China Trade: Shrinkage Report

We update the China-US goods trade deficit trend line and the import-export moves across the top 30 product groups.

US-China trade: Just another Long March?

With Mexico and Canada facing a review of the USMCA, we turn to China trends for another frame of reference on trade volume and shifting deficits. China-US trade volumes have plunged but China has mitigated trade risk by continuing to shift the mix of partners.

Among major topics of late, Canada and the EU are both looking to diversify their trade risks away from the US. The reality is that Team Trump keeps making threats at Canada such as the 100% tariff threat (tied to a “China free trade deal” that is not in process or even close) which continue to sour relations.

When your top 4 trade partners are 55% of your volume and you treat them all like “the enemy,” the self-fulfilling prophecy is that they need to reduce economic, political and national security ties. China is one thing, but NATO allies are another.

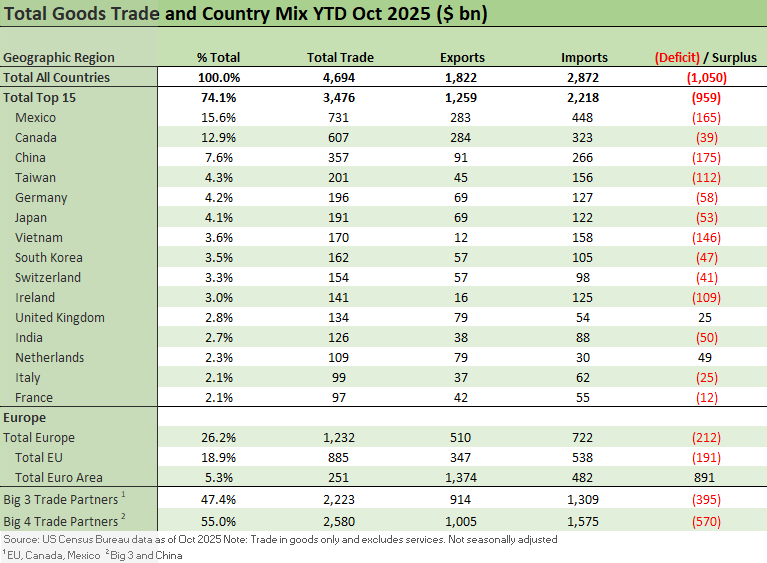

The above chart is the same one we used in the Canada review (see Canada-US Trade: Trump Attack N+1 1-25-26) and Mexico update (see Mexico Trade: Gearing up for More Trade Trouble? 1-27-26). We see China at a distant #3 in total trade in the Top 15 nations (ex-EU bloc). We see Taiwan at a more distant #4 as a national trade partner just ahead of Germany. The China + Taiwan share makes for easy math but very tough geopolitics.

The fact that 13 of the Top 15 total trade partners feature trade deficits (UK and Netherlands the exceptions) underscores what a challenge it will be for US buyers/importers who face punitive – and so far erratic – tariff policies. Toss a weaker dollar into the picture and the tariff costs adjusted into dollars is a headwind for buyers/importers.

We always cite the multiplier risks of import cost headwinds including lower volumes given the range of supporting services and infrastructure (freight and logistics, retail, finance, etc.). If the goal is to reduce imports, there is a cost that comes with that for the buyer and for all the related operations that come with that process of moving goods from “Point A to Point B.”

The economic policy goal of the US for now is to unwind global low-cost supplier chains by raising the costs to the buyers of products. In many cases (notably in manufacturing), the companies have spent decades building those integrated networks of suppliers. The trade policy is also to make fewer low-cost finished goods available to consumers (notably in retail). The theory is that all of the suppliers will be relocated to rebuilt capacity on US grounds. The thought process would be easier to embrace if Congress got to vote on such a radical change. It is a function of one policy maker.

