Footnotes & Flashbacks: Asset Returns 9-15-24

We update the running return profiles across debt and equity asset classes for a range of time horizons.

Hopefully Powell will be kind with his rope…

The rebound week comes ahead of the FOMC meeting and new dot plot this week as the market also gets another look at the consumer in the Retail Sales release and manufacturing numbers with Industrial Production.

The CPI metrics this past week offered more support for immediate easing, but the Services inflation was hardly a layup for the -50 bps advocates unless the extraordinarily anomalous and protracted nature of the UST inversion on the front end sparks some reevaluation for preventive action.

Oil prices remain under pressure and the market is a very long way from the 60% gasoline CPI line item of June 2022 after Russia invaded Ukraine in late Feb 2022 (ever notice that Putin’s behavior seldom gets cited by the GOP when pointing fingers on inflation?)

For all the volatility of the last 6 weeks, the recent time horizons have posted up some impressive running returns.

The above chart updates the returns for the high-level debt and equity benchmarks we watch. Considering the issues around the credit cycle, payroll jitters, the durability of the economic expansion, and lofty valuations in both asset classes, the 1, 3 and 6-month returns are very respectable. The above table lines up the returns in descending order in each asset class group for debt and equity.

For debt, the numbers are stacking up well with all positive for the trailing 1, 3, and 6 months with the UST curve helping push returns higher. The rolling 3-months have been quite favorable after a rough start to the year for duration following the late 2023 monster move in duration returns.

The 1-year number shows the benefits of the Nov-Dec 2023 period that helped 3 of the 4 debt indexes post double-digit returns that are above long-term nominal returns on equities. That offers another reminder of why portfolios diversify. As more refinancing takes place in corporate and HY bonds at current coupons, fixed rate bond allocations will have more income appeal into 2025.

For stocks, the S&P 500 had its best week of the year after its worst week of the year, but the NASDAQ is barely positive through the rolling 3-months. Looking back 1-year offers a reminder that it has been a great time to own stocks. We look at the wider range of benchmarks and numerous time horizons in our review of 32 benchmarks and industry/subsector ETFs further below.

Despite the wild VIX movements and selloff in early August, the “gang of 32” ETFs and benchmarks had a great week and overwhelmingly positive 1-month period. The score was 27 positive to 5 negative for 3 months, 30-2 YTD, and 30-2 LTM. That is not exactly the stock market crash predicted by Donald Trump.

The above chart updates the 1500 and 3000 series, where we see a broad and very strong 1-month and 3-month move for interest rate sensitive Real Estate with Energy mired in the red. Financials posted double digits for 3 months. The Growth benchmark lagged over 3 months while Industrials have been steady for the 1-month and 3-months periods but remain well into double digits over the LTM period. For the YTD period, 5 of 6 indexes are in double-digits with Energy as the material laggard.

The rolling return visual…

In the next section, we get into the details of the 32 ETFs and benchmarks for a mix of the trailing periods. Below we offer a condensed 4-chart view for an easy visual on how the mix of positive vs. negative returns shape up. This is a useful exercise we do each week looking for signals across industry groups and asset classes.

When you look at the positive vs. negative symmetry of the above charts (and YTD version detailed further below with 30 positive and 2 negative), it gets harder to envision the Fed going -50 bps out of the chutes and tacking on another -50 to -75 bps more by year end.

3Q24 earnings season was respectable and forecasts remain constructive, but it is not hard to find slowing growth rates, some household credit quality pressure, and more visibility of some plateaus in numerous industries and major employer groups. You look at the chart above, however, and the markets are not sending worrisome signals.

The single biggest hiccup on the immediate horizon is the election and how the market will start to discount in risks tied to tariffs or taxes or any one of a number of the unprecedented risks such as mass deportation or even defaults in the UST when the debt ceiling gloves come off in Jan 2025. That is an interesting month for obvious reasons given the Jan 6 history and could mark a ticking clock to the next constitutional crisis. That scenario is not alarmist since it is advertised daily to the point of it being normalized.

The Magnificent 7 heavy ETFs…

Some of the benchmarks and industry ETFs we include have issuer concentration elements that leave them wagged by a few names. When looking across some of the bellwether industry and subsector ETFs in the rankings, it is good to keep in mind which narrow ETFs (vs. broad market benchmarks) get wagged more by the “Magnificent 7” including Consumer Discretionary (XLY) with Amazon and Tesla, Tech (XLK) with Microsoft, Apple, and NVIDIA, and Communications Services (XLC) with Alphabet and Meta.

