Footnotes & Flashbacks: Asset Returns 2-2-25

We look back at a balanced week for equities that feeds into a solid trailing month as the new world of trade wars arrives.

Which guy was trade wars again?

The tariff shocks arrive this week, so recent asset returns in YTD 2025 (the month of January) will become ancient history very quickly.

The 25% on Canada and Mexico with 10% on Canadian energy comes with a retaliation clause to escalate if the USMCA trade partners/allies don’t simply lie down and surrender (see Tariffs: Questions to Ponder, Part 1 2-2-25). Too late.

The 10% tariff decision on China is generating a little less excitement for now even as Trump confirmed he will be hitting the EU was well. The cumulative effects are that the US is walking into a case study in economic conflict with trade wars on multiple fronts at a time when economic growth is solid and inflation in check. That might qualify as too addicted to headlines (!).

Below we revisit the time horizon returns as January proved to be a solid month to start the year with the benchmark debt and equity returns all positive. Equities put up good numbers in large caps and small caps with NASDAQ among the weaker return after the DeepSeek anxiety (see Mini Market Lookback: Surreal Week, AI Worries about “A” 2-1-25).

We see everything in the 1-month column positive for January in both debt and equities. The returns in equities for the rolling 3-months show good numbers with growth stocks leading. Meanwhile, the rolling 3-months in debt is a little noisier on duration and even negative for 6-months on UST.

The rolling return visual

In the next section, we get into the details of the 32 ETFs and benchmarks for a mix of the trailing periods. Below we offer a condensed 4-chart view for an easy visual on how the mix of positive vs. negative returns shape up. This is a useful exercise we do each week looking for signals across industry groups and asset classes.

As we look at the symmetry above, we see a heavy positive balance for 1-month to start the year. Equities forged ahead on favorable earnings growth forecasts that get regularly updated by FactSet and the street and we are in a 4Q24 earnings season and guidance expectations so far that were constructive. Some of those had some caveats around the potential for major policy setbacks in the area of tariffs, and that should show up in some color this coming week.

The question around what it all might mean in terms of trade partner retaliation and inflation risks is getting quickly answered. If you are the EU, you see an opportunity to react in size since blanket tariffs throw open the doors to retaliate on the broadest scale yet. For EU, you’ll be part of a team effort with Canada and Mexico.

After the election, deregulation and tax cuts had many investors fired up with banks rocking and credit markets comfortable to the point of catatonic on risk pricing. Now the short walk from broad deregulation to unbridled chaos is getting some visibility.

The sector rotation debates have been ebbing and flowing the past few months and the UST bear steepening of the UST curve during 2024 saw a fresh round of volatility since the Sept lows. The experience since late 2023 on “calling the curve” and the post-easing steepener has promoted humility in UST table pounding. The on-and-off tech excitement got a jolt this past week from DeepSeek that saw the tech ETF (XLK) plunging into the bottom quartile for the week and the trailing 1-month while hammering some AI bellwethers.

The equity and bond market will get a gut check on how they feel about all these moving parts of tariffs and trade this week. Trump has said the EU is next, and this is now turning into a case of a policy thought process that bears little resemblance to basic economic facts or concepts. The underlings have indulged Trump’s fantasies that the selling country pays. He either believes that or he has learned that it is false but cannot retreat from his frequent claims that he collected “billions and billions” from China. He simply cannot admit such mistakes or intentional misstatements.

The Magnificent 7 heavy ETFs…

Some of the benchmarks and industry ETFs we include have issuer concentration elements that leave them wagged by a few names. When looking across some of the bellwether industry and subsector ETFs in the rankings, it is good to keep in mind which narrow ETFs (vs. broad market benchmarks) get wagged more by the “Magnificent 7” including Consumer Discretionary (XLY) with Amazon and Tesla, Tech (XLK) with Microsoft, Apple, and NVIDIA, and Communications Services (XLC) with Alphabet and Meta.

The above table updates the tech bellwether performance with the line items in descending order of 1-week returns. We already looked at these in our Mini Market Lookback: Surreal Week, AI Worries about “A” (2-1-25). There is still a lot to work through on DeepSeek given much headline value has been ascribed to everything from real estate and data centers to power needs. The AI sector has been lighting up capex cycle expectations.

We had 4 of the Mag 7 report this past week with Meta and Apple making the market happy with 3 of the Mag 7 ending up negative on the week. Amazon reports this coming week (Thurs Feb 6) after the close of trading. We will be curious to hear their updated views on tariffs and trade wars. They do a fair amount of sourcing(!). Their leader is also closer to the action these days in the circle of tech dignitaries in Washington and the Mar-a-Lago buddy system.

