The Curve: Macho Man Meets Patient Man 10-12-25

The FOMC could now be facing a fresh round of stagflation threats with China tariff risks, weaker payrolls, and a shutdown kicker.

Wrong song for the occasion?

The UST curve rallied this week for all the wrong reasons with a fresh tariff threat against China and trade war signals presenting a potential breaking point for many investors living in a permanent state of confidence. The constant reminder about the impending doom for many households’ cash flow ties to health insurance premiums is not helping the growth and consumption story.

China trade battles are hard to win on either side, and the Trump vs. Xi dance off pits two very different profiles against one another. It is not like a fight with the EU, Mexico or Canada. Any sustained escalation with China could see a new bag of tricks (economic weapons?) tied to supply denial/constraints. That is, if this all goes sideways and is not just another “time out” for each side to regroup. A protracted China trade clash is the easiest path to stagflation and would cut across the widest range of product groups.

The lack of steady data inputs and more macro data from the BLS and BEA is a problem for the FOMC, who will necessarily be driving while impaired.

We update the 2Y to 10Y UST slope history as the trade-off of Fed easing with threats to inflation premiums out the curve leaves steepening as a core expectation into 2026 even if we see intermittent flattening and downward shifts along the way. The +53 bps 2Y to 10Y slope is inside the +89 bps long-term median, so that risk remains a fact of life with record deficits and record UST supply ahead.

The charts below update our rolling review on the state of yields. We break some sections into two parts: “Recent Trends” and “Historical Context.” The historical context is more about background, memory joggers, and for new readers. The recent trend sections offer quick summaries of the past week’s UST action.

The chart above and those that follow update our rolling review on the state of yields. We break some sections into two parts: “Recent Trends” and “Historical Context.” The historical context is more about background, memory joggers, and for new readers. The recent trends is a quick summary of the recent UST action.

Recent Trends:

With the Sept easing printed at -25 bps and -50 bps resoundingly rejected, the two FOMC meetings (Oct, Dec) will bring major decision points. The Oct meeting might get some CPI data as announced but payroll releases are a victim of the shutdown. The BLS decided inflation numbers are “essential,” so the CPI will be released by the BLS on Oct 24 and in FOMC hands for the Oct 29 meeting. The Dec 10 meeting also should have the pending SCOTUS decision in hand on the legality of Trump’s IEEPA strategy (expected November).

Data points effectively locked in the odds for Oct at -25 bps (98.3% odds on latest FedWatch) and December at -25 bps (91.7% odds). The Oct odds are up by around 2 points since last week while the Dec odds are up by almost 5 points.

As we await a Sept CPI number, we can look back at headline CPI for August which had come in warmer MoM and posted a YoY increase from 2.7% to 2.9%. The latest PCE inflation print did not offer relief either (see PCE August 2025: Very Slow Fuse 9-26-25). As a reminder, the last full month of Biden’s terms saw CPI in Dec 2024 at 2.9%.

While inflation is clearly not hitting the more dire scenarios one could spin if trade wars broke out and Trump did not dial back many of his tariffs, the China risks could change the entire debate. The tariff expenses, potential price adjustments, and tariff cost mitigation actions by companies will only play out over months and quarters and will be subject to other cyclical factors.

Payroll may hold the key here for Fed doves since the other cyclical fundamentals have not fallen out of bed yet. A big question is whether the data will be disrupted well into November. You can only fly blind for so long.

Another question is whether this shutdown offers an excuse to ideologues to radically overhaul data operations? The lose-lose bet for Democrats on the BLS and BEA in a shutdown is that the blame game is usually a tie, but the Project 2025 crowd could see it as an opportunity for mass purges at the BLS and BEA and accelerate consolidation of data capabilities. This is detailed in Project 2025. They are neither subtle nor cautious.

