Payrolls May 2025: Into the Weeds

We dig into the occupation lines for May 2025 as deltas show typically strong Service growth but lingering questions on Goods.

Will importers be happy with tariffs? Or cynics about the Golden Age?

The monthly +139K for nonfarm payroll reinforces the view of resilient labor market as we head further into tariff policy chaos. This level does not sound the alarm bells and gives the FOMC more time to assess where inflation and employment are heading in 2H25.

The expectation is that reactions from employers will be subject to tariff-related expenses and pricing pressure. May was another month where those risks have not yet materialized, but we are still early in the working capital (inventory liquidation/restocking, contracts) process and rolling tariff dates (with plenty of Section 232 ahead even without the Reciprocals).

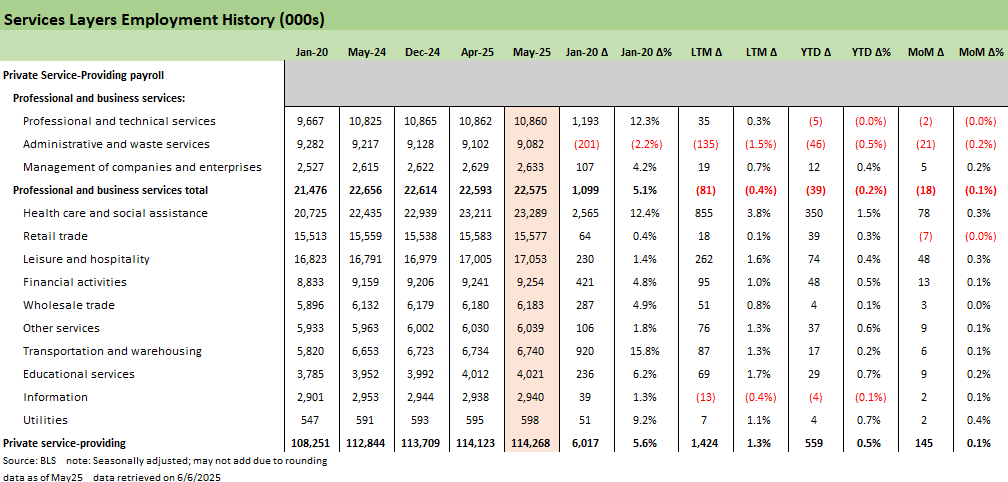

Employment strength on the month came from the typical Healthcare, Social Assistance, and Leisure & Hospitality areas. Healthcare is much more resilient to cyclical pressure but faces its own challenges as we saw pharmaceuticals lead goods imports down in April and the current state of the ‘Big Beautiful Bill’ aims at Medicaid cuts. Leisure and Hospitality gains are concentrated in highly discretionary industries, signaling continued decent demand.

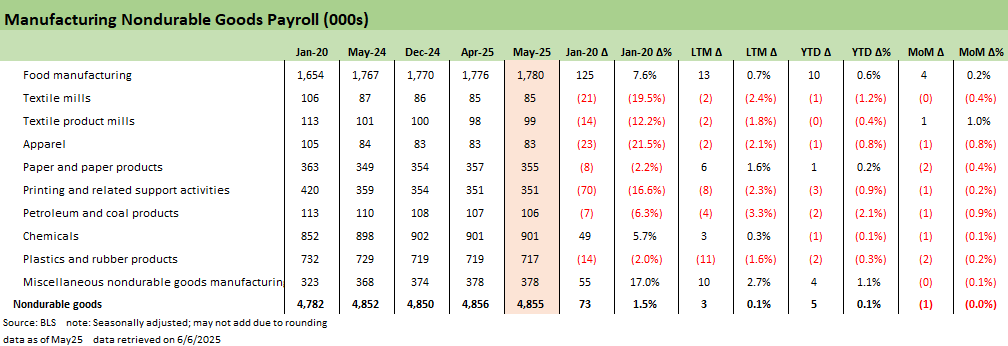

Manufacturing labor softened this month with results largely mixed but Machinery the major factor down -7K. Durables and Nondurable were both lower and Construction barely moved. The fact is that recovery and revival of domestic manufacturing is a daunting task and even with tariffs changing the landscape now, the payroll numbers do not reflect a turnaround yet.

