1Q25 GDP 2nd Estimate: Tariff and Courthouse Waiting Game

We run through 1Q25 2nd estimate deltas as some key growth lines weaken and notably PCE in both Goods and Services.

The market is rooting for an all-you-can-eat TACO fest. It won’t be enough.

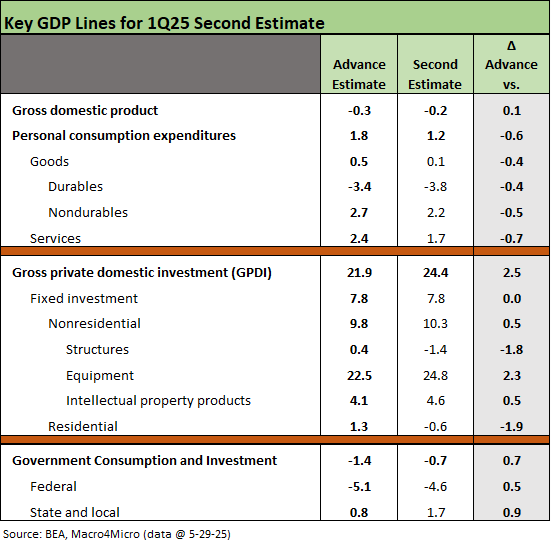

We see the headline 1Q25 GDP number slightly improve to a less negative number at -0.2% vs. -0.3% with mixed deltas in key lines such as PCE (worse), Equipment, (better), Structures (worse) and Government (better). The top line needle barely moved but there was action in the line items (see 1Q25 GDP Advance Estimate: Roll Your Own Distortions 4-30-25, 1Q25 GDP: Into the Investment Weeds 4-30-25).

The tariff headwinds were set to kick in during the summer months on the pauses and “negotiations” (which have badly lagged with the EU, Japan and South Korea) with the latest headline legal setbacks raising questions on timing and relative leverage near term. The SCOTUS decision on Trump’s power will more likely come sooner rather than later.

The new TACO headlines (“Trump Always Chickens Out”) will run the course of political backbiting and lampooning in coming days, but the extreme moves in tariffs lose some of their power unless the SCOTUS upholds Trump’s rights to use such shock-and-awe tariff numbers. The court ruling manages to take some of the crazier, more destructive gamesmanship off the table, but it is “on the clock.” Unless allowed again on appeal, the effect could be that Trump stalls on “deals” with less leverage for now or moves more slowly until he gets more ammo back in his arsenal. The timing is a matter of speculation (for now).

In the event he loses, some pressure would come off Canada and Mexico (fentanyl) and the EU and China would have better relative leverage vs. what they had before. When the smoke clears, tariffs will still be a multiple of all-time highs across numerous critical industry groups. The threat is still there but with less extreme immediate pressure favoring the Trump game theory (again, for now. Subject to SCOTUS).

At a minimum, the courts up the ante on legal outcomes for emergency tariffs getting finalized for the “reciprocal” and emergency tariffs. Today, an appeals court allowed Team Trump to keep collecting them. The duration of the stay is not set yet as we go to print and more legal motions are coming. Meanwhile, the massive budget bill includes language that tries to derail court challenges to Trump’s various executive actions (a separate story required for that one). Times are tense in trade, politics, and in the world of checks-and-balances.

Regardless of the “reciprocal” and emergency tariffs, the Section 232 laundry list of tariffs are still teed up with more in the queue (pharma, semis, aircraft/engines/parts, lumber, copper, etc.). Some are massive import line items (autos, pharma, aerospace, semis) so the trade war impulse remains. The mix of weapons just changed.

The above chart runs through the deltas we monitor (see 4Q24 GDP: The Final Cut 3-27-25). We like to watch the consumer and corporate investment patterns as first on the priority list with Government a distant 3rd even though government consumption and investment line is close to Gross Private Domestic Investment (GPDI) in its share of nominal GDP. As usual, the consumer and the PCE line rules at 68% of GDP followed by GPDI at 19% and Government at 17%. That adds to 104% (rounding) with over -4% from the net trade deficit.

The two big distortion lines in the 2nd estimate for 1Q25 are the usual suspects with the trade deficit (Net exports of Goods and Services) bringing a negative contribution to GDP of -4.9% (Table 2). The “change in private inventories” line added +2.64% with the mad scramble of pre-tariff inventory stocking as many industries sought to beat the tariff charges that importers (aka “buyers” not sellers) need to pay. Stocking inventory made for a lot of two-way traffic that juiced up the import line to a level that drove a -5.16% contribution to GDP vs. +0.34% for exports.

