Credit Crib Note: NVR, Inc. (NVR)

We look at the financial and operating fundamentals of NVR as it boasts credit quality more consistent with a single A tier rating.

CREDIT TREND: Positive

NVR has been an outlier in the homebuilding sector since the turmoil of the housing bubble for its consistently high credit quality, financial stability, and demonstrated resilience across some extraordinarily volatile markets. NVR’s distinctive operating strategy of avoiding the asset risk and balance-sheet-intensity of land development while using such risk-mitigation alternatives as land and lot options ended up as a model for the direction of the industry. Since the housing recovery, many major builders have earned their way into the investment grade tiers and closed the quality gap with NVR, who for its part has earned higher credit ratings.

We originally picked up NVR in prior lives just to better understand how they operated in contrast to the HY builders that were in post-bubble recovery mode. NVR was a rare (for a while, the only) investment grade builder with most of the peer group in HY range as they healed from the housing sector implosion.

Adding to the confidence in NVR’s low financial risk is that NVR now operates in a macro backdrop where demand far outpaces supply in single family residential housing. That will be a protracted economic reality from here. Mortgage rates have been a headwind impacting results as the cycle ages, but the challenge has not undermined NVR’s ability to generate superior financial metrics. Revenues peaked in FY 2022 as was the case with numerous builders, gross profits peaked in 2022, and orders hit cyclical highs in 2021.

NVR went through the housing crisis and stayed profitable across those years and held its investment grade rating. Given how many of today’s cyclicals (notably Auto OEMs and suppliers) filed Chapter 11 or dropped into the CCC range, the fact that NVR was then and still is a BBB tier name raises some questions around rating criteria vs. other cyclicals with NVR cash well in excess of homebuilder debt. NVR and some other bellwether builders boast track records that merit some reconsideration of how builder ratings should be framed in the context of an industry ratings ceiling. That said, we don’t expect that NVR is losing any sleep over its credit rating. They have no need to issue.

Considering how many IG banks and brokers were merged, hammered by risk aversion, and stress tested (literally) by economic conditions, we would argue that NVR and numerous builders have earned a place in the “very low operating risk” buckets. That is especially the case when framed against capex-intensive manufacturing and leveraged financials in the A and BBB tier. Numerous high-quality BBB tier builders have literally taken the traditional NVR playbook (more options, less land development activities, less balance sheet exposure, etc.) as their own. NVR was a good influence on the risk profile of the builders.

OPERATING PROFILE:

NVR ranks in the Top 5 in sales and equity market caps of the major builders. NVR ranks #4 in market cap (it was #3 until the recent boom in PulteGroup PHM) and ranked #5 in revenues behind Toll Brothers (TOL) at #4 and PHM at #3. The mega-beasts of D.R. Horton (DHI) at #1 and Lennar (LEN) at #2 lead the industry by a material margin.

NVR operates through three brands with Ryan Homes serving the first time and first time move-up buyers and through the NVHomes and Heartland Homes brands that typically serve the second-time move-up and luxury segment. NVR operates in 4 geographic homebuilding segments as laid out further below, but NVR’s ancestral stronghold was the Washington and Baltimore metro areas. NVR has historically boasted a strong position in Philly and Pittsburgh and in Charlotte and Nashville.

NVR has established itself as the champion of risk management just by performing so well in the worst housing sector crisis since the Great Depression. The key to their lower earnings and cash flow volatility was their land and lot strategy and use of options where they mitigate balance sheet risk and cap their loss exposure.

FINANCIAL TRENDS:

With NVR, a securities holder (bond or stock) is looking at a leading industry player with an exceptional track record since their problems in the early 1990s when NVR took on too much leverage in their early growth moves (see “History and Highlights” section at the end of this commentary). NVR weathered a brutal housing sector collapse from 2008 to 2011 while remaining profitable in 2008 and even posted double-digit gross margins.

NVR has maintained cash in excess of homebuilding debt since 2017 and has grown its margins and asset base, doubling total homebuilding assets from 2018 to 1Q24. Along the way, NVR has repurchased over $6.5 bn in common stock from 2018 to 1Q24 which is around 28% of NVR’s current market cap. NVR does not pay a dividend. They buy back shares. To quote the NVR 10K: “We have never paid a cash dividend on our shares of common stock and have no current intention to do so in the future.”