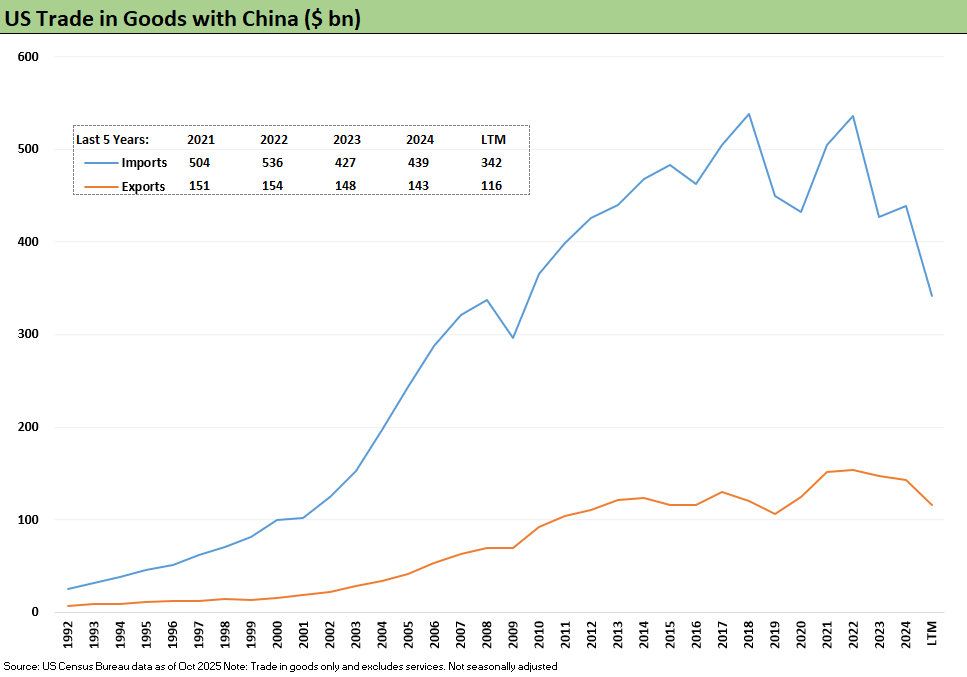

The above chart updates the timeline for US-China imports and exports. We see the sharp, glaring drop in China imports. The tariffs have taken China imports materially lower across numerous products as detailed in other charts herein. China has simply grown their trade volumes with other nations.

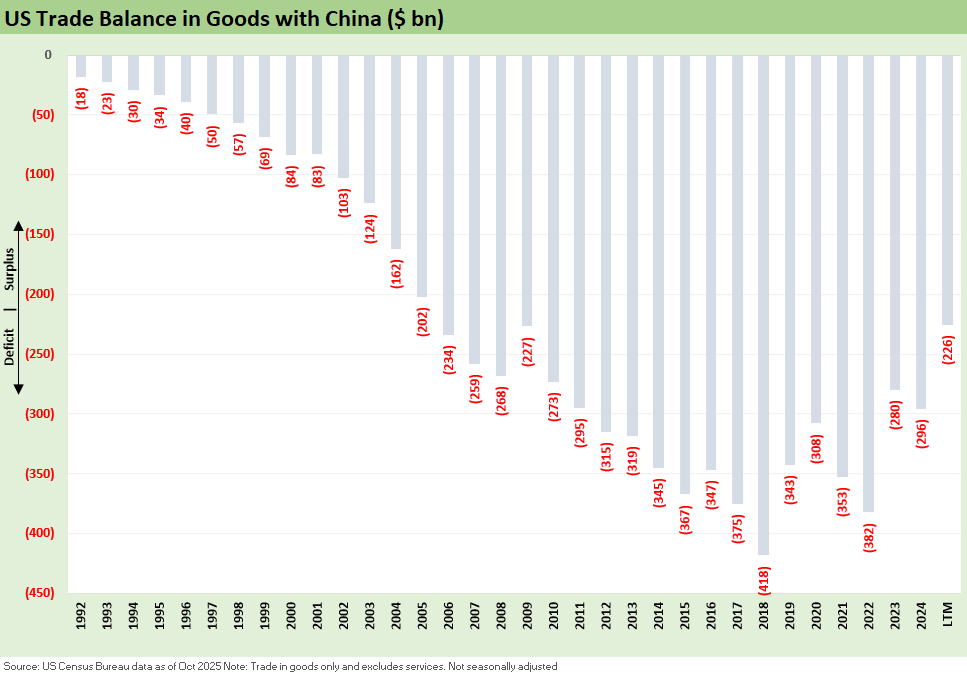

The above chart shows the record high trade deficits in Trump 1.0 during 2018 at -$418 bn and then a gradual ratcheting down to the latest level LTM of -226 bn.

