The Curve: Blind Man’s Bluff 10-5-25

The lack of data will not stop the White House from opining on everything, but 3Q25 earnings will help offer some infill.

Bessent’s team is not going to help much.

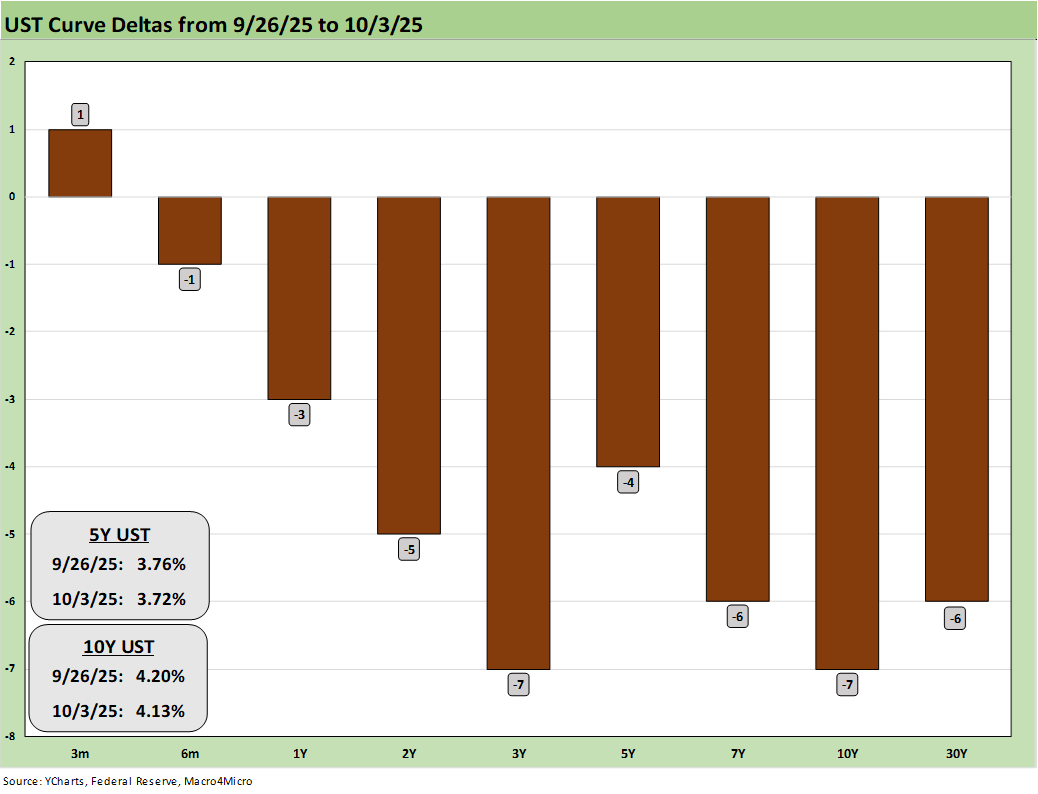

The UST curve rallied on the week on continued expectations of labor pressures even with the likelihood of no data for a while as ADP supported that logical theory.

The shutdown could spill across into other multiplier effects if we move into a cycle of vindictive mass layoffs and more radical changes to the data providers themselves as Project 2025 has endorsed.

The lack of payroll and inflation data could last a while just as Trump is rolling in a wave of new tariffs. Poor transparency could be part of the intent.

The political risk factors have not wagged the market, but this week’s military “pep talk” aiming at cities for “training” and the “enemy within” was a fiasco for the ages and reflects pure authoritarian ambitions. That is not an aphrodisiac for the consumer at a time when the reality of major increases in health insurance premiums (or loss of coverage) for millions is closer to sea level household budgets.

Recent Highlights:

We had a modest rally in the UST curve this week but against a backdrop where the word “unique” truly applies. We have entered a sweeping government shutdown in a period when the market faces unprecedented tariffs in the postwar era (WWII, not the Gulf War).

Stagflation is threatening for the first time since Volcker in the 1980-1982 double dip recession. This comes at a time when the cycle is clearly on the cusp of a cyclical turn if we stay on the current trajectory through year end and toss in mass layoffs in government and insurance premiums spike. Trump will break his own 2018 US shutdown record of 34 days unless the Democrats see more defections.

Prior to the government shutdown at midnight on Sept 30, JOLTS came in mixed, but ADP also indicated continued employment weakness. On Friday (10/3), the payroll release was the first major casualty of the shutdown war allowing the market to hum along undeterred (see Market Commentary: Asset Returns 10-4-25). Is the market calm a case of Bruce Lee’s “emotional content,” bandwagon FOMO, or ignorance is bliss?

