Mini Market Lookback: Out of Tacos, Tariff Man Returns

A broad rebound from the ugly prior week rolls into a guessing game on tariffs as the pause clock ticks and tensions rise.

The week ended on a rough note with a doubling of steel and aluminum tariffs to 50%. Trump apparently took the TACO label personally. The tariff action on steel and aluminum has the effect of continuing the severe economic coercion plan on Canada and could be a death knell for the northern piece of USMCA. Then again, the auto industry is at an existential crossroads in Mexico also. The EU will take the latest action personally at a critical time.

Based on OPEC production news calling for another hike, oil markets could see more downside in the coming weeks in price action that might help headline inflation as cyclical questions get revisited on the likelihood of more trade clash and outright trade wars.

The news making the rounds this week on Section 899 of the budget bill likely needs more focus from the “hear no evil, see no evil” members of the GOP Senate. Kudos to the FT for amping up the noise on that buried clause. The 899 provision offered a fresh arsenal of tax weapons to be used against foreign asset holders at a time of recurring record UST supply needs and a vulnerable dollar. Arming Trump with even more avenues to policy aggression to push the tariff envelope would magnify risks for both the “real economy” and the capital markets.

The “flood-the-zone” external stimuli overload gets tough to process even as stocks rolled on. Risk pricing might have to regroup soon as the reciprocal tariff rates get “finalized” (in many cases simply assigned) and Canada and the EU take stock of how to respond to the latest steel and aluminum move. Meanwhile, China relations just took a sharp turn for the worse from Trump rhetoric to close the week but more importantly very aggressive language from Hegseth with martial jawboning in Singapore at the ironically named Shangri-La Dialogue.

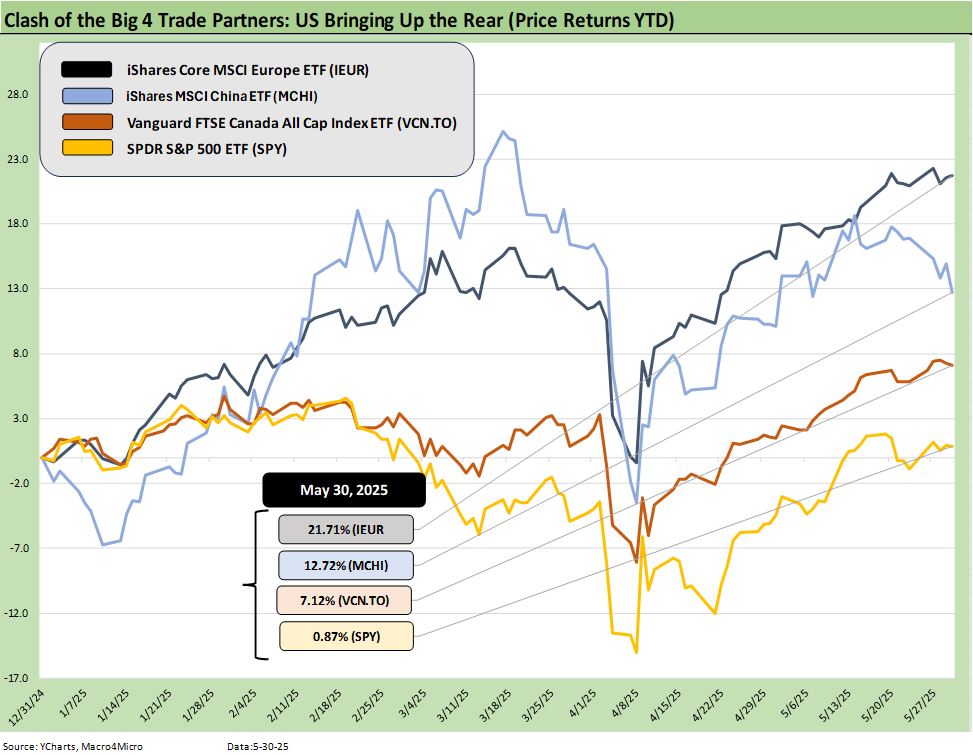

The above recurring weekly chart updates the running YTD returns on a cross-section of benchmark equity ETFs for the 4 major clashing trade partners – US vs. Europe vs. China vs. Canada. We use what we consider to be useful ETFs that frame those markets across a diversified mix of industries and market caps. We let the US off easily by using the S&P 500 ETF (SPY) since generally small caps and midcaps have lagged.

