Existing Home Sales Dec 2024: Another “Worst Since” Milestone

We put a very tough existing home sales year to bed as Dec 2024 winds down the slowest existing home sales year since 1995.

Gold is good, but these are too tight to free up transaction volumes…

The superlatives are making the rounds in the trade rags on how bad the 2024 existing homes sales performance has been even if Dec 2024 by itself was a good note to end on.

Despite relatively low UST rates in multicycle context during a year that had low unemployment, solid and steady growth, favorable demographics to drive first time demand and “empty nester” activity for boomers, the headline was “worst year for existing home sales since 1995.”

The much-discussed “golden handcuffs” and “locked in effect” from low mortgages ruled the existing home sales theme music. Those mortgages were incurred during the protracted ZIRP years after 2008 and COVID. Record low mortgages in the hands of homeowners was a big swing factor in existing home transaction volumes.

Existing home sales faltered badly in 2024 even at a time of record home equity balances and record high home prices for the full year 2024 of $407.5K ($404.4K for the month of Dec 2024).

Existing home inventory levels dropped by -13.5% sequentially despite the streak of 18 months of YoY price increases while YoY inventory levels are still up by +16.2% vs. year end 2023 and almost +20% vs. year-end 2022.

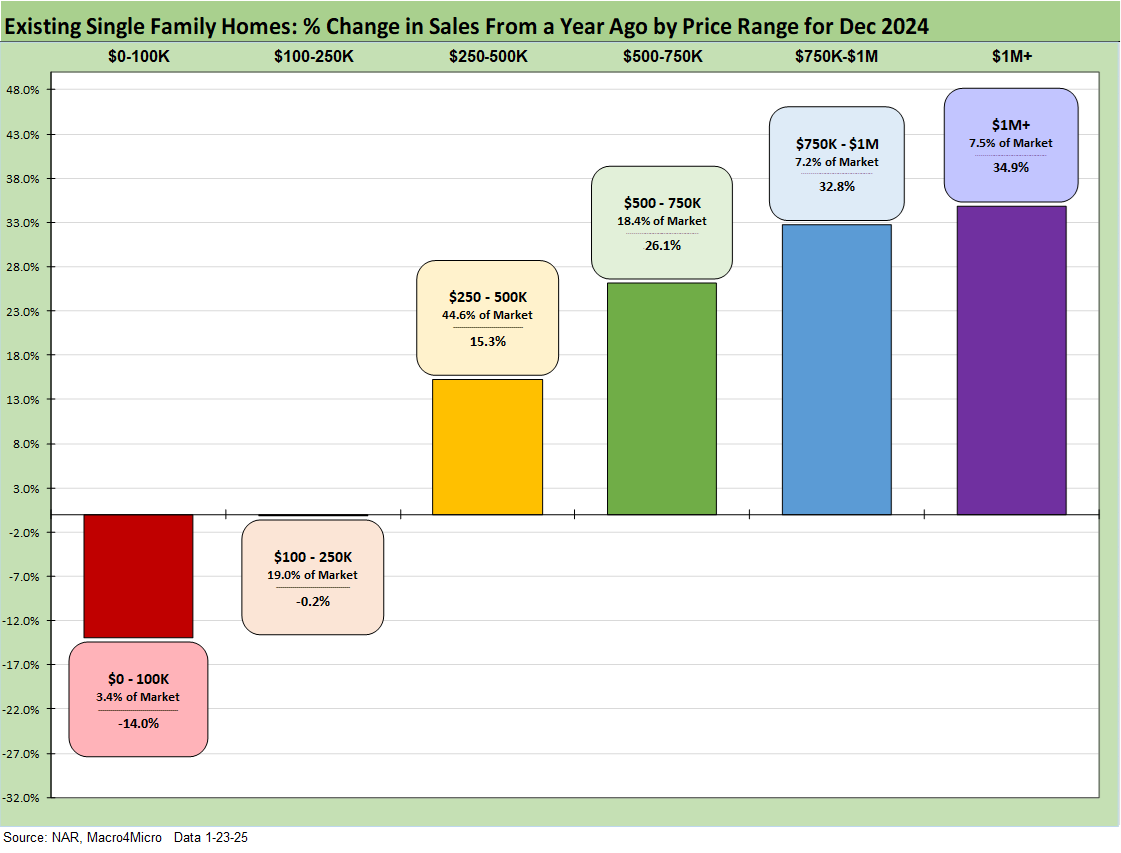

The above chart updates the YoY existing home sales deltas YoY by price tier. We see the two lowest price tiers decline and the 4 highest price tiers rise as overall existing home sales rose to the highest level since Feb 2024. The trend for the 4 higher price tiers and 2 lower price tiers show a similar pattern to last month.

The above chart shows the geographic mix of volumes and details on price mix by region. The South is the main event in single family volumes whether new or existing at almost 46% of volumes for existing.

For the bar chart, we break out the mix for each region by price tier. For example, the South shows over 52% of its existing home sales volume in the $250k to $500K range and 16.1% of its sales in the $500 to $750K bucket. The bars for each region add up to 100% (occasionally a rounding miss!). The high cost of homes in the West (notably California) is clear enough in the price mix just by glancing at the bar chart with 18.8% in prices over $1 million. The second highest in the $1million club is the Northeast at 9.7%.

We see a big concentration in the $250K to $500K bracket for all regions at almost 45% of the total and a heavy weighting in the $100K to $250K bracket for the Midwest at 33.9%. The map explains what states are in each Census region, and there is a wide range of home price profiles in the West and Midwest.

The above time series updates the total existing home inventory details. Current inventory of 1150K is well above the 850K lows that came after the record low mortgage rates and post-COVID housing demand spike. Even with the rise of inventory up until the recent decline this past month, the inventory level remains materially below the long-term median of 2125K.