In the prior two months, the UST curve handicapping exercise has been influenced more by the payroll side of the dual mandate than inflation worries after major downward revisions to payroll. The BLS data is clearly showing employment under pressure while inflation (CPI/PCE) is proving sticky at best and ticking higher sequentially along many lines as tariff impacts unfold (see PCE August 2025: Very Slow Fuse 9-26-25, CPI August 2025: Slow Burn or Fleeting Adjustment? 9-11-25, PPI Aug 2025: For my next trick… 9-10-25).

Inflation has clearly not been hitting the more dire scenarios one could spin if trade wars broke out and Trump did not dial back many of his tariffs. However, the tariff expenses, potential price adjustments, and tariff cost mitigation actions will only play out over the coming months and quarters and will be subject to other cyclical factors at play.

New economic data from the BLS and BEA will be on hold until further notice by an administration that is actively threatening to take advantage of the shutdown to eliminate more jobs at the federal level as per Project 2025. While Team Trump and Vought, especially, may be delighted, don’t get it twisted. This is not a good thing for the economy even if rewarding a more extreme ideology.

The government is not guaranteed to reopen by the time the Oct FOMC meeting takes place (10-29), so we still anticipate an Oct cut of -25 bps (94.6% FedWatch as we go to print, which is down from over 96% earlier in the day and up from 91.2% last week). An additional -25 bps cut is still heavily favored in Dec at 83.0% as we go to print (down from 86.3% earlier in the day and up from 80.5% last week). The pending SCOTUS decision on the legality of Trump’s IEEPA strategy is expected in November and will further inform the Fed’s decision.

The last FOMC meeting underscored that there is NOT broad conviction that the inflation threat from tariffs does not remain. While Trump and Bessent like to target Powell as the leader, there are 19 dots (see FOMC: Curve Scenarios Take Wing, Steepen for Now 9-17-25).

Historical Context:

Note: these “Historical Context” sections are carried forward and updated as needed each week for new readers.

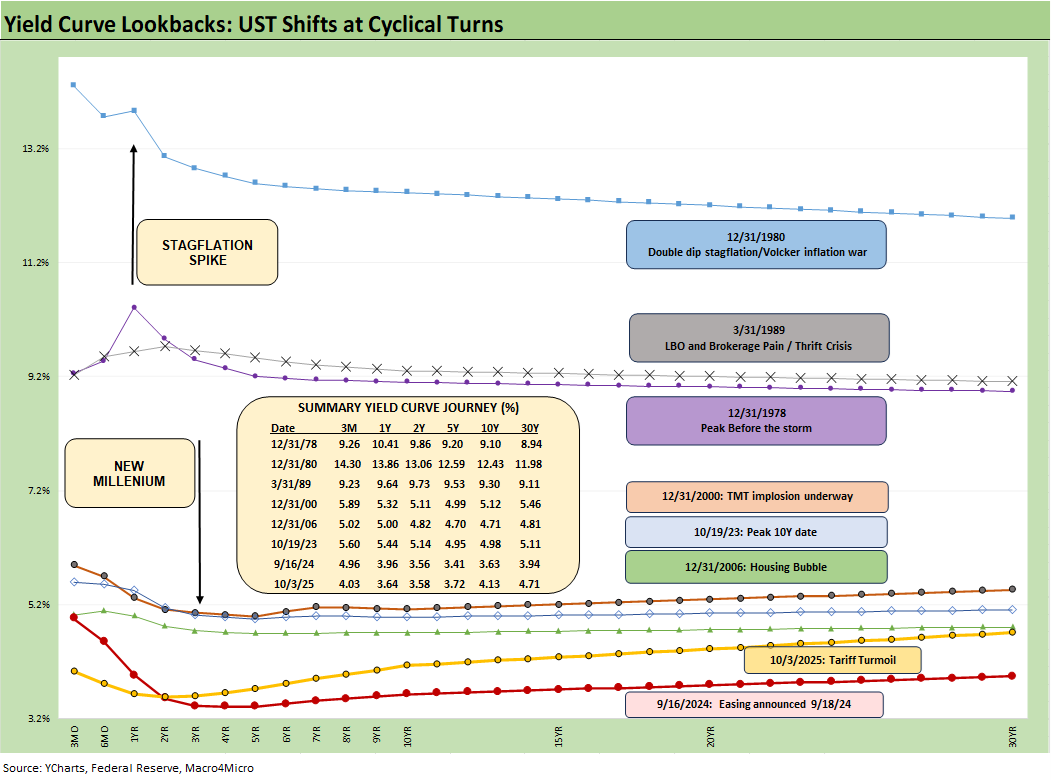

Overall, the above chart provides historical context to the level and shape of the current yield curve vs. a range of market backdrops. The curves are plotted across some historical economic expansions and in some cases pending turns in the economic and/or monetary cycle. We face both in late 2025. Those historical curves are worth pondering for compare-and-contrast purposes since they mark key transition points in cycles and market risk backdrops.

