Mini Market Lookback: Surreal Week, AI Worries about “A”

We look back at a wild week in the market and in policy as tariffs now descend.

Three wishes? Frictionless tariffs, unopposed purges, Fed control…

Across a week that included a shocker around AI and chips equities, 4 of the Mag 7 reporting earnings, FOMC thumbing its nose at Trump’s “demand” for lower rates even as the long end rallied, the headlines were jammed with policy conflicts in Washington that took on the shape of constitutional body blows.

We will look at the confirmation of tariffs by Trump separately, but the combination of tariffs, deportation, the DeepSeek swirl and a rising sense of unprecedented political risk in the US (just toss in Greenland and Panama seizure and geopolitical reactions), and the words “risk aversion” could start creeping into the picture again. We are not there yet, but capital budgeting decisions in the face of tariffs can just as easily see companies hit “pause” and raise prices while focusing on buybacks and M&A.

Meanwhile, waves of industries reported solid numbers in a weird juxtaposition of economic calm set against this strange, disruptive and apparently intentional attempt to promote divisions, conflict, and chaos. That could start to flow into capital budgets and consumer behavior.

The DeepSeek headlines dominated early and lingered in the weekly returns as China laid claim to a competitive AI product that cost a bit less in spending than the average annual revenues of two McDonalds franchises. That is questionable but drove a lot of second-guessing on the economic chain.

Information Technology was the only one of the 11 S&P 500 sectors to generate negative returns in January. For the week, the 11 S&P 500 sectors saw 5 positive and 6 negative as Telecom led the pack at +2.7% for the week and Info Tech was at -4.6%.

The 1-week return mix for our usual 32 benchmarks and ETFs weighed in at 14 positive and 18 negative. There was clearly a divergence across the Mag 7 performance in an earnings week that included Apple, Microsoft, Meta, and Tesla. Communications Services (XLC) and Consumer Discretionary (XLY) were in the top quartile while the Tech ETF (XLK) was in the bottom quartile with only E&P (XOP) and Energy (XLE) doing worse.

An interesting anomaly relative to recent periods was the Homebuilder ETF (XHB) sitting in the bottom quartile despite a UST rally and a modest dip in 10Y UST yields and a minimal move in the Freddie Mac 30Y mortgage as we detail further below. We see the long duration UST 20+Y ETF (TLT) make it into the top quartile this week. Homebuilder earnings have been uninspiring (see D.R. Horton: #1 Homebuilder as a Sector Proxy 1-28-25, Credit Crib Note: Lennar Corp 1-30-25).

Financials performed well again with Regional Banks (KRE) and Financials (XLF) mixed in with the credit-intensive and high income BDCs (BIZD) alongside the defensive Consumer Staples ETF (XLP). On the XLP performance, sorting out the UST impact from the defensive attributes needs to play out over longer timelines.

The weekly tech bellwether returns are detailed above and lined up in descending order of total returns for the week. It was an ugly week overall with the DeepSeek headlines hammering chip names and some second guessing over the investments being made by some of the players and what it all means for the economic multiplier effects from data centers to power names. A lot more has been riding on AI than chip leaders.

We saw good numbers out of Meta and Apple with those two on top. TSLA has stalled somewhat over the past month, but the 3-month TSLA return remains off the charts at +62%. As a reminder that tech is about single names and not a blanket category win, the Equal Weight NASDAQ 100 ETF (QQEW) has been a regular underperformer across the time horizons posted.

The above chart updates the 1-week UST deltas, and we see a modest rally beyond 2Y with a benign response on the front end with the FOMC holding the line.