We also looked at the 1-week returns already in our Mini Market Lookback: Surreal Week, AI Worries about “A” 2-1-25. The 14-18 score included the DeepSeek shock. Then the week ended with the news that the Tariff Rider would arrive in 24 hours on his White Horse. The horse was sort of spinning around with crazed eyes with two borders and two different oceans to process. That is a lot of potential trade wars to ponder. All we need now is the “BRICS+” club to attack the dollar.

The month of January will give way to a chaotic February, but we see a 29-3 score for January above. The only negative returns were in UST (GOVT), Base Metals (DBB), and Tech (XLK). We see 5 of the 8 lines in the bottom quartile in the form of bond ETFs with HY (HYG) and EM Sovereign (EMB) in the third quartile.

The winners for the month saw Midstream Energy (AMLP) at #1 and another high yielding line with BDCs (BIZD) also in the top quartile. Financials held in strong with the broad Financials ETF (XLF) just ahead of Regional Banks (KRE). Materials (XLB) and Industrials (XLI) were in the top tier joined by a single Mag 7 heavy ETF with Communications Services (XLC). Health Care (XLV) rebounded, but we are not clear why. Perhaps it was RFJ Jr self-immolating as a nominee with a brutal set of sessions (which means it will be a very close vote).

The 3-month run was a bit volatile with the UST price action and periodic rotation whipsaw showing breadth “coming and going” along the way. The market has been trying to gauge the significance for the markets of Trump’s 49% handle “landslide” victory. It had been going well until this weekend preps a trade war. We see a score of 20-12 in the positive vs negative mix.

The biggest winner over 3 months was Tesla and its role in the Consumer Discretionary ETF (XLY). We also see Communications Services (XLC) at #3 and NASDAQ in the top quartile with the S&P 500 just over the line at the top of the second quartile with the Equal Weight NASDAQ 100 (QQEW) just behind the S&P 500.

In other words, tech had a good rolling 3 months with Financials (XLF) and Regional Banks (KRE) right in the top quartile mix. Income heavy Midstream Energy (AMLP) was #2 and a consistently solid line of late and in the top quartile for the trailing 1-year.

The bottom performers over the rolling 3 months show interest rate sensitive sectors in the negative range. The long duration UST ETF (TLT) was at -4.0% in the bottom tier. Homebuilders (XHB) brought up the rear after a very strong run through Sept. Builders were joined by Materials (XLB) and Real Estate (XLRE) in the bottom tier with defensive income stocks such as Consumer Staples (XLP). EM Equities (VWO) and Base Metals (DBB) lagged on mixed China headlines and UST moving higher.