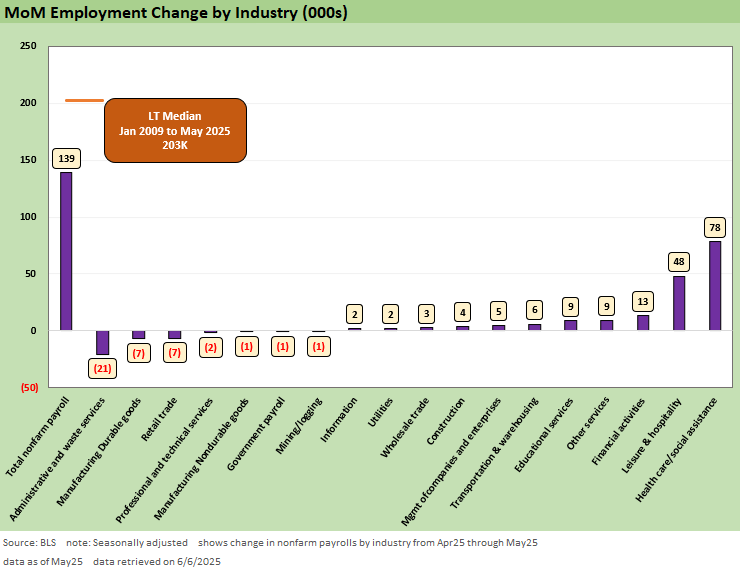

The above chart covers the monthly deltas by key industry groupings that we track in Table B-1 of the Payrolls report. May at +139K payroll adds is a softer month but still well within expansion territory, tempered by -95K of cumulative revisions in the past two months. This month continued the growth trend, but the optimism might be a bit overstated with the adds down slightly MoM from +147K after the April revisions.

Healthcare remains the number one gainer in May, adding +78K jobs. Demographically driven healthcare demand will keep that sector relatively insulated from current tariff policy fallout, but policy risk lurks as the Medicaid cuts are on the table in budget talks. Employers are at risk in many regions. There may be some incremental damage in the sector as Section 232 pharma tariffs lead to supply chain dislocations but the bulk of labor demand should remain intact given the often nondiscretionary nature of healthcare needs.

Leisure & Hospitality is the second largest gain at +48K and is a notable bright spot in the report given the highly discretionary nature of the demand drivers within. The month saw +30K from Food services and drinking places and just shy of +10K from Amusement, gambling, and recreation industries. We see strengthened demand in those industries as having a calming effect on some of the consumer jitters. More jobs for now means consumers still have a paycheck to spend but how they split and spend that in the coming months with rising prices will keep focus on areas like these. Recent PCE number have been softening (see PCE April 2025: Personal Income and Outlays 5-30-25, 1Q25 GDP 2nd Estimate: Tariff and Courthouse Waiting Game 5-29-25).

The worst detractor for the month is Administrative and waste services at -21K. Given that the majority of that is from -21K Temp jobs, we see these as more of a reshuffling than a strict negative. On the other hand, manufacturing seeing a -8K decline in payrolls (-7K durables, -1K nondurables) is a negative signal on early influence of tariffs for rosy reshoring scenarios. Rebuilding will be a multi-year effort but early missteps in ramping up domestic capabilities raise questions about how successful the short-term pain for long-term gain trade off will be.

With another month clearing the low bar of no contraction in the labor markets, the market reaction is positive again this morning. The morphing plans around tariffs have in part moved to the sidelines, but the Fed is watching closely as the early economic ramifications will continue to show up. How quickly the transmission to inflation and/or employment pain will continue to be the focus for any late year easing – not political pressure.

Into the Weeds…

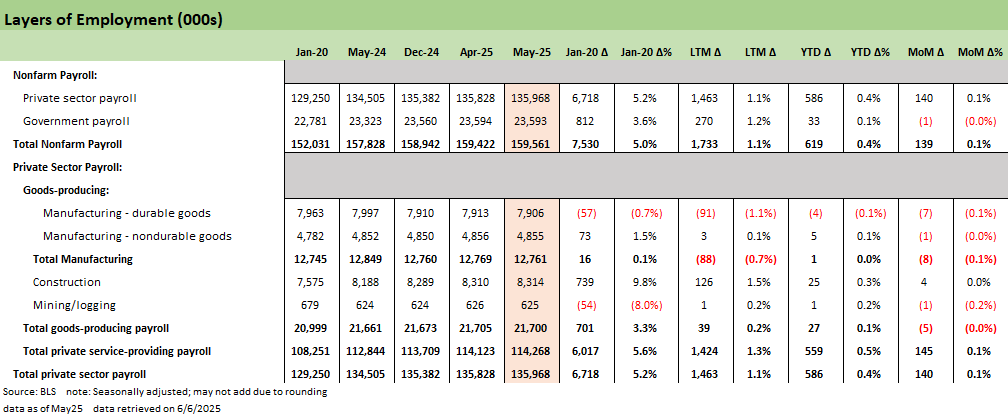

The next series of charts break out in granular detail various occupation lines and industry groupings from this morning’s release with key time horizons shown. This first one above shows the broadest groupings across Public and Private and Goods-Producing vs. Service-Providing.