We see the US pulling up the rear in last place YTD but at least back in positive range. If equity markets are forward looking as they are supposed to be, this is not a great vote on valuation and the results of the radical macro and micro economic policies being rolled into place in the US. The US has so far eluded the inflation boogeyman (see PCE April 2025: Personal Income and Outlays 5-30-25) but those fears remain high with many consumers, investors and also the FOMC.

The tariff transaction impacts only come at a lag of months across working capital cycles, effective dates of the tariffs, orders, purchasing contracts, and the pricing decisions made by the payer of the tariff at the border (that is the importer/buyer who pays regardless of the White House disinformation).

The “reciprocal” tariffs (IEEPA) are not completed yet but have faced a whipsaw series of court actions this week. The final decision on those tariff rights will need to get put in front of SCOTUS, and that is a toss-up even on a very good day for those looking to mitigate executive branch excess.

Theme spinners will play the tariff wildcard to the max for their own political home team, but we are only now getting to the point where the inventory restocking of 1Q25 starts to get drawn down and new products with tariffs get off the docks and into the freight and logistics chain and warehouses. There is a lot of high volume product still in the Section 232 queue including semis, pharma, aircraft/engines/parts, copper, and lumber. Those do not get covered by this week’s court actions. That was only for the unilateral IEEPA from Trump. The Section 232 tariffs are all full steam ahead and most not in place yet. The pharma tariffs and semis especially will beg retaliation at some point and notably from the EU on pharma.

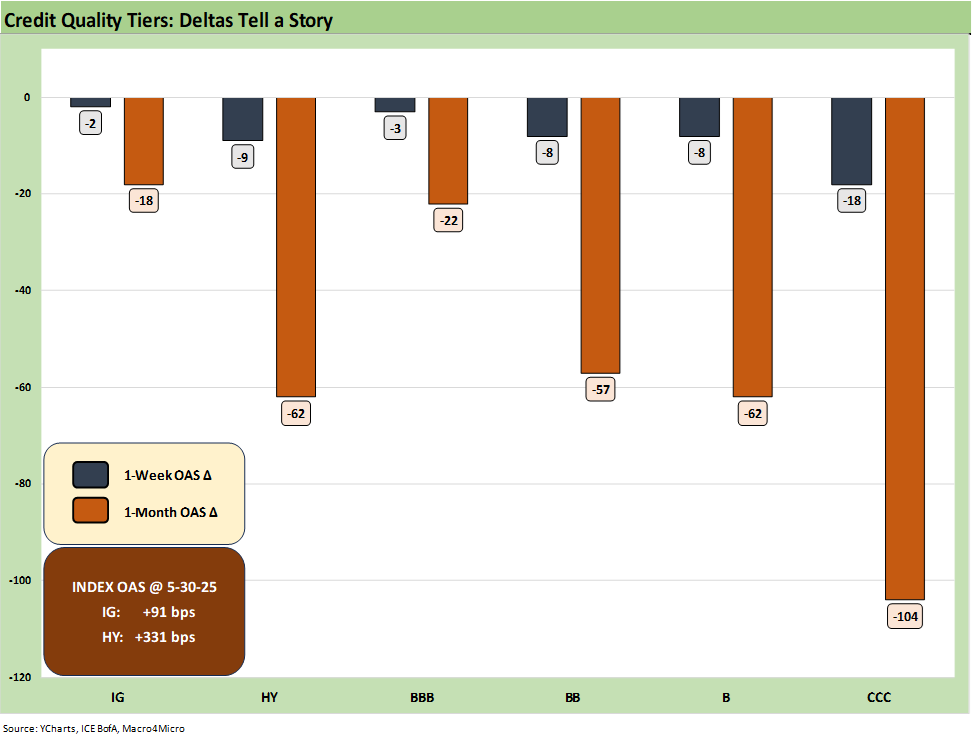

The above chart updates the running 1-week and 1-month spread deltas for IG and HY and the credit tiers from BBB to CCC. The month was obviously a rally month off the pause and China truce. We update more of the spread trends in our separate Footnote commentaries on Credit Markets and Asset Returns later this weekend. For now, the YTD OAS deltas show IG bonds at +9 bps and a -24 bps negative excess return with HY OAS posting +39 bps of spread widening and -14 bps excess returns YTD.

The volatility has clearly been wild across headlines from macro risks (inflation fear, budget deficits, UST supply/demand imbalances, currency weakness of USD, foreign investor stress such as Japan) to the micro level issues (tariff fallout on demand and costs, trade partners retaliation, cyclical worries with consumers, auto sector volume and cost pressures, etc.).

