Credit Snapshot: Meritage Homes (MTH)

We summarize the credit fundamentals of Meritage Homes.

Credit Trend: Stable

Summary credit profile:

The mix of financial and operating variables paint a picture of a stable low BBB tier name with plenty of cyclical questions still ahead on where mortgage rates will trend with the UST curve steepening. At this point, MTH is moving further into peak selling season with a freshly printed bond deal, recent BBB3 composite ratings, and reaffirmed guidance for 2025. MTH offers a good track record in its distinctive strategy with 100% spec and a 60-day guarantee “sales pitch” that sent it to #5 in the homebuilder ranks based on units. MTH has been busy in the bond markets in 2024-2025 with new issue IG term debt, a convertible bond, and an extension/increase in the unsecured, undrawn credit agreement.

MTH is well positioned to deal with most scenarios ahead. If builders face an old fashioned downturn (economic contraction not stagflation), then in theory mortgage rates and affordability should benefit and MTH will adjust land spend, pricing actions will evolve, and pace will likely trump price. MTH will keep running its inventory strategy and 60-day guarantee plan that has allowed it to effectively compete vs. the “resale” market (existing home sales).

MTH ended 2024 at around 90% entry level orders (92% entry level % average communities), so the sensitivity of monthly payments and exposure of its core customer base is high. The past two years included a +200 bps Hi-Lo range in mortgages rates, and the MTH results were still quite strong. MTH has been tested, and they delivered. The stagflation scenario will test all industries, but homebuilders can adjust more rapidly than most in the context of the BBB and BB industrial universe.

Relative value:

We don’t see an abundance of 10-year paper in the homebuilders. We see some longer dated bonds in higher quality low A/high BBB credit tiers, but the sector overall is still characterized by below-market coupons and shorter maturities with so much issuance during the ZIRP and QE years. MTH is in the “distinctive middle” with a BBB3 tier unsecured bond composite rating on the cusp. Most major IG builders carry higher ratings (DHI, NVR, LEN, PHM). The current coupon on its 2025 vintage issue ($500 mn of 5.65% due March 2035) is currently around +170 bps (various sources). That 2035 bond offers a coupon over 100 bps above the BBB tier composite coupon and offers spreads materially wide to the BBB tier Industrial composite OAS of around +113 bps.

We see MTH as a good core BBB name in broader BBB context with the intrinsic financial flexibility of homebuilders and favorable demographic outlook supporting demand. MTH will face the same modest cyclical pressures and mixed signals we are seeing with builders in 2025, but MTH offers more resilience in the downturn and contraction scenarios that offer lower risks that what can be crafted for BBB commodity and manufacturing names in similar cyclical dynamics. A strong balance sheet, inventory liquidation and land spend flexibility, and the potential for lower rates in a routine contraction (i.e. not stagflation) is a differentiator.

Business risk:

We have discussed the relatively lower business risk profiles in our other credit commentaries on homebuilders where we highlight the ability to adjust land spend and liquidate inventories to generate cash in slower markets. That resilience applies to MTH although that comes with the caveat that they have a less liquid mix in their real estate asset coverage with a higher relative inventory of land/lot development vs. finished homes and homes under construction.

