Footnotes & Flashbacks: Asset Returns 12-1-24

The market keeps shaking off more extreme policy outcomes on the theory that reason and economic logic will prevail.

I think this is what they meant by Prisoner’s Dilemma!

Capital market confidence in current conditions – as distinct from what policy changes or major miscues could do to those conditions – continue to drive the consensus for asset allocation strategies as reflected in equity and credit bullishness (see Mini Market Lookback: Tariff Wishbones, Policy Turduckens 11-30-24).

Equities rallied again this week and were accompanied by a favorable round of duration performance on a UST bull flattener move even with mixed PCE inflation (see PCE Inflation Oct 2024: Personal Income & Outlays 11-27-24).

HY had a minor spread widening week, but credit pricing for both IG and HY remains in the zone of prior peak credit cycles.

This coming week brings a fresh test for the UST curve and equities with the latest nonfarm payroll report after the JOLTS earlier in the week with new trade data feeding even more focus on the latest round of tariff-palooza (EU up next?).

The above chart highlights a return to all positive trailing 1-month returns for the high-level debt and equity benchmarks that we track weekly. At this point, only the trailing 3-month UST benchmarks are in the red over the past year as we cover in the ETF section further below.

The back-to-back years of over 20% for the S&P 500 has market historians going back to frame similar periods (as posted on Barron’s). The article highlighted that it has happened 4 times, once in the 1920s (1927/1928), once in the Great Depression (1935/1936) and once in the bull market 1990s (1995/1996) and now for 2023/2024. Of course, the 1990s kept rocking in 1997, 1998, and 1999 before the TMT implosion.

All those markets were very distinct (asset risks, financial system structure, bank health, globalization, derivatives and counterparty risk, etc.). The main point is that this is a very unusual backdrop coming off a pandemic and the first inflation war since the 1980-1982 double dip.

Policy risk ahead or just ancillary neuroses?

The sustained strength to close out 2024 is especially notable with the Trump high level nominees framing up like a “worst of” combination from the DC Comics and Marvel villain collection. We assume many center right and “smart right” types had hoped for more competence and less subservience since there are many perfectly qualified and experienced right-wing leaders that could fill those roles. Blind loyalty “trumps” quality these days.

The nominees will face some second-guessing in the Senate, but we would expect a high free throw percentage (not a batting average) on approval. After all, it is hard to look over the horizon for risky effects when you are a Senator lying prostrate in a full-body kowtow. The most worrisome roles to us are AG, Defense, and FBI. Those are the seats that can be leveraged for political vendettas and authoritarian ambitions.

Fed independence will be more akin to a clash over policy (“the money”) but when it comes to guns and money, “the guns” tend to have a louder voice. The Justice Department and Pentagon should have loyalties to the constitution first, second and third. That loyalty pecking order is anything but clear as of now given the coconut collection of nominees.

The policy risks can only play out over time through actual policy implementation and economic events and market reactions. This week saw 25% tariff threats on the largest trade partner (Mexico) and largest export nation (Canada). The Trump tariff plan for the largest trade partner as a bloc (the EU) is waiting for its round of headlines on Truth Social.

The weekend brought a fresh round of social media tariff news that promised 100% tariffs on the BRIC group nations that are looking to develop an alternative to the dollar as a reserve currency. They are attempting to start a de-dollarization process to avoid sanction risks and the SWIFT bank hammer. That list includes China but generally smaller trade partners otherwise (e.g., India, Brazil). The threats might tend to reinforce why more nations seek such an alternative to the dollar. Consider the Chinese UST holdings in the context of that threat. Threats against nations who are seeking to avoid threats seem self-fulfilling.

Assuming this is all just “Trump being Trump” and just negotiating runs the risk of disappointment if the “other side of the table” does not fold based on the same expectation (i.e. “the bluff”). We could easily see a situation where one trade partner breaks ranks and then retaliates in force, opening the way to allow others to follow. The EU is not even facing its set of specific tariff threats at this point, but Trump still seems to think Germany should be buying Chevrolets and Fords even though the “Big 2” could not succeed when they were mass producing cars in Germany and broadly in the EU.

The above chart updates the 1500 and 3000 series with small caps turning in one of their most consistently strong performances in years. The 1-month and 3-month numbers are very solid even if Energy and Real Estate can whip around on fundamentals (oil prices for energy and UST rates for Real Estate).