In some cases, the timelines include bouts of dulled risk senses and occasional valuation excess (notably 1989, 2000, 2006). We highlight such periods as reminders at a time when current equity valuations are at all-time highs and bond spreads resemble some all-time tights. Major domestic and global uncertainty is fueled by the Trump administration’s sweeping and unprecedented tariff regime, making this an especially challenging period that mixes a post-inflation tightening and easing cycle with tariff policies not seen since the start of the Great Depression.

The major moving parts come at a time of the worst political dysfunction since the Civil War and a period where the GOP leadership in the House and Senate – where tariffs are supposed to be their responsibility – have fully abdicated their roles. The tariff power delegated to the executive branch by existing legislation has allowed for the questionable application of national security rationales under Section 232. IEEPA is set to be settled by SCOTUS, who seldom buck Trump. That decision is expected in November.

Highlights across monetary journey…

The last time a stagflation threat had to be considered was after the Carter inversion of 1978 indicated above. The stagflation threat then showed up in force by the Dec 1980 curve after a peak Misery Index of 22% in June 1980 and Volcker was in full swing trying to break inflation.

Another useful period to ponder is the TMT cycle faltering in 2000 on the way to a massive Greenspan easing in 2001. The current cyclical tech boom and valuations cannot escape looking back at the late 1990s. That period saw credit markets under pressure in 1999 and creeping up on 6% HY default rates, but that did not stop the NASDAQ from printing an 86% total return year in 1999 on the way to a March 2000 peak (see UST Curve History: Credit Cycle Peaks 10-12-22, Greenspan’s Last Hurrah: His Wild Finish Before the Crisis 10-30-22, Yield Curve Lookbacks: UST Shifts at Cyclical Turns 10-16-23).

That period offers another case study in excess in equity and credit markets with the peak in 1999 (credit) and NASDAQ (2000). The TMT bubble bursting led to excessive easing by Greenspan in 2001 and then into early 2004, in turn setting the table for the housing bubble peak in 2006. During the 2004 to 2007 period, leveraged derivative exposure and structured credit was out of control and counterparty risk was soaring. The good news is that currently the credit markets and banking/dealer system are sound unlike in 1999 and 2007.

Passing across the distortion years…

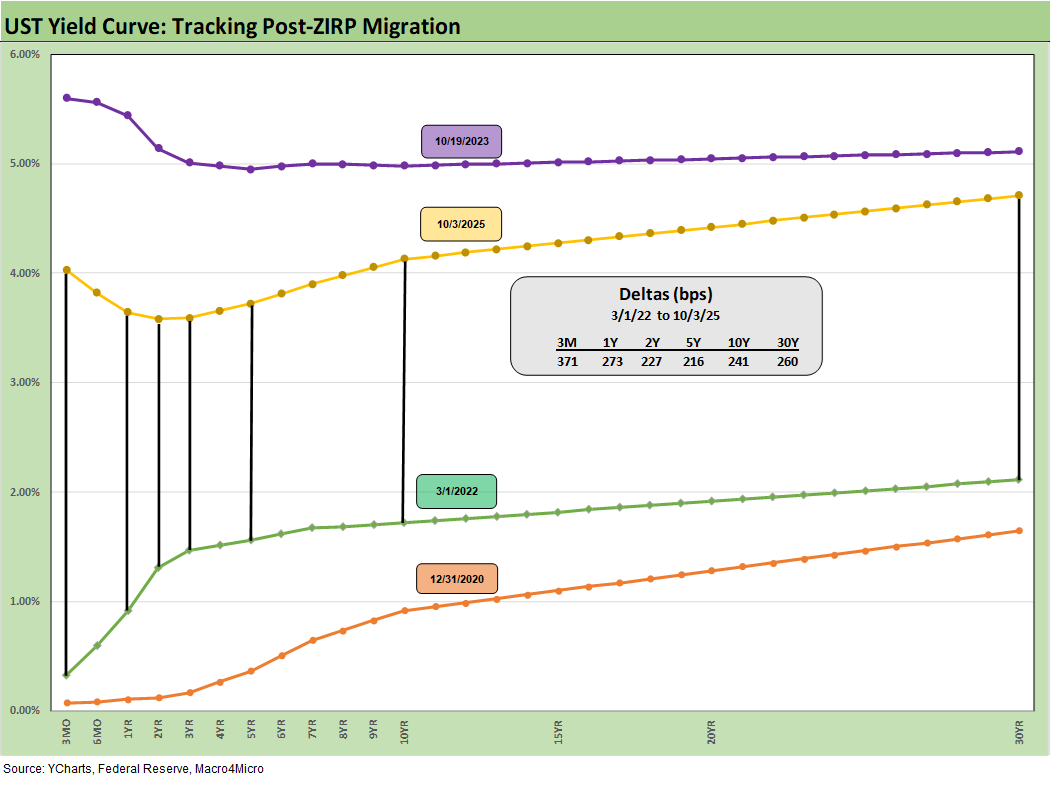

The chart above jumps from 2006 to 2023, which takes the market beyond the crisis period and the ZIRP years and COVID. Both the post-credit crisis period and later COVID crisis prompted the Fed to deliver a wave of market liquidity support and confidence building programs that helped save the capital markets, reopened the credit markets, reduced refinancing risk anxiety, and reduced the contingent liquidity risk profile of the banks.

