Facts Matter: China Syndrome on Trade

China and trade came up in the last debate (with shockingly false statements), so we update the stats on two-way China trade for the debate tonight.

Some advice…when Trump says he is worth $10 billion, just smile and nod. Tell him he is very smart.

China has been transformed in the political rhetoric and business theme music from a source of low-cost supplier chain opportunities and potential growth market for direct investment in the early 2000s to the enemy of US jobs, abuser of intellectual property, a haircut on US economic growth, and a national security threat, all in under two decades. For the GOP, the only thing worse than China is the Democrats.

As the expectation of widespread tariffs heats up, we look at the China trade flows and the trends of the relative goods trade deficit with China.

Whenever we update trade deficits, we always restate that the deficits go up when the US has a strong economy since the US is a major net buyer and trade deficits reflect much that is favorable about the #1 economy in the world.

We look at the import exposure with China as a virtually assured tariff battle subject to election outcomes with the China import lines running from high value-added to low cost, labor-intensive products. They are almost systemic in US retail.

The above chart plots the extraordinary growth of the US-China trade deficit that peaked in 2018 at -$418 billion. The low point was -$279 bn FY 2023 under Biden for the lowest US-China goods trade deficit since 2010.

Trump: “Under this guy, we have the largest deficit with China.”

In the first debate, Trump stated that the trade deficit with China has never been higher than under Biden when it in fact had never been lower after it reached its highest point in 2018 under Trump (see The Debate: The China Deficits and Who Pays the Tariff? 6-29-24). That was one of many misstatements, but it was barely covered in the news flow the next day. It was more about Biden blanking out on the job.

The debate moderators could have used a follow-up question even if real time fact checking was not allowed. Follow up questions that are well designed is not fact checking but does confirm who is a “lying sack.” Tapper and Bash were dozing off when that statement was made, and Biden was lost.

The US-China import exposure and retaliation targets…

With tariffs now at the top of Trump’s economic policy priorities, this commentary does an update on some of the data on the narrow China topic. We looked at the broader tariff and trade picture in our earlier note today (see Tariffs: Questions that Won’t Get Asked by Debate Moderators 9-10-24). Our hope is that the ABC moderators do a better job in questioning than Tapper and Bash, who did their best mannequin impersonations. Edward R. Murrow was doing a corkscrew in his grave.

The timeline of US-China trade shows the race to record trade volumes until the Trump team blew the whistle on NAFTA and China trade. Trump’s fixation on trade deficits was in line with his view that trade deficits are the equivalent of the US writing a check to China each year. He had some reasonable points on fair trade and IP violations that are legendary in the private sector to those dealing with China. What Trump lacked was a grasp on the facts or economic concepts. Trump was constantly saying that the US was banking billions of China’s money in the Treasury via tariffs and citing deficits that were 2x the accurate number.

“Way back when” around 2000, China was going to be the land of opportunity for global multinationals for direct investment. The thought was there was plenty of upside in the “land of a zillion consumers” as well as being a source of low-cost supplier chains where there would be synergy galore serving that potentially massive market as well as serving US and European needs. That did not work out as planned.

We’ll skip the books already written on that subject, and here we are with growing geopolitical enmity, too much exposure to China/Taiwan semiconductor supply and components, and an increasingly tenuous defense rivalry where China invading Taiwan is no longer derided as the “million-man swim.”

The sum of the backdrop is that geopolitics are bad, economic pressures are mutually destructive, and military intimidation would backfire and make it all worse. Those who are familiar with the Korean War or had relatives fight in it may have heard that China does not back down. Mao did not blink at nuclear threats. Basically, he said, “we have a lot of people.” And that was before they were a nuclear power (that was 1964 when they became nuclear power). Tough to have a comeback for that one.

The above chart plots the timeline for Chinese goods imports, and we see the decline after the 2018 peak. It has been 6 years since Trump’s 2018 tariff battles kicked off and trade saw a sharp drop in 2019 China imports.

In the US, the decline in China trade also saw a slowing investment backdrop in the US and weaker exports that drove the Fed to ease 3 times in later 2019. That was after stocks ahead already been slammed in 2018 (see HY Pain: A 2018 Lookback to Ponder 8-3-24, Histories: Asset Return Journey from 2016 to 2023 1-22-24). Then came COVID in 2020. We remember that period differently than Trump.

The above chart shows the modest upward trend in exports to China the past 4 years, but that also requires a look at what product lines are likely to be targets for retaliation. There is a lot of energy in that mix of exports that China needs. Exports have essentially plateaued, but China is still #4 in US exports behind the EU, Canda, and Mexico at less than half of #3 Mexico. Trump of course will be picking a trade fight with the Top 3 as well. For China, the bigger story is more in the import lines and breadth of the exposure that will see prices rise to the buyer (the one who pays the tariffs despite what Trump says).