The rolling return visual

In the next section, we get into the details of the 32 ETFs and benchmarks for a mix of the trailing periods. Below we offer a condensed 4-chart view for an easy visual on how the mix of positive vs. negative returns shape up. This is a useful exercise we do each week looking for signals across industry groups and asset classes. We also have a YTD version that we include in the broader commentary on the time horizons further below.

The shape of the four time horizons above shows across-the-board good news with a heavy weighting on the positive side of the ledger including all positive returns for the LTM period. A mix of the Trump effects will likely include lower taxes, less regulation, support for easier bank capital rules, and perhaps a sense of FOMC subjugation to prevent tightening. Those expectations helped with the 1-month horizon and immediate election reaction. The 1-week performance got a boost from a less frequently favorable but solid set of numbers for the bond ETFs relative to recent periods.

The Magnificent 7 heavy ETFs…

Some of the benchmarks and industry ETFs we include have issuer concentration elements that leave them wagged by a few names. When looking across some of the bellwether industry and subsector ETFs in the rankings, it is good to keep in mind which narrow ETFs (vs. broad market benchmarks) get wagged more by the “Magnificent 7” including Consumer Discretionary (XLY) with Amazon and Tesla, Tech (XLK) with Microsoft, Apple, and NVIDIA, and Communications Services (XLC) with Alphabet and Meta.

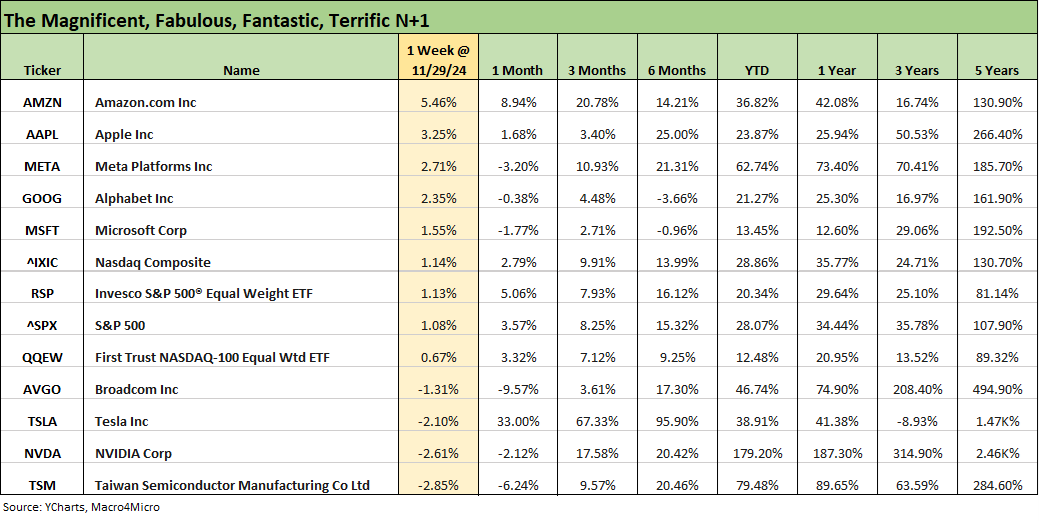

The above chart updates our tech bellwether chart where we line up the names in descending order of returns for the week. We see 5 of the 7 Mag 7 names in the top 5 slots with NVIDIA and Tesla in the red, so the performance was somewhat split even if the 5 Mag 7 winners beat the NASDAQ and S&P 500.

As we cover below in the benchmarks and ETF results, the Tech ETF (XLK) and Equal Weight NASDAQ 100 ETF (QQEW) were in the bottom quartile for the week and the NASDAQ only ranked in the third quartile. Of the Mag 7 heavy ETFs we detailed above, only Consumer Discretionary (XLY) made it into the lower end of the top quartile.

We already did some digging in the 1-week numbers in Mini Market Lookback: Tariff Wishbones, Policy Turduckens. The 29-3 score for the week was impressive in light of the tariff threats and mixed inflation report. In the negative range, we see the volatile E&P ETF (XOP) and broad energy ETF (XLE) with a mild trim for Regional Banks (KRE) that had been soaring since Trump won. As noted in the following charts, KRE is #1 for the trailing 1-month, #3 over 3-months, #4 YTD, and #1 for the LTM period. One theory is that M&A and consolidation lies ahead for the regional banks with an easier hand from regulators on capital rules.

