KB Home 4Q24: Strong Finish Despite Mortgage Rates

KB Home printed a very strong 4Q24 period across revenues, earnings, deliveries and orders with margins holding the line.

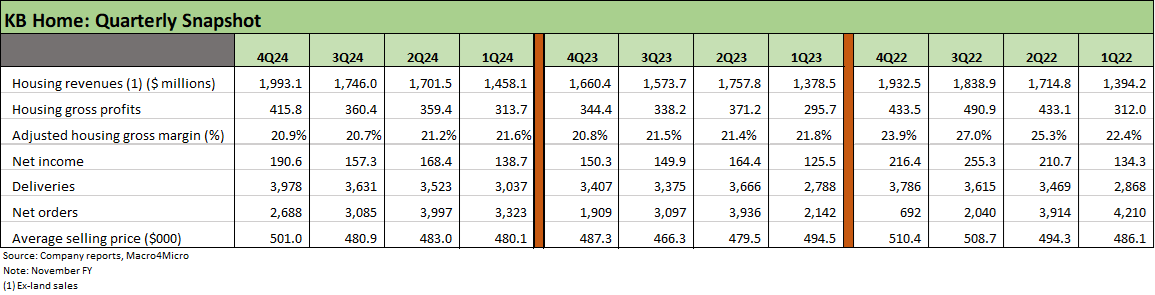

KB Home (KBH) turned in strong 4Q24 numbers despite its traditionally high mix of first-time buyers (50% in 4Q24) and the mortgage strain seen by the industry. KBH net orders were up by over 40% YoY, deliveries up by +17%, and average selling prices over the $500K line for 4Q24.

The majority of homes are still built-to-order in contrast to the pureplay spec homebuilders, so the swings in mortgage rates show more lag time in the effects on KBH across quarters.

The West Coast comprises 46% of revenues, 32% of deliveries, 43% of net order value, and 39% of backlog value, and the fires are capturing headlines. Management stated that their “divisions, communities, and sales offices were fully operational” even as the backdrop is “not business as usual” for many employees.

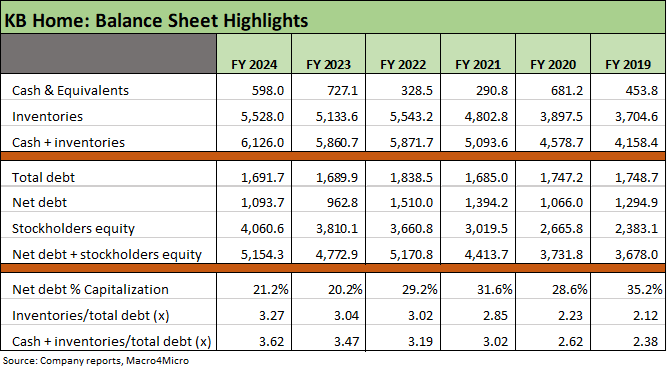

Balance sheet leverage and asset coverage remains solid but with debt/cap and inventory coverage essentially sideways YoY but well below 2022. KBH is not showing the progress of some peers in lower total debt or net debt levels across the post-COVID cycle.

The market has seen a wild ride for homebuilder equities across 2024 and then into the easing cycle from September into early 2025. As detailed in the above chart, where we look at the timeline since just before the tightening cycle in early 2022, KBH beat the Homebuilder (and supplier) peer group as defined by the Homebuilder ETF (XHB) and also beat the median of the major public homebuilders.

Looking back over the past year, KBH equity slightly lagged Taylor Morrison (TMHC) as a BB tier comp but was ahead of Tri Pointe (TPH). KBH was slightly below the S&P 500 with its Mag 7 heavy flavor but beat the Equal Weight S&P 500 ETF (RSP).

In other words, KBH stock price action is not signaling trouble. Taking care of shareholders in a homebuilder equity market that has been on the downswing of late is in focus as mortgages head back to 7% and has driven builder equities materially lower from the peak. That comes after the Homebuilder ETF (XHB) was leading the pack at north of a 70% LTM total return and posted +64% at the end of Sept shortly after the first FOMC easing (see Footnotes & Flashbacks: Asset Returns 9-29-24).

