Retail Sales Dec 2024: A Steady Finish

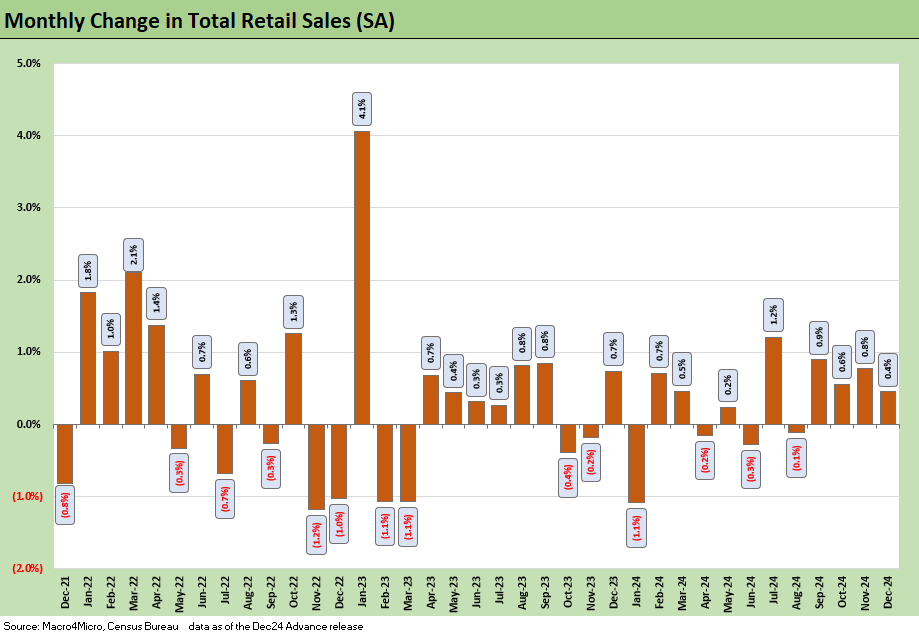

We update the final 2024 Retail Sales as policy shifts could pose a challenge to a consumer still spending but in slower growth mode.

Largest assortment of FOMC forecasts anywhere....

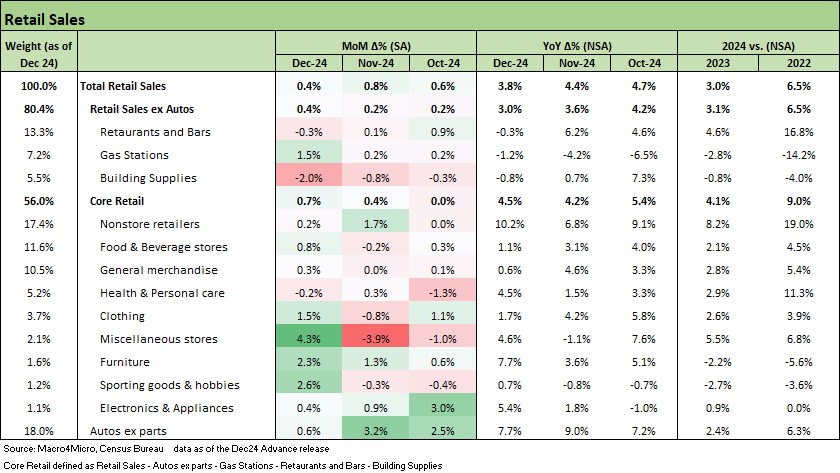

The Retail Sales report was positive overall with headline up 0.4% MoM and Core Retail sales up 0.7% MoM. As UST curve pressure and balance sheet pressures fueled concerns around consumer health, 2H24 and the recent holiday season helped to alleviate many of those.

Building Supplies was the biggest line item drag at -2.0% MoM as the post-COVID home improvement spend rush and rate hikes have left more measured spending after peaking in mid-2022.

Though early in the 4Q24 earnings reporting season with more consumer credit focused operators still to come (especially on the lower end), the read-through from major bank earnings shows no major pitfalls for consumer credit health to cause alarms - yet.

At the end of the day, the market weighs these results based on expectations and headlines this morning’s talking head reactions were mixed. The curve immediately reacted to shift higher but as we go to print, they moved back into slightly lower in 10Y UST and the equity markets yawning.

Retail sales naturally get a lot of focus as a bellwether indicator for the consumer sector. In a market where the FOMC handicapping exercise absorbs a steady stream of releases each month, the mixed-but-net-favorable CPI report this after bullish payroll numbers has left the market grasping for any new shifts in the prevailing winds (see CPI Dec 2024: Mixed = Relief These Days 1-15-25).

We like to scroll headlines right after some of the more critical releases just to catch nuances in the tone. After the Retail Sales release today, we did a quick scan to show the challenges of framing such data in the media. Below we flag the headlines that were released shortly after the headlines hit. Each of these words or phrases were excerpted from the headline:

“less than expected”

“rise solidly”

“decelerated”

“fade”

“dip below forecast”

“broadly advance after upward revision”

“indicating slower consumer spending”

“rose modestly”

“slower than expected”

“point to strong holiday operating season”

“starts off 2025 with some momentum”

Whatever direction you want to lean regarding the headline flavor, the market significance usually frames the reaction based on expectations. The economy is set by actual results rather than based on the variance from market consensus forecast. From the standpoint of growth in the economy, the news remains favorable even if the real action is ahead once the much-discussed policy shifts from trade/tariffs, taxes, deportations, and energy get more clarity.