Tariff combat headlines will pick up pace this coming week…

As we cover herein, the next week will hold a lot of back and forth on how trade partners will react to the doubling of steel and aluminum tariffs from 25% to 50%. Some of the typically cowed trade groups will presumably get noisy about how damaging those incremental expenses will be to purchasers of steel and aluminum.

Those cost pressures will impact a scale of buyers that dwarf by a significant multiple of those who will benefit from such tariffs. The US Chamber of Commerce and National Association of Manufacturers covered the violently net negative economic impact of such tariffs during Trump 1.0 but got nowhere. They have been active again as noted in these links but it just got worse. The Chamber of Commerce was a deep red political organization (no matter what they say), but they are not suffering from MAGA concept and fact blindness. They will presumably be lobbying for exemptions.

Buyer still pays, so it comes out of someone’s pocket…

We have discussed the tariff issues ad nauseum from trade partners’ exposure to the simple reality of the multiplier effects of trade and what gets added to the US economy from imports and higher total trade volumes (see The Trade Picture: Facts to Respect, Topics to Ponder 2-6-25, Tariffs: Questions to Ponder, Part 1 2-2-25). What might prove interesting in the coming days is whether Trump reverts back to his misinformation game of “selling country pays” as his refrain. When it comes to the “red hat crowd,” Trump can say the moon is made of green cheese and it becomes gospel (in some of the wackier MAGA cliques, literally gospel).

In the 2H25 period, someone will have to foot this bill and it will be some combination of buyers, supplier chains, manufacturers, and consumers. Some pockets of the economy will also feel the inevitable impact of retaliation. We will need to look name by name on relative exposure, but autos and cap goods are right near the top. For some such as autos, aluminum was a means of reducing steel content and thus weight of the vehicle (mileage per gallon etc.). Costs will rise on both in the US market.

The trade partner strategy (retaliation) is tricky to handicap in light of Trump’s volatility and poor grasp of the economic fallout. After all the TACO trash talking and memes (Trump Always Chickens Out), he is likely to be especially inflexible. Retaliation is an important part of telling US voters such policies have a cost while for domestic constituencies in the EU, Canada, and Mexico is about showing strength. In other words, this could get uglier. We believe it will. There is so much more coming in Section 232 activity and that chance that Trump wins his case with SCOTUS, the question may be more about, “When does it become a full-on multi-partners trade war?”

