Canada-US Trade: Trump Attack N+1

More threats from Trump against Canada and antagonism of the EU makes 2026 a tense year including the pending USMCA review.

Board of Peace: Trump Seeks the Like-Minded. Canada values sovereignty.

With a focus on sovereign rights and more reliable trade partners instead of an embrace of subservience, Canada has crossed the line with Trump and could face 100% tariffs.

We look at the latest trade mix, which includes one of the highest value-added US export mixes of the US. Imports include waves of critical resources the US needs and the private sector demands.

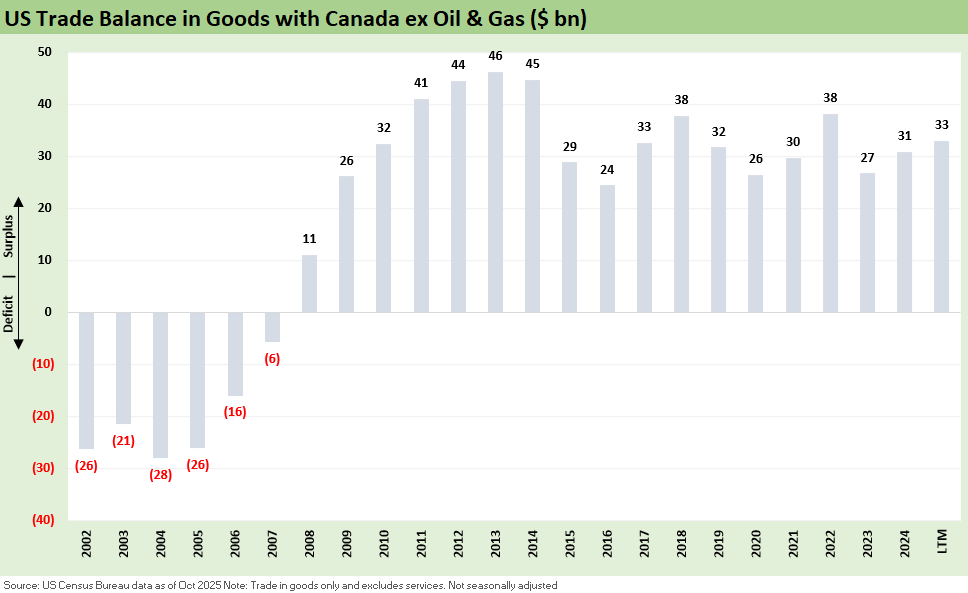

The US boasts a goods trade surplus with Canada ex-crude oil with its highly desirable, discounted heavy crudes used by US refiners.

With a strategic advantage in the Arctic and a member of NORAD and NATO, Canada should be a priority relationship. In contrast, Trump has assured poor relations given his insulting behavior and “51st state” annexation rhetoric combined with threats of economic coercion. The 2026 USMCA review leaves little room for optimism based on Team Trump conduct.

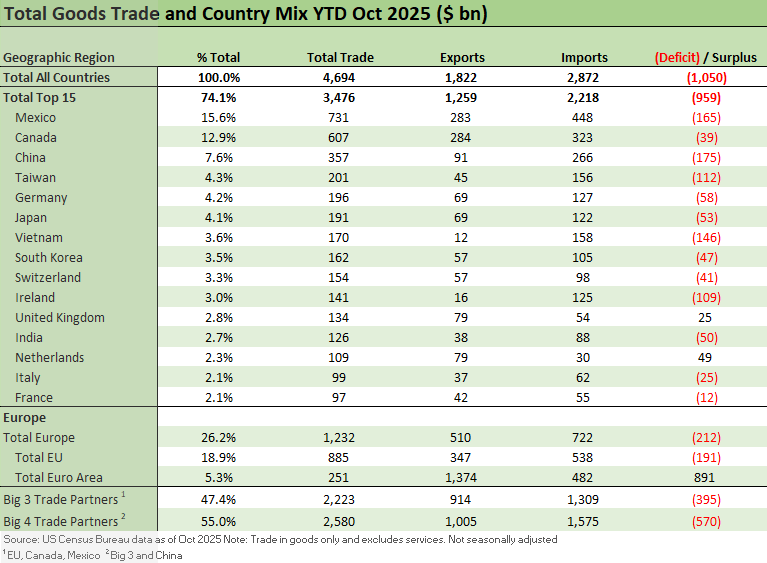

The above table updates the running trade partner rankings as a frame of reference. We then look at Canada given Trump’s latest tariff rant. Using “national” scale rankings (as opposed to the EU trade bloc), we see Mexico at #1, Canada at #2, and China at #3. If we include the EU as a trade bloc, they leap to #1. We then break out the EU nations on the list with Germany ahead of the European pack.