Higher payrolls and favorable demographics (more paychecks, more spending) and decent bank earnings reports and guidance to this point on the consumer credit front make for a good story overall in the broader economy. We get the first estimate of 4Q24 GDP on Jan 30 with the PCE lines and then Jan 31 brings detailed Personal Income and Outlays data for Dec 2024.

A lot more color lies ahead from consumer finance operators across asset quality and how stretched consumers are faring in credit cards. The reality of new entrants into the work force or some returning to work brings a fresh “game clock” on consumer spending and the direction of “dropping the credit card” to consume more. For the providers of consumer credit, the direction of their rates, margins and earnings power gets back to rolling up single name color on reserving policies vs. the usual metrics on delinquencies and net charge-offs. The consumer credit disclosure from the major banks and consumer lenders requires a lot of extrapolation.

Moving into the weeds of the report, we cover the key line items and subcategories underlying this morning’s headline. The reality of 0.4% MoM headline and 0.7% MoM for Core Retail is a steady finish to the year that is favorable for the overall state of the economy. It signals a still-resilient consumer, with Core Retail sales up 4.1% overall for 2024, modestly outpacing inflation.

The recent trend reflects robust holiday spending and a strong autos sales recovery in 2H24. Pulling back to a broader view of 2024, a continued shift towards online retailers remained full swing as Nonstore retailers grew another +8.2% in 2024 with only Restaurants and Bars (+4.6%) and Miscellaneous Stores (+5.5%) posting above 3.0% growth.

On the other hand, Building Supplies (-0.8%) Furniture (-2.2%), and Sporting goods (-2.7%) had down years. Furniture sales and building supplies remain in a post-COVID, post-tightening cycle hangover that saw peaks in mid-2022. These are areas where the higher rates and pull-forward of demand continue to impact sales. We do not see either as cause for alarm given the strength elsewhere in the report and given the need for a lot of rebuilding into next year amidst hurricane and wildfire disasters. These product segments should see renewed demand.

Overall, today’s retail sales report still indicates a resilient consumer that did not contract across the holiday season and maintained late year spending growth. How the next leg of policy changes impact inflation is a key question for consumers into 2025 and beyond with higher rates potentially weighing on behavior.

Kevin Chun, CFA

Glenn Reynolds. CFA

See also:

CPI Dec 2024: Mixed = Relief These Days 1-15-25

Footnotes & Flashbacks: State of Yields 1-12-25

Footnotes & Flashbacks: Asset Returns 1-12-25

Mini Market Lookback: Sloppy Start 1-11-25

Payroll Dec 2024: Back to Good is Bad? 1-10-25

US-Canada: Tariffs Now More than a Negotiating Tactic 1-9-25

Payroll % Additions: Carter vs. Trump vs. Biden…just for fun 1-8-25

JOLTS: A Strong Handoff 1-7-25

Annual GDP Growth: Jimmy Carter v. Trump v. Biden…just for fun 1-6-25

Footnotes & Flashbacks: State of Yields 1-5-25

Mini Market Lookback: Mixed Start, Deep Breaths 1-5-25

Footnotes & Flashbacks: Credit Markets 2024 1-3-25

Footnotes & Flashbacks: Asset Returns for 2024 1-2-25

HY and IG Returns since 1997 Final Score for 2024 1-2-25

Spread Walk 2024 Final Score 1-2-25

Footnotes & Flashbacks: Asset Returns for 2024 1-2-25

Credit Returns: 2024 Monthly Return Quilt Final Score 1-2-25

Annual and Monthly Asset Return Quilt 2024 Final Score 1-2-25

HY and IG Returns since 1997: Four Bubbles and Too Many Funerals 12-31-24

Footnotes & Flashbacks: State of Yields 12-29-24

Mini Market Lookback: Last American Hero? Who wins? 12-29-24

Spread Walk: Pace vs. Direction 12-28-24

Annual and Monthly Asset Return Quilt 12-27-24

Credit Returns: 2024 Monthly Return Quilt 12-26-24

New Home Sales: Thanksgiving Delivered, What About Christmas? 12-23-24

Mini Market Lookback: Wild Finish to the Trading Year 12-21-24

Trump Tariffs 2025: Hey EU, Guess What? 12-20-24

PCE, Income & Outlays Nov 2024: No Surprise, Little Relief 12-20-24

Existing Home Sales Nov 2024: Mortgage Vice Tightens Again 12-19-24

GDP 3Q24: Final Number at +3.1% 12-19-24

Fed Day: Now That’s a Knife 12-18-24

Credit Crib Note: Iron Mountain 12-18-24

Housing Starts Nov 2024: YoY Fade in Single Family, Solid Sequentially 12-18-24

Industrial Production: Nov 2024 Capacity Utilization 12-17-24