Historical Context:

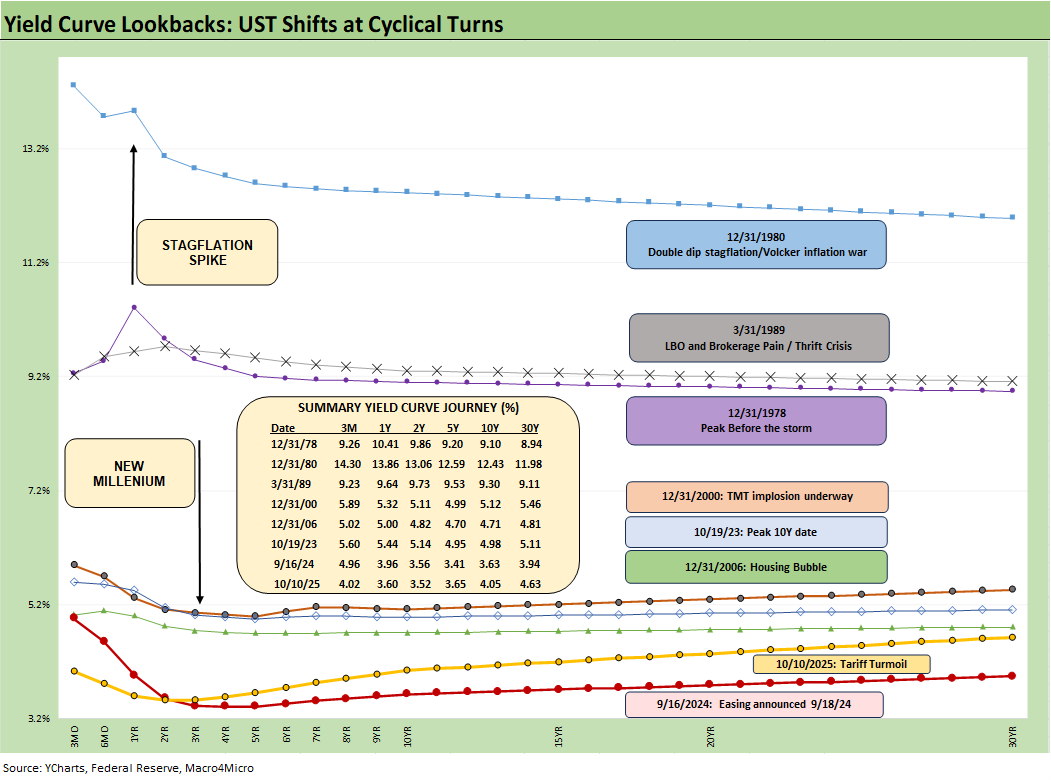

The above chart overall helps give historical context to the level and shape of the current yield curve vs. a range of market backdrops. The curves are plotted across some historical economic expansions and in some cases pending turns in the economic and/or monetary cycle. They are worth pondering for compare-and-contrast purposes since they mark key transition points in cycles and market risk backdrops. In some cases, the timelines included bouts of dulled risk senses and occasional valuation excess (notably 1989, 2000, 2006).

Highlights across monetary journey…

The last time a stagflation threat had to be considered was after the Carter inversion of 1978 indicated above. The stagflation threat then showed up in force by the Dec 1980 curve after a peak Misery Index of 22% in June 1980 and Volcker was in full swing trying to break inflation.

Another useful period to ponder is the TMT cycle faltering in 2000 on the way to a massive Greenspan easing in 2001. The current cyclical tech boom and valuations cannot escape looking back at the late 1990s. That period saw credit markets under pressure in 1999 and creeping up on 6% HY default rates, but that did not stop the NASDAQ from printing an 86% total return year in 1999 on the way to a March 2000 peak (see UST Curve History: Credit Cycle Peaks 10-12-22, Greenspan’s Last Hurrah: His Wild Finish Before the Crisis 10-30-22, Yield Curve Lookbacks: UST Shifts at Cyclical Turns 10-16-23).

That period offers another case study in excess in equity and credit markets with the peak in 1999 (credit) and NASDAQ (2000). The TMT bubble bursting soon led to excessive easing by Greenspan in 2001 and then into early 2004, in turn setting the table for the housing bubble peak in 2006. During the 2004 to 2007 period, leveraged derivative exposure and structured credit was out of control and counterparty risk was soaring. The good news is that currently the credit markets and banking/dealer systems are sound unlike 1999 and 2007.

Passing across the distortion years…

The chart above jumps from 2006 to 2023, which takes the market beyond the crisis period and the ZIRP years and COVID. Both the post-credit crisis period and later COVID crisis prompted the Fed to deliver a wave of market liquidity support and confidence building programs that helped save the capital markets, reopened the credit markets, reduced refinancing risk anxiety, and reduced the contingent liquidity risk profile of the banks.

