +3.0% in August, with transport equipment up +0.4% and orders now higher for two consecutive months. Stepping below to ex-transport shows a slightly stronger read at +0.6% MoM for a now five-month period of ex-transport order expansion.

The orders growth this year outside aircraft activity has been concentrated in Computers & Electronics and Electrical Equipment. The connection to the massive AI capex spend in the year is clear but the last three months have seen a pickup for more traditional manufacturing spend in a broadening of strength.

With the data backfill slowly rolling in, the fog may be lifting a little but there is still a lot of uncertainty baked in with such a data lag for the upcoming FOMC meeting. This report provides a cleaner read on some real-economy momentum but it is still not a manufacturing renaissance. We would see good cyclical news if the data can “hold serve” into the 4Q25 period.

We still see a slow-burn capex cycle outside the data-centric activity that pushes back a bit on some of the late-cycle narrative, but tariffs and policy uncertainty remains. The same is true for the UST curve backdrop and how the tariff costs and cost of capital flows into 2026 budgets.

The above shows headline durable goods orders, which increased +0.5% MoM in September, following an upwardly revised +3.0% in August. That leaves headline orders up for two straight months after the spring/summer whipsaw around aircraft and tariff headlines.

Against the backdrop of a still-uncertain policy path and elevated long rates, a positive headline is welcome, but the volatility in aircraft and defense reminds us that this is not where the clean signal resides. The path to sustainability of capex demand relies on continued data-related capex on one hand, and on how manufacturing evolves at the intersection of tariffs and tax policy on the other. For now, Fed actions on rates and what is signaled in the December meeting will carry the most weight in near-term improvements for incremental capex.

We focus on the ex-transport series because the headline volatility gives a low-quality signal for underlying demand given the lumpiness of aircraft orders. The improvement in September of +0.6% MoM now builds out to a fairly positive trend since May that has seen an extended run of steady gains.

We read this as a broadening in core capex given the recent compositional changes. The gains are still modest in level terms, and one month (or even two) doesn’t guarantee a durable trend, but the breadth across metals, machinery, and electrical equipment suggests more than just a narrow AI-hardware story. Against late-cycle signals from payrolls, housing, and credit that have turned noisier, this kind of incremental breadth is a useful offsetting data point.

We delve into the underlying details for September with both the ex-Defense and ex-Transport cuts included. Transport Equipment saw a +0.4% MoM swing this month after a very volatile few months. Within that, motor vehicles and parts were up 0.4% MoM, extending a steady run of small positive prints despite tariff and margin pressure in autos.

Core manufacturing categories paint a more constructive picture. Machinery orders were up 0.5% MoM, Fabricated Metals 0.1% MoM, and Primary Metals 1.4% MoM. The strength across these categories sits in contrast to softening payrolls in durable manufacturing, which have shown contraction across 2025. The real capex investment activity still looks very modest across 2025. Rounding out the core manufacturing categories, Computers and Electronic Products and Electrical Equipment also returned to growth after a mixed August and should remain key anchors for continued capex growth in 2026.

The above covers shipments, which provide a cleaner link to near-term GDP and revenue. Total durable goods shipments increased 0.1% MoM in September. Ex-transport shipments were stronger at 0.6% MoM. Within transport, shipments fell 0.9% MoM, driven by a 9.3% MoM drop in nondefense aircraft after a very strong August, partially offset by gains in defense aircraft and other transport equipment.

See Also:

Retail Sales September 2025: Foot off the Gas 11-25-25

The Curve: Flying Blind? 11-24-25

Market Commentary: Asset Returns 11-23-25

Mini Market Lookback: FOMC Countdown 11-23-25

Employment Sept 2025: In Data We Trust 11-20-25

Payrolls Sep25: Into the Weeds 11-20-25

Credit Markets: Show Me the Data 11-17-25

The Curve: Slopes Can Get Complicated 11-16-25

Mini Market Lookback: Tariff Policy Shift Tells an Obvious Story 11-15-25

Retail Gasoline Prices: Biblical Power to Control Global Commodities 11-13-25

Credit Markets: Budget Armistice or GOP Victory Day? 11-12-25

Simplifying the Affordability Question 11-11-25

The Curve: Back to the Future 11-9-25

Market Commetary: Asset Returns 11-9-25

Mini Market Lookback: All that Glitters… 11-8-25

Mini Market Lookback: Not Quite Magnificent Week 11-1-25

Synchrony: Credit Card Bellwether 10-30-25

Existing Home Sales Sept 2025: Staying in a Tight Range 10-26-25

Mini Market Lookback: Absence of Bad News Reigns 10-25-25

CPI September 2025: Headline Up, Core Down 10-24-25

General Motors Update: Same Ride, Smooth Enough 10-23-25

Mini Market Lookback: Healthy Banks, Mixed Economy, Poor Governance 10-18-25

Mini Market Lookback: Event Risk Revisited 10-11-25

Credit Profile: General Motors and GM Financial 10-9-25

Mini Market Lookback: Chess? Checkers? Set the game table on fire? 10-4-25

JOLTS Aug 2025: Tough math when “total unemployed > job openings” 9-30-25

Mini Market Lookback: Market Compartmentalization, Political Chaos 9-27-25

PCE August 2025: Very Slow Fuse 9-26-25