Mexico Trade: Gearing up for More Trade Trouble?

We update the record trade deficit history of US-Mexico as Team Trump gears up for the USMCA review.

Don’t make me haunt you…

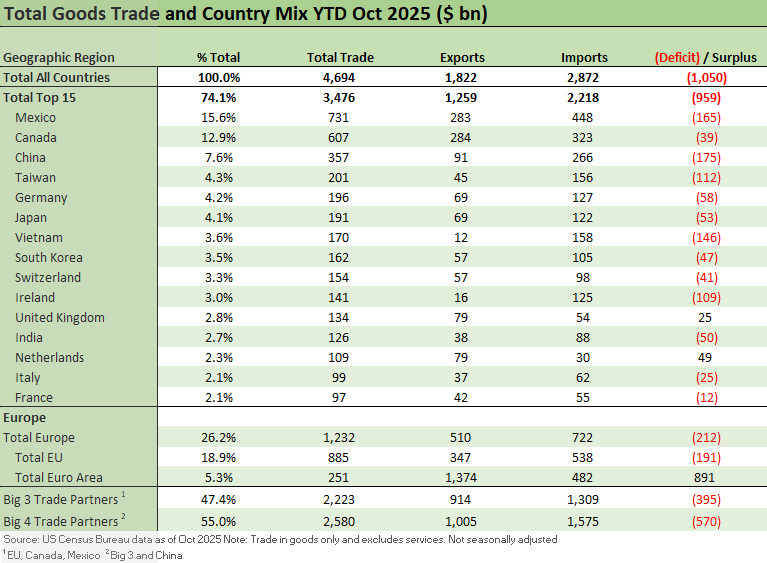

Mexico is the #1 trade partner as a nation (i.e. ex-EU as a bloc) with by far the #1 import volume. Canada and Mexico are in a dead heat in export volumes. Unlike Canada with its massive high value-added export base from the US and a few dozen states having Canada as their #1 export market, Mexico has a single digit number of states where Mexico is the #1 export market. A large base of exports to Mexico gets swept up in the “round trip manufacturing flows” as end markets in the US embed more labor cost advantages from Mexican assembly.

The trade situation with Mexico is a more about the “labor cost arb” in manufacturing with assembly plant costs materially lower as part of the decades of low-cost supplier chain planning. Lower imports from Mexico on tariffs will mean higher costs to US buyers (thus lower margins) and the potential for higher prices on the US side of the border at some point. That will take time to play out and is somewhat discretionary on “eating costs” as key industries such as automotive redeploy capex and capacity to the US.

With the USMCA up for review by midyear and Trump taking a more strident stand on drugs and cartels, there is room for crossing the line on Mexico sovereignty. That could in turn drive more supplier chain disruptions to go with ill will and supply-demand imbalances across manufacturing.

For those who like reading trade rags from autos to cap goods, it is easy to find pervasive fears of financial fallout from units costs to labor. Exposure to supplier chain stress is a recurring topic that could come home to roost in the event of recession, which for now is not an imminent risk. The complexity of supplier chains (from materials across Tier 1 ,2, and 3 suppliers and then to assembly) are daunting given global inputs from tech to integrated systems and heavy Mexico labor exposure.

The above table updates the trade partner rankings, and Mexico clearly ranks at the top of the partner nations (ex-EU trade bloc). The USMCA, which was Trump’s deal from his first term, could see the review being a case of sweeping Mexico surrender or a battle where Mexico needs to draw a line.

The dialogue has only recently becomes contentious after the Venezuela actions when some overt threats were made in Mexico’s direction. With the auto sector as the ground zero of Mexico vs. US trade tension, the US-based OEM capacity is already slated for massive redeployment in coming years. That is notably the case with GM but non-US producers operating in Mexico are also in the Trump crosshairs.

Trump is a big fan of President Polk, who hangs on his wall and was a big part of the Mexican War, but we suspect Trump’s knowledge of the very convoluted history with Mexico in the 20th century is a bit light (Trump might think the Zimmerman Telegram was a reminder from a dentist).

Either way, Trump’s nationalism might overlap with his well-documented aversion to Latin Americans generally and especially those who are not on the far right. That can make for politically fraught negotiations ahead. We include the picture of Pancho Villa above as a reminder of the complex US-Mexico history. That includes some border violence and military actions in Mexico on the way into WWI that included names such as Pershing and Patton.