The credit crisis period from late 2008 to COVID in 2020 brought plenty of QE and normalization distortions to the yield curve shape. The Fed’s dual mandate made that possible. The market could soon face new legislative threats to the Fed in 2026 that seek to reel in the dual mandate. That is based on commentary from Bessent and mirror plans discussed in Project 2025 (See Chapter 24). That will be a topic to tackle as we get closer to those ideas coming into play.

Recent Trends:

The above chart plots the recent trends in the 30Y UST vs. the dollar index (DXY) as the US dollar weakness throws another risk variable into the picture and poses a major risk factor for non-US buyers of UST.

This past week saw the dollar firm up to 99.45 at close on 10/9 and then retreat again on 10/10 as noted in the chart. That came after Trump threatened 100% tariffs on China. Pre-China announcement, the recent rebound was being attributed to FOMC actions and post-meeting commentary not signaling a hyper easing move – at least until Trump gets “his guy” in the seat and more like-minded people in leadership positions.

The UST rally out to 30Y as detailed below largely took place on Friday. The reality is that a UST steepener remains very much a threat with inflation not easing and UST supply pressures remaining higher across the longer horizon despite the tariff revenue.

Team Trump loves to speak of record tariff revenue as if the word “record” makes it a good thing when it comes out of US consumer and corporate pockets. If you wanted to create a recipe for stagflation, that would be the easier recipe book. Just add record deficits and a weaker dollar from the spice rack that make the tariff even higher at the border.

Tariffs hit prices or profitability – there is no hiding from the tariff expense paid to customs by the buyer/importer. Resulting expense offsets create layoffs or slow hiring and expansion by companies who get hit on the cost line. Reigniting the trade war with China promises to exacerbate this issue. How it all plays out (actual tariff % by product lines, carve outs for various goods, pharma, etc.) remains to be seen.

Historical Context:

The dollar has gone through its worst pounding in 2025 since the 1970s during the dark days of stagflation and multiple deep recessions. On the one hand, lower rates could be a catalyst for dollar weakness while political risk factors and governance quality should now be factors in the US sovereign credit quality assessment. The flip side is rates and inflation metrics may not cooperate with baseline scenarios. In a world where everyone is a borrower, someone has to be the lender.

Record forward-looking deficits and the optics of political instability (military occupation of major cities by an authoritarian-leaning, confrontational leader) adds a negative element to the sovereign risk profile of the US that no rating agency would have the courage to flag. The latest assault on free speech and Trump’s threat to arrest people who accuse him of being against free speech is not without its humor and twisted irony (“Call me a fascist and I will arrest you.”?!?). Tossing around the Insurrection Act is anything but reassuring to political stability and broader economic confidence.

Recent Trends:

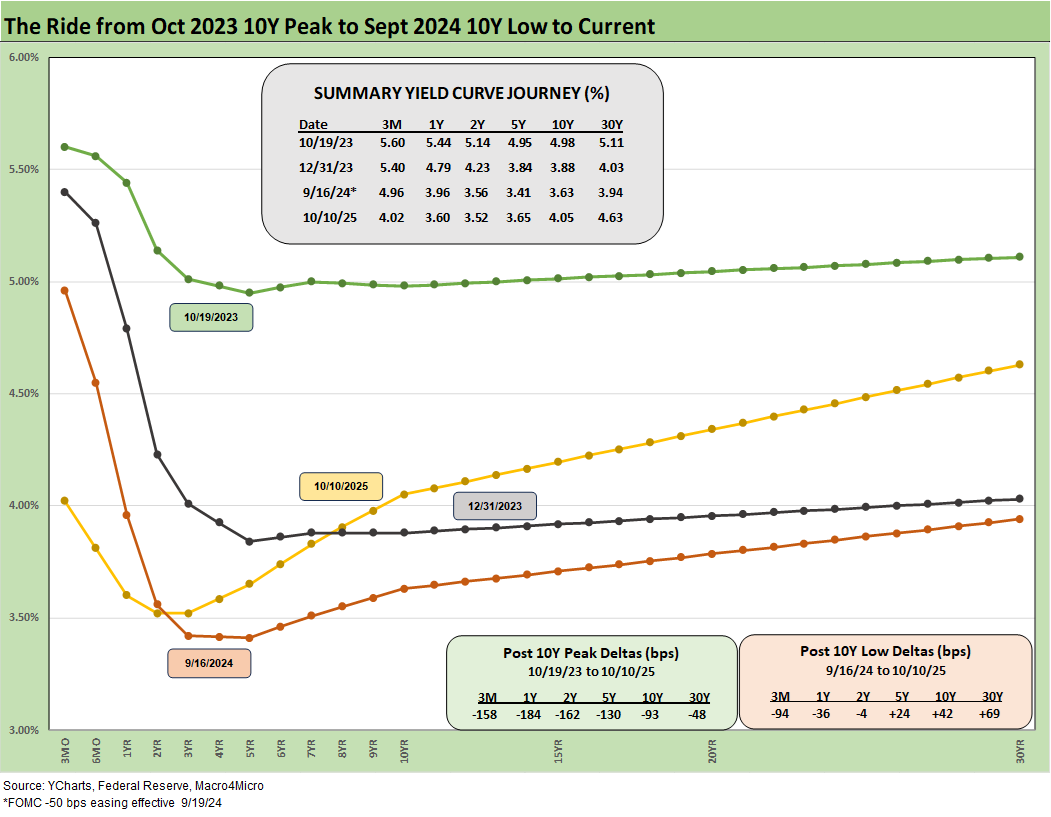

The above chart updates the post-easing shift and gives some context to the last major easing in Sept 2024. The current curve has not followed the Sept 2024 shift into a bull flattener with the lower fed funds. The rally after Sept 2024 was brief and soon gave way to a bear steepener.

We saw a downward shift this week with intermediate to long rates moving in a bull flattener pattern after a timeline that saw a bear steepener since the Sept 2024 easing (the box on the right above embedded in the chart). The long bond (30Y) chaos in various countries has kept global investors on edge since the supply-demand concerns for UST funding are not going away. That said, we have seen the UST 30Y finally get into a modest rally mode in 2025.

Historical Context:

The above chart frames today’s rates amid the wild ride from the Oct 2023 peak (10Y UST) down across the bull flattener into year-end 2023 and then into the easing actions and rally of Sept 2024. Then came the ensuing bear steepener that is evident in the journey to Sept 2025. We break out some numerical UST deltas in the box.

The UST experience in the period after Sept 2024 and the -50 bps in cuts (followed by another two cuts in 4Q24) will loom large in memory banks. This chart reminds us that the “ease and flatten” shapeshifting pattern is hard to rely on in a market where the supply-demand of UST is tenuous and tariff impacts are hard to predict.

Fed easing and the flattener vs. steepener debate…

There was a lot of bear steepener action from the end of 2023 into the summer of 2024 and fresh bouts of the same after the big rally in the fall of 2024. The Sept 2024 easing gyrations will make it hard to take much for granted this time after Sept 2025 with much higher, sweeping tariff policies and an ongoing debate over a cyclical slowing in the mix of variables.

