Switzerland-US Trade: A Deficit that Glitters

We look at Switzerland’s moving parts as it showed outsized deficit moves in 2025 that received disproportionate Trump focus.

Quick! Lower the tariff!

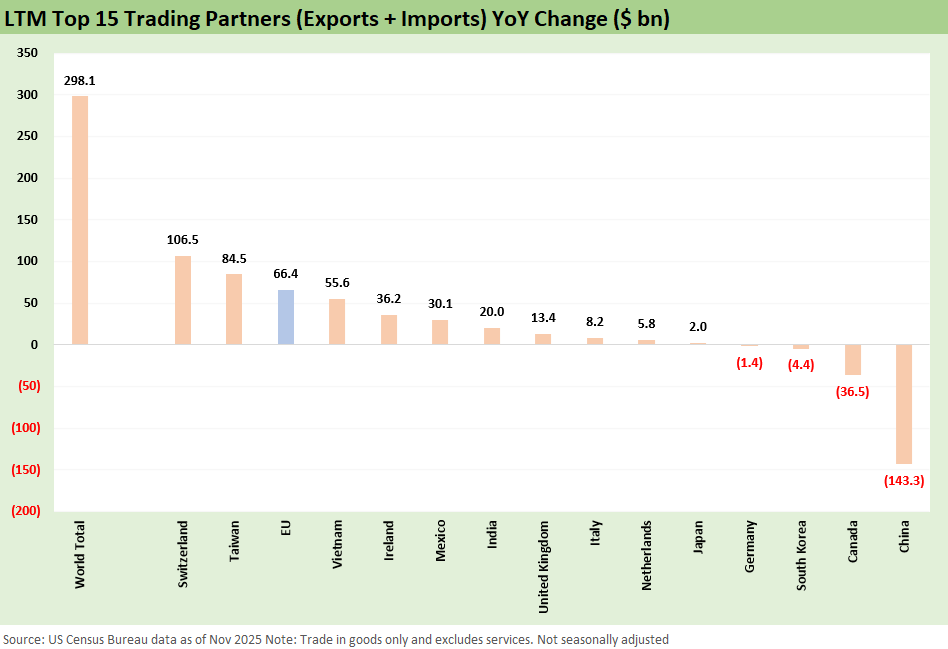

Switzerland made the top 10 trade partners on an LTM basis, ranked #1 in terms of the increase in total trade volume (imports + exports), and the move to a 39% tariff caught a lot of headlines as Trump said the then-Swiss President (female) “rubbed him the wrong way.” (A rarity for Trump to be upset with strong women).

A visit from some leaders of luxury product companies and corporations (males from Rolex, Cartier/Richemont among others) who were also bearing gifts (e.g., personalized gold bar and Rolex clock) did the trick and bought tariffs back to 15% from 39%. The tariff drama with Switzerland offers a reminder that IEEPA tariffs and the tariff setting process are sometimes ego-driven and less about economics. The Swiss domestic political blowback about corruption and oligarch influence was loud (in Washington, they call it Tuesday), but the 15% was a good result.

Swiss trade is broader based in imports in the US than just gold, watches/jewelry, and chocolate with Pharma a major line item that gets a lot of Trump focus. US-Swiss trade in 2025 was dominated by the two-way traffic in gold with the Swiss import line into US showing a disproportionate increase in gold bullion/bars as detailed in the product line charts below.

The irony is a major increase in gold imports/exports comes in a period where Trump has been a destabilizing X factor. That is not lost on those analyzing Swiss trade and higher deficits. One could argue Trump’s behavior by itself sent the US-Swiss trade deficit higher.

Team Trump gained some investment concessions from Switzerland with potential US expansion for Pharma investment and gold refining among other opportunities. The investment totals in the US were cited at around $200 billion.