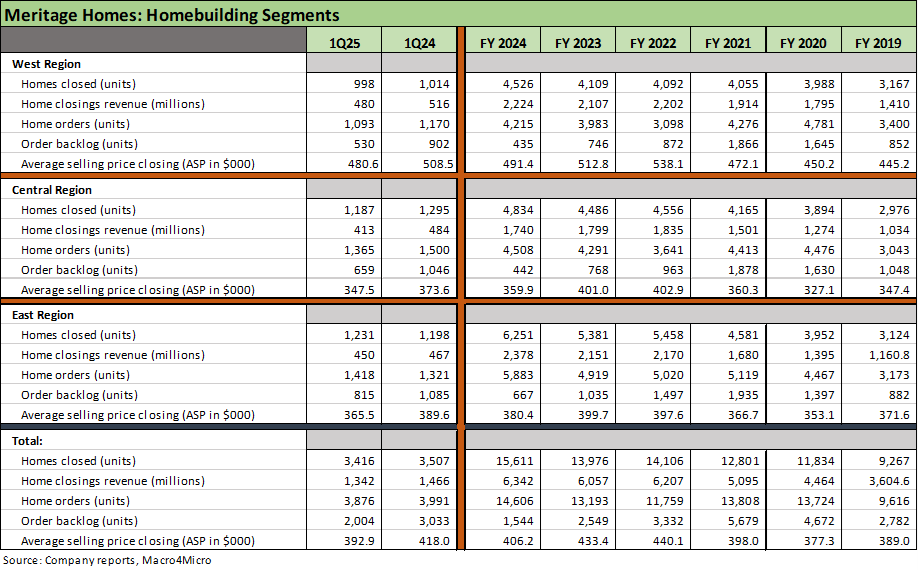

That inventory mix variable is a qualified reservation on relative business risk vs. peers since that 100% spec, 60-day delivery strategy (using realtors in the process) is distinctive in the peer group. The strategy has been successfully executed, and MTH has been picking up market share based on units (see Homebuilder Rankings: Volumes, Market Caps, ASPs 5-28-25). MTH has more exposure to mortgage rates than some of the BBB and upper BB homebuilder peers given their price tier and target customer mix at the entry level. Their ample land/lot supply gives them flexibility to cut land spend quickly in an economic contraction scenario.

Tariffs:

MTH has been like other homebuilders in being understated about the tariff threat, but the trade groups have been clear that such a tax on materials (lumber, aluminum, steel, copper, etc.) and major durables such as appliances will raise the cost for builders. Material costs can also flow into higher prices on finished lots, so overall tariffs are by definition a bad thing for builders as well.

The NAHB published an updated commentary on tariffs last month (see NAHB: How Tariffs Impact the Home Building Industry, NAHB Members Cite Impact of Tariff Uncertainty on Home Building ). Most builders do not want to get into discussions of trade partner burdens (making their suppliers eat more of the cost) or too much talk of pricing power or design strategies (“less house for their dollar”) to mitigate the impact. The variable cost heavy nature of the builders will allow them to design and price a house economically even if it comes at the cost of “some give” in gross margins.

Profitability:

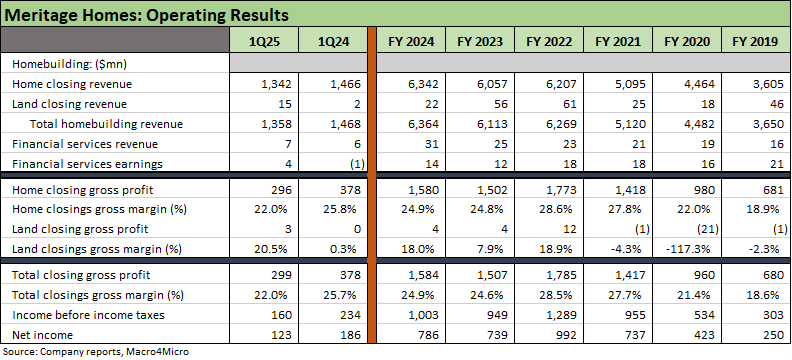

The homebuilding market is currently facing somewhat of a stall as we saw in 1Q25 earnings season and guidance. For MTH, the 1Q25 period saw guidance reaffirmed from its 4Q24 release, and that was uncommon in the peer group. MTH is hanging its hat on investment and double-digit growth in community count in 2025. As the company said on its 1Q25 earnings call: “it's more about the community count growth that's driving our full year guidance than it is about us assuming that the market is going to get better.”

The reality of the broader YoY trend is that volumes (closings) were down. Average sales prices were down, and orders (units and dollars) were down. Gross margins were down with home closing margins down to 22.0% in 1Q25 from 25.8% in 1Q24 after 24.8% in FY 2024. We have seen plenty of gross margin erosion across the peer group from incentives, pockets of price weakness, mix shifts, and less operating leverage from SG&A. MTH is not underperforming and part of a broad trend. It should be noted the 22% handle margins are a few points above 2019 when home closing margins posted an 18% handle.