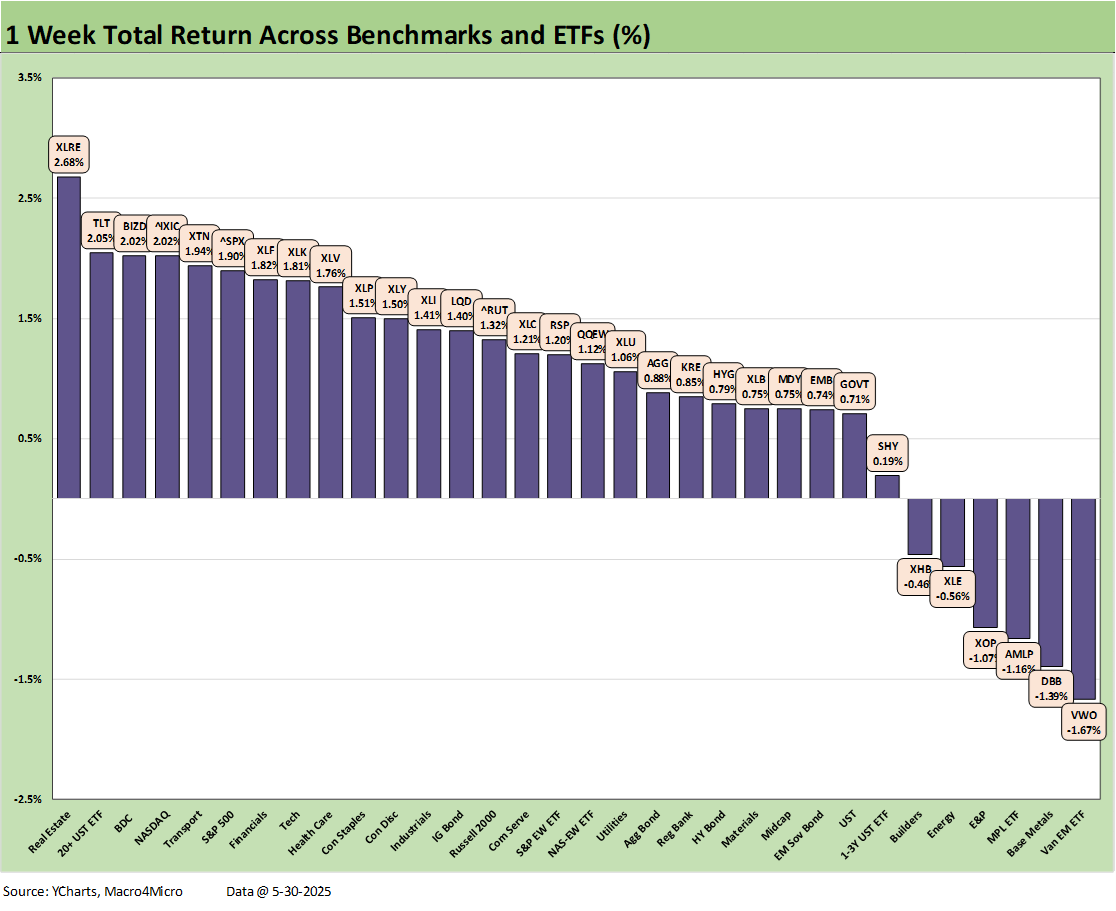

The 32 asset lines in our weekly return recap weighed in with a score of 26-6 after last week’s 3-29, so it is safe to say the weeks have been volatile around headlines. The 6 in negative range include 3 Energy ETFs with midstream (AMLP), upstream (XOP) and diversified Energy (XLE). Homebuilders (XHB) were hit again, and Base Metals (DBB) and EM Equities (VWO) could reflect more China-US tension.

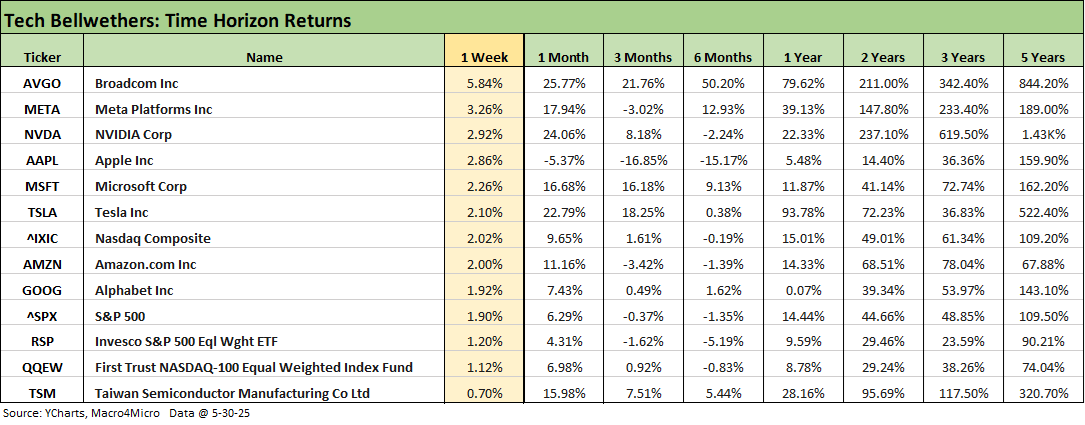

The tech bellwethers are updated above in descending order of returns for the week. We see a banner set of 1-month returns after the tariff pauses and China truce/pause went into effect. For the rolling 3 months, some have moved back into positive range, but we still see 3 of the Mag 7 in the red (Meta, AAPL, AMZN) with Alphabet barely positive. Looking back 6 months, we see 3 of the Mag 7 in the red (NVDA, AAPL, AMZN).

The Mag 7 and other tech bellwethers and benchmarks (NASDAQ, QQEW, etc.) could get sloppy when Semis get through the Section 232 process and the international reactions (aka retaliations) kick into gear. The well-established supplier chains in Asia cannot be easily reconfigured by high tariffs.

On the geopolitics front, Hegseth hectoring the Asian regional nation leaders and allies (arguably former allies subject to how the reciprocal tariffs play out) is a curious strategy. Lecturing the regions to step up their military budgets might have left some leaders wondering why they were so aggressively targeted for very high tariffs (see Tariffs: Some Asian Bystanders Hit in the Crossfire 4-8-25). Those revenues and economic strengths might come in handy when it comes to investing in defense.