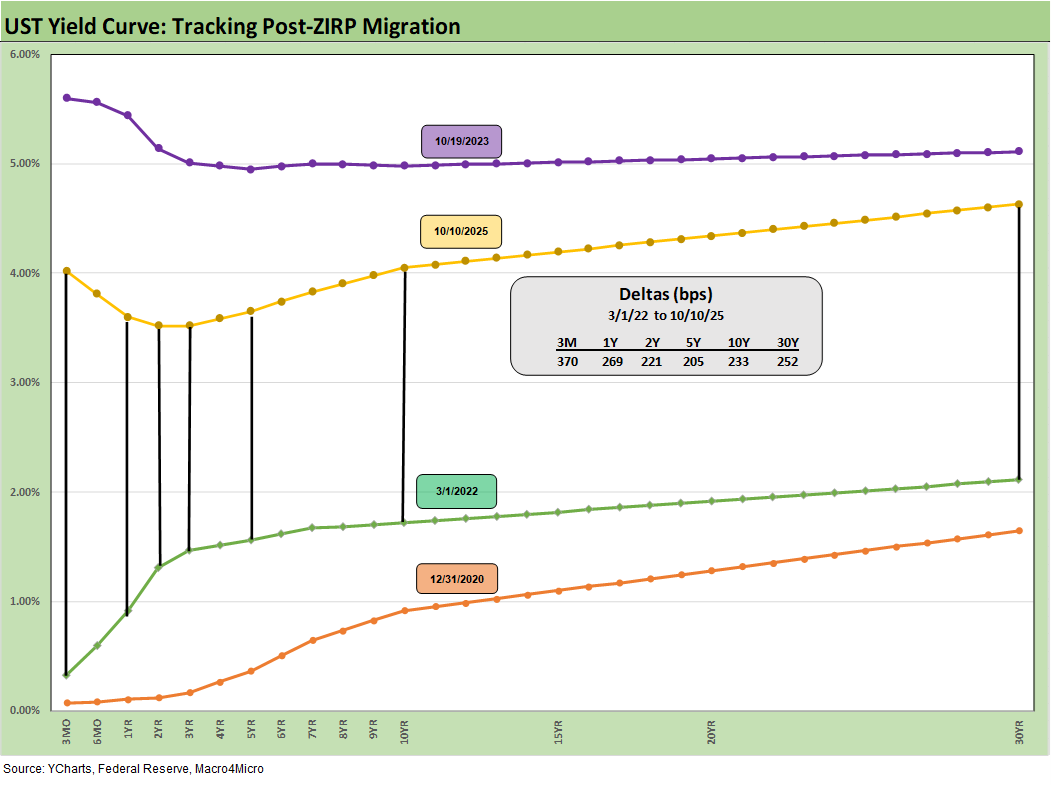

Historical Context:

The above chart just updates where the current UST curve stands relative to the Dec 2020 UST curve on the low end and the 10-19-23 highs after the tightening cycle went into effect in March 2022.

Recent Trends:

The above chart updates the 1-week UST deltas and the renewed anxiety around the cycle and the lack of predictability on what might come with the latest threat of a trade war with China. Inflation fears vs. growth worries and how that flows into payrolls, consumer spending, and industrial production rates (e.g. autos) leave a long list of questions including how the consumer might react to any protracted sell-off in equities.

Only time will tell how this might shake out and impact the pace of FOMC easing in coming months. We’ll keep our ears open for comments by Fed members especially those already cautioning against further easing in the face of tariff uncertainty. The “hawks” need to ponder the recession risk vs. the goods affordability challenge as one big line item – health care insurance – is going to have multiplier effects beyond the health care bill.

For all those who say the Fed is damaging the housing market, the mortgage story and the supply-demand imbalances by region and price tier underscore that the topic is a lot more complicated than that. This week, the 30Y mortgage rate level remained in the 6.3% range (6.32% according to Mortgage News Daily on Friday) despite the 10Y UST rally.

We saw mortgage rates move higher to almost 6.4% after the easing after earlier it had moved closer to 6.1% prior to the easing. Everyone got a taste in late 2024 and into 2025 that the fed funds rate does not dictate mortgage rates, and that Sept 2024 aftermath was before the tariff wave started to work its way into the various industry ecosystems.

Recent Trends:

The above chart updates the YTD UST deltas. We see how the bull steepener has paid off for bond returns in YTD 2025 with the 7 bond ETFs we track all in positive return range (see Market Commentary: Asset Returns 10-11-25).

