Durable Goods Dec 2024: Respectable ex-Transport Numbers

We look at Durable Goods to wrap up a year marked by large swings as Boeing idiosyncratic issues continue to weigh on the headline numbers.

Headline Durable Goods orders declined sharply -2.2%, extending the poor November results that saw a downward revision to -2.0% with this release. The back-to-back declines reflect weak order activity in Transport equipment, specifically for Nondefense Aircraft and Parts that sit around half of last December’s volume.

The weak headline close to the year led to Durable Goods orders down -1.5% overall for 2024 vs. 2023, though it should come as no surprise that stripping out Transport shows orders up 1.4% instead. Though not strong numbers, it is indicative of ongoing robust investment even with transport-related headwinds.

Though the market is digesting AI-related volatility after yesterday, we see today’s release contributing to a modest upward UST curve move as we go to print.

It will take some time to sort through how the shipments and orders may have been influenced by tariffs threats and then in turn gauge what expected retaliation to tariffs could mean for export expectations and supplier chain disruptions.

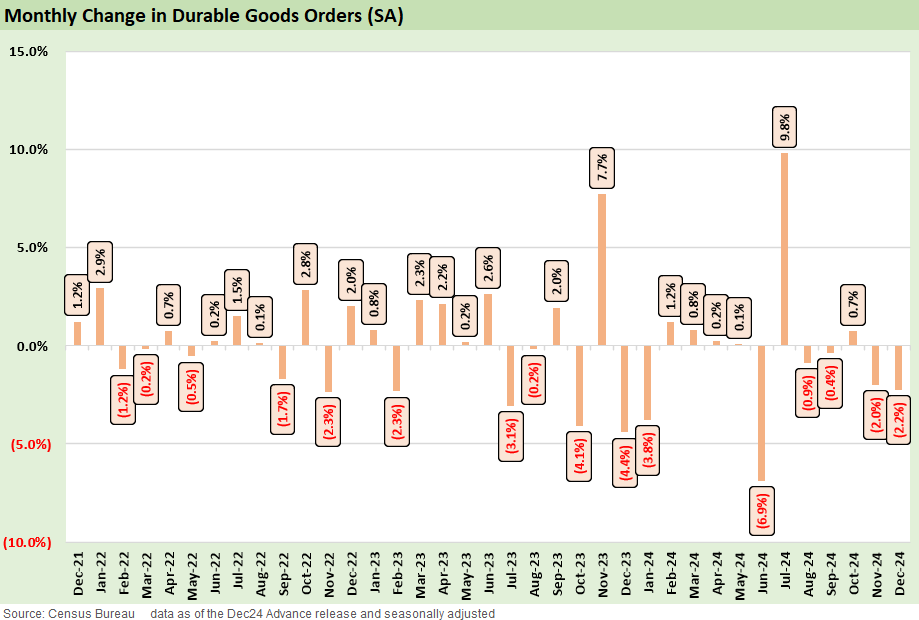

The overall 2024 MoM Durable Goods orders were mixed with 6 positive months and 6 negative months amidst heightened volatility. The expectation of slower and lower growth due to higher rates after coming off a strong 2023 meant signs of some robustness is still positive for the broader industrial sector.

This month sees a -2.2% decline and underscores the outsized role of transportation that declined -7.4% and includes a 45.7% collapse in Nondefense aircraft orders. These swings have been noted since ongoing Boeing challenges began in late 2023 with this year seeing both -3.8% and -6.9% downward moves in January and June, respectively.

While awaiting more concrete tariff actions and policy detail, ramping up domestic manufacturing should be a tailwind in the coming months for further capex investment in durables. As we’ve highlighted before, as the Fed began to cut in September and now combined with any policy tailwinds, gains likely remain incremental and are still ruled by project economics and not simple hand-waving (or pen-waving) exercises.

The above chart aims to provide a more balanced view of Durable Goods orders by removing the most volatile component. Of course, it is hard to evaluate the whole by removing about a third of the picture, but at least it shows the underlying stability in the broader industrial sector.

The tally changes to 7 positive and 5 negatives on the year, but the overall growth for 2024 ex Transport is at least positive at 1.4%. With another headline decline today, we see this metric at least as a signal that there is broader Durable Goods weakness that translates to weak industrial activity overall.

With advance 4Q24 GDP numbers due on Thursday, the market will need to be thinking through the fixed investment and equipment trends and how the IP products line might be influenced (if at all) by any new assessments of the AI headlines this week. The NASDAQ index appears to be waving off DeepSeek today after a shocking reaction yesterday.