It does not take a lot of imagination to see what a problem it would be for the US if a few of the major trade partners employed the “just say no” strategy to Trump. The top 3 are 47% of trade while the Big 4 amount to 55%.

Trump has been doing his utmost to keep the #4 US trade partner (China) from teaming up with Mexico and Canada to reduce US exposure. In an election year where tariffs and inflation and affordability are hot topics, that might be a fight worth having. Meanwhile, the SCOTUS IEEPA waiting game continues.

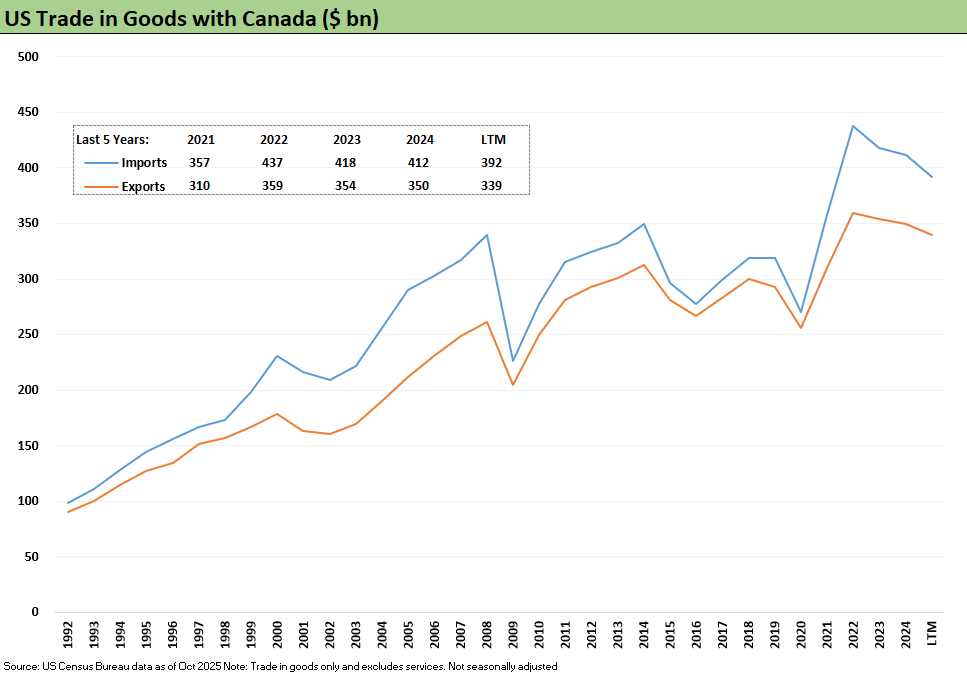

The above chart plots the time series for US-Canada imports and exports. As we detail below, the deficit is about oil and the attractive nature of the discounted Canadian crudes (and oil sand products).