We looked at this chart in our earlier Mini-Market Lookback (see A Strange Policy Risk Week: Mini Market Lookback 9-14-24). The table lines up the Mag 7 plus Taiwan Semi and Broadcom in descending order of returns for the week.

The swing this week was impressive but that only flips the extreme all-negative moves of the week before with NVDA and AVGO deeply negative and in the last two places the week before bouncing back to materially positive and #1 and #2 this week. The rolling 3-month column drives home the wear and tear on tech at the lofty valuations set against the “sector rotation” debates.

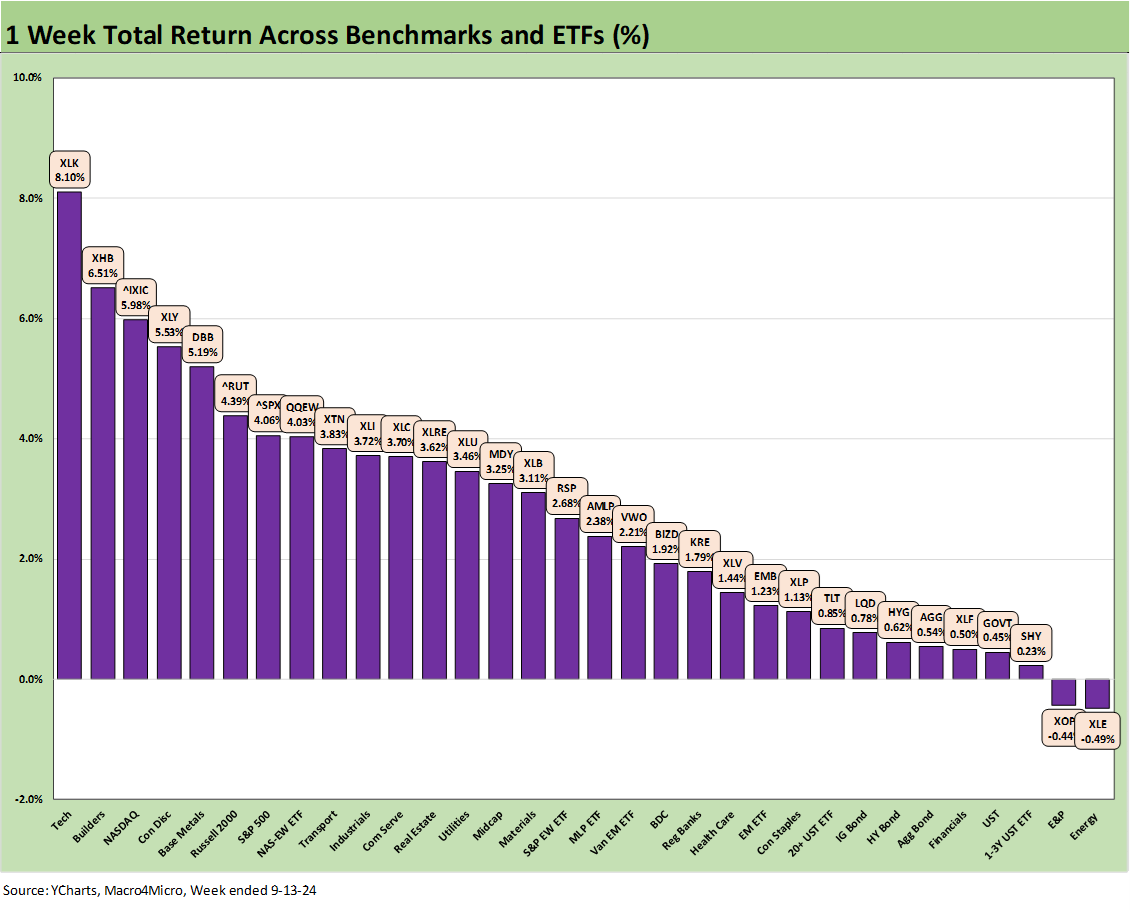

The 1-week numbers were covered in the lookback we posted yesterday (see A Strange Policy Risk Week: Mini Market Lookback 9-14-24) with only 2 energy ETFs, E&P (XOP) and Energy (XLE), slightly in the red for a score of 30-2 favoring positive. The Tech ETF (XLK) put up a +8.1% week after a -7.5% the week before. We see the NASDAQ, S&P 500, and Russell 2000 all in the top quartile.

As covered in recent periods, the interest-rate-sensitive sectors have been solid performers with another good week for the Homebuilding ETF (XHB) at +6.5%. The modestly favorable move in the UST curve left all 7 bond ETFs positive with 5 of the 7 in the bottom quartile and the long duration UST 20+ year ETF (TLT) and EM Sovereigns (EMB) just across the line in the third quartile.

