PulteGroup 3Q24: Pushing through Rate Challenges

PHM posts solid 3Q24 numbers with volumes leading the way with stable average selling prices and modest compression of its leading gross margins.

The double-digit growth in home sale revenue (12%) and closing volumes (12%), and near miss on earnings (9%) combine with the substantial excess inventory coverage at a material multiple of total debt to present a minimal financial risk profile and credit risk superior to PHMs credit ratings.

Net debt to cap of only 1.4% and inventory at 7.8x total debt mitigates cycle risk in an industry that has clearly demonstrated cash flow resilience in a downturn as inventory liquidates in a market where demographic demand exceeds supply.

The debate is now more about whether the industry will face a fresh round of valuation second-guessing with the 10Y UST edging higher and flowing into 30Y mortgage rates now closer to 7% than 6%.

The mixed dynamics on higher mortgage rates is that it costs the homebuilders some margin on incentives but also exacerbates the “golden handcuffs” and “locked-in” effects undermining the existing home sales side. That in turn feeds pricing power across product tiers at a time when the headwinds hitting the entry level and first time homebuyers are back at uncomfortable levels.

The stock performance trend for PHM equity as detailed above tells a simple enough story about Pulte given the dramatic outperformance across the tightening cycle. Pulte has been one of the best stories in a broader homebuilding sector that has boomed on the equity side and rendered rating agency criteria somewhat overdue for material revisions given the demonstrated financial resilience of the industry.

The ability of numerous large homebuilders to pay down debt while rewarding shareholders with material stock buybacks and in some cases rising dividends is how the Homebuilder ETF (XHB) achieved its rank as a distant #1 for the LTM period and close #2 to Utilities (XLU) YTD (see Footnotes & Flashbacks: Asset Returns 10-20-24).

The recent reversals in the UST and 30Y mortgages rates have hit the homebuilder equities again this week after such a heady run as investors handicap demand and the costs of incentives. With a +73% LTM stock return on PHM through last Friday, the sector could start to see more equity chips come off the table. Yesterday, PHM stock was off -7.2% with all the major down but PHM by more.

PHM is a distant #3 in revenues behind industry leaders D.R. Horton and Lennar, but has the highest margins of the group and been the superior equity performer across the tightening cycle and since the 2019 pre-COVID period (see Credit Crib Note: PulteGroup (PHM) 8-11-24).

The sustained revenue growth across the cycle since 2019 for PHM is the obviously positive feature of the income statement with industry-leading gross margins in the high 20% range. PHM even cracked the 30% gross margin line in FY 2022. We saw a small compression in 3Q24 vs. 3Q23 but essentially flat YoY in the YTD 9 month numbers.

Solid volume growth as broken out above and steady new orders tell a good story from here with the peak selling season now behind PHM and the pipeline into 2025 more likely to get wagged by the UST wrestling match. As covered in earlier commentaries, PHM has a broad national scale and product range that leave it among leaders on average selling prices without excess reliance on the West Coast and California markets (see Homebuilders: Equity Performance and Size Rankings 7-11-24). The balance across price tiers and regional mix is a distinct positive factor in the PHM business risk profile.

The table shows average selling prices topping off in somewhat of a stall and the need for incentives remains a common challenge. However, the flexibility to deliver incentives (mortgage buydowns, fee relief, etc.) has allowed the homebuilders to pick up a higher share of total home sales relative to existing home sales.

The golden handcuffs and low mortgage rates (60% below 4%, 30% below 3%) that existing homeowners hold leave them facing “barriers to exit” and less economic refinancing on the other side. We routinely cover those topics in our single name and housing sector research (see links at the bottom).

For PHM, the $548K average selling price was essentially flat YoY but is well ahead of the $427K in 2019 and $463 in 2021 when ZIRP was in place ahead of the 2022 tightening cycle.

The above chart updates the closing volumes by geographic segment. We see 5 of the 6 clearly higher with only Florida flat in volumes. While not shown above, we see 4 of 6 geographic segments lower in ASP for the 3Q24 quarter even if the bias in the segment mix is more flattish YTD.

While new orders are down slightly in total, the steady tension around mortgage rates is getting worse again in recent weeks with rates closer to 7% than the low 6% we saw before the big Sept payroll number. That started a process where the curve was taking in more data that pushed the UST curve steeper (see Footnotes & Flashbacks: State of Yields 10-21-24, Payroll Sept 2024: Rushing the Gate 10-4-24).

The above chart updates the segment earnings histories for each geographic segment. The trend line is mixed but flows into higher total segment “Income Before Taxes.” The biggest increase was in the West region (higher volume and ASP) with a solid increase in the Midwest (higher volume and price) and Florida down the most on lower ASP.