As we detail below, the financial profile and performance metrics will not earn KBH investment grade soon, but they helped get KBH to a high BB tier composite rating from a mid-BB composite a year ago.

The revenue line for 4Q24 and FY 2024 framed up favorably on a YoY basis. For FY 2024, pretax income only fell short of the peak year of FY 2022. The rise in revenue of +19.5% in 4Q24 and pretax income of +24% beats the +8% rise in revenue for FY 2024 YoY and the +10% increase in pretax income.

Looking at housing only, gross margins have been in a narrow range in the low 20% handles since the peak of over 24% in FY 2022 but up from 18% in FY 2019 and FY 2020.

We update the quarterly run rates for KBH since 1Q22 or just before the Fed tightening cycle and the end of ZIRP. The quarterly revenue lines also give some sense of the seasonality patterns. The chart breaks out volumes with deliveries and net orders detailed along with the average selling prices (ASPs). For 4Q24, we see ASPs cross the $500K line not seen since 4Q22.

We see margins below the peer group at KBH, but we also see steady and consistent results that include a solid recent set of housing sector comps YoY in a market where the prices are high and mortgage rates are high.

At the end of the day, homebuilding is a price x volume business in a cyclical industry. As cyclical as homebuilding can be, the bragging rights that anchor the core industry story are the secular trends and tailwinds of demographics. The affordability and supply crisis relative to demand is not going away any time soon, and supplier chain setbacks will not help unit costs or speed up building cycles and inventory turns.

On tariffs, KBH highlighted that the “majority” of its supplies are domestically sourced. We often hear and read that, but the homebuilders need to build more than a majority of the house (!). Like numerous major builders, KBH demonstrated its ability to navigate supplier chain challenges and has the benefit of the COVID learning curve.

The labor issues around deportation are not very transparent at this point until we see what Trump and Miller are going to do. Many industry watchers have cited Mexican worker ranks as a clear concern for subcontractor capacity.

Another issue for West Coast labor supply is the rebuilding process after the fires. The competition for labor could intensify when many could end up on a bus heading south. KBH indicates they don’t expect a materials or labor “pinch.” They answered the question as builders usually do, but there must be major concerns behind the scenes.

The above table breaks out the ASPs by geographic segment for the full fiscal years since 2019. As evident in the table, the West Coast always rings the bell on high prices. Mix can shift around and wag the total ASP with $358 in the Central region and $679 in the West Coast region for FY 2024. All prices in all regions are materially higher than the pre-COVID (2019) and COVID period (2020) ASPs at a time when financing costs are also much higher.

The balance sheet story is stable vs. 2023 using debt to cap and modestly better using inventory and “inventory + cash” coverage. Book leverage is materially lower in FY 2024 than across 2019 to 2022 but has leveled off. Total debt balances have not seen the needle move much. For many major builders, gross debt is typically much lower across these years as well as leverage moving lower on a gross and net basis.

See also:

Housing:

Footnotes & Flashbacks: State of Yields 1-12-25

New Home Sales: Thanksgiving Delivered, What About Christmas? 12-23-24

Existing Home Sales Nov 2024: Mortgage Vice Tightens Again 12-19-24

Housing Starts Nov 2024: YoY Fade in Single Family, Solid Sequentially 12-18-24

Homebuilders:

Toll Brothers: Rich Get Richer 12-12-24

PulteGroup 3Q24: Pushing through Rate Challenges 10-23-24

KB Home: Steady Growth, Slower Motion 9-26-24

Lennar: Bulletproof Credit Despite Margin Squeeze 9-23-24

Credit Crib Note: PulteGroup (PHM) 8-11-24

Credit Crib Note: D.R. Horton (DHI) 8-8-24

Homebuilders: Updating Equity Performance and Size Rankings 7-11-24

Credit Crib Note: KB Home 7-9-24

Lennar: Key Metrics Still Tell a Positive Macro Story 6-20-24

Credit Crib Note: NVR, Inc. 5-28-24

Toll Brothers: A Rising Tide Lifts Big Boats 5-23-24

Credit Crib Note: Taylor Morrison 5-20-24