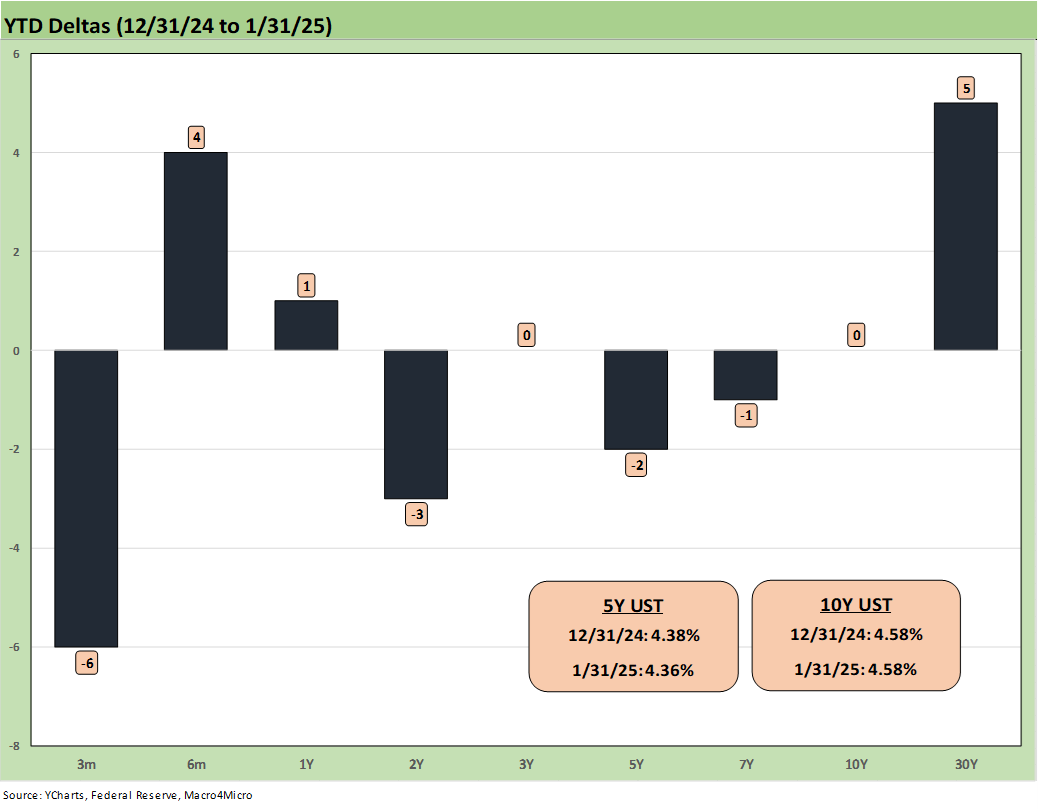

The above chart updates the UST deltas YTD with its mild net movement after some turmoil along the way. The 10Y is still a long way from the 10Y UST lows around 3.6% back in Sept 2024.

The above chart offers a reminder of the journey of the 10Y UST and Freddie Mac 30Y since the ZIRP period of early 2021. We see the high 7.8% peak on the Freddie Mac benchmarks in late Oct 2023 when some other mortgage surveys were above 8%. We also frequently use the 10-19-23 date to mark the 10Y UST high point in the post-ZIRP years. The 200 bps band for 30Y mortgages after the last tightening move and now into the easing cycle makes for a wide range of mortgage payments for a given home price.

The week saw some widening with HY OAS +8 wider to +268 bps, which is still well inside where the June 2007 level ended but wide to where June 2007 began (see Footnotes & Flashbacks: Credit Markets 1-27-25).