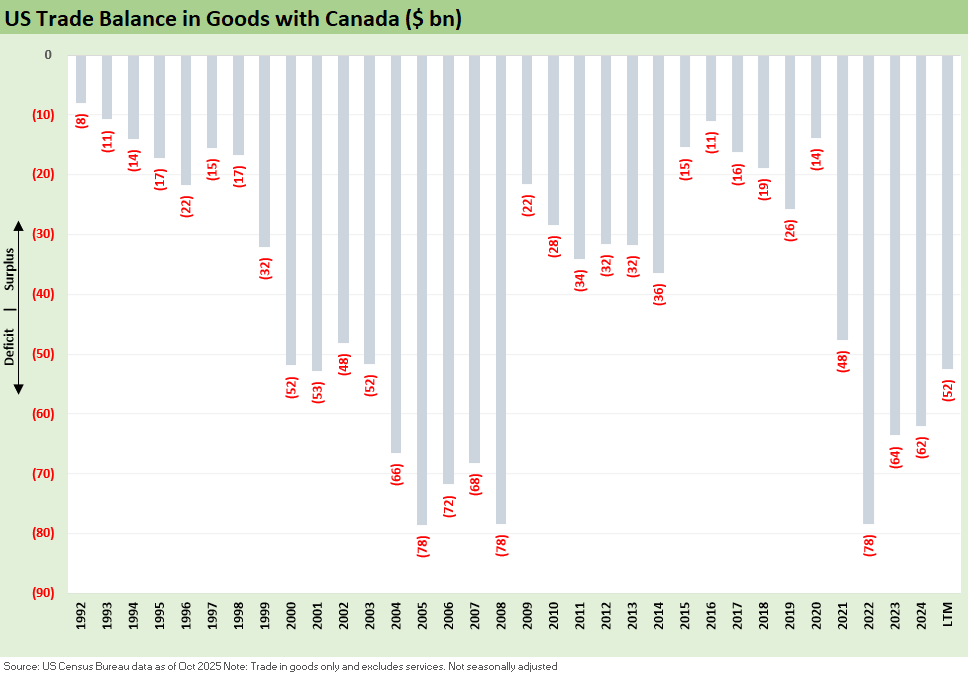

The above chart frames the running US-Canada goods trade deficit across the decades. Rising oil sands production as major projects came online and material swings in oil prices in the new millennium were a big part of the story. The 2015-2020 period was a tough stretch for oil producers.

The above chart highlights the US-Canada trade balance ex-oil. A surplus is a good thing in Trump Land, but that did not stop him from slamming Brazil after that nation held Trump’s “coup bro” accountable for his crimes (not everyone has a stacked Supreme Court and a collection of pocket judges).

The above trade surplus ex-oil history with Canada presents a very different profile than EU and Mexico among the top trade partners. The nature of discounted Canadian crudes are a distinctive story line for US refiners. Without those crudes, refined product flows would be subject to upward price pressure given high unit costs (other things being equal).

Cheap Canadian crudes are thus a positive factor in the energy picture. The role of heavy Venezuelan crudes in the picture in coming years is a topic for another day, but the desire to get closer to China factors into that future risk for Canada