The table above runs from the pre-COVID period when the first attempts at interest rate normalization stalled in late 2018. That was before the Fed eased on macro weakness with 3 fed funds cuts in 2019 and before the COVID onset in late Feb 2020. Then came the tightening cycle (ZIRP ended March 2022) and rising mortgage rates to levels more akin to the 2005-2006 period (see Footnotes & Flashbacks: State of Yields 5-27-24).

Margins were essentially flat for 1Q24 at 24.5% vs. 1Q23 at 24.6% and were sequentially above FY 2023 at 24.3%. That comes after seeing peak gross margins during 2022 at 25.8%. These gross margins are well ahead of the 19% area numbers in 2019-2018.

Operating margins are essentially gross margins less SG&A in the above chart, and those have expanded impressively to a 19% handle in 2023-2024 vs. the low 13%/high 12% area in 2018-2020.

The 4 geographic segments are detailed above for revenues and gross profits/margins with 3 of 4 segments posting higher gross profits YoY in 1Q24 after 3 of 4 segments showed lower gross profits for the FY 2023 period vs. the profit peak year of FY 2022.

FY 2023 posted higher gross profits vs. FY 2021 in 3 of 4 segments above, but all segments have solid margins in industry context rolling up to the mid-20% range.

In FY 2023, the Mid Atlantic segment (NVRs spelling of these segments) is the largest segment with a 45% share of homebuilding segment gross profit with the South East segment next at 28% of gross profit.

The South East segment posted the best margins of the last few years in FY 2022 at almost 30%.

The above chart details the new orders, settlements, and backlog total units and average price for each since FY 2018. We also detail the average active communities count, which have declined from 2018-2020 to 427 as of 1Q24 and FY 2023 from the 470 area in 2018-2019.

For NVR, new orders peaked in units in FY 2020 with only a slight decline in FY 2021 for a cyclical peak backlog to end FY 2021, setting the stage for the peak revenues, gross profits, and net income in FY 2022.

We see backlog prices remained in a narrow range after 2022 in the upper $460K area after peaking in FY 2022 at $472K. These average price levels are always subject to product mix and regional variances across time.

Cancellation rates remain high in the time series in the 13% to 14% area.

The cash flow lines of NVR offer one more angle on the disciplined and consistent capital allocation policies of NVR as it maintains a strong balance sheet, a low level of financial risk, and a notable absence of M&A in recent housing cycles.

NVRs focus is on execution in their core business lines and operating units and deploying a hefty base of their cash flow (sometimes in excess of net income) to stock buybacks. As noted, NVR does not pay dividends and does not plan to.

As a reminder, the market saw the cyclical peak for home starts late in 2020 (see Housing Starts April 2024: Recovery Run Rates Roll On 5-16-24), and NVR issued $600 mn in bonds in May 2020 as the COVID crisis was peaking. They added $300 mn more in two add-ons in Sept 2020 to total $900 mn face value. The outstanding $600 face value bond was redeemed in 2022.

The above table plots the main moving parts of the balance sheet with total homebuilding assets more than doubled since 2018, stockholders’ equity grew by almost 2.5 fold, cash quadrupled, and the increase in inventory almost tripled the increase in homebuilding debt.

As noted in the cash flow section, NVR issued low coupon debt during 2020 and was thus able to effectively extend maturities as rates plunged and tap the markets in advance of the UST shift.

The company planned ahead for the redemption of its outstanding $600 mn face value bond even as NVR was prudently building liquidity during a very unpredictable pandemic. As a reminder, the vaccine did not arrive until early Nov 2020 and NVR had already taken prudent liability management steps.

