FOMC: Curve Scenarios Take Wing, Steepen for Now

The FOMC action came in as expected with -25 bps with the dot plot in no way showing a flock of doves in the dot count.

Why can’t we all just get along?!

The -25 bps cut was in line with the oddsmakers, but the lack of broader support for steeper cuts through the end of 2025 show how the tariff and inflation worries are still there for numerous players in the Gang of 19 (and subset of 12). The same is true on labor.

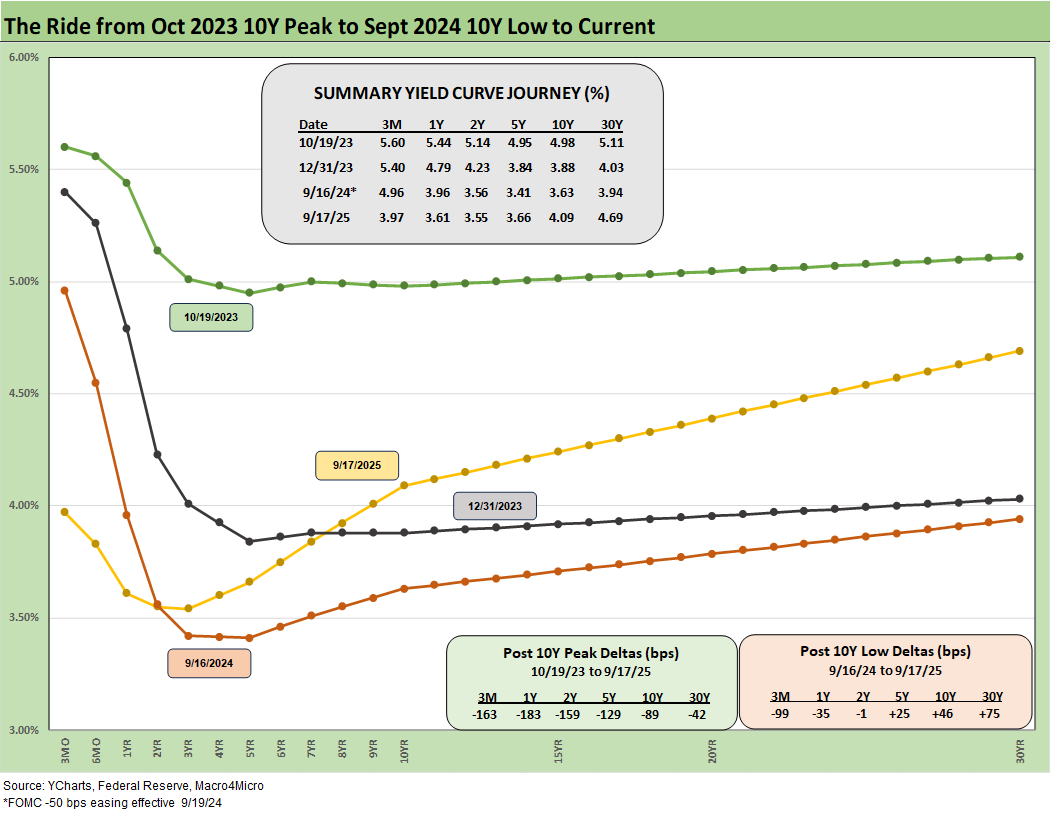

The clear signal at the median was for more cuts, which initially got the equity markets excited before a fade. The 10Y UST actually rose, so the bear steepener flashbacks, after the Sept 2024 easing and 4Q24 series that totaled -100 bps, are still there (see chart below).

The new guy on the block (Stephen Miran), who is on leave from the White House and seen as a Trump proxy vote, wanted a cut of -50 bps. The institutional players seemed inclined to highlight Fed independence and prudence and push back at the recurring Trump demand for -300 bps. We assume a few were inclined to cut -50 bps but also wanted to show unity and support for the institution.

