New Homes Sales June 2024: Half Time? Waiting for Mortgage Trends

Soft new home sales release in June is consistent with the recent macro and issuer level data, but the mortgage rate challenge is still the overriding X-factor.

Penalty on mortgages… roughing the potential buyer!

New home sales took another leg down as stubborn mortgage rates hold back the pace of sales in the peak selling season and keep starts under pressure as already released earlier in the month (see Housing Starts June 2024: Still All About the Deliveries 7-17-24).

The soft new home sales numbers are consistent with the pressures evident in starts and existing home sales and the direction of volumes across the public builders that saw equities weaken sharply before the post-CPI rally (see Homebuilders: Equity Performance and Size Rankings 7-11-24, Homebuilder Equities: “Morning After” on Rate Optimism 7-12-24).

Running through some of the homebuilder earnings reports and management commentary this week on volumes, home prices, and guidance during the peak selling season, the question comes back to mortgage rates and the same old discussion of when the Fed will ease and whether that will flow into the long end and take 30Y mortgages lower (see Footnotes & Flashbacks: State of Yields 7-21-24).

The above chart updates the long-term time series for new single family home sales since 1963. Despite the shortage of homes to meet the needs of a very different demographic profile than that seen in these earlier decades, the run rate of 617K in June 2024 fell below the long-term median.

The 617K level marks the low of calendar year 2024 and the lowest since Nov 2023. The April 2024 numbers had weighed in at +730K on a banner month from the South at +451K in April, but the South was also down to 375K this month.

The “inventory months” are taking it on the chin at these lower sales rates, rising to 9.3 months from 7.7 months. The low point over the trailing year was 7.3 months in July 2023.

Investors generally do not get too excited by such inventory metrics since in the end it all gets back to profit margins, cash flow, and balance sheet health. These metrics remain very solid for the major builders.

The biggest players have been weighing in with June quarter numbers last week and this week. We will look at those separately, but the numbers reflect sound management of inventories (and favorable inventory coverage of total debt), good gross margins, high free cash flow, and aggressive stock buybacks. There is a reason the builders have seen strong equity performance with the post-CPI rebound showing the market looking ahead for better rates.

The balance of working capital is being closely managed by the builders, so starts and new home sales are intertwined with the two needing to stay in a balance that does not materially derail pricing, incentive costs, and thus undermine margins. That has been working so far, the guidance from bellwethers such as D.R. Horton shows stability ahead but slow growth.

The above chart updates the higher market share of total home sales (existing + new) held by the homebuilders. The share is now at 14.8% vs. the long-term median of 12.5% as existing home sales struggle as well (see Existing Home Sales June 2024: Supply Up, Prices Up, Volumes Down 7-23-24). We have covered this topic frequently so there is no need to rehash the intrinsic advantages builders have to drive volumes despite unfriendly mortgage rates and unfavorable monthly payment economics. The potential for Fed easing and inflation trends will get a fresh read this Friday with the PCE release.

The above chart updates the time series for median prices vs. volumes. The combination of higher prices and high mortgage rates make the effects much worse. The relative housing shortage and record demographics create a supply-demand imbalance that hold promise if mortgage rates can get pushed down, and that will remain the focal point into the fall. It is difficult for us to be optimistic on long rates as we discuss in other commentaries.

