Homebuilder Equities: “Morning After” on Rate Optimism

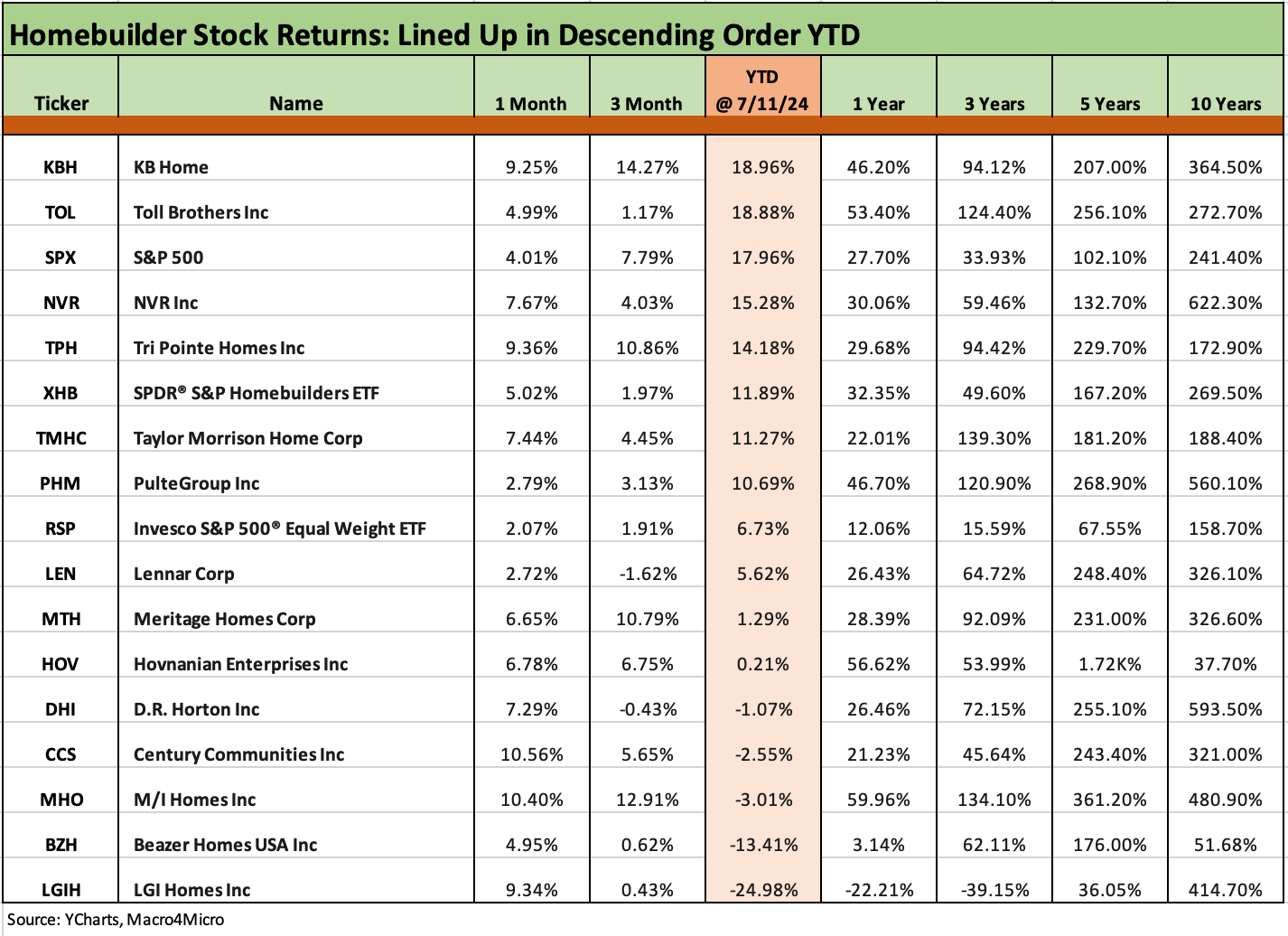

As promised in yesterday’s homebuilder commentary, we update the rolling time horizon stock returns to reflect yesterday’s winnings.

This is your brain on one CPI release…

We follow up on our late afternoon homebuilder commentary on “builder rally day” (see Homebuilders: Equity Performance and Size Rankings 7-11-24) with the homebuilder equity return realignment that includes the post-CPI rebound.

The rally gave a lot of credit to the odds of likely Fed easing flowing into much-improved affordability if it pulls down the 10Y UST that drives 30Y mortgages.

The housing market is already in peak home sales season with a lot of spec inventory and construction in progress and solid order books already underway.

The theory is that the lower mortgage rates will show up and remain for a while and feed a rapid drawdown of builder inventories, a fresh round of order increases, speedier deliveries, and increased starts.

After the CPI posted an actual MoM deflation number in the morning of -0.1% and a range of constructive line items across the various product subsets and special aggregates of the CPI index, the builders were off to the races (see CPI June 2024: Good News is Good News 7-11-24).

As noted in the chart above adjusted for yesterday’s close, the running 1-month returns on the 14 public builders we watch, and the homebuilder ETF (XHB) went from only 1 positive at the Wed close (NVR) to all positive for the rolling month by the Thursday close. For the YTD period, the updated score is 9 single names and the builder ETF (XHB) positive YTD and 5 negative (DHI, CCS, MHO, BZH, and LGIH).

The price action has seen a major swing after leading the LTM ranks through the 1Q24 period and calendar year 2023 in the group of 32 benchmarks and ETFs we track weekly (see Footnotes & Flashbacks: Asset Returns 7-7-24). The UST curve has been having a rough year to date (see Footnotes & Flashbacks: State of Yields 7-7-24) but builder equities had pushed right through until spring numbers from the macro releases to the individual company guidance started to signal slowing with a heavy base of specs already completed and in process.

For the full day yesterday, the UST curve was remarkably muted by the end of the day for such a rally when you start gaming out the FOMC easing decisions on “How much? How many?” The market then needs to figure out how 1 or 2 cuts of 25 bps in fed funds would flow into the 10Y UST in the middle of a steep inversion with record supply of UST issuance ahead and Trump threatening to slap tariffs on all imports and slam the supplier chains as well.

Nothing in the stock price action has changed our already favorable view of the credit quality and financial resilience of most major builders from the BB tier up through major BBB tier names. If the market slows down, they will be generating mountains of cash flow on inventory liquidation.

See also:

Homebuilders: Equity Performance and Size Rankings 7-11-24

CPI June 2024: Good News is Good News 7-11-24

Credit Crib Note: KB Home 7-9-24

Footnotes & Flashbacks: Asset Returns 7-7-24

Footnotes & Flashbacks: State of Yields 7-7-24

New Home Sales: Pumping the Brakes 6-26-24

Existing Home Sales May 2024: Weary Climb 6-21-24

Housing Starts May 2024: Starts vs. Deliveries Balancing Act 6-20-24

Lennar: Key Metrics Still Tell a Positive Macro Story 6-20-24

Credit Crib Note: NVR, Inc. 5-28-24

New Home Sales April 2024: Spring Not Springing Enough 5-23-24

Toll Brothers: A Rising Tide Lifts Big Boats 5-23-24

Credit Crib Note: Taylor Morrison 5-20-24