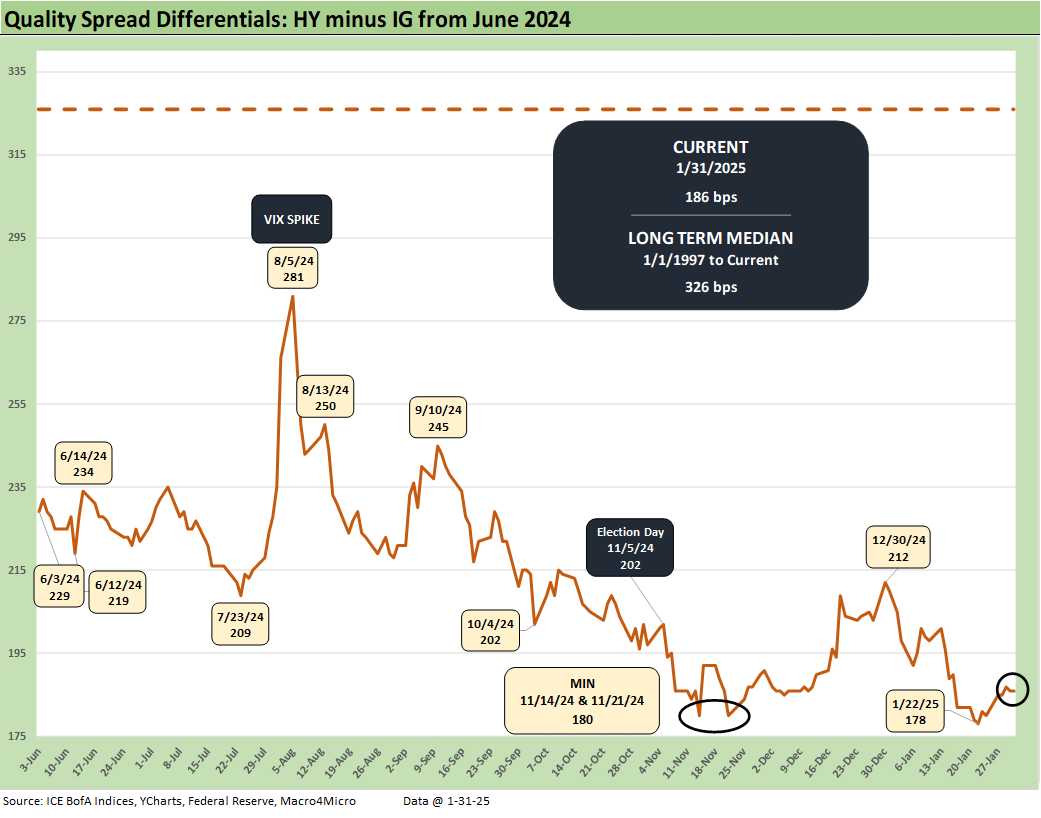

The “HY OAS minus IG OAS” quality spread differential widened out by +6 bps on the week to +186 bps and remains in that rare sub-200 bps range.

The “BB vs. BBB” quality spread differential also moved wider on the week by +5 bps to +64 bps. The recent low was +57 bps during the middle of last week. That +57 (+59 to end last week) had matched some earlier lows in the fall but remained above the July 2024 low of +55 bps. The current differential is around half the long-term median.

See also:

PCE: Inflation, Personal Income & Outlays 1-31-25

Employment Cost Index 4Q24: Labor Crossroad Dead Ahead 1-31-25

4Q24 GDP: Into the Investment Weeds 1-30-25

4Q24 GDP: Inventory Liquidation Rules 1-30-25

Credit Crib Note: Lennar Corp 1-30-25

D.R. Horton: #1 Homebuilder as a Sector Proxy 1-28-25

Durable Goods Dec 2024: Respectable ex-Transport Numbers 1-28-25

New Home Sales Dec 2024: Decent Finish, Strange Year 1-28-25

Footnotes & Flashbacks: Credit Markets 1-27-25

Footnotes & Flashbacks: State of Yields 1-26-25

Footnotes & Flashbacks: Asset Returns 1-26-25

Mini Market Lookback: Policy Blitz Formation 1-25-25

Existing Home Sales Dec 2024: Another “Worst Since” Milestone 1-24-25

Top 10 Fun Facts on Past Presidents and their Economies 1-20-25

Industrial Production Dec 2024: Capacity Utilization 1-17-25

Housing Starts Dec 2024: Good Numbers, Multifamily Ricochet 1-17-25

Retail Sales Dec 2024: A Steady Finish 1-16-25

CPI Dec 2024: Mixed = Relief These Days 1-15-25

KB Home 4Q24: Strong Finish Despite Mortgage Rates 1-14-25

United Rentals: Bigger Meal, Same Recipe 1-14-25

Mini Market Lookback: Sloppy Start 1-11-25

Payroll Dec 2024: Back to Good is Bad? 1-10-25

Payroll % Additions: Carter vs. Trump vs. Biden…just for fun 1-8-25

JOLTS: A Strong Handoff 1-7-25

Annual GDP Growth: Jimmy Carter v. Trump v. Biden…just for fun 1-6-25

Mini Market Lookback: Mixed Start, Deep Breaths 1-5-25