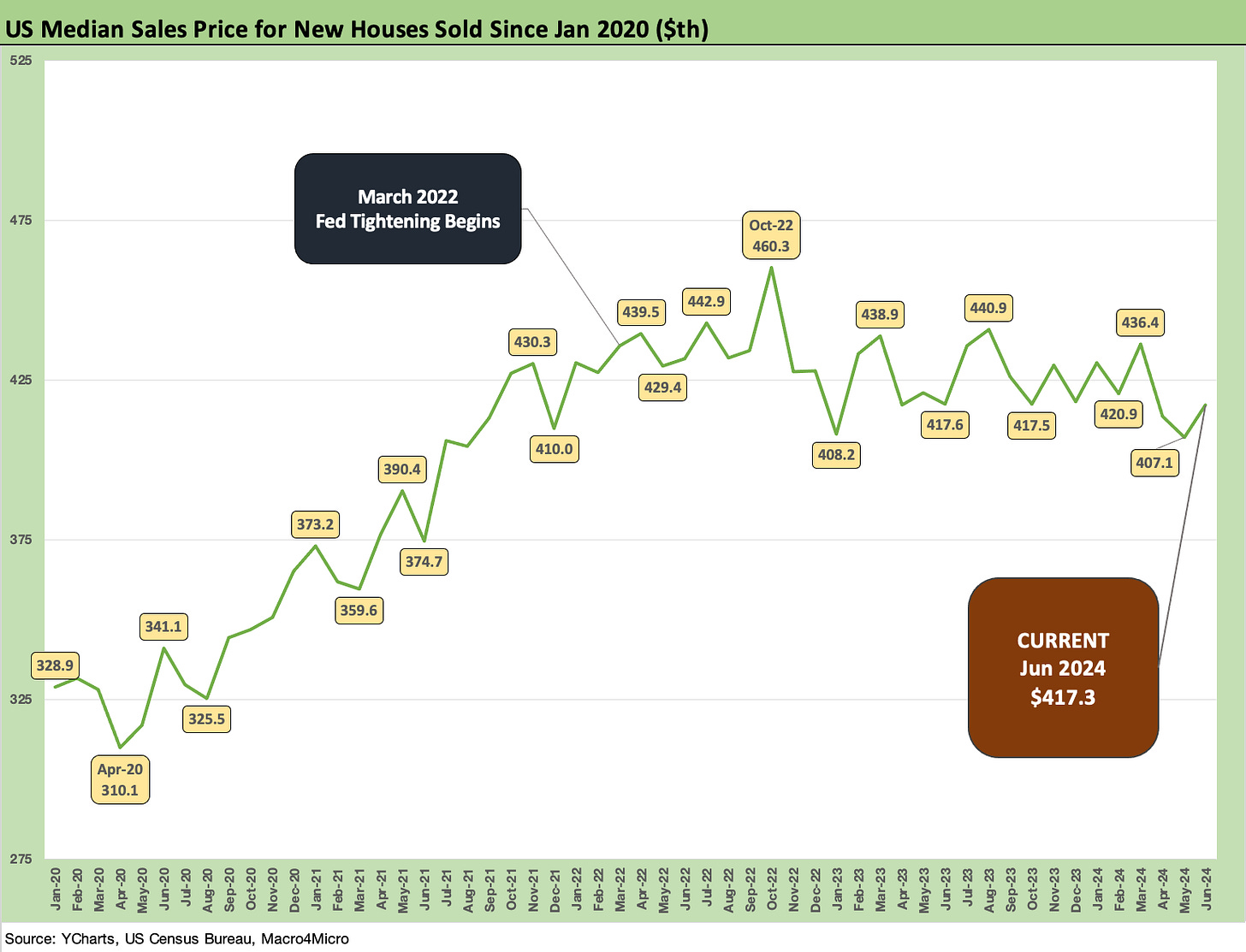

The above chart offers a simple single-line time series on median prices from Jan 2020. The price rise pushed right through COVID before a tightening cycle made homebuyer economics more of a strain but did not drive a major decline in prices.

The supply headwinds for existing home sales are easing, but the demand side of the equation is still waiting for better mortgage rates. Getting down into the 5% handle range would be a major source of support, but that is not an easy path by any stretch given the outlook we regularly discuss in our yield curve commentaries. The 10Y UST drives the 30Y mortgages, and the inversion will keep the plot thick and supply side of UST tense as we potentially face tariffs and labor disruptions in 2025.

The above chart updates the timeline on median prices from Jan 2022, just ahead of the end of ZIRP and the start of the tightening cycle in March (effective 3-17-22). These median price moves come with the asterisk of regional mix shifts and the community mix variances within each region.

The next two charts wrap the monthly update for new home sales with some historical time series visuals on the two largest markets above and the two smaller markets in the next chart. The South market (with Texas and Florida) is by far the largest for single family and is running well above the long-term median.

The West at #2 is running below the median. We frame some of the highs and lows along the cycles from 1973. The housing bubble impact in the South drove volumes into the stratosphere with some pockets of the West also grossly overbuilt at the time.

The Midwest and Northeast market are both running below long-term medians with the Northeast a small factor in homebuilding despite its major economic impact in major cities. At current run rates, the Midwest is a multiple of the Northeast. The Midwest is a very long way from the expansion of the housing bubble years.

See also:

Existing Home Sales June 2024: Supply Up, Prices Up, Volumes Down 7-23-24

Footnotes & Flashbacks: Credit Markets 7-22-24

Footnotes & Flashbacks: State of Yields 7-21-24

Footnotes & Flashbacks: Asset Returns 7-20-24

Housing Starts June 2024: Still All About the Deliveries 7-17-24

Homebuilder Equities: “Morning After” on Rate Optimism 7-12-24

Homebuilders: Equity Performance and Size Rankings 7-11-24

Credit Crib Note: KB Home 7-9-24

New Home Sales: Pumping the Brakes 6-26-24

Lennar: Key Metrics Still Tell a Positive Macro Story 6-20-24

Credit Crib Note: NVR, Inc. 5-28-24

New Home Sales April 2024: Spring Not Springing Enough 5-23-24

Toll Brothers: A Rising Tide Lifts Big Boats 5-23-24

Credit Crib Note: Taylor Morrison 5-20-24