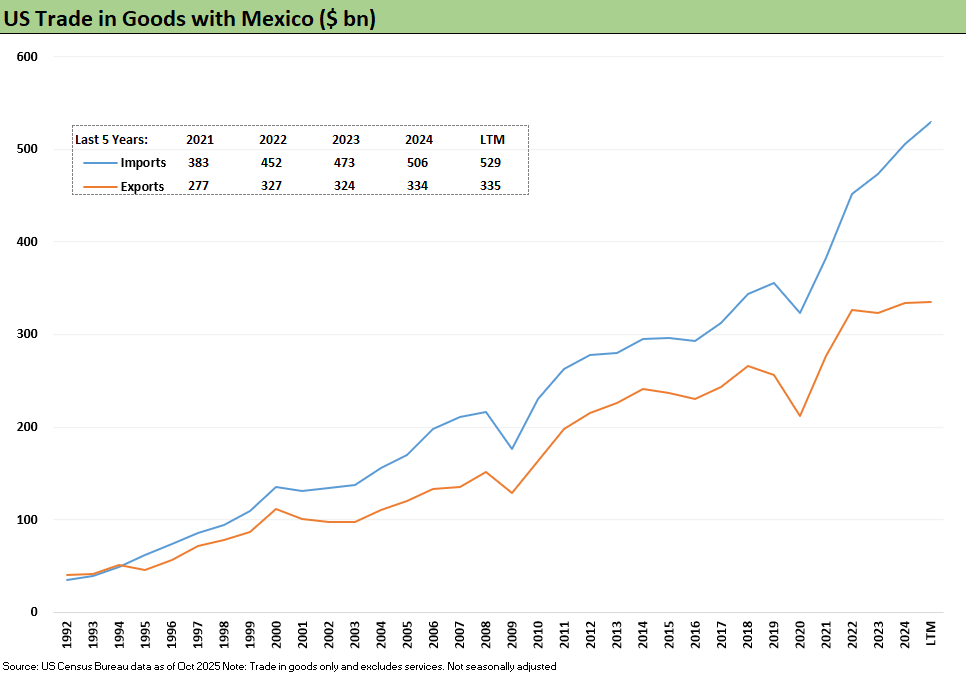

The above chart updates the running imports and exports across the “NAFTA years” and the more recent period of the USMCA. Imports are running at a high as the US economy has been steady and solid in what is generally a 2% handle GDP growth market in the new millennium. Low-cost sourcing has been a priority of US manufacturing base since the early 1990s. When the US economy is doing well, imports tends to rise. That pattern has been more mixed since the tariffs with China lower, but Mexico clearly is rising. It is something that cannot simply be unwound within a single economic cycle without major financial damage.

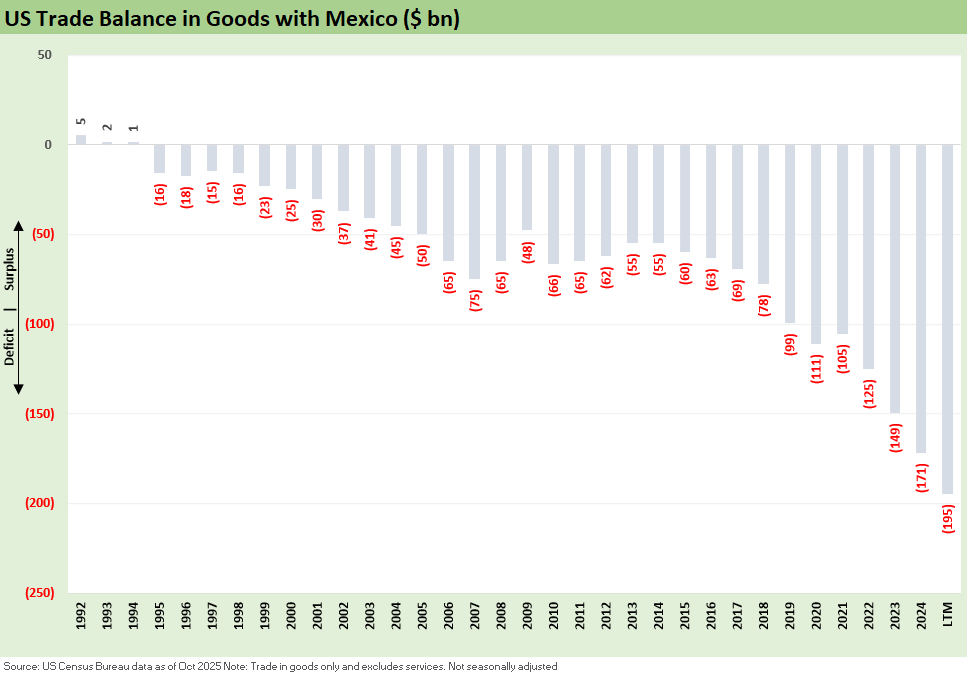

The above chart details the steady growth in trade deficits with Mexico including a new LTM high. In contrast, Canada-US shows a goods trade surplus ex-crude (see Canada-US Trade: Trump Attack N+1 1-25-26).