The idea of demanding higher defense budgets while their economies are being undermined by the US is somewhat inconsistent as a policy strategy. If the plan is to make the region safe from China, does that require that you also make the US safe from their “cut and sew apparel”? These same nations will be targeted by US Section 232 semi tariffs (implying they are not allies). Meanwhile, Macron was pitching the region to build more alliances with the EU. The EU will be courting Canada and Asia (and vice versa) in the face of US tariff attacks. China now sees opportunities as well.

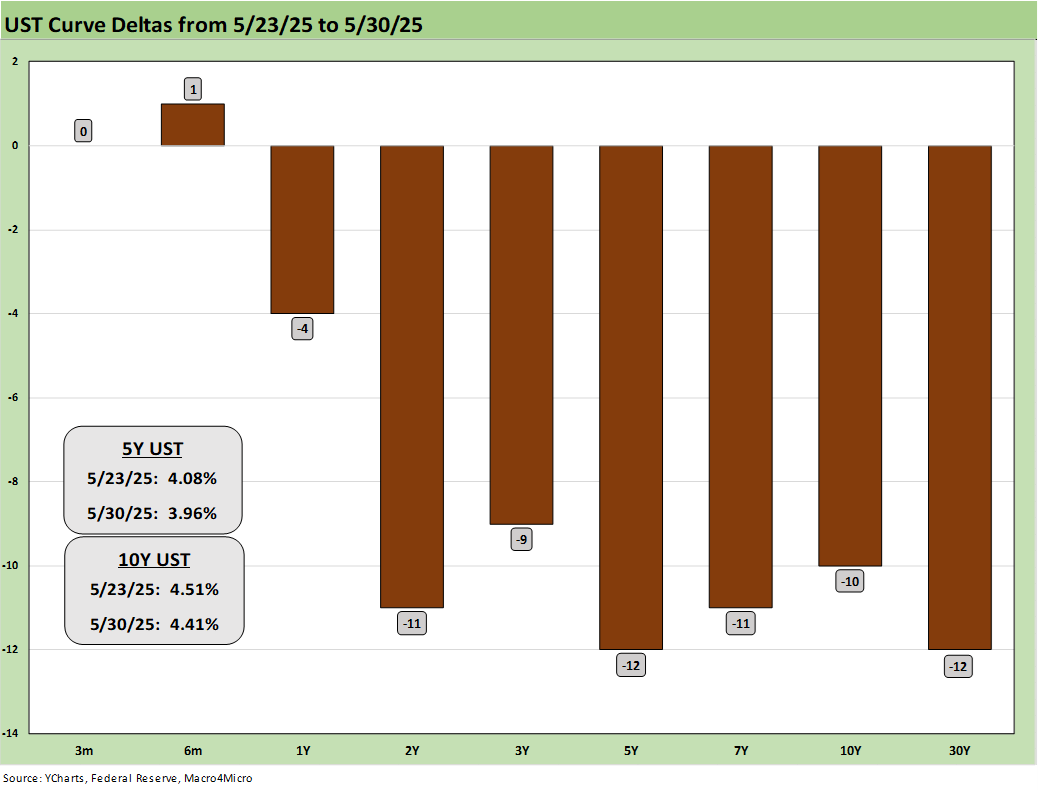

The above chart highlights the 1-week rally in the UST curve with some moderate easing of inflation fears, a constructive PCE inflation release, and a 2nd estimate for 1Q25 GDP that showed weakness in some key line items such as PCE that signal a softer consumer sector and some erosion in some investment lines with Durable Goods telling a cautious story during the week (see 1Q25 GDP 2nd Estimate: Tariff and Courthouse Waiting Game 5-29-25, Durable Goods Apr25: Hitting an Air Pocket 5-27-25). Savings rates also climbed in the face of lower consumption and wavering confidence surveys this past week.

The Income and Outlays release also showed some consumption weakness in relative terms vs. income (see PCE April 2025: Personal Income and Outlays 5-30-25). Tariff news remained volatile during the week around courtroom action (even if ending on a bad note late Friday with steel/aluminum).

The coming week’s UST moves could reflect that aggressive move on steel and aluminum tariffs. Retaliation from Canada would presumably be a higher risk today than earlier Friday. We already see an ambiguously hostile reaction from the EU on the screen as we go to print on Saturday. The coming week also brings JOLTS and payroll that could show some intent around offsets to tariffs (e.g. any cost cutting and payroll actions in the goods sector). The budget bill will get some headline time also as the US runs the risk of looking more like Italy in systemic public sector borrowing as a % GDP (Italy is a BBB tier sovereign rating).