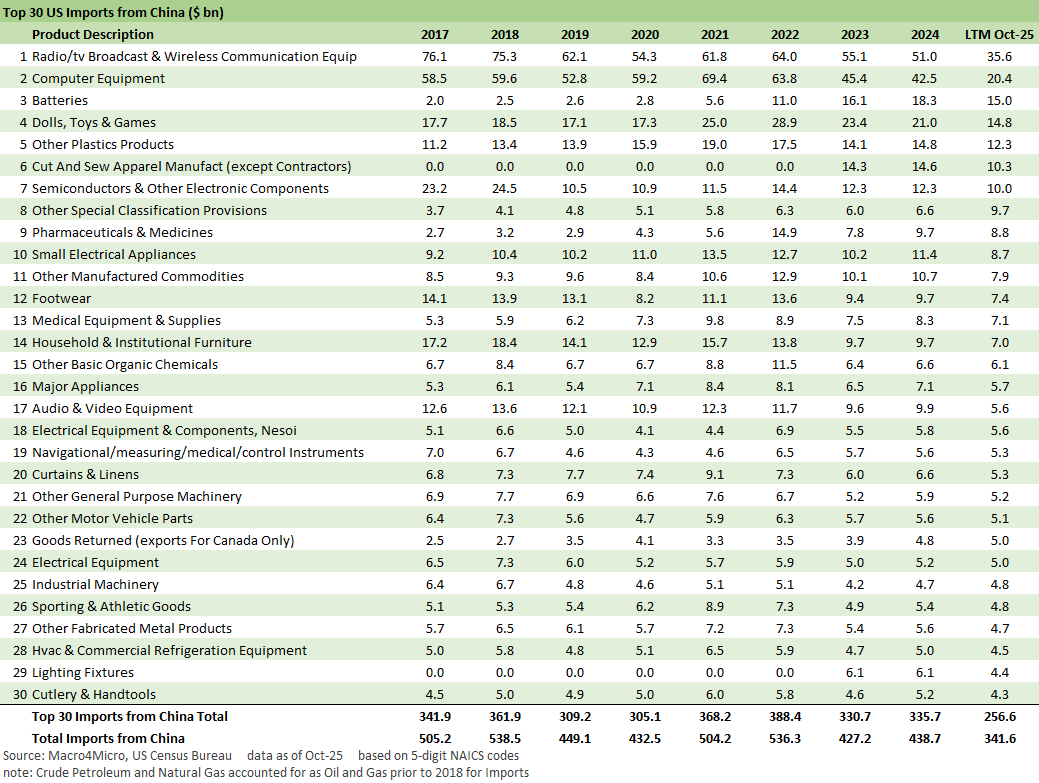

The above table update the import trends from China across the major product groups. We see the biggest move lower in the top 2 lines: Radio/TV Broadcast & Wireless Communications Equipment and Computer Equipment. We also see a decline in line #14 with Household & Institutional Furniture. We see a decline in Footwear on Line 12. The changes move the needle on the deficit overall, but we doubt many will feel flush with relief on the national security implications.