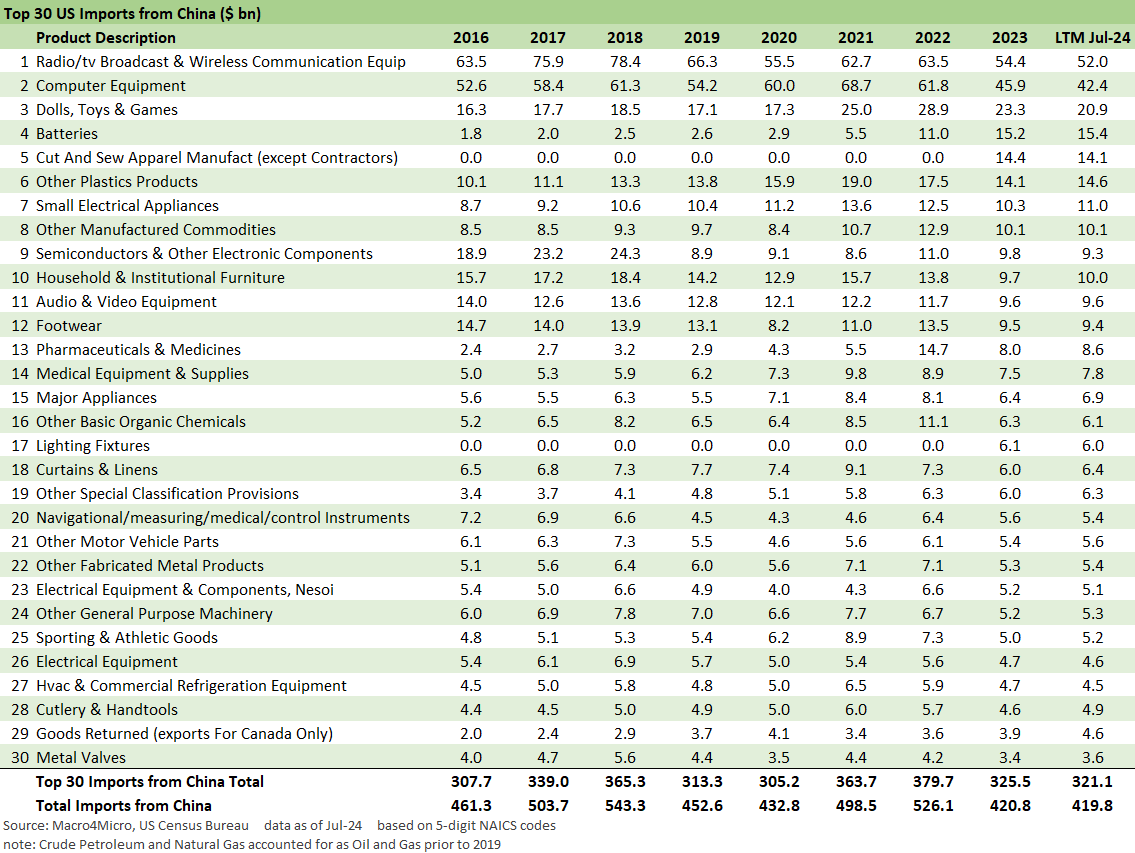

The above details and wide and diverse range of imports, where China ranks #3 on an LTM basis behind the EU and Mexico. Mexico is the #1 importing nation and China #2 if we break the EU into individual nations.

Now picture all of these line items moving 10% to 20% higher in prices with tariffs on some China imports tagged for 60%. In the interest of being absurdly repetitive, the buyer pays those tariffs not China.

If there are substitutes readily available, the buyer switches. If there are substitutes in Mexico or Vietnam (which has soared as a trading partner), then the origin of the import changes without reshoring. If the buyer’s profit margins get hit, that hurts the US company’s ability to hire, grow or expand. If there are substitutes in the US, then those producers could raise their prices also and they make more in profits.

China also controls large swaths of medical and pharma supplier chains for meds. That strikes close to home at the household level. We have been hearing about rare earths supplier chain risk for years. Meanwhile, a shortage of semis would set off a fresh round of production chain interruptions and inflation and generate multiplier effects along the supplier chains and related services. You would think those lessons would have been learned.

The above chart details the largest export product groups that would in the crosshairs for retaliation The severity of the trade battles will set how aggressive China wants to be, but the usual targets were in agriculture with soybeans #1 in the mix and corn and meat products on the list.

Gloom and doom scenarios would be anything that spilled over to the aerospace sector for commercial aircraft. This is one headache Boeing does not need. China needs to expand aircraft and airport capacity as part of its infrastructure buildout, so that is unlikely. That said, geopolitics is an unpredictable wildcard when it comes to the topic of Taiwan. Those are topics for another day.

You don’t need to read too much history to know that Taiwan is not an area of compromise for China. It was something people of earlier generations took a natural interest in as decades went by and Nixon finally opened relations and Carter later recognized China at the UN. The subject was quite toxic and politically risky for years (Henry Luce and the China Lobby, etc.). The history of China with the US is not something that gets a lot of airtime in US primary and secondary education.

We would expect some of the deep thinkers in the House are not history buffs and their China focus is likely more menu-based. They just fall into line with the directive from above on Russia (don’t bother Russia, Hate on Ukraine) and China (bad guys, etc.). Something else to hate and to accuse the Democrats of being soft on. It is the second largest economy in the world and a major military power. Maybe they should pay more attention.

Glenn Reynolds, CFA glenn@macro4micro.com

Kevin Chun, CFA kevin@macro4micro.com

See also:

Tariffs: Questions that Won’t Get Asked by Debate Moderators 9-10-24

The Debate: The China Deficits and Who Pays the Tariff? 6-29-24

Trade Flows: More Clarity Needed to Handicap Major Trade Risks 6-12-24

Trade Flows: Deficits, Tariffs, and China Risk 10-11-23

Midyear Trade Flows: That Other Deficit 8-10-23

State of Trade: The Big Picture Flows 12-18-22