The credit crisis period from late 2008 to COVID in 2020 brought plenty of QE and normalization distortions to the yield curve shape. The Fed’s dual mandate made that possible. The market could soon face new legislative threats to the Fed in 2026 that seek to reel in the dual mandate. That is based on commentary from Bessent and mirror plans discussed in Project 2025 (See Chapter 24). That will be a topic to tackle as we get closer to those ideas coming into play.

Recent Highlights:

The above chart plots the recent trends in the 30Y UST vs. the dollar index (DXY) as the US dollar weakness throws another risk variable into the picture and poses a major risk factor for non-US buyers of UST. This past week saw the dollar weaken again as more in the market see the downward pressure on rates if this meltdown gets even uglier.

The headline color after the Sept FOMC actions and post-meeting commentary was not signaling a hyper easing move – or at least until Trump gets “his guy” in the seat and more like-minded people in leadership positions. With the shutdown, the tone could start to shift with so many consumers about to have an insurance premium sticker shock moment in coming weeks. October is not a SEP and Dot Plot meeting, so there will be some guesswork on everything from data to what the FOMC said. The speeches will then pick up again.

This week saw modestly lower rates on the long end of the UST curve as detailed below, but the reality is that a UST steepener remains very much a threat with inflation not easing and UST supply pressures remaining higher despite the tariff revenue. Without CPI and PPI data early in the month or PCE data later in the month, the White House might be happy to avoid specific questions on specific numbers. You do not have to be a conspiracy theorist to gauge the motive and intent on the part of the White House.

Historical Context:

The dollar has gone through its worst pounding since the 1970s during the dark days of stagflation and multiple deep recessions. On the one hand, lower rates could be a catalyst for dollar weakness while political risk factors and governance quality should now be factors in the US sovereign credit quality assessment. The flip side is rates and inflation metrics may not cooperate with baseline scenarios. In a world where everyone is a borrower, someone has to be the lender.

Team Trump loves to speak of record tariff revenue as if the word “record” makes it a good thing when it comes out of US pockets. If you wanted to create a recipe for stagflation, that would be the easier recipe book. Just add record deficits and a weaker dollar from the spice rack. Tariffs hit prices or profitability. Resulting expense offsets create layoffs or slow hiring and expansion by companies who get hit on the cost line.

Record forward-looking deficits and the optics of political instability (military occupation of major cities by an authoritarian-leaning, confrontational leader) adds a negative element to the sovereign risk profile of the US that no rating agency would have the courage to flag.

The latest assault on free speech and Trump’s threat to arrest people who accuse him of being against free speech is not without its humor and twisted irony (“Call me a fascist and I will arrest you.”?!?). The troop deployment in tandem with the speech to military leaders this past week was shocking to anyone who has paid the slightest bit of attention to US and world history (see Mini Market Lookback: Chess? Checkers? Set the game table on fire? 10-4-25).

Recent Highlights:

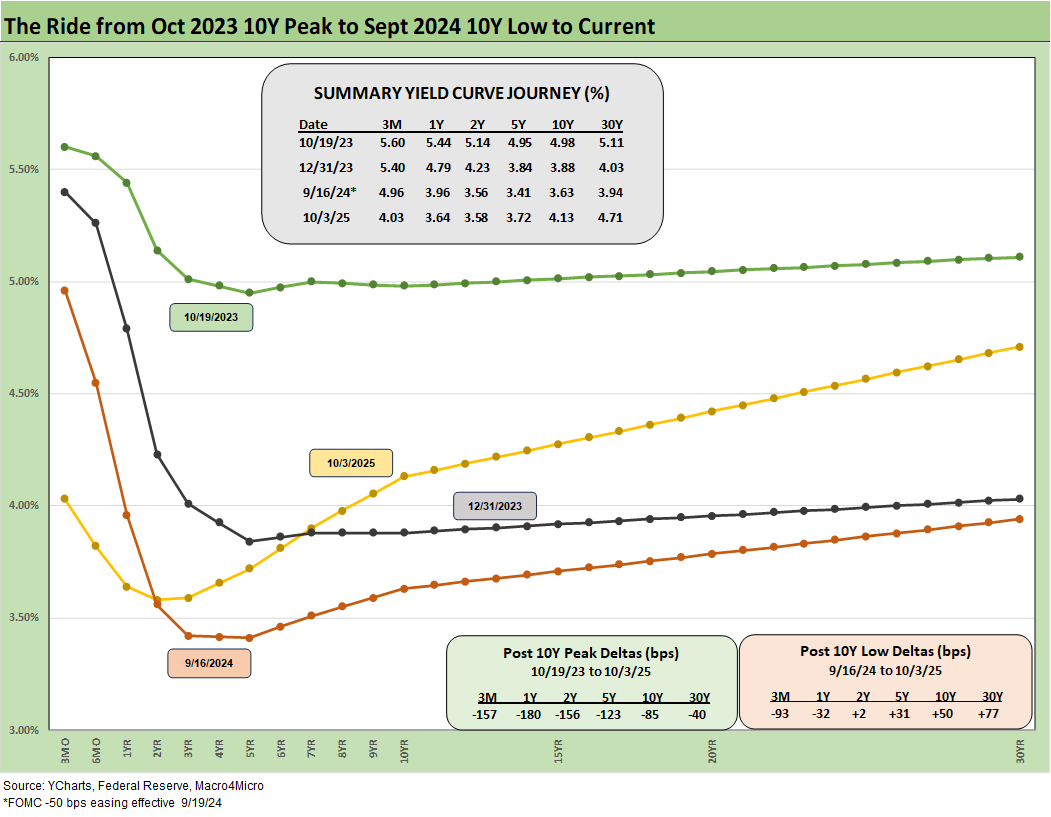

The above chart updates the post-easing shift from late 2024 and gives some context in the flattening vs. easing debate that ensued in late 2024 and will be revisited over the course of 4Q25. The big difference is that the market might be light on some critical data for more than 1 month as Trump is getting carpal tunnel from signing tariff orders and departmental pink slips (autopen?).

We have reviewed that Sept to Dec 2024 period routinely as a reminder that fed funds easing is not a reliable leading indicator to lower long rates or lower mortgages. That steepening risk ties into inflation fears that run the risk currently of turning into stagflation realities. The current curve did not follow the Sept 2024 shift into a bull flattener to go with the lower fed funds, and reactions so far have been mixed in 2025. The rally after Sept 2024 was brief and soon gave way to a bear steepener.

Historical Context:

The above chart frames today’s rates amid the wild ride from the Oct 2023 peak (10Y UST) down across the bull flattener into year-end 2023 and then into the easing actions and rally of Sept 2024. Then came the ensuing bear steepener that is evident in the journey to Sept 2025. We break out some numerical UST deltas in the box.

The UST experience in the period after the Sept 2024 easing and the -50 bps in cuts (followed by another two cuts in 4Q24) will loom large in memory banks. This chart reminds us that the “ease and flatten” shapeshifting is hard to rely on in a market where the supply-demand of UST is tenuous and tariff impacts are hard to predict.

Fed easing and the flattener vs. steepener debate…

There was a lot of bear steepener action from the end of 2023 into the summer of 2024 and fresh bouts of the same after the big rally in the fall of 2024. The Sept 2024 easing gyrations will make it hard to take much for granted this time after Sept 2025 with much higher, sweeping tariff policies and an ongoing debate over a cyclical slowing in the mix of variables.

Recent highlights:

The market sees the inversion on the front end as an anomaly more than 5 years into an expansion with record stock markets and steady growth across the tightening cycle including very healthy consumer spending. That good news is starting to fade on growth and in the consumer sector and payrolls taking a hit.

The theory is that the inversion from 3M to 2Y and 5Y should be corrected by Fed action. White House policy makers are unlikely to admit the lack of more pronounced easing is a self-inflicted wound. The shutdown and lack of payroll and inflation data will only complicate the FOMC decision process.

Historical Context:

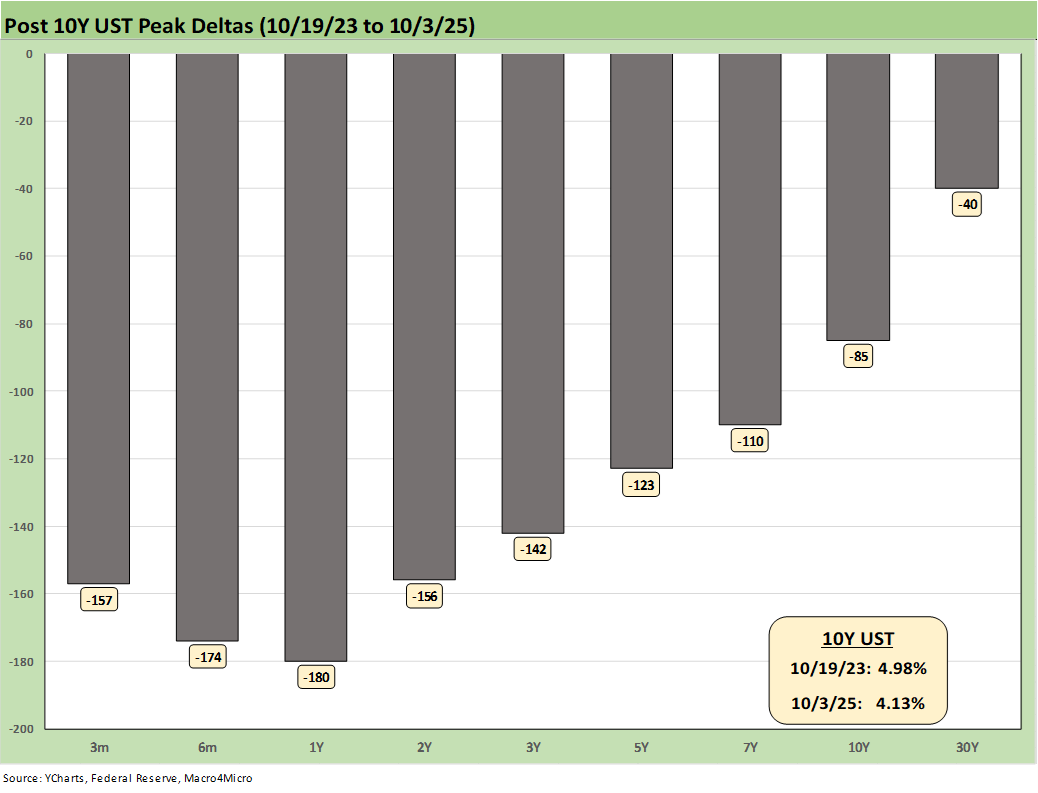

The above chart just updates where the current UST curve stands relative to the Dec 2020 UST curve on the low end and the 10-19-23 highs after the tightening cycle went into effect in March 2022. We also look at the post-10-19-23 deltas further below.

Recent Highlights:

The above chart updates the 1-week UST deltas, and we see a rally across the UST curve on mixed data and the shutdown. Anxiety around the pace of easing set in rapidly after the FOMC meeting with some constructive economic numbers and more than a few public comments from the Fed speech circuit and others who believe caution was warranted with the tariff effects still highly uncertain.

For all those who say the Fed is damaging the housing market, the mortgage story and the supply-demand imbalances by region and price tier underscore that the topic is a lot more complicated than that. We saw mortgage rates move higher to almost 6.4% after the easing after getting closer to 6.1% prior to that action. This past week we are still above 6.3%.

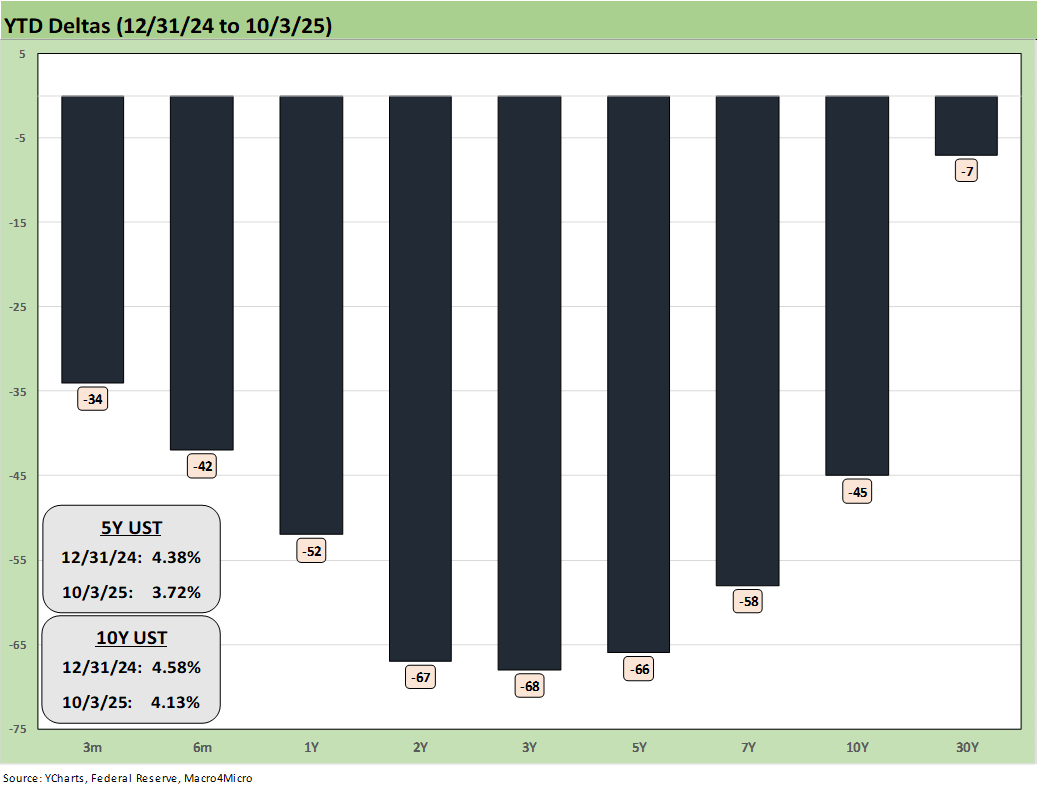

The above chart updates the YTD UST deltas. We see how the bull steepener has paid off for bond returns in YTD 2025 with the 7 bond ETFs we track all in positive return range (see Market Commentary: Asset Returns 10-4-25).