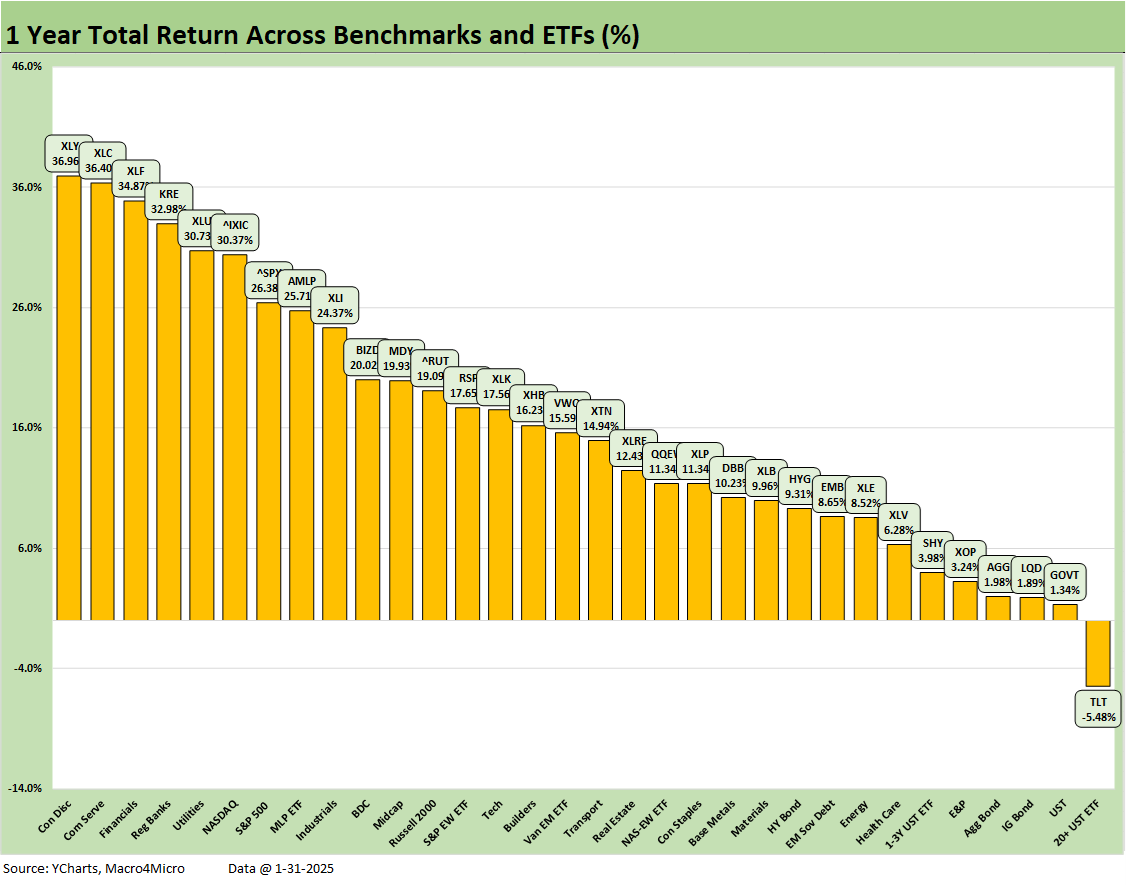

The trailing 1 year will take some time to show more lines in the red, but the 31-1 score has been a common score after the first back-to-back 20+ % S&P 500 return years since the late 1990s. We covered that in the annual recap (see Footnotes & Flashbacks: Asset Returns for 2024 1-2-25).

A trade war could shift that mix rather quickly and especially once Trump pulls in the EU.

See also:

Tariffs: Questions to Ponder, Part 1 2-2-25

Mini Market Lookback: Surreal Week, AI Worries about “A” 2-1-25

PCE: Inflation, Personal Income & Outlays 1-31-25

Employment Cost Index 4Q24: Labor Crossroad Dead Ahead 1-31-25

4Q24 GDP: Into the Investment Weeds 1-30-25

4Q24 GDP: Inventory Liquidation Rules 1-30-25

Credit Crib Note: Lennar Corp 1-30-25

D.R. Horton: #1 Homebuilder as a Sector Proxy 1-28-25

Durable Goods Dec 2024: Respectable ex-Transport Numbers 1-28-25

New Home Sales Dec 2024: Decent Finish, Strange Year 1-28-25

Footnotes & Flashbacks: Credit Markets 1-27-25

Footnotes & Flashbacks: State of Yields 1-26-25

Footnotes & Flashbacks: Asset Returns 1-26-25

Mini Market Lookback: Policy Blitz Formation 1-25-25

Existing Home Sales Dec 2024: Another “Worst Since” Milestone 1-24-25

Top 10 Fun Facts on Past Presidents and their Economies 1-20-25

Industrial Production Dec 2024: Capacity Utilization 1-17-25

Housing Starts Dec 2024: Good Numbers, Multifamily Ricochet 1-17-25

Retail Sales Dec 2024: A Steady Finish 1-16-25

CPI Dec 2024: Mixed = Relief These Days 1-15-25

KB Home 4Q24: Strong Finish Despite Mortgage Rates 1-14-25

United Rentals: Bigger Meal, Same Recipe 1-14-25

Mini Market Lookback: Sloppy Start 1-11-25

Payroll Dec 2024: Back to Good is Bad? 1-10-25

Payroll % Additions: Carter vs. Trump vs. Biden…just for fun 1-8-25

JOLTS: A Strong Handoff 1-7-25

Annual GDP Growth: Jimmy Carter v. Trump v. Biden…just for fun 1-6-25

Mini Market Lookback: Mixed Start, Deep Breaths 1-5-25

Tariff links:

US-Canada: Tariffs Now More than a Negotiating Tactic 1-9-25

Trade: Oct 2024 Flows, Tariff Countdown 12-5-24

Mexico: Tariffs as the Economic Alamo 11-26-24

Tariff: Target Updates – Canada 11-26-24

Tariffs: The EU Meets the New World…Again…Maybe 10-29-24

Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24

Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24

Facts Matter: China Syndrome on Trade 9-10-24

Trade Flows: More Clarity Needed to Handicap Major Trade Risks 6-12-24

Trade Flows 2023: Trade Partners, Imports/Exports, and Deficits in a Troubled World 2-10-24

Trade Flows: Deficits, Tariffs, and China Risk 10-11-23