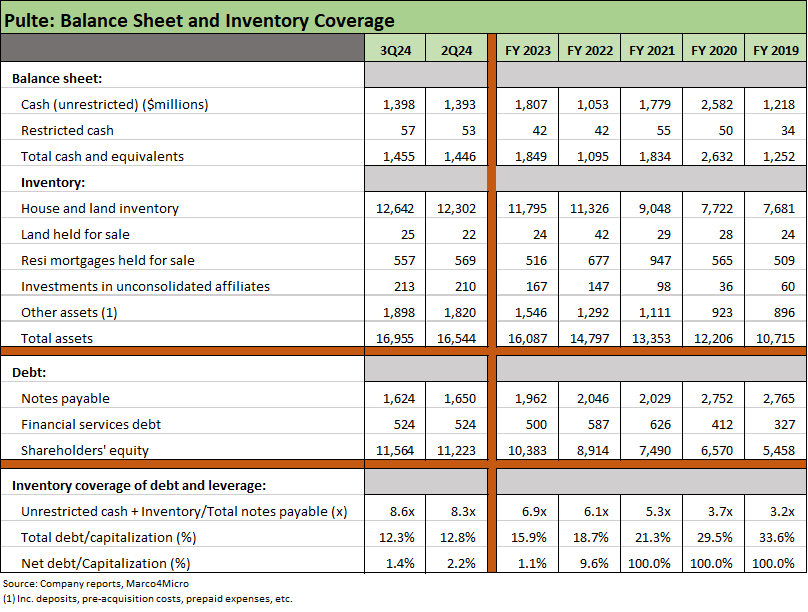

The balance sheet metrics improved in both book leverage and asset coverage. We see +1.4% net debt to cap and “Unrestricted cash + Inventory” coverage of debt at 8.6x vs. 6.9x at the end of 2023 and more than double the 3.2x at the end of 2019 ahead of COVID.

With these metrics and the history detailed above, there is not much to debate around balance sheet trends. Notes payable are down by over $1 billion since FY 2020 and down by almost another $340 million YTD. At 3Q24, PHM has $252 million of 5.5% March 2026 bonds left outstanding and $337 million of 5.0% Jan 2027 bonds among the shorter maturities before the next maturity in 2032.

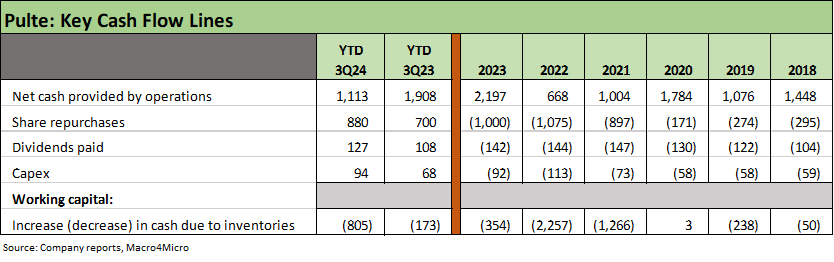

The cash flow lines YTD are consistent with the pattern we have seen and detailed in earlier commentaries. The mix of cash flow investment in inventories to fund revenue growth and deployment to shareholders in buybacks and dividends with a heavy focus on buybacks from 2021 through YTD 2024.

The healthy cash flow, the nature of the working capital dynamics (closing vs. starts) and the impressive asset coverage (cash + inventory/debt) make the case for the credit quality of the top tier builders.

See also:

Footnotes & Flashbacks: Credit Markets 10-21-24

Footnotes & Flashbacks: State of Yields 10-21-24

Footnotes & Flashbacks: Asset Returns 10-20-24

Mini Market Lookback: Banks Deliver, Equities Feel the Joy 10-19-24

Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24

Retail Sales Sep 2024: Taking the Helm on PCE? 10-17-24

Industrial Production: Capacity Utilization Soft, Comparability Impaired 10-17-24

CPI Sept 2024: Warm Blooded, Not Hot 10-10-24

HY OAS Lows Memory Lane: 2024, 2007, and 1997 10-8-24

Payroll Sept 2024: Rushing the Gate 10-4-24

Credit Returns: Sept YTD and Rolling Months 10-1-24

Housing and Homebuilders:

Housing Starts Sept 2024: Long Game Meets Long Rates 10-18-24

KB Home: Steady Growth, Slower Motion 9-26-24

New Home Sales Aug 2024: Waiting Game on Mortgages or Supply? 9-25-24

Lennar: Bulletproof Credit Despite Margin Squeeze 9-23-24

Existing Homes Sales Aug 2024: Mortgages Still Rule 9-19-24

Home Starts Aug 2024: Mortgage Rates to Kickstart Hopes Ahead? 9-18-24

Harris Housing Plan: The South’s Gonna Do It Again!? 8-28-24

New Home Sales July 2024: To Get by with a Little Help from My Feds? 8-24-24

Credit Crib Note: PulteGroup (PHM) 8-11-24

Credit Crib Note: D.R. Horton (DHI) 8-8-24

New Homes Sales June 2024: Half Time? Waiting for Mortgage Trends 7-24-24

Homebuilder Equities: “Morning After” on Rate Optimism 7-12-24

Homebuilders: Equity Performance and Size Rankings 7-11-24

Credit Crib Note: KB Home 7-9-24

Lennar: Key Metrics Still Tell a Positive Macro Story 6-20-24

Credit Crib Note: NVR, Inc. 5-28-24