That trend is the market explaining purchasing economics to the Trump trade policy team. The trade policy architects set their sundial by Trump’s view of the world and not intro economics or cost accounting. The above chart highlights that there will be a lot of focus on the record Mexico US trade deficit in the upcoming USMCA round.

Since these tariffs are set by Trump and not by legislative action with the House and Senate, those planning multiyear, long-term capex and capacity decisions face material policy risk. The “next body” in the White House could decide national security is a bogus basis for some tariffs. When upholstered furniture is tagged as a national security risk, the integrity of the decision-making is intrinsically shaky.

There will be plans to redeploy end market capacity as we have seen with the Auto OEMs in scale, but closing capacity in Mexico and moving it all to the US is riskier and more costly in reality than it looks on paper. That is especially the case if the supplier is not a unit of a US operation and is a legacy Mexico operator.

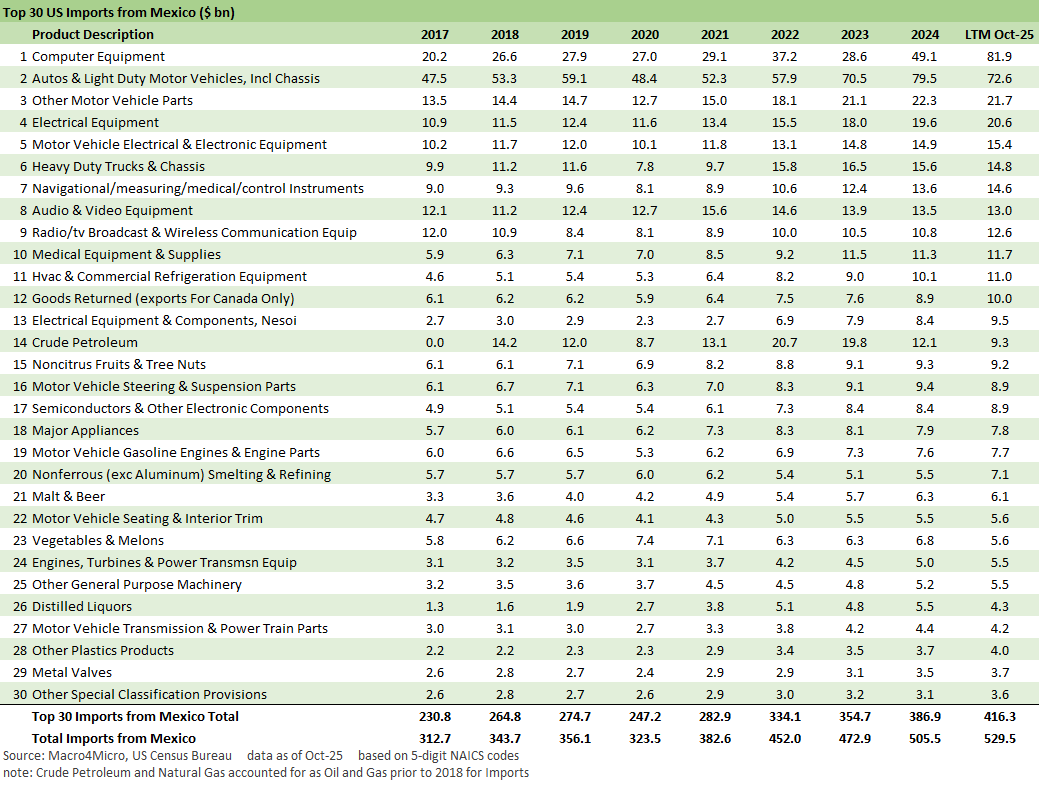

The above chart checks off the import list and product mix of Mexico imports. Autos and supplier chains of all types with a meaningful labor component are typical line items. From autos to tech to consumer electronics and from low value to high value, the range of imports is impressive. Which imports skate by on the USMCA advantage and which could see tariffs spike in a disorderly USMCA negotiation ahead is a material uncertainty. The review process will keep tension high for supplier chains and finished goods operators in 2026.