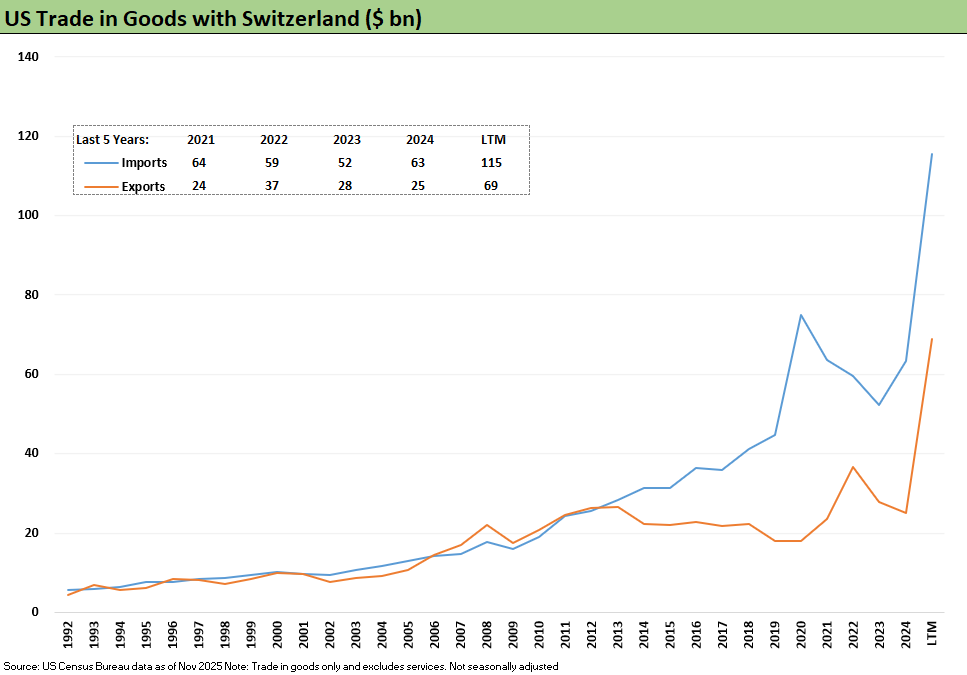

The above chart highlights the dramatic move in both imports and exports as the rapid rise in gold exports was dwarfed by the sharp rise in refined gold imports (gold bars etc.) Refining gold is a low margin business, but the volumes did make Switzerland look like a major problem in how Trump looks at trade deficits (regardless of economic reality). Gold bars and related products will not face tariffs.