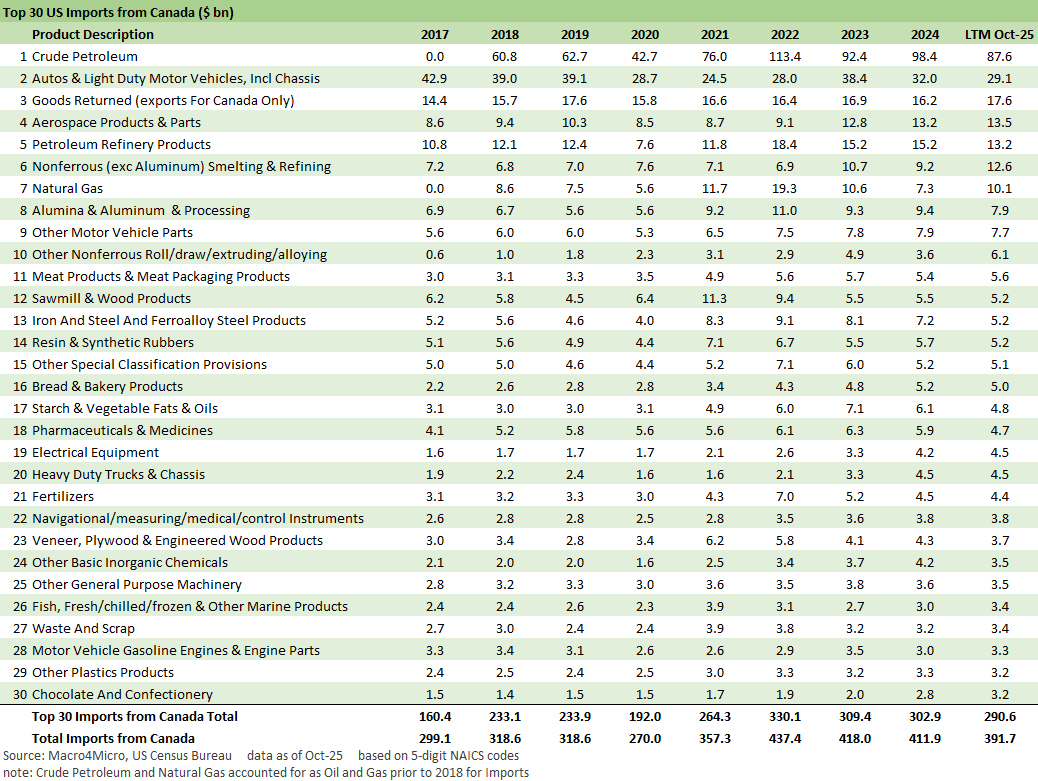

The above chart updates the import list with crude oil way out in front. With Trump having dreams (in some cases pipe dreams) of a massive increase of heavy crude production from Venezuela (competes with Canadian heavy crudes and downstream oil sands volumes), Canada needs to plan ahead. China demand would clearly fit in the picture as would Europe if Canada can also get its LNG house in order for international markets. That means direct competition with the US, who has an increasingly strained relationship with the EU.

There is an increasing number of nations that would prefer to deal with anyone other than the economic genius of Trump and his “selling country pays the tariff” theme music. China and the EU markets are natural priorities for Canada to reduce the massive exposure to the US. The 2028 election will an important driver of trade risk given the “tariffs by executive order” strategy of Trump. The “next guy” may have a different view on tariffs.

Many of these product lines above have been targeted by Trump (aluminum, steel, the forest products chain). Some reflect critical supplies that the US badly needs (e.g. potash, uranium) as detailed in the links below. Canada also has important strategic value in the area of arctic security, so Trump might want to ponder the role of NORAD and the geographic advantages of Canada in national security. That is, unless he is planning Greenland Part Deux.

