United Rentals: Bigger Meal, Same Recipe

United Rental acquires another major player in H&E Equipment. Accretive in Year 1, leverage quite manageable.

United Rentals executes on another equipment rental leader acquisition with the $4.8 bn deal, including $1.4 bn in H&E net debt. URI keeps the expansion program moving even more aggressively as it pulls away in its leadership role as industry consolidator.

The all-cash deal will only push leverage pro forma to 2.3x and get back to 2.0x within 12 months as URI uses its typical strategy of “pausing” stock buybacks during the post-deal stage. The leverage range of 1.5x to 2.5x is intact.

The inherent financial flexibility and cash flow resilience of the equipment rental operators is the same story as in the many large deals printed by URI. As a frame of reference, URI’s Monday closing market cap was around $45 bn.

The $92 bid for HEES is a huge premium and a big win for HEES (closed just under $44 last night). The deal is in many ways the same old story but a much bigger deal.

URI is still anchored by the high rate of construction activity in place and multiyear projects with some growth expectations better (Energy) and some potentially seeing political pressure over the intermediate term (EV and climate projects). Reshoring themes are the wildcard, so there are a lot of scenarios to consider.

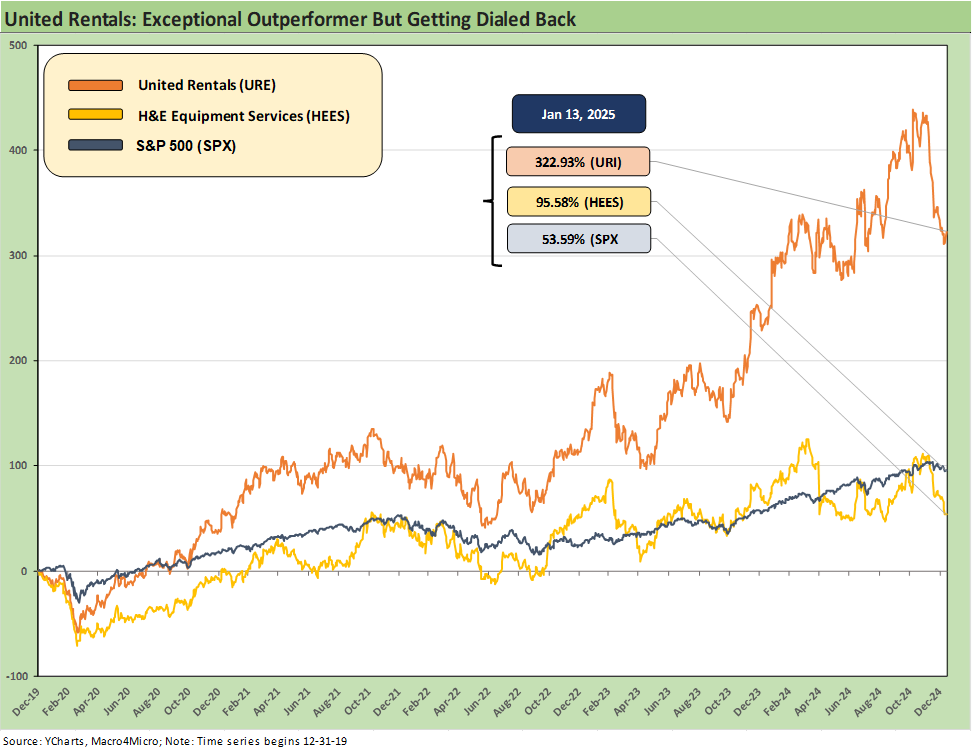

The above stock chart gives some sense of the scale of the outperformance of URI equity vs. the broader market as well as HEES narrowly. The HEES chart will look a lot different at the end of the trading day today with the URI bid posting an increase of over 100% above the Monday close.

We have covered the major equipment rental players in detail in past commentaries that are worth looking at for comps for those looking at the industry again. The latest round of expanded issuance from URI will certainly follow with the inevitable refinancing:

Credit Crib Note: United Rentals (URI) 11-14-24

Credit Crib Note: Herc Rentals (HRI) 12-6-24

Credit Crib Note: Ashtead Group plc (AHT) 11-21-24

The equipment rental industry has only a few major issuers of bonds. The industry presents a favorable risk symmetry profile at a time when the economy is going strong, but there is a substantial amount of uncertainty around what the tariffs and trade outcomes will be across 2025 and into 2026.

The equipment rental industry and the major consolidator URI specifically has shown resilience across some wild cycles that include a post-TMT meltdown in the early 2000s, a systemic bank crisis and a record downturn period in 2008-2009, and then a pandemic that roiled supplier chains all over the world (including equipment production chains). The inflation spike and tightening cycle saw URI outperform by an even healthier margin as we detail in the above links. We refer to the URI Credit Crib Note (11-14-24) for background.

The stock chart above highlights the very strong equity performance of URI as it has executed on its expansion plan, broadened its visibility in the large cap market, and gained a lot more street coverage over the years. The raw numbers are hard to argue with in terms of profit margins, cash flow, leverage and the flexibility of its capex planning and fleet management programs.

As we detail in our single name work on URI, Ashtead and Herc (see links), URI was a major beneficiary of the Trump tax cuts and the Biden programs that have driven much higher construction volumes and many multiyear projects. URI and Ashtead as the two leaders have also demonstrated how they can navigate supplier chain meltdowns. The simplest version in supplier chain setbacks is “those with the equipment on the ground here in the US win.” The ability to adjust capex with short lead times and downsize the fleet is a very distinctive and positive attribute of this industry.

The HEES transaction…

We looked through the United Rentals M&A presentation slides provided on its website. The $4.8 bn deal is consistent with the traditional URI playbook across a long string of $1 bn to $2 bn deals that were easily absorbed. The company posted its 8-K with details including a $3.8 bn bridge.

The typical process goes like this:

Announce an all-cash deal.

Fund it with bank lines and use a healthy slice of ABL with URI’s high quality, liquid asset base always leaving banks very comfortable.

Move quickly on issuer refinancing in the bond market using unsecured bonds, 1L, or 2L bonds. This has been the practice and we assume the bond refinancing will be unsecured.

URI taps the brakes on its recurring major stock buyback programs while driving higher EBITDA to a pro forma leverage back around the 2.0x midrange.

We will follow up as more information becomes available and take some fresh looks at HEES history. We have not published on HEES to this point.

Glenn Reynolds. CFA

Kevin Chun, CFA

See also:

United Rentals: In the Market, Right on Cue 3-7-24

United Rentals: Another Billion Out of the Gate 3-4-24

United Rentals: Another Bellwether Supporting the Macro Health Story 1-31-24

Rental Equipment: A Cyclical Confidence Booster 9-15-23

Credit Crib Notes: United Rentals (URI) 9-12-23

Ashtead 4Q23/FY 2023 - Company Comment 6-14-23

United Rentals: Investor Day Backs Up Bulls 6-11-23