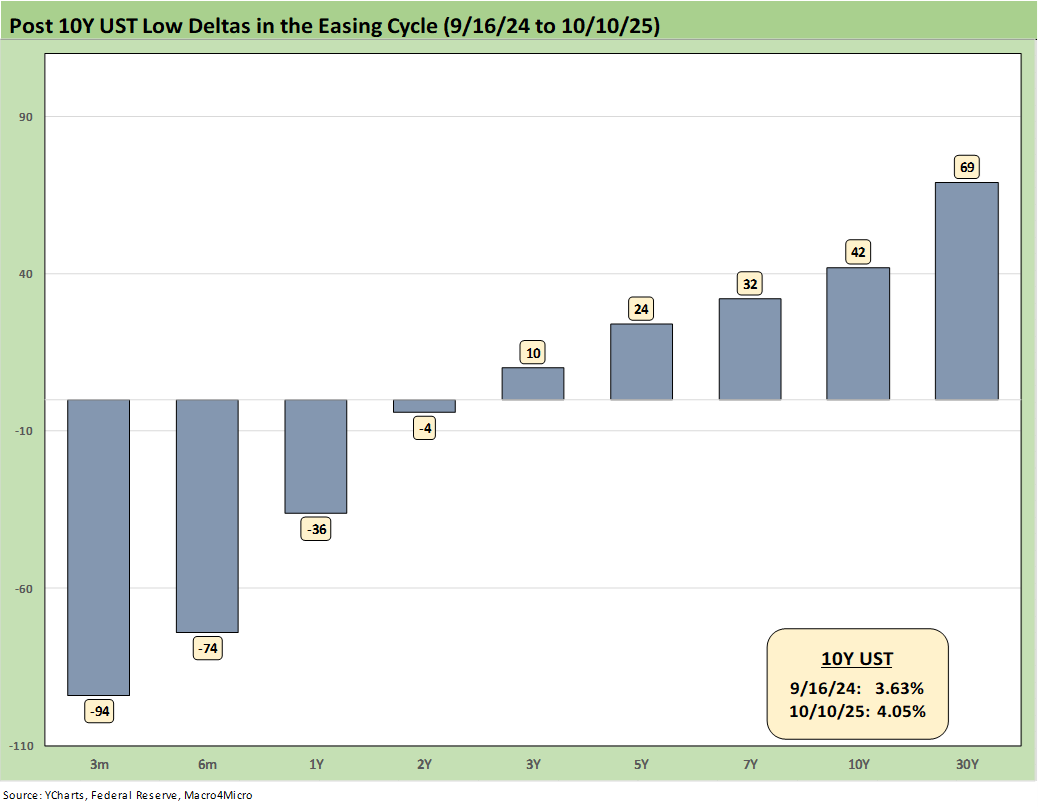

Recent Trends:

The above chart updates the running UST deltas from the recent low point in the post-tightening cycle reached in Sep 2024 (9-16-24) when the 10Y UST (10-19-23) dipped to 3.6% around the first -50 bps easing. The latest UST move shaved some more bps off the UST deltas. At the very least, the 3.6% on 10Y UST offers some hope to the UST flattening bulls as the FOMC gears up for more easing heading into year end.

The biggest difference between the current backdrop and Sept 2024 is the radically different tariff policies and the slowing GDP growth on key lines such as PCE and select fixed investment lines (see 2Q25 GDP Final Estimate: Big Upward Revision 9-25-25). There is no question the economy has been posting weaker growth in 2025 than 2024. PCE is weaker in growth while the investment line should recover based on the proposed investment “promises.” Those are not in the GDP numbers yet.

Lead times on projects vary materially, and a promise is not a contract. We assume the loosely defined investment promises are subject to market conditions and to final, inked trade deals. As of now, ironclad trade deals are lacking with the EU, Mexico, Canada, and China. That is, deals are lacking for the majority of US trade, which is dominated by those four.

The sudden shift by Team Trump (notably Bessent, Hassett) to emphasize the 2Q25 headline GDP of 3.8% after instructing their audience to ignore the revised 1Q25 headline number of -0.6% as distorted is almost funny.

The key here is to understand how the major tariff-related distortions in net exports/imports and “change in inventories” lines impact the headline GDP number. This is not necessarily intuitive.

Headline GDP for both 1Q25 and 2Q25 is materially distorted by the import line. In 1Q25, higher imports, as part of the pre-tariff import spike and inventory build, generated a -4.7% hit to GDP. In 2Q25, dramatically lower imports generated an additional +5.0% to headline GDP. That +5.0% decline in imports gets netted against a -0.2% decline in exports for a net addition to GDP of +4.8% in 2Q25.

Bessent and Hassett want you to adjust for the negative distortions for 1Q25 to make the number higher. Then they want you to ignore the positive distortions from imports in 2Q25. That is a tad self-serving – and intellectually dishonest.

Beyond the net exports/imports line, the “change in private inventories” is also a major distorting variable. In 1Q25, change in private inventories adds +2.6% to GDP while in 2Q25, it deducts -3.4%. In other words, imports in 2Q25 “artificially” boosted GDP and you can net that +5.0% against -3.4% from inventory.

On a darker note, the huge decline in imports can also be construed as a sharp decline in companies’ low-cost sourcing capabilities and in turn higher expenses. That gets back to the debate of how they sustain margins via price or alternative cost cutting. Or companies simply have lower margins. Nothing comes for free under the laws of economics or double-entry accounting.

If you want to make the case that declining imports, declining exports and lower investment in inventories is a good thing in 2Q25, just don’t bring it up in macroeconomics class or ahead of your bonus review.

Headline GDP numbers are part of the exercise, but the value-added focus should always be first and foremost on the PCE lines and various Fixed Investment lines. That is where the cyclical stories can be found.

Recent Trends:

The above chart updates the running UST deltas from 10-19-23 through Friday. At the very least, it offers a reminder of what could go wrong if we get adverse inflation outcomes from tariffs. The politics of inflation have always been a death knell for reasonable discussion based on facts (“seller pays” vs. “buyer pays,” etc.).