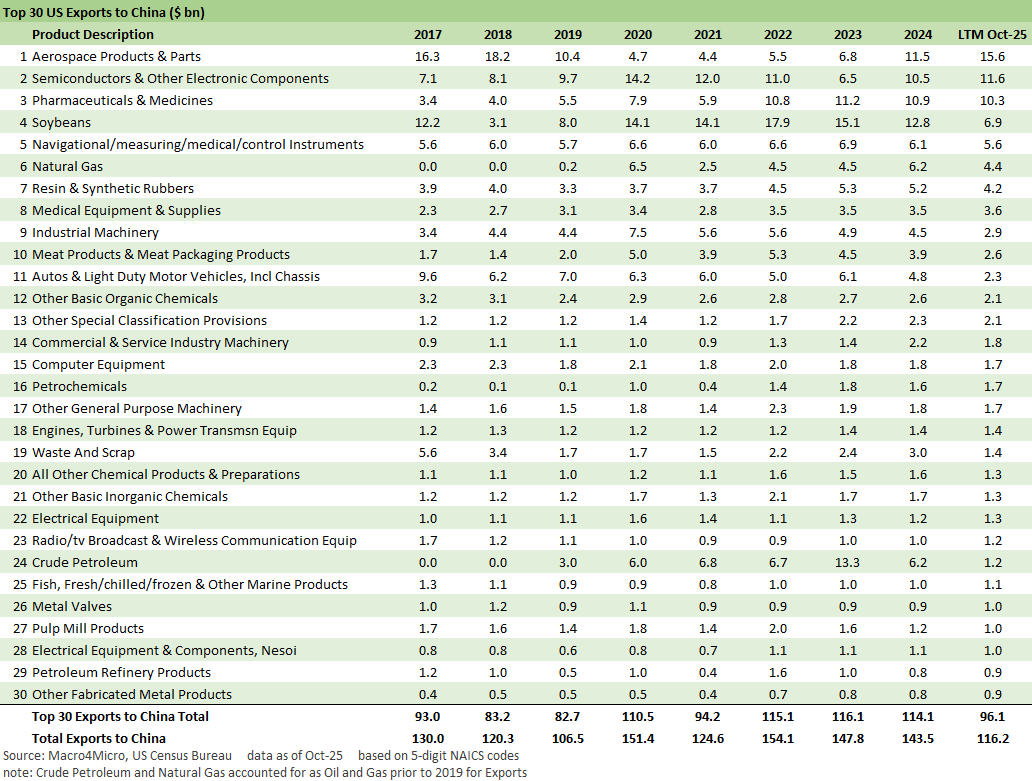

The above table handles the export flows with soybeans showing a sharp decline at #4, down from the #1 ranking in recent years. Autos posted a notable relative decline with a small move lower in Industrial Machinery along with some Waste and Scrap. “Crude Oil + Natural Gas” declined.

Overall, the goal of reducing the trade deficit is working with China. The more challenging exercise is gauging what benefit comes from that fact for the US economy unless one embraces the theory that “all trade deficits” are intrinsically, by definition bad (note: we are not in that school).

Tariff commentary:

Mexico Trade: Gearing up for More Trade Trouble? 1-27-26

Canada-US Trade: Trump Attack N+1 1-25-26

US-Canada Trade: 35% Tariff Warning 7-11-25

India Tariffs: Changing the Music? 7-11-25

Taiwan: Tariffs and “What is an ally?” 7-10-25

Tariff Man Meets Lord Jim 7-8-25

South Korea Tariffs: Just Don’t Hit Back? 7-8-25

Japan: Ally Attack? Risk Free? 7-7-25

US-Vietnam Trade: History has its Moments 7-5-25

US Trade in Goods April 2025: Imports Be Damned 6-5-25

Tariffs: Testing Trade Partner Mettle 6-3-25

US-UK Trade: Small Progress, Big Extrapolation 5-8-25

Tariffs: A Painful Bessent Moment on “Buyer Pays” 5-7-25

Trade: Uphill Battle for Facts and Concepts 5-6-25

Tariffs: Amazon and Canada Add to the Drama 4-29-25

Ships, Fees, Freight & Logistics Pain: More Inflation? 4-18-25

Tariffs, Pauses, and Piling On: Helter Skelter 4-11-25

Tariffs: Some Asian Bystanders Hit in the Crossfire 4-8-25

Tariffs: Diminished Capacity…for Trade Volume that is…4-3-25

Reciprocal Tariff Math: Hocus Pocus 4-3-25

Reciprocal Tariffs: Weird Science Blows up the Lab 4-2-25

Tariffs: Enemies List 3-6-25

US-Mexico Trade: Import/Export Mix for 2024 2-10-25

Aluminum and Steel Tariffs: The Target is Canada 2-10-25

Trade Exposure: US-Canada Import/Export Mix 2024 2-7-25

US Trade with the World: Import and Export Mix 2-6-25

The Trade Picture: Facts to Respect, Topics to Ponder 2-6-25

Tariffs: Questions to Ponder, Part 1 2-2-25

US-Canada: Tariffs Now More than a Negotiating Tactic 1-9-25

Mexico: Tariffs as the Economic Alamo 11-26-24

Tariff: Target Updates – Canada 11-26-24

Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24

Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24

Facts Matter: China Syndrome on Trade 9-10-24

Tariffs: Questions that Won’t Get Asked by Debate Moderators 9-10-24

The Debate: The China Deficits and Who Pays the Tariff? 6-29-24

Trade Flows: Deficits, Tariffs, and China Risk 10-11-24