How one wants to ponder that -4% haircut from trade is very multi-layered and often in the eye of the beholder. We have looked at that topic in other commentaries. Everyone has a view. Lower cost imports help juice up profits? Consumers are happy with lower costs and higher purchasing power for goods? Supply chains are optimized in quality and cost? International expansion base? Reinvestment of profits in capex, hiring, R&D, tech, and more downstream investment from offshore? (Auto transplants, dealers, finance and insurance, real estate, freight and logistics investment, etc.)

The dark side has been advertised regularly in the US with the erosion of the manufacturing base and race to the bottom on wages. Trump also believes a trade deficit is a payout/subsidy and nothing else.

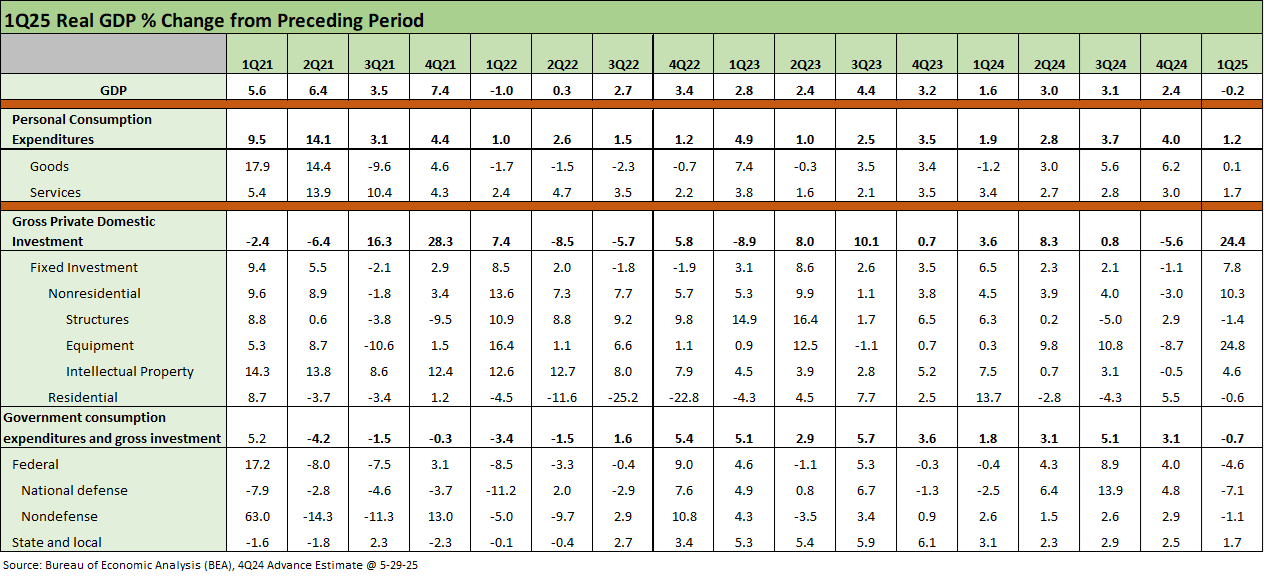

The above chart breaks out the longer timeline from the start of 1Q21 in Biden’s term for an easy scan across the post-COVID period that includes the ZIRP year of 2021 and then into the rising inflation and tightening cycle of 2022 before the start of easing in 3Q24.

The PCE trend line is unfavorable in the drop from +4.0% to+1.2 but it is at least not contracting. We get another round of outlays data for April this week with the PCE release (Income and Outlay). Goods declined sharply and Services also dropped.

In GPDI, we see the Equipment line rolling along at +24.8%, but the Structures line has been faltering and hit -1.4%, well below the earlier stimulus periods. Residential has been volatile and had another subpar reading by falling into the red zone. IP Products ticked higher to 4.6% in the revised numbers. The Government line hit the lowest since the peak inflation quarter of 2Q22.

Overall, the revisions for 1Q25 signal weakness but no recession. That will be up to tariffs, which is a drama in the process and how consumers respond.

See also:

Homebuilder Rankings: Volumes, Market Caps, ASPs 5-28-25

Durable Goods Apr25: Hitting an Air Pocket 5-27-25

Footnotes & Flashbacks: Credit Markets 5-27-25

Footnotes & Flashbacks: State of Yields 5-25-25

Footnotes & Flashbacks: Asset Returns 5-25-25

Mini Market Lookback: Tariff Excess N+1 5-24-25

New Home Sales April 2025: Waiting Game Does Not Help 5-23-25

Existing Home Sales April 2025: Soft but Steady 5-22-25

Credit Snapshot: Lithia Motors (LAD) 5-20-25

Home Starts April 2025: Metrics Show Wear and Tear 5-19-25

Footnotes & Flashbacks: Credit Markets 5-19-25

Industrial Production April 2025: CapUte Mixed but Time Will Tell 5-15-25