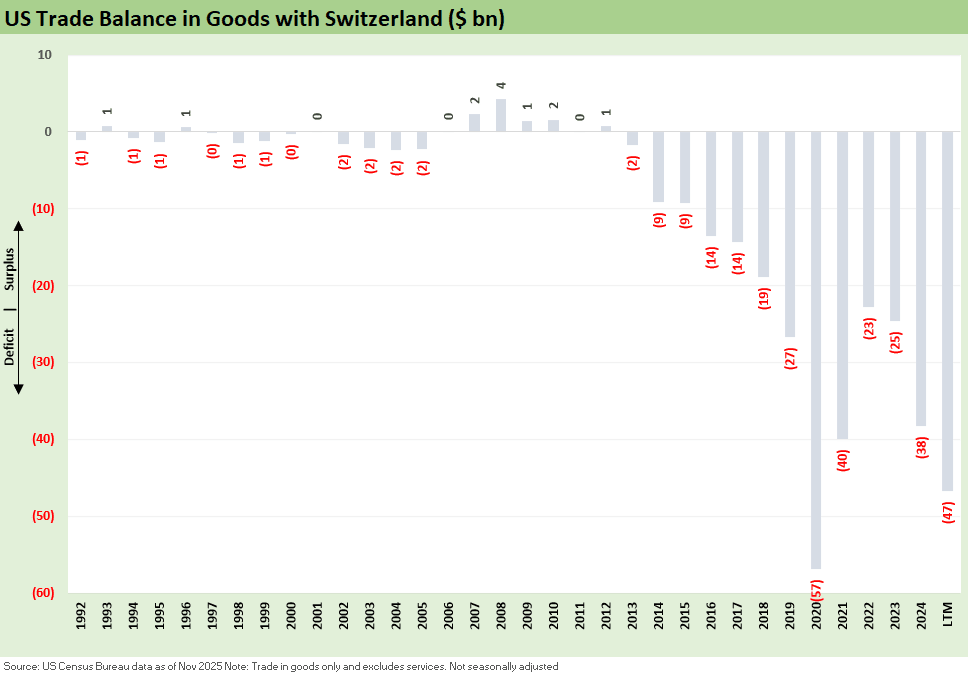

The above chart updates the trade deficit in LTM Nov 2025 period. The last time such a spike happened was 2020 during the year of COVID.

The above chart shows the total trade volume deltas (imports + exports) for LTM. Switzerland led the pack with Taiwan second (see Trade Deficits: Math Challenge 1-30-26).

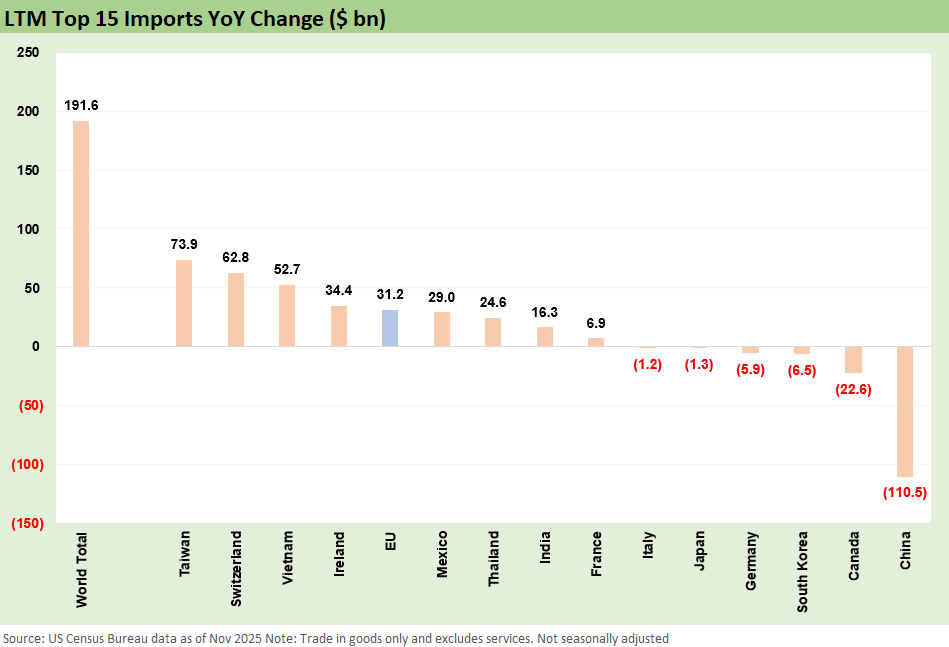

The above chart shows the leaders in YoY import deltas with only Taiwan ahead of Switzerland (see US-Taiwan Trade: Risks Behind the Curtain 2-1-26).