As already discussed, the Services gains this month are the entire driver of payroll adds, with both Goods-producing and Government detracting from the +145K Services adds. There is little material direct impact to be seen from tariff policy so far either positive or negative that stands out immediately. The desired policy goal of a shift towards goods producing still remains highly aspirational with the contraction this month. The real impact will still take years to play out. In the meantime, the damage done from consumer demand destruction across the board from rising prices, rising unemployment, or just uncertainty that could increases savings rates are 2025 issues. The mismatch in timing along supplier-to-finished goods chains does not bode well for how tariffs will affect the economy as the year continues, pre-tariff inventory winds down, and economic realities become felt. As always, retaliation on US exports could add to problems.

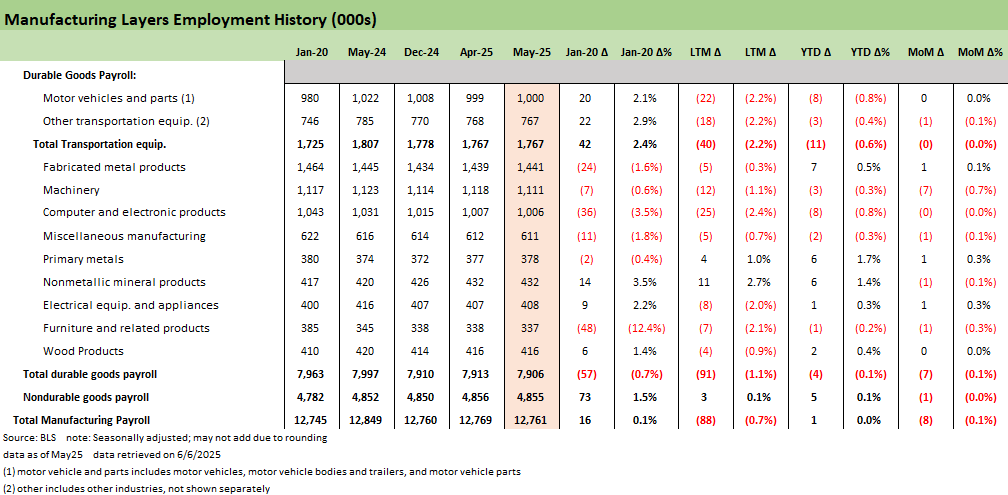

The total manufacturing contraction this month is -8K jobs, split across -7K in Durables and -1K for Nondurables. This reverses nearly all the YTD gains, especially in Durables that now comes to -4K YTD. Whereas most of the pain this year has been on the Transportation side, this month saw the decline stemming from a -7K MoM Machinery decline.

Results so far in 2025 reflect the challenges in planning investment and hiring actions for large build outs when policy remains in limbo. The two areas that reflect growth and may buck that trend so far YTD are the +6K payroll adds for both Primary Metals and Nonmetallic mineral products. At least there is some connection to be made from the Section 232 Steel and Aluminum tariffs to Primary Metals. Those are not wrapped up in the eventual IEEPA case at SCOTUS, so planners at least have one less uncertain variables to consider. Of course, the significant price increases from tariffs on materials (steel, aluminum, copper, lumber) could prompt some tough decisions by employers along metals products chain and those in materials-intensive industries (e.g. manufacturing and nonresidential construction).

The Nondurables manufacturing lines are shown above with another relatively negative month across the board as all sectors except Food manufacturing (+4K) and Textile product mills (+1K) reported some level of decline. When looking at the sectors above that generally show a history of sectoral decline within the US, we think about which of these are those that need domestic capabilities. The broad tariff regime and especially continued need for resolution with China may lead to some incremental job creation in a handful of these sectors, but the tradeoff may be skewed heavily negative in mature end markets who lose low-cost offshore suppliers (notably in Asia). Apparel is one to consider in retail industry context as tariffs drive prices higher.