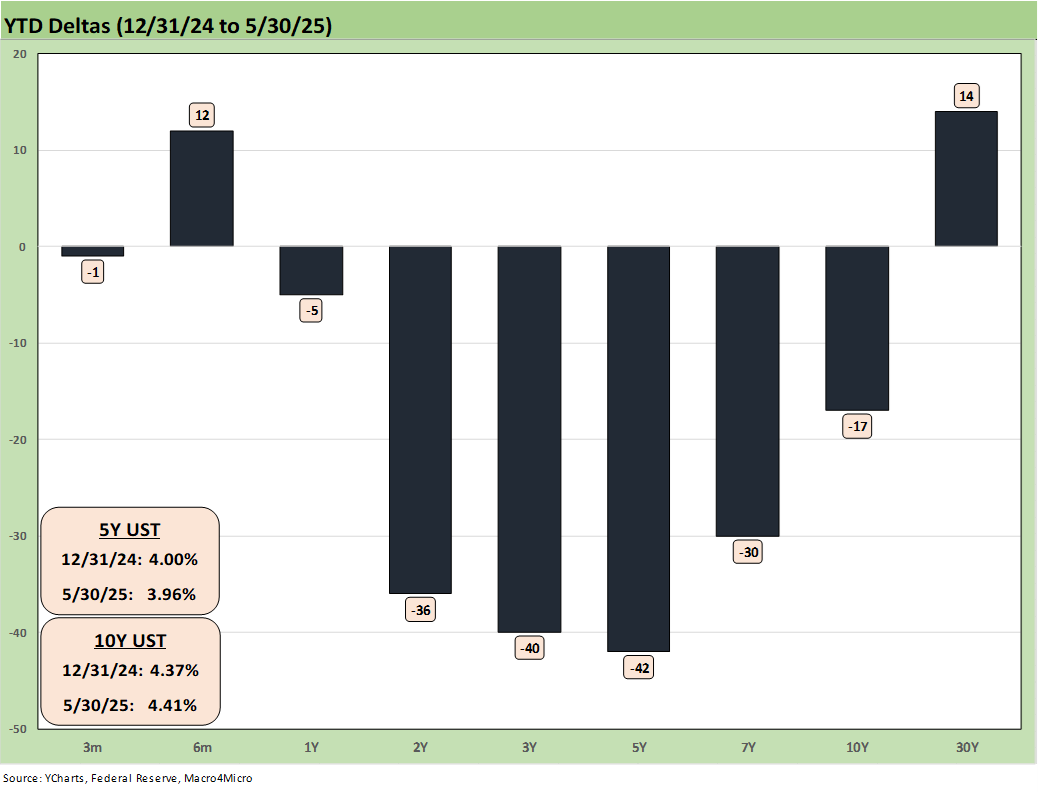

The above chart updates the running YTD UST deltas with the 5Y UST leading the pack at -42 bps YTD as part of a modified bull steepener move beyond 2Y UST. The near-term yield action will be dominated by more tariff tension and the “One Big Beautiful Bill Act” and its massive impact on a higher deficit and much greater borrowing need.