The low supply in historical context is despite the record demographic demand and opportunities to take out major gains in home equity values. There are many household-specific situations that dictate the relative priority of transacting vs. waiting for friendlier mortgage rates. The ability to refinance later is one common excuse to pull the trigger to the extent the buyer is creditworthy. That is, print the 7% now and refi later in the 5% range.

When potential sellers/buyers lose hope in mortgage rate relief, they are more likely to transact and settle for “less house for their dollar.” That is one factor in why higher price tiers have been more resilient than lower tier homes. The lower income borrower is more likely to get squeezed out and have less flexibility to refinance or fear eligibility.

The above two-sided chart updates the trend line in total existing home sales vs. new single family homes (i.e. sold by homebuilders). We look at this trend each month in the New Home Sales release when the two are in the same month (the above chart is Nov for new and Dec for existing). New home sales for Dec 2024 will be released on Monday Jan 27.

The main point is that builders have an advantage in being able to use their mortgage finance operations as sales incentives (mortgage buydowns and fee relief, etc.). “Joe Homeowner” looking to sell his home does not have that critical lending edge even if the broker can cut commissions. Then he faces a materially higher mortgage himself on the other side of the trade as he “moves up” or simply shifts product tiers (retirement downsize, etc.)

The builders have thus picked up market share of total home sales during the FOMC tightening cycle and held a share edge vs. history with the UST curve seeing a bear steepener in 2024. The economy, deficit, and relative inflation trends sent the 10Y UST and 30Y mortgages higher to around 7% since the brief Sept 2024 lows of near 6% (see Mini Market Lookback: The Upside of Volatility 1-18-25, Footnotes & Flashbacks: State of Yields 1-19-25).

Existing home sales volumes always dominate the total, but builders have been able to prosper despite the recent stock selloffs. Even the builders are seeing some plateauing in recent months along with price pressure and margin erosion as they are forced to beef up incentive packages.

At the margin, builders have been winning since they can design, price, and deliver the homes at a healthy profit margin and on terms that the buyer can handle. With high gross margins generally north of 20%, the builders have room to maneuver. That said, even the builders are running into bigger challenges again given the return to 7% area mortgages. Many buyers would rather wait for lower rates and lower prices, but there are plenty of signs that sellers and buyers are giving up and transacting in existing home sales.

The above chart breaks out the timeline for single family alone of 3.83 million vs. total existing home sales of 4.24 million, which is well below the long-term median (from Jan 1999) of 5.235 million for total existing homes. The lower line is ex-condo/ex-co-ops. We saw 410K in condos and co-ops in Dec 2024, up from 390K in Nov.

The above chart updates the time series for existing single family sale prices with $409.3K in the latest print. That is 48% above the sub-$300K Dec 2019 price of $277K. We are below the $432.9K peak price of June 2024. These prices always come with the asterisk of the mix shifts that can unfold across price tiers and regions.

The above chart updates the monthly existing home sales across the timeline from Jan 2021 through Dec 2024. The market is a long way from the mid-6 and high 5 million handles of 2021 and then into early 2022 when many homeowners refinanced, and new buyers locked in low mortgages. ZIRP ended in March 2022 and then the UST migration began. The Dec 2024 total of 4.24 million is back above the May 2020 COVID low tick of 4.07K. We had a few more sub-4 million handles along the way as noted in the chart, so this has been a brutal period for brokers.

The above chart revisits the topical area addressed earlier on the existing home sales deltas by price tier. The largest tier is the $250K to $500K at almost 45% of sales volumes, and that was up by a healthy +15.3%. The challenge for the lower tier buyer is evident in the decline of -0.2% in the $100K to $250K tier that comprises almost 19% of volume while the $500K to $750K tier is 18.4% of the market and rose by +26.1%.

Overall, the Dec 2024 month was a solid month in relative terms in the year but in what is still a very bad year for existing home sales volume in the context of past cycles.

See also:

Footnotes & Flashbacks: Credit Markets 1-20-25

Top 10 Fun Facts on Past Presidents and their Economies 1-20-25

Footnotes & Flashbacks: State of Yields 1-19-25

Footnotes & Flashbacks: Asset Returns 1-19-25

Mini Market Lookback: The Upside of Volatility 1-18-25

Industrial Production Dec 2024: Capacity Utilization 1-17-25

Retail Sales Dec 2024: A Steady Finish 1-16-25

CPI Dec 2024: Mixed = Relief These Days 1-15-25

Housing:

Housing Starts Dec 2024: Good Numbers, Multifamily Ricochet 1-17-25

New Home Sales: Thanksgiving Delivered, What About Christmas? 12-23-24

Existing Home Sales Nov 2024: Mortgage Vice Tightens Again 12-19-24

Homebuilders:

KB Home 4Q24: Strong Finish Despite Mortgage Rates 1-14-25

Toll Brothers: Rich Get Richer 12-12-24

PulteGroup 3Q24: Pushing through Rate Challenges 10-23-24

KB Home: Steady Growth, Slower Motion 9-26-24

Lennar: Bulletproof Credit Despite Margin Squeeze 9-23-24

Credit Crib Note: PulteGroup (PHM) 8-11-24

Credit Crib Note: D.R. Horton (DHI) 8-8-24

Homebuilders: Updating Equity Performance and Size Rankings 7-11-24

Credit Crib Note: KB Home 7-9-24

Lennar: Key Metrics Still Tell a Positive Macro Story 6-20-24

Credit Crib Note: NVR, Inc. 5-28-24

Toll Brothers: A Rising Tide Lifts Big Boats 5-23-24

Credit Crib Note: Taylor Morrison 5-20-24