Considering the big swings of the past 6 weeks, the 1-month numbers weigh in favorably at a score of 30-2 and again with E&P (XOP) and Energy (XLE) on the bottom as the only two in red. Homebuilders (XHB) were getting it done at +9.2% with Consumer Discretionary (XLY) #2 at +8.1% on the Amazon and Tesla bounce. The interest-sensitive Real Estate ETF (XLRE) was #3 with +8.0% and high dividend payer Midstream Energy (AMLP) at #4 with +6.1%. Staples at #5 with 6.1% performed well with steady dividend payers getting a lift.

We see all 7 bond ETFs positive with TLT at the top of the third quartile ahead of EM Sovereigns and the IG Corporates (LQD) at the bottom of the third quartile and the remaining 4 bond ETFs in the bottom quartile. The month saw Regional Banks (KRE) climb back into the top quartile and Financials (XLF) just across the line in the second quartile.

The 3-month run rate has more in the red zone than the other periods at a score of 27-5. The interest-rate-sensitive sectors are at the helm with Regional Banks (KRE), Real Estate (XLRE), Homebuilders (XHB), Utilities (XLU), Staples (XLP), Financials (XLF), and the long duration UST 20+ Year ETF (TLT) holding down the top 7 slots in the high quartile.

We see E&P at -11% sitting on the bottom with Energy (XLE) and Tech (XLK) in the bottom 3. NASDAQ and the Equal Weight NASDAQ 100 ETF (QQEW) also sit in the bottom quartile. For some MAG 7 heavy ETFs, we did see Consumer Discretionary (XLY) in the second quartile, but Communications Services (XLC) settled into the middle of the third quartile.

We have seen the BDC ETF (BIZD) lagging for a while on a mix of cyclical concerns after a good run with the expectation of floating rate assets moving in the other direction faster than some have anticipated. For the YTD period, BIZD is near the top of the third quartile and at the head of the third quartile LTM.

The YTD return profile weighed in at 30-2 with the usual laggards of E&P (XOP) and Transports (XTN) sitting in the red. The YTD positive weighting is a clear reminder of the good year for stocks with almost half the line items already in double digits and around 2/3 of the lines at a double-digit annualized pace. The bond ETFs are all positive but with 4 in the bottom quartile and 3 just across the line in the third quartile as EMB weighed in at #1 among the 7 bond ETFs and HY #2.

The LTM returns are interesting since that timeline includes the massive UST and equity rally of Nov-Dec 2023 (see Footnotes & Flashbacks: Asset Returns 1-1-24, Footnotes & Flashbacks: Asset Returns 12-3-23). The top 15 on the list are 20% or higher and 27 line items posted double-digit returns. That includes 5 of the 7 bond ETFs at 10% or higher with the EM Sovereign bond ETF (EMB) at #1 among the bond ETFs at 15.5%, HY (HYG) at 13.1% and LQD at 13.0%. TLT as a pure duration play weighed in at +10.8% and AGG at +10.0%.

See also:

A Strange Policy Risk Week: Mini Market Lookback 9-14-24

Consumer Sentiment: Inflation Optimism? Split Moods 9-13-24

CPI Aug 2024: Steady Trend Supports Mandate Shift 9-11-24

Facts Matter: China Syndrome on Trade 9-10-24

Tariffs: Questions that Won’t Get Asked by Debate Moderators 9-10-24

Footnotes & Flashbacks: Credit Markets 9-9-24

Footnotes & Flashbacks: State of Yields 9-8-24

Footnotes & Flashbacks: Asset Returns 9-7-24

Another Volatile Week: Mini Market Lookback 9-7-24

August 2024 Payrolls: Slow Burn, Negative Revisions 9-6-24

Trump's New Sovereign Wealth Fund: Tariff Dollars for a Funded Pool of Patronage? 9-5-24

Goods and Manufacturing: Fact Checking Job Rhetoric 9-5-24

JOLTS July 2024: Mixed Bag, Hires Up, Layoffs/Discharges Up, Quits Flat 9-4-24

Construction Spending: A Brief Pause? 9-3-24

Labor Day Weekend: Mini Market Lookback 9-2-24

PCE July 2024: Inflation, Income and Outlays 8-30-24

2Q24 GDP 2nd Estimate: The Power of 3 and Cutting 8-29-24

Harris Housing Plan: The South’s Gonna Do It Again!? 8-28-24

New Home Sales July 2024: To Get by with a Little Help from My Feds? 8-25-24

Payroll: A Little Context Music 8-22-24

All the President’s Stocks 8-21-24