Recent Highlights:

The above chart updates the running UST deltas from 10-19-23 through Friday. At the very least, it offers a reminder of what could go wrong if we get adverse inflation outcomes from tariffs. The politics of inflation have always been a death knell for reasonable discussion based on facts (“seller pays” vs. “buyer pays,” etc.). That said, there is likely to be no debate on the Sept CPI release that won’t happen.

If jobs stay weak and inflation numbers get uglier (if and when released), there is every reason to expect intervention by the White House data delivery as we saw after weak July payrolls (see Happiness is Doing Your Own Report Card 8-1-25). At this point, the shutdown could open up some extreme scenarios for actions against the BLS and BEA (see Mini Market Lookback: Chess? Checkers? Set the game table on fire? 10-4-25).

Historical Context:

We now live in a world where votes and economic data get rejected, and the lemmings fall right into line and join the disinformation chorus. The data sets do struggle in payroll, and the need to better model assumptions and survey issues have been picked over ad nauseum. When Trump piled on the “get rid of quarterly reports” bandwagon (in the age of AI and streamlined data delivery), the “intent” to mask any negative trends in the economy started to get more transparent in terms of motives.

The Project 2025 ambition (detailed in Chapters 21, 24) is to consolidate data and information and unify control – not to assure better and more comprehensive data. That has been evident in an array of actions that we have covered in other notes. Ambitions for better data require more investment, more tech, and more public-private alliances. However, that dilutes control – and control is the point.

Recent Highlights:

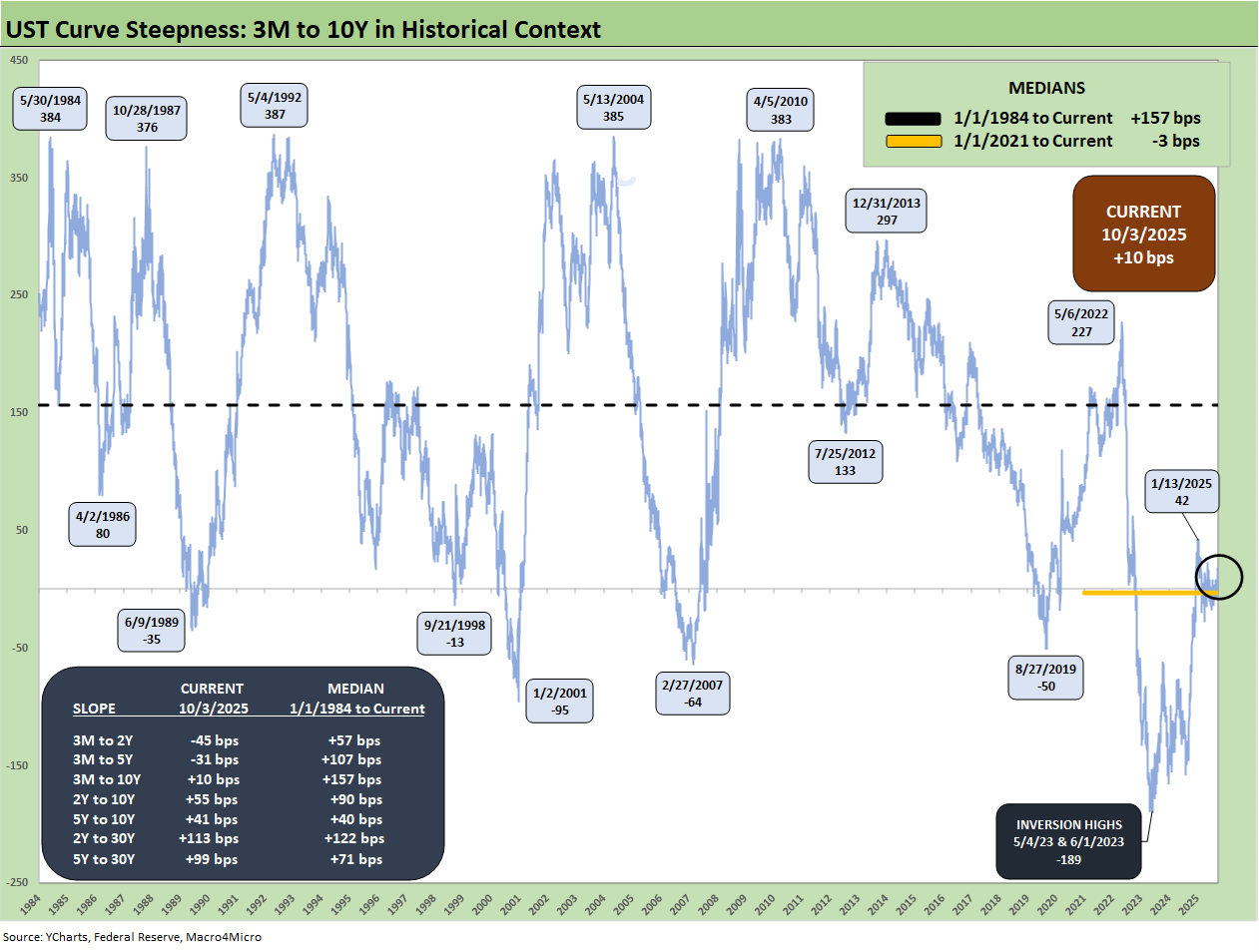

The above chart plots the 3M to 10Y slope from 1984 for a read on the current shapeshifting potential ahead. For the 3M to 10Y, the current +10 bps vs. long-term median of +157 bps shows ample room for steepening from current levels. That is the worry if more inflation pressures start to show up with a daunting array of planned tariffs that are not yet in effect or have not flowed into the working capital cycles yet.

In mid Jan 2025, the 3M to 10Y steepened to +42 bps as the market continued to absorb the fall 2024 Fed cuts (-100 bps over 3 actions) while the 10Y peaked at 4.79% (Freddie Mac 7+% on 1/16/25).

During 2025, a bull steepening trend unfolded. Recent signals of economic slowdown (esp. employment) should in theory continue the bull steepening pattern unless we start to see inflationary pressures that would severely complicate FOMC alternatives. Trump appears more focused on lowering his interest expense tab than taking a defensive approach around stagflation risk.

The indications in the market odds (FedWatch, etc.) are that the Fed’s recent -25 bps cut will be replicated this month and in December. That is not a layup given the FOMC commentary and most recent dot plot. The tricky part for the FOMC is the lack of more data support.

Included in the chart are details on the other UST curve segment slopes that we watch along with their long-term medians. The front-end inversion from 3M is still the most anomalous part of the curve when you consider the fact we have been in an economic expansion since spring 2020 after a very brief 2-month recession per NBER.

The economy is now slowing in 2025 with PCE inflation still inside the 3.0% line (see PCE August 2025: Very Slow Fuse 9-26-25). The 3M to 2Y UST inversion of -45 bps is starkly different from the post-1984 historical median of +57 bps. The 3M to 5Y inversion of -31 bps is a long walk from the +107 bps median.

Historical Context:

We see the peak inversions in May and June 2023 of -189 bps after the 3M to 10Y had hit a slope of +227 bps in May 2022 when inflation was spiking (peaking in June at 9.1% for CPI, headline PCE at +7.1% in June 2022). The Fed had just begun tightening (too late).

At that time, COVID era supply-demand imbalances were still working themselves out and oil and gas prices spiked with the Russian invasion of Ukraine in Feb 2022. That Russian inflation catalyst is seldom – if ever – cited by Trump and his GOP leadership when they point fingers. Politics as usual in Washington.

See also:

Market Commentary: Asset Returns 10-4-25

Mini Market Lookback: Chess? Checkers? Set the game table on fire? 10-4-25

JOLTS Aug 2025: Tough math when “total unemployed > job openings” 9-30-25

Credit Markets: Cone of Silence Ahead? 9-29-25

The Curve: Easing Anxiety at Bat, Tariffs on Deck 9-28-25

Mini Market Lookback: Market Compartmentalization, Political Chaos 9-27-25

PCE August 2025: Very Slow Fuse 9-26-25

Durable Goods Aug 2025: Core Demand Stays Steady 9-25-25

2Q25 GDP Final Estimate: Big Upward Revision 9-25-25

New Homes Sales Aug 2025: Surprise Bounce, Revisions Ahead? 9-25-25

Credit Markets: IG Spreads Back in the Clinton Zone 9-22-25

Mini Market Lookback: Easy Street 9-20-25

FOMC: Curve Scenarios Take Wing, Steepen for Now 9-17-25

Home Starts August 2025: Bad News for Starts 9-17-25

Industrial Production Aug 2025: Capacity Utilization 9-16-25

Retail Sales Aug 2025: Resilience with Fraying Edges 9-16-25

Credit Markets: Quality Spread Compression Continues 9-14-25

Mini Market Lookback: Ugly Week in America, Mild in Markets 9-13-25

CPI August 2025: Slow Burn or Fleeting Adjustment? 9-11-25

PPI Aug 2025: For my next trick… 9-10-25

Mini Market Lookback: Job Trends Worst Since COVID 9-6-25

Payrolls Aug 2025: Into the Weeds 9-5-25

Employment August 2025: Payroll Flight 9-5-25

Hertz Update: Viable Balance Sheet a Long Way Off 9-3-25