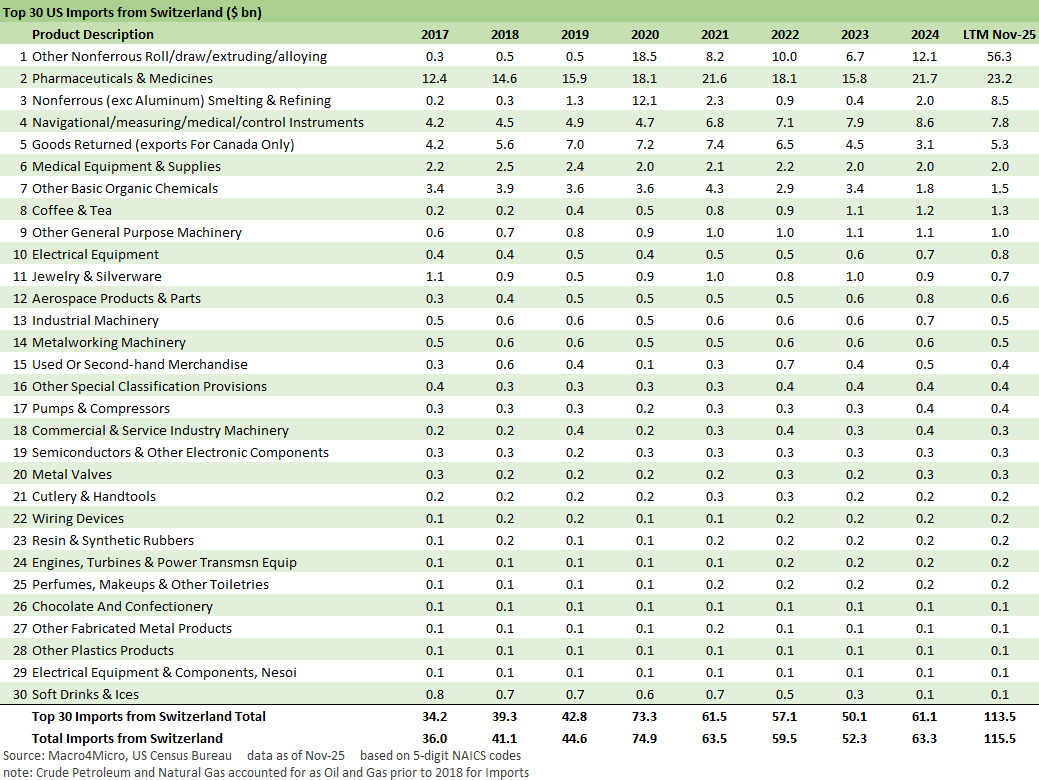

The above table details the product lines that rolled up into such high import numbers. We see the #1 line (“Nonferrous roll/draw/extruding/alloying”) rise by well over 4x and the same for the “Nonferrous smelting & refining” line at #3. Pharma and Medicines remain consistently high across the columns with a peak for LTM Nov 2025.