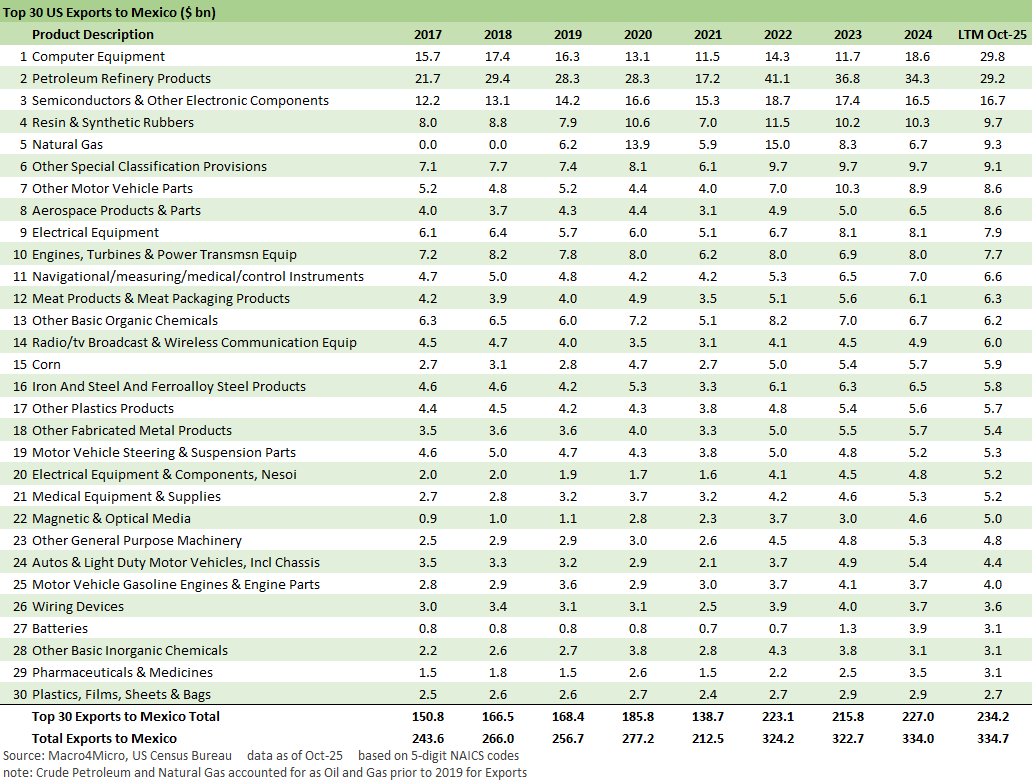

The above table update the Mexico export flows, and Mexico is essentially in a dead heat with Canada. On an ex-oil basis, Mexico is a dominant factor in both imports and exports. The interesting exercise with Mexico “exports” is framing how much gets sent down south of the border in order to be sent back after cheap labor handles the final process. That muddies the analysis but also gets the Bernie Sanders and Donald Trumps on the same page protecting American labor.

Tariff commentary:

Canada-US Trade: Trump Attack N+1 1-25-26

US-Canada Trade: 35% Tariff Warning 7-11-25

India Tariffs: Changing the Music? 7-11-25

Taiwan: Tariffs and “What is an ally?” 7-10-25

Tariff Man Meets Lord Jim 7-8-25

South Korea Tariffs: Just Don’t Hit Back? 7-8-25

Japan: Ally Attack? Risk Free? 7-7-25

US-Vietnam Trade: History has its Moments 7-5-25

US Trade in Goods April 2025: Imports Be Damned 6-5-25

Tariffs: Testing Trade Partner Mettle 6-3-25

US-UK Trade: Small Progress, Big Extrapolation 5-8-25

Tariffs: A Painful Bessent Moment on “Buyer Pays” 5-7-25

Trade: Uphill Battle for Facts and Concepts 5-6-25

Tariffs: Amazon and Canada Add to the Drama 4-29-25

Ships, Fees, Freight & Logistics Pain: More Inflation? 4-18-25

Tariffs, Pauses, and Piling On: Helter Skelter 4-11-25

Tariffs: Some Asian Bystanders Hit in the Crossfire 4-8-25

Tariffs: Diminished Capacity…for Trade Volume that is…4-3-25

Reciprocal Tariff Math: Hocus Pocus 4-3-25

Reciprocal Tariffs: Weird Science Blows up the Lab 4-2-25

US-Mexico Trade: Import/Export Mix for 2024 2-10-25

Aluminum and Steel Tariffs: The Target is Canada 2-10-25

Trade Exposure: US-Canada Import/Export Mix 2024 2-7-25

US Trade with the World: Import and Export Mix 2-6-25

The Trade Picture: Facts to Respect, Topics to Ponder 2-6-25

Tariffs: Questions to Ponder, Part 1 2-2-25

US-Canada: Tariffs Now More than a Negotiating Tactic 1-9-25

Mexico: Tariffs as the Economic Alamo 11-26-24

Tariff: Target Updates – Canada 11-26-24

Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24

Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24