We saw 7 of the 19 calling for no more action in 2025 with 9 “dots” at 2 more cuts and 2 at 1 more cut. The identity of the outlier seeking 5 more cuts in 2025 is not much of a mystery. We see 5 dots with 2% handles for fed funds in 2026 with all 19 below 4%.

In the above chart, we include the ride from the Oct 2023 peak on the way down to the post-FOMC-easing lows of Sept 2024. That steepener risk is alive and well again given the constructive backdrop of growth (positive is worth something) and lingering threats of job losses running alongside tariff effects on goods pricing and corporate expenses (and the tariff cost mitigation strategies that come with that).

In the Summary of Economic Projections (SEP), we see the updates on medians and the changes from the last meeting. The last SEP report in June saw some negative revisions with this SEP more muted in the number and direction of the changes (see FOMC Day: PCE Outlook Negative, GDP Expectations Grim 6-18-25).

Below we frame a few of the more interesting economic projections:

PCE inflation: The new estimate for 2025 is unchanged after the increase in the last go-around. The June estimate was 3.0% and that stayed flat at 3.0%. That June 2025 SEP median was an increase from 2.7% in March and from 2.5% in Dec 2024. The inflation threat appears to be coming off the peak as a fear factor with median 2026 PCE inflation ticking lower to 2.6% with Core PCE for 2025 at 3.1% (flat to June) moving to 2.6% in 2026 (that was 2.4% for 2026 in the June 2025 numbers).

Unemployment: The unemployment rate median forecast remains at +4.5%, up modestly from current levels. The 2026 estimate has a median of 4.4%. That is a low rate in long term historical context.

GDP growth: The 2025 GDP estimate bumped up to +1.6% from 1.4% in June. We see sub-2% GDP for each year out to 2028 with the 1.8% GDP for 2026 an uptick from 1.6% in the June SEP. Sub-2% GDP is not bragging material.

Fed funds rate: The median fed funds for 2025 was notched down to 3.6%, down from +3.9% in June. The 2026 median is down to 3.4% from the 3.6% in June.

We watched the Powell press conference, and given the scrutiny he has been getting of late (including Jackson Hole), there was not much new with the most interesting dialogue about the change in the labor market. The theme around the likely effect of a one-time event of higher prices ahead was consistent as was the caveat that such action could give rise to more inflation effects on the wage – price links. That is the classic “short but tall” forecast one often hears.

The topic of what tariff pass-through effects look like was another routine topic. That is a radical departure from the Team Trump view, which is that Trump collected hundreds of billions from selling countries in Trump 1.0 (patently false since he collected zero). Trump has been reiterating that tariffs are bringing in “trillions.” (You should have seen the fish that got away!)

In the next jobs number, it will be important to see if bad news hits the payroll trifecta for another month. We get the final 2Q25 GDP numbers and another PCE print next week along with more housing releases. The return to the data grind remains as the market will get the SCOTUS IEEPA decision by the next SEP report.

See also:

Home Starts August 2025: Bad News for Starts 9-17-25

Industrial Production Aug 2025: Capacity Utilization 9-16-25

Retail Sales Aug 2025: Resilience with Fraying Edges 9-16-25

Credit Markets: Quality Spread Compression Continues 9-14-25

The Curve: FOMC Balancing Act 9-14-25

Footnotes & Flashbacks: Asset Returns 9-14-25

Mini Market Lookback: Ugly Week in America, Mild in Markets 9-13-25

CPI August 2025: Slow Burn or Fleeting Adjustment? 9-11-25

PPI Aug 2025: For my next trick… 9-10-25

Mini Market Lookback: Job Trends Worst Since COVID 9-6-25

Payrolls Aug 2025: Into the Weeds 9-5-25

Employment August 2025: Payroll Flight 9-5-25

JOLTS July 2025: Job Market Softening, Not Retrenching 9-3-25

Hertz Update: Viable Balance Sheet a Long Way Off 9-3-25

Mini Market Lookback: Tariffs Back on Front Burner 8-30-25

PCE July 2025: Prices, Income and Outlays 8-29-25

2Q25 GDP: Second Estimate, Updated Distortion Lines 8-28-25