The magical appearance of a China AI product that is mysteriously capex lite and low cost was a not a sign of high confidence in valuations and the solid ground of the “monster capex, Data center shortage, and power needs” themes. In a world of daily mis/disinformation at home and abroad, some tangible evidence of what that all means will need a lot more scrutiny.

The above table provides the line items below the headline. The Nondefense Aircraft and Parts collapse of -45.7% comes on the heels of -20.1% in November and exits 2024 down -36.2%. The distortions from the many issues at Boeing (who reported today) are very much art of the “caveat air cover” within Transport, we see that Motor Vehicles and the Other Transport Equipment line also ended the year on a three-month downward slide.

Quantifying what policy and rate fears mean for orders as well as shipments and inventory planning will take some time to sort out. Day 1 has already come and gone, and for all the noise and releases we have no idea on the game plan for a USMCA overhaul (and violations and possible termination) or punitive tariffs on the #1 and #2 trade partner nations, Mexico and Canada. The China “negotiating tactics” (or are they?) are also creating more confusion for manufacturers around production planning when the balance of supplier activities needs to be carefully managed. The books on lean manufacturing practices are getting tossed on the policy bonfire, but at least the books have not been banned.

Moving away from the transport section, we see a generally positive end to the year with only Primary Metals orders in the red. Looking across to the annual results, we see that non-transport activity all saw at least some growth on the year with Fabricated Metals and Computers and Electronic Products both above 2.5% growth for the year.

Finally, we cover the shipments side of the equation that flows into the 4Q GDP numbers coming this week. December saw a 0.9% increase in shipments, offsetting the small contractions earlier in the quarter. With the end of the year in Orders going so poorly, we expect that Shipments will soon reflect that as we enter 2025. While are orders are not just “for show” by stretch, shipments are “for dough” and flow into revenues and earnings.

The confusion around working capital management, inventory planning, and capital budgeting (timing and amounts) have all been unsettled by the current erratic policy commentaries flowing out of Washington and most notably for the many manufacturing and services companies that need to book orders.

In the end, Dec 2024 was a reasonable month for non-aircraft set against a highly unreasonable backdrop of policy crosscurrents (and whirlpools).

See also:

New Home Sales Dec 2024: Decent Finish, Strange Year 1-28-25

Footnotes & Flashbacks: Credit Markets 1-27-25

Footnotes & Flashbacks: State of Yields 1-26-25

Footnotes & Flashbacks: Asset Returns 1-26-25

Mini Market Lookback: Policy Blitz Formation 1-25-25

Existing Home Sales Dec 2024: Another “Worst Since” Milestone 1-24-25

Top 10 Fun Facts on Past Presidents and their Economies 1-20-25

Industrial Production Dec 2024: Capacity Utilization 1-17-25

Housing Starts Dec 2024: Good Numbers, Multifamily Ricochet 1-17-25

Retail Sales Dec 2024: A Steady Finish 1-16-25

CPI Dec 2024: Mixed = Relief These Days 1-15-25

KB Home 4Q24: Strong Finish Despite Mortgage Rates 1-14-25

United Rentals: Bigger Meal, Same Recipe 1-14-25

Mini Market Lookback: Sloppy Start 1-11-25

Payroll Dec 2024: Back to Good is Bad? 1-10-25

Payroll % Additions: Carter vs. Trump vs. Biden…just for fun 1-8-25

JOLTS: A Strong Handoff 1-7-25

Annual GDP Growth: Jimmy Carter v. Trump v. Biden…just for fun 1-6-25

Mini Market Lookback: Mixed Start, Deep Breaths 1-5-25

Tariff links:

US-Canada: Tariffs Now More than a Negotiating Tactic 1-9-25

Trade: Oct 2024 Flows, Tariff Countdown 12-5-24

Mexico: Tariffs as the Economic Alamo 11-26-24

Tariff: Target Updates – Canada 11-26-24

Tariffs: The EU Meets the New World…Again…Maybe 10-29-24

Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24

Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24

Facts Matter: China Syndrome on Trade 9-10-24

Trade Flows: More Clarity Needed to Handicap Major Trade Risks 6-12-24

Trade Flows 2023: Trade Partners, Imports/Exports, and Deficits in a Troubled World 2-10-24

Trade Flows: Deficits, Tariffs, and China Risk 10-11-23

Midyear Trade Flows: That Other Deficit 8-10-23

State of Trade: The Big Picture Flows 12-18-22