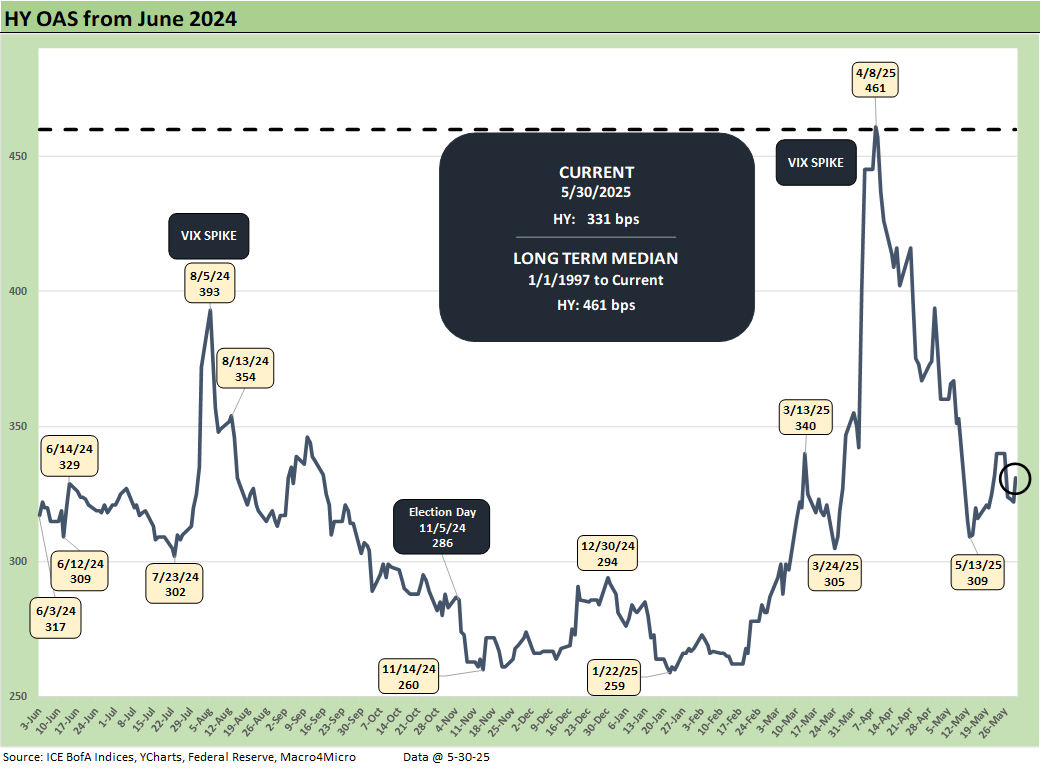

The above chart updates the modest 1-week move tighter of -9 bps for HY to +331 bps. That level is right in the neighborhood of the June 2014 lows (+335 bps on 6-23-14) but a long way from the lows of +259 bps in Jan 2025 and +260 bps in Nov 2014.

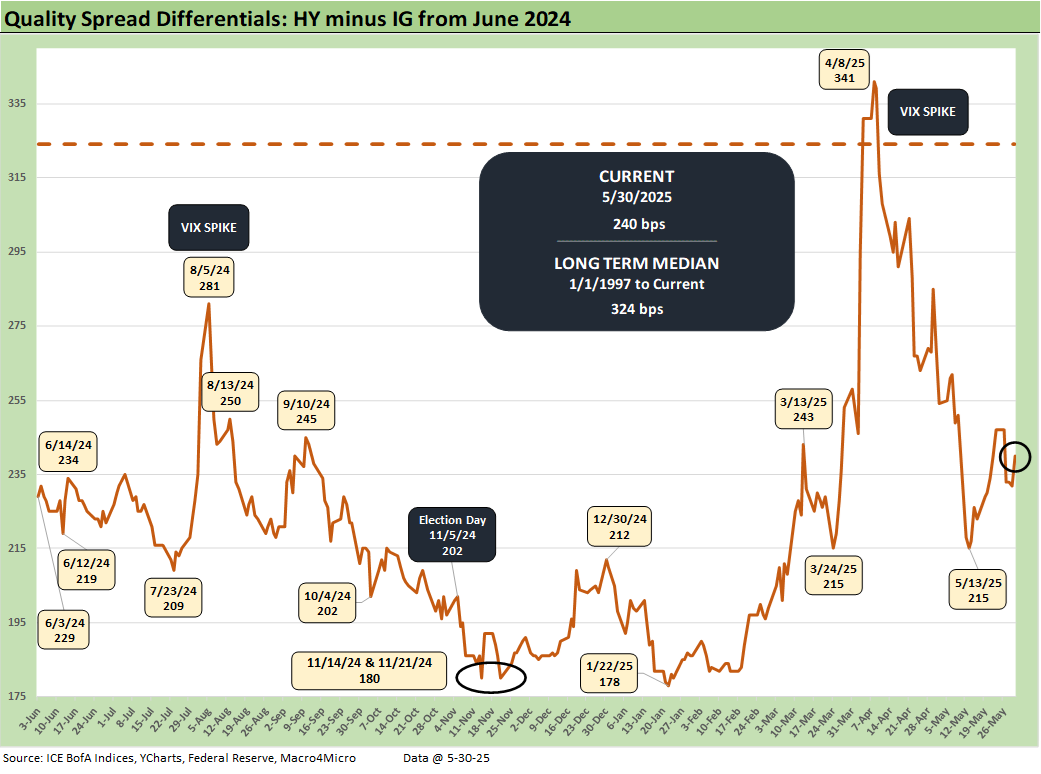

The above updates the “HY OAS minus IG OAS” quality spread differential. The narrowing from +247 bps last week to +240 came along with a modest HY rally of -9 bps vs -2 bps in IG.