Balance sheet:

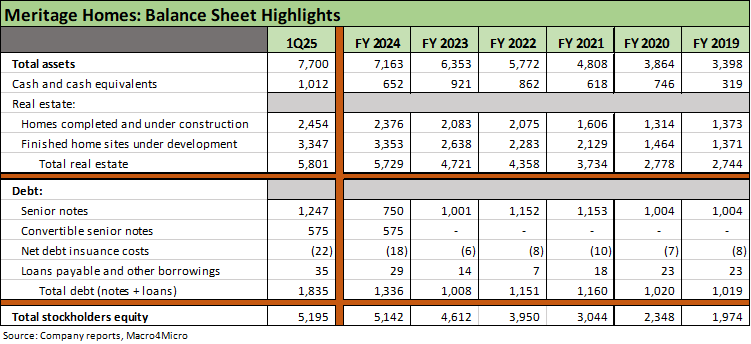

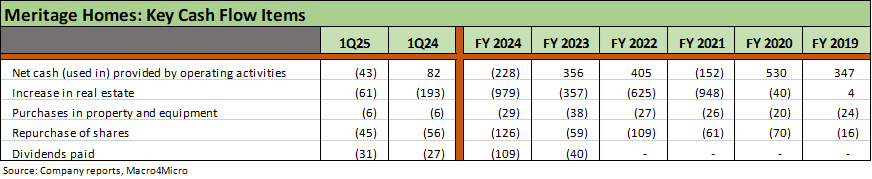

MTH has been busy on the liability management front in 2024 and 2025 with refinancing and extension of bonds via unsecured notes and a convertible issue. MTH also grew and extended its undrawn unsecured credit facility with $910 million now due in June 2029. MTH issued a new convertible during May 2024 with the $575 million use of proceeds to refinance debt and build cash: “increased our available sources for land spend, dividends, and share repurchases.” As cited in Relative Value above, MTH issued $500 mn of 10Y bonds to pad its liquidity cushion and continue to grow its community count. Land spend was 86% of the capital allocation in 1Q25 with the remainder allocated to share repurchases (8%) and dividends (6%).

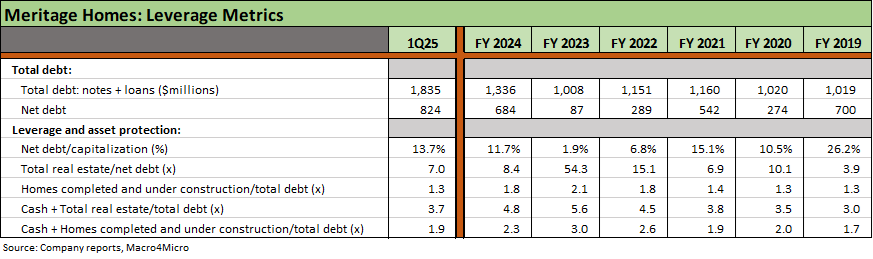

Net debt leverage ticked higher into 1Q25 (13.7%) from 4Q24 (11.7%), up from 1.9% at FY 2023. MTH is now more aggressive to fund expansion, but net debt/cap of only 13.7% is strong and worthy of IG ratings. The asset coverage we like to look at (e.g. inventory as a multiple of total debt and net debt) offers a very substantial cushion to bondholders as detailed in the charts below. The undrawn credit agreement has a leverage ratio test of less than 60% and MTH currently is at 11.8% under that definition. That leaves a lot of room for cyclical disappointment.

SELECT CHARTS

Feeling the gross margin squeeze like most builders.

Closing volumes and ASPs biased lower but orders are rising.

Both sides of balance sheet growing. Development inventory mix is higher vs. peers.

Leverage rising off the 2023 lows but well below 2019.

Cash flow deployment focused on land and growth.