The Personal Income and Outlays report and second estimate for 3Q24 GDP were steady. The GDP release showed mild downward adjustments within the PCE mix and net favorable adjustments in Fixed Investment (see PCE Inflation Oct 2024: Personal Income & Outlays 11-27-24, 3Q24 GDP Second Estimate: PCE Trim, GPDI Bump 11-27-24). The +3.5% growth on the PCE line in GDP is a favorable indicator as was the higher savings rate move sequentially.

The 1-month returns weighed in at 29-3 with Regional Banks (KRE) and the broad Financials ETF (XLF) in the top quartile. Those were joined by Transports (XTN) as Airlines drove solid results. We also see Midstream Energy (AMLP), E&P (XOP), and the broad Energy ETF (XLE) in the top quartile.

Consumer Discretionary (XLY) rounded out the top quartile on very strong performances by Tesla and Amazon for the month as detailed earlier. The Russell 2000 small caps stayed in the upper ranks with Midcaps at the top of the second quartile in a tribute to the breadth of the rally for US-centric names that overlap with the HY bond issuer universe.

Tariffs and currencies…

On the bottom of the chart in negative range, China weakness is seen in 2 of the 3 lines in negative range with EM Equities (VWO) and Base Metals (DBB). The tariff threats have had the effect of strengthening the dollar and weakening other currencies, and base metals denominated in dollars can see demand undermined.

Similarly, the easy rationalization to excuse tariffs is that a strong dollar mitigates the threat of tariff costs with increased US buying power. Of course, tariff apologists neglect to mention the commodities traded in dollars imported from lower cost base metal providers (like aluminum from Canada). Projected dollar strength was a cornerstone of the roundly rejected Border Adjustment Tax proposed back in 2017.

The House tax reform delivered by Ryan and Brady to the Senate included a raft of simplistic currency assumptions that would perfectly offset the costs of the tariffs (20%) in exact weighting of trade flows. In framing the “BAT Tax” back in 2017, the idea of dollar denominated imports did not sully their simplistic assumptions nor was there much discussion of the damage to export competitiveness. The Senate ignored the House bill and then laughed it out of consideration. Now the concept is embraced again even if it is no longer called “a tax.”

The experts usually don’t continue to the next important topic of the dollar, which is that a strong dollar hurts export markets even before the angry trade partner slaps tariffs on US exports. It is the partial stories on tariffs that can destroy the credibility of brand name economists shilling for protectionist platforms. We have seen enough of them on CNBC as guests.

We also see health care in the red zone for the past week with some concerns around what will unfold for various pharma products and notable vaccines. Life will get strange in 2025 with people calling Kennedy and various other appointees made this past week the “pro-polio, pro-herd-immunity” gang based on past policy positions (Kenndy is not “pro polio,” but he can expect a lot more heat like that).

The 3-month result posts a score of 28-4 with 3 of 4 in the red and 5 of the 8 in the bottom quartile being bond ETFs. Only the HY ETF was able to make the third quartile on spread compression, higher coupons and less duration exposure.

Many of the same factors were at work for the 3-month period as for 1-month with Airlines driving Transports to #1 while the Regional Banks (KRE) and Financials (XLF) were well positioned. Consumer Discretionary (XLY) and Communications Services (XLC) made the top 5 while Small Caps (RUT) and Industrials (XLI) show signs of cyclical confidence. The income-heavy Midstream ETF (AMLP) also made the top tier again.

Apart from the bond ETFs, we see Materials (XLB) in the bottom tier as rates also dropped Homebuilders (XHB) into the third quartile. We also see the Health Care ETF (XLV) on the bottom for some of the reasons already discussed (if you are worried about mumps, measles, and rubella (MMR), new parents sending kids off to school can just nail a chicken to the door. All good…).

The YTD returns posted a 31-1 score with only the long duration UST ETF (TLT) in the red. We see 7 of the 8 lines in the bottom quartile comprised of the 7 bond ETFs. Only E&P (XOP) from equities ranked in the bottom tier.