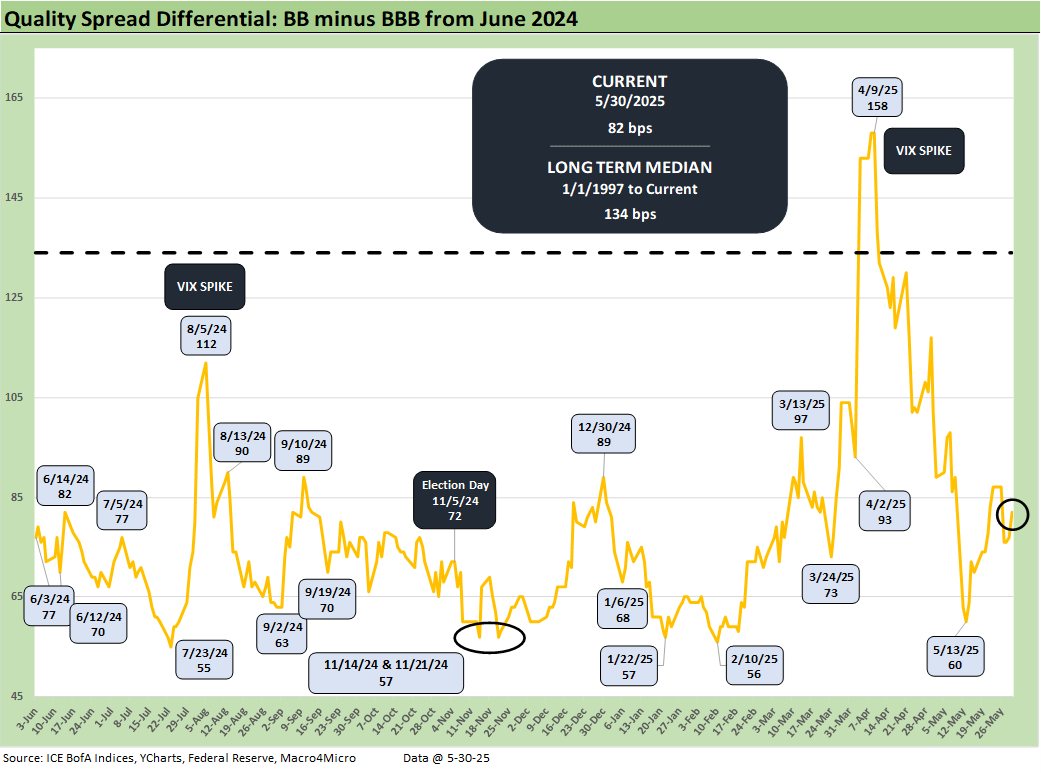

The “BB OAS minus BBB OAS” quality spread differential narrowed by -5 bps as BB tightened by -8 bps and BBB by -3 bps. The BBB tier OAS of +115 bps vs. BB of +197 still tells a story of solid demand in middle tier credits. The +82 bps quality spread is still well inside the +134 long-term median.

Any disarray in energy (E&P is vulnerable), commodities (metals/mining with high offshore exposure to tariffs), cyclical manufacturing (notably autos) could generate volatility in the BBB tier and the same in HY. As a net number, the effects of such setbacks on quality spread differentials would be quality spread widening.

See also:

PCE April 2025: Personal Income and Outlays 5-30-25

Credit Snapshot: Meritage Homes (MTH) 5-30-25

1Q25 GDP 2nd Estimate: Tariff and Courthouse Waiting Game 5-29-25

Homebuilder Rankings: Volumes, Market Caps, ASPs 5-28-25

Durable Goods Apr25: Hitting an Air Pocket 5-27-25

Footnotes & Flashbacks: Credit Markets 5-27-25

Footnotes & Flashbacks: State of Yields 5-25-25

Footnotes & Flashbacks: Asset Returns 5-25-25

Mini Market Lookback: Tariff Excess N+1 5-24-25

New Home Sales April 2025: Waiting Game Does Not Help 5-23-25

Existing Home Sales April 2025: Soft but Steady 5-22-25

Credit Snapshot: Lithia Motors (LAD) 5-20-25

Home Starts April 2025: Metrics Show Wear and Tear 5-19-25

Footnotes & Flashbacks: Credit Markets 5-19-25

Industrial Production April 2025: CapUte Mixed but Time Will Tell 5-15-25