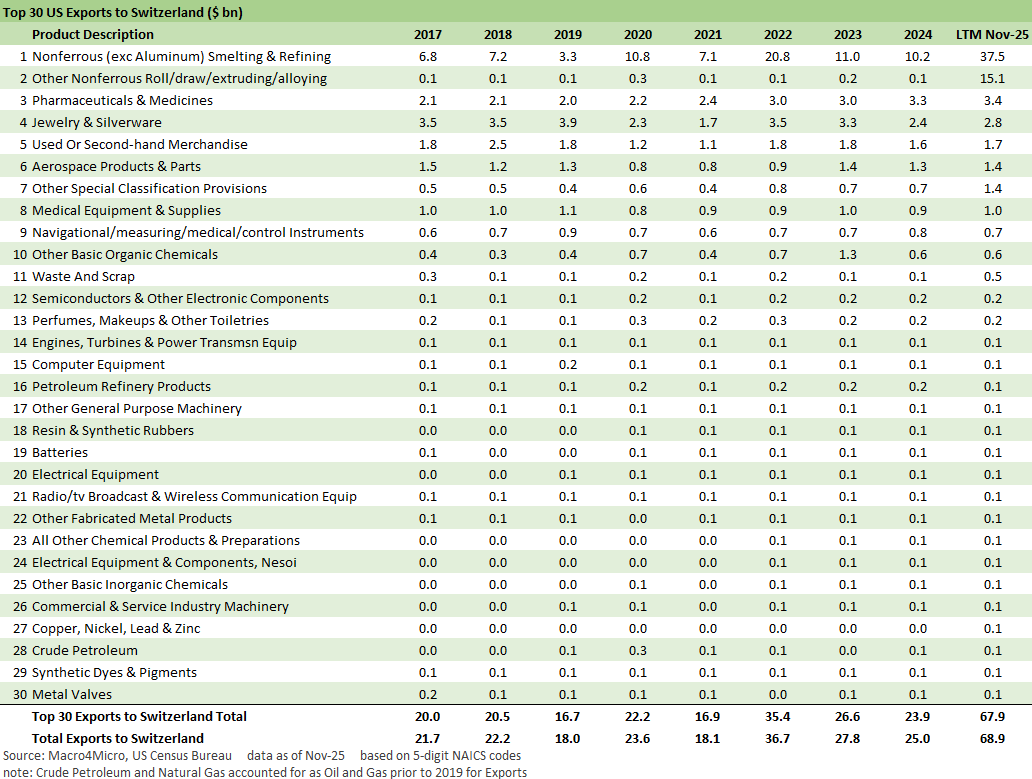

The above table updates the export lines with Nonferrous product lines leading the pack. Other than the battle over high imbalances for Pharma, there is not much to fight over in these export lines with the nonferrous lines (heavily about gold) distorting the numbers in 2025.

Tariff commentary:

US-Taiwan Trade: Risks Behind the Curtain 2-1-26

Trade Deficits: Math Challenge 1-30-26

China Trade: Shrinkage Report 1-28-26

Mexico Trade: Gearing up for More Trade Trouble? 1-27-26

Canada-US Trade: Trump Attack N+1 1-25-26

US-Canada Trade: 35% Tariff Warning 7-11-25

India Tariffs: Changing the Music? 7-11-25

Taiwan: Tariffs and “What is an ally?” 7-10-25

Tariff Man Meets Lord Jim 7-8-25

South Korea Tariffs: Just Don’t Hit Back? 7-8-25

Japan: Ally Attack? Risk Free? 7-7-25

US-Vietnam Trade: History has its Moments 7-5-25

US Trade in Goods April 2025: Imports Be Damned 6-5-25

Tariffs: Testing Trade Partner Mettle 6-3-25

US-UK Trade: Small Progress, Big Extrapolation 5-8-25

Tariffs: A Painful Bessent Moment on “Buyer Pays” 5-7-25

Trade: Uphill Battle for Facts and Concepts 5-6-25

Tariffs: Amazon and Canada Add to the Drama 4-29-25

Ships, Fees, Freight & Logistics Pain: More Inflation? 4-18-25

Tariffs, Pauses, and Piling On: Helter Skelter 4-11-25

Tariffs: Some Asian Bystanders Hit in the Crossfire 4-8-25

Tariffs: Diminished Capacity…for Trade Volume that is…4-3-25

Reciprocal Tariff Math: Hocus Pocus 4-3-25

Reciprocal Tariffs: Weird Science Blows up the Lab 4-2-25

Tariffs: Enemies List 3-6-25

US-Mexico Trade: Import/Export Mix for 2024 2-10-25

Aluminum and Steel Tariffs: The Target is Canada 2-10-25

Trade Exposure: US-Canada Import/Export Mix 2024 2-7-25

US Trade with the World: Import and Export Mix 2-6-25

The Trade Picture: Facts to Respect, Topics to Ponder 2-6-25

Tariffs: Questions to Ponder, Part 1 2-2-25

US-Canada: Tariffs Now More than a Negotiating Tactic 1-9-25

Mexico: Tariffs as the Economic Alamo 11-26-24

Tariff: Target Updates – Canada 11-26-24

Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24

Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24

Facts Matter: China Syndrome on Trade 9-10-24

Tariffs: Questions that Won’t Get Asked by Debate Moderators 9-10-24

The Debate: The China Deficits and Who Pays the Tariff? 6-29-24

Trade Flows: Deficits, Tariffs, and China Risk 10-11-23