The top quartile had a Mag 7 influenced mix with Communications Services (XLC) at #2 along with NASDAQ and S&P 500 in the upper ranks. Financials (XLF) took the #1 slot with Utilities (XLU) at #3 and Regional Banks (KRE) at #4 and the ever-reliable Midstream Energy (AMLP) at #5. Homebuilders (XHB) rode a very strong stretch earlier in the year to hold on in the top quartile with Industrials (XLI) just across the line in the second quartile.

The LTM returns still had the benefit of a very strong finish to 2023 in the numbers at a 32-0 score. Even the bottom quartile had line items with two ETFs posting double-digit returns. That performance came in a group of 32 lines with a median return around 24%. That is quite an LTM period for absolute returns and shows impressive breadth across subsectors and industries. That is hardly late-breaking news at this point.

Maybe with the election over, more people in the GOP can use their outside voice and say, “The year 2024 could end up as only the second time in the postwar era with back-to-back 20+% years for the S&P 500.” The other time was under Clinton, who had 8 years untouched by recession (Clinton actually posted 5 consecutive years above 20%).

We see Regional Banks (KRE) at #1 and Financials (XLF) at #3 with Homebuilders (XHB) splitting them up at #2. Only two tech-centric lines ranked in the top tier with Communications Services (XLC) at #4 followed by the NASDAQ at #8. We also see Industrials (XLI), Utilities (XLU) and Small Caps (RUT). For all the tech headlines across the year, that top tier mix presents a well-diversified range of benchmarks and ETFs.

In the bottom quartile, we see all 7 bond ETFs with only E&P (XOP) from the equity ETF side of the ledger. The bottom tier mix saw TLT posting better returns than the short duration UST ETF (SHY) for the LTM period given the strong finish to 2023 for duration. As noted above, TLT was the only negative YTD.

See also:

Mini Market Lookback: Tariff Wishbones, Policy Turduckens 11-30-24

PCE Inflation Oct 2024: Personal Income & Outlays 11-27-24

3Q24 GDP Second Estimate: PCE Trim, GPDI Bump 11-27-24

New Home Sales Oct 2024: Weather Fates, Whither Rates 11-26-24

Mexico: Tariffs as the Economic Alamo 11-26-24

Tariff: Target Updates – Canada 11-26-24

Footnotes & Flashbacks: Credit Markets 11-25-24

Footnotes & Flashbacks: State of Yields 11-24-24

Footnotes & Flashbacks: Asset Returns 11-24-24

Mini Market Lookback: Market Delinks from Appointment Chaos… For Now 11-23-24

Credit Crib Note: Ashtead Group 11-21-24

Existing Home Sales Oct 2024: Limited Broker Relief 11-21-24

Housing Starts Oct 2024: Economics Rule 11-19-24

Mini Market Lookback: Reality Checks 11-16-24

Industrial Production: Capacity Utilization Circling Lower 11-15-24

Retail Sales Oct 2024: Durable Consumers 11-15-24

Credit Crib Note: United Rentals (URI) 11-14-24

CPI Oct 2024: Calm Before the Confusion 11-13-24

Mini Market Lookback: Extrapolation Time? 11-9-24

The Inflation Explanation: The Easiest Answer 11-8-24

Fixed Investment in 3Q24: Into the Weeds 11-7-24

Morning After Lightning Round 11-6-24

Payroll Oct 2024: Noise vs. Notes 11-2-24

Employment Cost Index Sept 2024: Positive Trend 10-31-24

Tariffs: The EU Meets the New World…Again…Maybe 10-29-24

Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24

PulteGroup 3Q24: Pushing through Rate Challenges 10-23-24

Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24

CarMax: Why Do We Watch KMX as a Bellwether? 10-3-24

On trade:

Mexico: Tariffs as the Economic Alamo 11-26-24

Tariff: Target Updates – Canada 11-26-24

Tariffs: The EU Meets the New World…Again…Maybe 10-29-24

Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24

Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24

Tariffs: Questions that Won’t Get Asked by Debate Moderators 9-10-24

Facts Matter: China Syndrome on Trade 9-10-24

Trade Flows: More Clarity Needed to Handicap Major Trade Risks 6-12-24

Trade Flows 2023: Trade Partners, Imports/Exports, and Deficits in a Troubled World 2-10-24

Trade Flows: Deficits, Tariffs, and China Risk 10-11-23