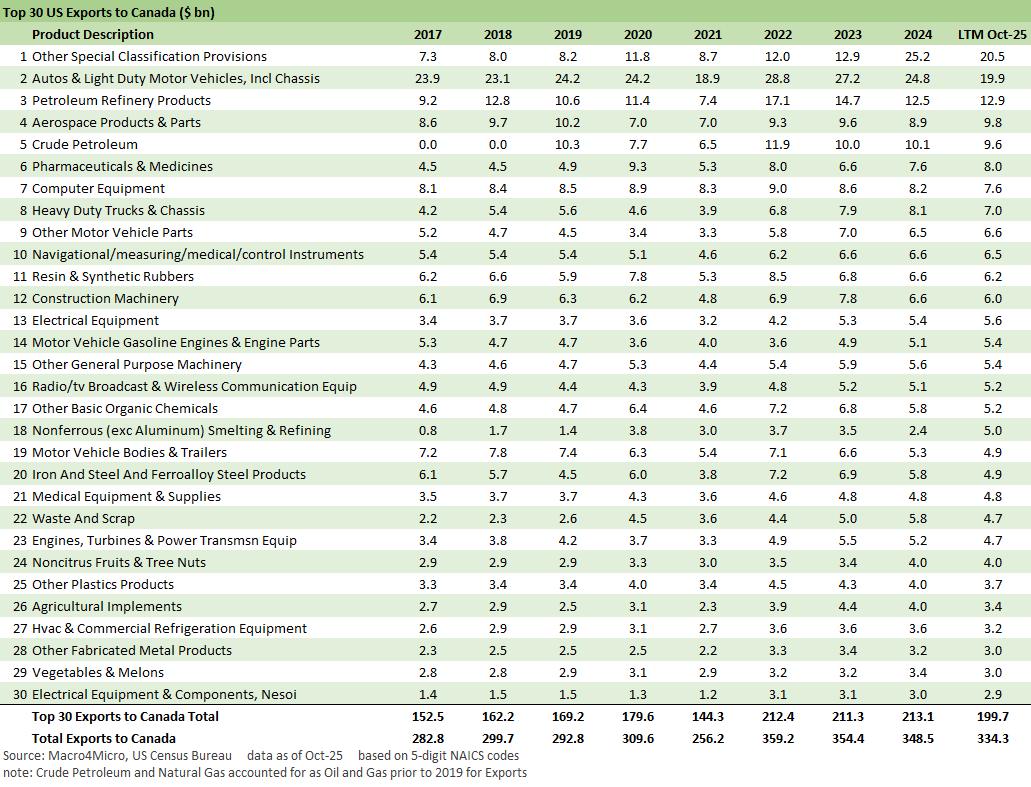

The above chart updates the export list for Canada from the US. We have looked at more than a few import-export lists across trade partners, and this is as good as it gets in size and breadth. This is a very compelling product list. A trade war would be felt on both sides.

That auto piece of the puzzle has been under siege under Trump tariff policies from assembly capacity back along the supplier chain, and there is every reason to assume that the USMCA review will be a case of Trump beating on Canada. Tomorrow’s USMCA could look very different than the current one, and Trump has displayed a ready willingness to be abusive to allies and trade partners.

The more EV-friendly nature of the political backdrop in Canada could open up doors for China even if it creates political flack from Doug Ford and Ontario. Magna and other EV supplier chain jobs could in theory benefit, and there is investment capital and infrastructure that could get traded off in the energy sectors for Canada with a massive natural customer in China. Overexposure to the US has become a liability.

Canada Tariff Commentaries:

US-Canada Trade: 35% Tariff Warning 7-11-25

Tariffs: Amazon and Canada Add to the Drama 4-29-25

Trade Exposure: US-Canada Import/Export Mix 2024 2-7-25

Aluminum and Steel Tariffs: The Target is Canada 2-10-25

US Trade with the World: Import and Export Mix 2-6-25

The Trade Picture: Facts to Respect, Topics to Ponder 2-6-25

Tariffs: Questions to Ponder, Part 1 2-2-25

US-Canada: Tariffs Now More than a Negotiating Tactic 1-9-25

Tariff: Target Updates – Canada 11-26-24

Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24

Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24

Other Tariff commentary:

India Tariffs: Changing the Music? 7-11-25

Taiwan: Tariffs and “What is an ally?” 7-10-25

Tariff Man Meets Lord Jim 7-8-25

South Korea Tariffs: Just Don’t Hit Back? 7-8-25

Japan: Ally Attack? Risk Free? 7-7-25

US-Vietnam Trade: History has its Moments 7-5-25

US Trade in Goods April 2025: Imports Be Damned 6-5-25

Tariffs: Testing Trade Partner Mettle 6-3-25

US-UK Trade: Small Progress, Big Extrapolation 5-8-25

Tariffs: A Painful Bessent Moment on “Buyer Pays” 5-7-25

Trade: Uphill Battle for Facts and Concepts 5-6-25

Ships, Fees, Freight & Logistics Pain: More Inflation? 4-18-25

Tariffs, Pauses, and Piling On: Helter Skelter 4-11-25

Tariffs: Some Asian Bystanders Hit in the Crossfire 4-8-25

Tariffs: Diminished Capacity…for Trade Volume that is…4-3-25

Reciprocal Tariff Math: Hocus Pocus 4-3-25

Reciprocal Tariffs: Weird Science Blows up the Lab 4-2-25

Canada Metals and Steel Information:

Minerals and Metals Facts: Canada

Aluminum Facts: Canada

Copper Facts: Canada

Potash Facts: Canada

Uranium Facts: Canada

Canadian Steel Policy

Solid breakdown of the trade asymmetry. The point about US running a goods surplus ex-crude oil is underappreciated in the tariff debate. I've been watching how Canadian policymakers are quietly diversifying toward Asia Pacific markets. The strategic angle you mentioned (NORAD, Arctic positioning) makes the antagonistic approach even more puzzling from a longterm security standpoint, especially with increased Russian and Chinese activity inthe region.