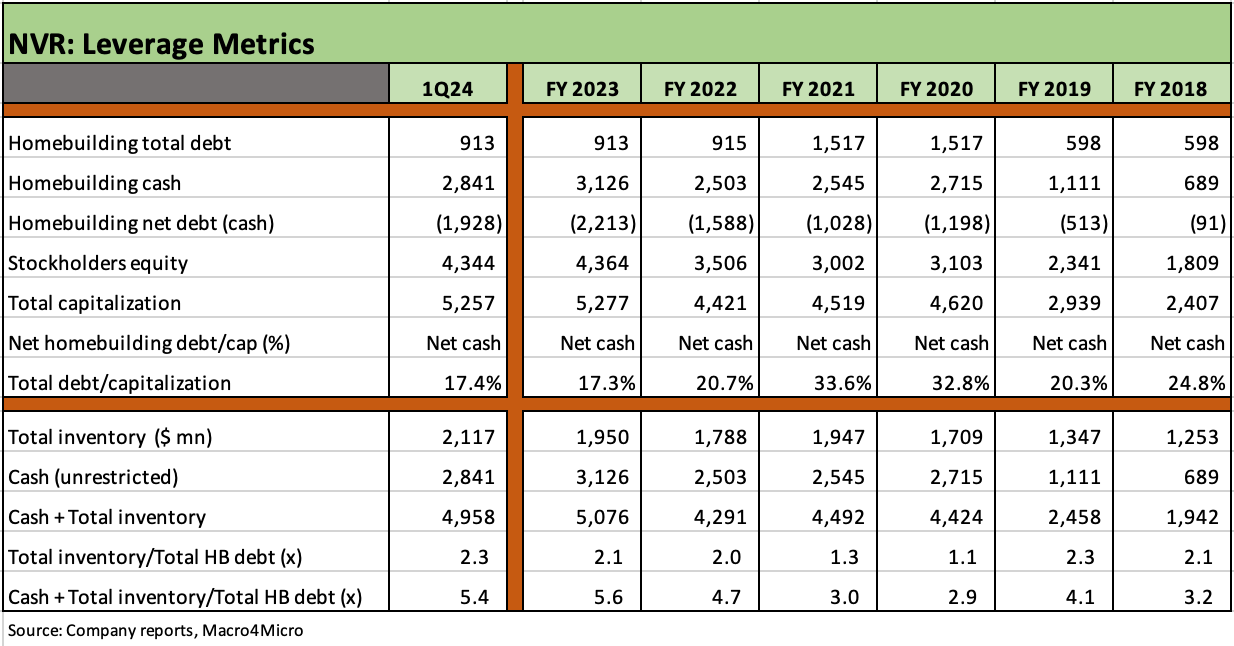

We use both book leverage and inventory coverage of homebuilding debt as our favored leverage metrics for homebuilders.

We see a 17% handle for Total debt % capitalization metrics at 1Q24, down from 33.6% at 2021. If we adjust for the market value of equity, total debt was recently only 3.7% of market adjusted capitalization.

Given the policy of NVR to maximize stock buybacks within the constraints of maintaining a strong balance sheet, the reality of buying back shares at market value has the effect of distorting the stockholders’ equity base lower in relative terms compared to other builders given the sheer scale of NVR buybacks over time. The market cap of NVR as of this past week was around 5.5x book. By comparison, Lennar was 1.6x and D.R Horton was 1.9x.

When inventory is downsized during periods of slow demand, builders generate cash from inventory liquidation, so the direct link between inventory balances and working-capital-based cash flow is more critical to the debt service story than EBITDA.

There is a reason the banks focus on book value leverage with homebuilders, and we agree with that approach. It is also important to consider how much cushion is built into gross margins for any potential weakening in the carrying value of inventory and how that flows into the income statement and cash flow statement. Builders can generate substantial cash flow during a working capital liquidation cycle.

HIGHLIGHTS AND HISTORY

Like many companies that grew rapidly in the 1980s, NVR Inc. has a colorful history that started with NVHomes (note: “NV” stands for North Virginia), who launched a HY bond financed hostile takeover of the much larger Ryan Homes back in 1986. That was not long after NVHomes had gone public from its MLP status with public LP units.

Ryan Homes of Pittsburgh tried to resist, but the newly combined entity was soon a leveraged “junk issuer” of the late 1980s with its rapid expansion financed by excessive debt.

Like many leveraged builders over the decades, NVR’s predecessor entity foundered in the challenging markets of the time and filed Chapter 11 in 1992 before emerging as a reorganized C-Corp in 1993.

Perhaps that unpleasant history inspired NVR to pursue such low risk financial and operating strategies (they also avoid having earnings calls). Regardless, whatever they have done since the early problem years has worked out very well for shareholders.

Fiscal conservatism and minimal inclination for big bang M&A has been the legacy of the company that is now one of the lowest risk homebuilders in financial context and a company that does not go on the aggressive expansion strategies that have been typical of some major industry players in recent cycles before and after the housing crisis.

NVR in its current form consistently leads the industry in long-term ROE peer group comps. That conservatism has served shareholders well.

See also:

New Home Sales April 2024: Spring Not Springing Enough 5-23-24

Toll Brothers: A Rising Tide Lifts Big Boats 5-23-24

Existing Home Sales April 2024: Pay More, Get Less, but More Available 5-22-24

Credit Crib Note: Taylor Morrison 5-20-24

Footnotes & Flashbacks: State of Yields 5-19-24

Housing Starts April 2024: Recovery Run Rates Roll On 5-16-24