Construction Spending: A Brief Pause?

We look at slowing July construction spending numbers after 1H24 kept the bar moving higher for MoM comps.

The headline construction spending number for July 2024 registers as the first negative since 2022, but the silver lining is more positive upward revisions in the release for recent months.

On a half full note, the July SAAR number was still up 2.9% vs. Dec 2023 even if there is no changing the reality that growth in fixed investment is slowing while sustaining a high rate of economic activity in most markets.

Construction spending trends across 2022 point to some pull-forward followed by a brief contraction as project economics were reevaluated amidst higher rates in the tightening cycle.

Despite the scope and pace of upcoming rate cuts that remain to be seen, a stall in spending is not all too surprising where short-term delays/pauses are feasible.

The chart above shows the Month-over-Month variations in construction spending across a very strong stretch of construction activity with now five negative months in three years. A low negative for July looks like a blip given such a long stretch of growth. Even when combined with further negative revisions to the Gross Private Domestic Investment lines (see 2Q24 GDP 2nd Estimate: The Power of 3 and Cutting 8-29-24) that might cause worry, we would still categorize this as consistent with a soft-landing that is becoming more of a reality.

For construction spending more narrowly, the expectation of a slowdown was reversed with substantial government legislative support for a range of projects using public funds and incentives for private investment. Construction jobs have accordingly boomed as we cover in our monthly payroll commentaries.

Major sequential increases in public construction spending have not continued into this year but rather maintained at high levels that are up 11.0% YTD vs. 2023. The benefits provided to manufacturers in the private sector, which are up 24.9% YTD, are not included in that 11.0% and show the scope of government spending with high multiplier effects attached to them. The multiplier effects run along the value chain from materials to equipment and related freight and logistics services (i.e. “tonnage”). The multiplier effects right down to services ecosystem and local tax base often get ignored.

The above chart provides a high-level split across residential, nonresidential, public, and private construction spending. These are all down across the board except for Public Nonresidential construction still up after contracting in June. Despite such diversity in the underlying industries, the YTD growth numbers are very impressive with Private Nonresidential the laggard at 6.7%.

Construction spending gets pushed down the priority list of economic moving parts given the focus on inflation and consumer health. With an absence of bad PCE news last Friday (see PCE July 2024: Inflation, Income, and Outlays 8-30-24), we do not expect that today’s construction spending will change the perception on the direction of the economy. The sequential comps have continued to get tougher and a contraction this month still means close to all-time highs on continued real economic activity stemming from these projects.

The above chart gets into the total (i.e. combined public and private) construction spending activity across industries. Nine of the 16 nonresidential lines are in the red but only Lodging and Commercial are negative across other comparison periods. Though it may come as a surprise at first glance, Office construction spending has eked out a low positive on the year. However, that line includes spending on data centers that has offset a decline in traditional office spaces in a post-COVID world.

We discussed where reshoring and clean energy spending themes are strongly represented in some of the growth numbers above previously. The election cycle is quickly coming to a head and will at least reduce the policy uncertainty (in theory) and bring in another round of decision making around capex.

This is a very tricky time for capital budgeting decisions with the FOMC likely to be moving the needle one way, but the policy divergence has some elements of threatening supplier chain changes and the economics of plans on the tax side. For some industries, breaking ground on domestic projects and reshoring plans need more certainty on rates and tariffs. That is a good reason for some to slow walk project approvals. There is always a wide range of offshore Tier 1, 2, and 3 suppliers. Cost estimates could get very complicated.

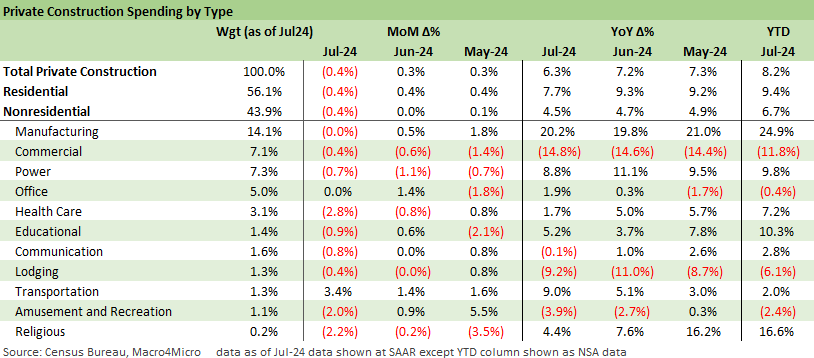

This chart breaks out the private construction and lines up the industries in order of relative weight. A negative month broadly sees weakness across the board with Transportation a small bright spot. Healthcare stands out as a laggard this month and is now just 1.7% above where it was this time last year. The columns over to the right help provide more context as to where the spending pull back has been more sustained across Commercial, Office, Lodging, and Amusement and Recreation.

The final chart looks at the Public side of the ledger. The majority of it falls under nonresidential and it bounced back for a positive month. The line items were mixed as the top two industries both had another poor month. Overall, the ball has kept rolling for public sector projects and we expect no major changes until next year.

Contributors:

Kevin Chun, CFA kevin@macro4micro.com

Glenn Reynolds, CFA glenn@macro4micro.com

Construction Links:

2Q24 GDP 2nd Estimate: The Power of 3 and Cutting 8-29-24

2Q24 GDP: Into the Investment Weeds 7-25-24

GDP 2Q24: Banking a Strong Quarter for Election Season 7-25-24

Construction Spending: Stalling Sequentially at High Run Rates 6-4-24

Construction Spending: Timing is Everything 12-1-23

Construction: Project Economics Drive Nonresidential10-2-23

Construction Spending: Demystifying Nonresidential Mix 5-9-23

See also:

Labor Day Weekend: Mini Market Lookback 9-2-24

PCE July 2024: Inflation, Income and Outlays 8-30-24

Harris Housing Plan: The South’s Gonna Do It Again!? 8-28-24

Footnotes & Flashbacks: Credit Markets 8-26-24

Footnotes & Flashbacks: Asset Returns 8-25-24z

Footnotes & Flashbacks: State of Yields 8-25-24

Payroll: A Little Context Music 8-22-24

All the President’s Stocks 8-21-24

Total Return Quilt: Annual Lookback to 2008 8-14-24z

CPI July 2024: The Fall Campaign Begins 8-14-24z

HY Industry Mix: Damage Report 8-7-24

Volatility and the VIX Vapors: A Lookback from 1997 8-6-24

HY Pain: A 2018 Lookback to Ponder 8-3-24

Payroll July 2024: Ready, Set, Don’t Panic 8-2-24

Presidential GDP Dance Off: Clinton vs. Trump 7-27-24

Presidential GDP Dance Off: Reagan vs. Trump 7-27-24