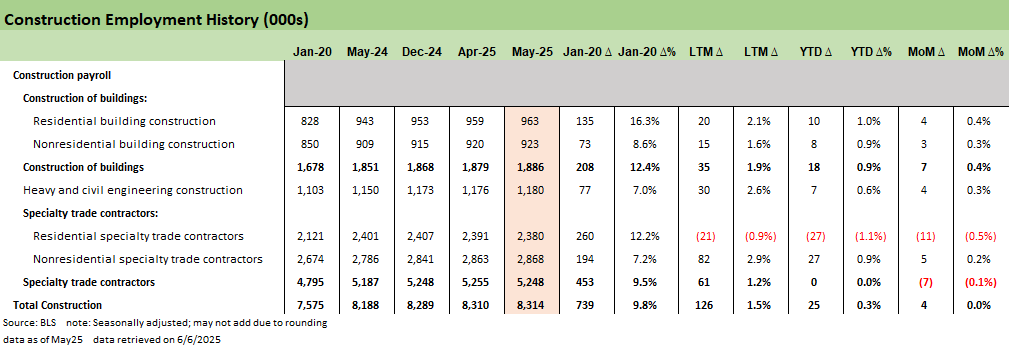

The Construction number this month came in at a positive +4K payroll adds as the declines in residential trade contractors appears reshuffled to the other lines within. The minor increases are positive just from an optics standpoint, but the challenges to breaking new ground with everchanging project economics remains. The past week was a reminder as steel and aluminum tariffs saw a fresh increase to +50% tariffs from 25% and other increasing materials costs necessarily lead to reduced demand or higher costs. Some mitigating factors can be seen such as new demand from markets such as data and power generation needs where the market is focused in current times.

We already discussed the major moves in Services and further detail more line item trends in the chart above. We highlight the decrease in Retail Trade that came from a mixed bag of industries (furniture, department stores, health and personal care). A now two-month reversal (April -2K, May -7K) against the 2025 +39K YTD number is a possible sign of concern where consumer behavior might have changed. These are areas where employment decisions face less friction and give some insight into staffing decisions for those consumer-facing industries.

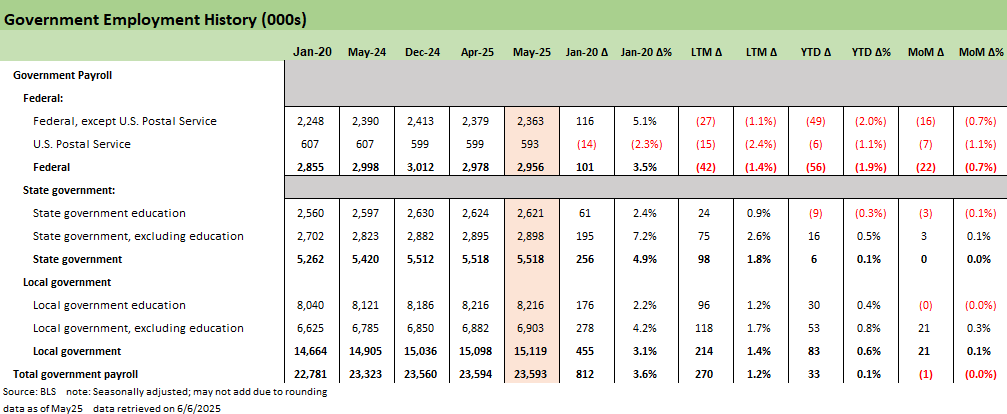

We complete the collection with the Government employment lines that add up to -1K impact to headline as the -22K in Federal payrolls offset a +21K Local payrolls growth. Even with a DOGE driven -56K of Federal cuts on the year, the Local level hiring growth has remained impressive this year at +83K.

See also:

Employment May 2025: We’re Not There Yet 6-6-25

US Trade in Goods April 2025: Imports Be Damned 6-5-25

Past-Prologue Perspective for 2025: Memory Lane 2018 6-5-25

JOLTS April 2025: Slow Burn or Steady State? 6-3-25

Tariffs: Testing Trade Partner Mettle 6-3-25

Footnotes & Flashbacks: Credit Markets 6-2-25

Footnotes & Flashbacks: State of Yields 6-1-25

Footnotes & Flashbacks: Asset Returns 6-1-25

Mini Market Lookback: Out of Tacos, Tariff Man Returns 5-31-25

PCE April 2025: Personal Income and Outlays 5-30-25

Credit Snapshot: Meritage Homes (MTH) 5-30-24

1Q25 GDP 2nd Estimate: Tariff and Courthouse Waiting Game 5-29-25

Homebuilder Rankings: Volumes, Market Caps, ASPs 5-28-25

Durable Goods Apr25: Hitting an Air Pocket 5-27-25

Mini Market Lookback: Tariff Excess N+1 5-24-25

New Home Sales April 2025: Waiting Game Does Not Help 5-23-25

Existing Home Sales April 2025: Soft but Steady 5-22-25

Credit Snapshot: Lithia Motors (LAD) 5-20-25

Home Starts April 2025: Metrics Show Wear and Tear 5-19-25

Industrial Production April 2025: CapUte Mixed but Time Will Tell 5-15-25

Retail Sales April 25: Shopping Spree Hangover 5-15-25

Credit Spreads: The Bounce is Back 5-13-25