If jobs stay weak and inflation numbers get uglier, there is every reason to expect intervention by the White House in the BLS and BEA process (see Happiness is Doing Your Own Report Card 8-1-25). With Vought’s ominous and completely vague announcement on Thursday that “the RIFs have begun,” we are waiting to see how the forthcoming mass firings impact the BLS and BEA.

Historical Context:

We now live in a world where votes and economic data get rejected, and the lemmings fall right into line and join the disinformation chorus. The data sets do struggle in payroll, and the need to use better model assumptions and improve survey utility have been picked over ad nauseum. When Trump piled on the “get rid of quarterly reports” bandwagon (in the age of AI and streamlined data delivery), the “intent” to mask any negative trends in the economy started to get more transparent in terms of motives.

The explicit Project 2025 ambition (Chapter 21, 24) is to consolidate data and information and unify control – not to assure better and more comprehensive data. That has been evident in an array of actions that we have covered in other notes. Ambitions for better data require more investment, more tech, and more public-private alliances. That dilutes control – and closer control is the point for the White House.

Recent Trends:

The above chart plots the 2Y to 10Y slope from 1984 for a read on the current shapeshifting potential ahead. For the 2Y to 10Y, the current +53 bps vs. long-term median of +89 bps shows ample room for steepening from current levels. Bear steepening moves have been common in the 2024-2025 timeline, and the tariff topic is one more force that keeps it on the front burner as a risk to watch.

Historical Context:

We see a peak inversion in July 2023 of -108 bps after the 2Y to 10Y had hit a UST segment slope of +159 bps in March 2021 when the macro picture had bounced off COVID in a ZIRP market and fed material supply-demand imbalances.

Oil and gas prices spiked with the Russian invasion of Ukraine in Feb 2022. That Russian inflation catalyst is seldom – if ever – cited by Trump and his GOP leadership when they point fingers. Politics as usual in Washington.

We also include a box within the chart that details the other UST curve segment slopes that we watch along with the long-term medians. The front-end inversion from 3M is still the most anomalous part of the curve when you consider the fact we have been in an economic expansion since spring 2020 after a very brief 2-month COVID recession per NBER.

The economy is now slowing in 2025 with PCE inflation still inside the 3.0% line but edging higher (see PCE August 2025: Very Slow Fuse 9-26-25). The 3M to 2Y UST inversion of -50 bps is starkly different from the post-1984 historical median of +57 bps. The 3M to 5Y inversion of -37 bps is also a long walk from the +107 bps median.

See also:

Market Commentary: Asset Returns 10-11-25

Mini Market Lookback: Event Risk Revisited 10-11-25

Credit Profile: General Motors and GM Financial 10-9-25

Credit Markets: The Void Begins 10-6-25

The Curve: Blind Man’s Bluff 10-5-25

Mini Market Lookback: Chess? Checkers? Set the game table on fire? 10-4-25

JOLTS Aug 2025: Tough math when “total unemployed > job openings” 9-30-25

Credit Markets: Cone of Silence Ahead? 9-29-25

The Curve: Easing Anxiety at Bat, Tariffs on Deck 9-28-25

Mini Market Lookback: Market Compartmentalization, Political Chaos 9-27-25

PCE August 2025: Very Slow Fuse 9-26-25

Durable Goods Aug 2025: Core Demand Stays Steady 9-25-25

2Q25 GDP Final Estimate: Big Upward Revision 9-25-25

New Homes Sales Aug 2025: Surprise Bounce, Revisions Ahead? 9-25-25

Credit Markets: IG Spreads Back in the Clinton Zone 9-22-25

Mini Market Lookback: Easy Street 9-20-25

FOMC: Curve Scenarios Take Wing, Steepen for Now 9-17-25

Home Starts August 2025: Bad News for Starts 9-17-25

Industrial Production Aug 2025: Capacity Utilization 9-16-25

Retail Sales Aug 2025: Resilience with Fraying Edges 9-16-25

Credit Markets: Quality Spread Compression Continues 9-14-25

Mini Market Lookback: Ugly Week in America, Mild in Markets 9-13-25

CPI August 2025: Slow Burn or Fleeting Adjustment? 9-11-25

PPI Aug 2025: For my next trick… 9-10-25

Mini Market Lookback: Job Trends Worst Since COVID 9-6-25