A Strange Policy Risk Week: Mini Market Lookback

A muted UST bull steepener ahead of the FOMC, an equity rally, low 6% mortgages, and the search for economic policy details.

The new spirit animal for a Debate Dodger…

The week saw mixed consumer sentiment indicators following a constructive CPI release that helped the easing story as Retail Sales and Industrial Production are teed up just ahead of the FOMC decision this week and the answer to the -25 bps vs. -50 bps debate (see CPI Aug 2024: Steady Trend Supports Mandate Shift 9-11-24).

The Presidential debate was not as helpful in getting policy specifics into discussion mode, and we heard the usual lies on tariffs – “collected billions and billions from China” as opposed to the zero in fact collected – that raises more concerns around the foundation of Trump economic policy (see Tariffs: Questions that Won’t Get Asked by Debate Moderators 9-10-24). There will be no second Harris-Trump debate as Trump just declared victory and ran to the bone spurs doctor.

The Trump rants (a mixture of venom and spittle) did not put Harris in the position of needing to offer details on housing and tax policies and how housing supply would be addressed. The main debating point on housing should have been the risks to shelter inflation if only the demand side was supported (see Harris Housing Plan: The South’s Gonna Do It Again!? 8-28-24). Trump instead chose imaginary Haitian dining habits and crowd sizes for his priority topical focus.

From a consumer sector risk perspective, the confirmed lack of a Trump plan on healthcare after all these years is a direct threat to household finances in 2025 at a time when tariffs would have the same damaging effect (only worse) in corporate fixed investment plans that we saw in 2018-2019. That period saw the 2018 beatdown in the markets before the Fed rode to the rescue in 2019 (see HY Pain: A 2018 Lookback to Ponder 8-3-24).

The week was a strange one on the policy=economics wildcards…

Below we regroup on our quick snapshot on how the week framed up. We will post the full Footnotes publications on Asset Returns, State of Yields, and Credit Markets later.

It would have been nice to have a second Harris-Trump debate that locked in on specific topics and most notably on the economy. There were so many specifics that could have been addressed and debated to allow voters to assess who has facts and concepts in their head and who is just making noise and spewing formulaic right and left themes. That did not unfold.

Unfortunately for voters, there will be no next time. Trump ran to the podiatrist again rather than defend his tariffs, mass deportations, and any health care priorities (in substance a repeal no matter what he said) with specifics. He ran scared. No escaping that. It is like his 2020 vote lies. Declare victory and bring no evidence. They have been trying to get him to produce evidence of election fraud since 2020.

In the next debate, perhaps Trump could introduce the world to this person named “Everybody” he keeps referring to (“everybody” as in “everybody” wanted Roe vs Wade overturned, “everybody” knows he had the best economy in history, etc.) We all need this guy “Everybody” to do what our elementary school teachers asked for as in “show your work for partial credit.” Trump wants 100% credit without showing any work.

While Harris was gung-ho for another round, she had a lot of questions to answer on her housing plan and the thought process on some issues such as capital gains. We would rate housing as the #1 topic unless Trump still plans to have no health care plan before he gets elected when (and if) he can repeal the ACA.

For healthcare risks, the US sees tens of millions depending on ACA with its subset needing the rule on pre-existing conditions. Misbehavior on health care could weaken the consumer sector at a time when tariffs will drive shortages and higher prices for many goods. Trump has made it a mission in life to repeal it since it was Obama’s success story. ACA is not a political issue as much as it is now an economic risk factor.

In this latest debate, Harris missed a golden opportunity to say, “Your tariff policy is based on a fraud and you collected zero in tariff money from China.” One might suspect Trump does not want to face that topic.

A second debate could have steered clear of abortion and Russia/Ukraine and China/Taiwan and just talked about the economy and jobs (like debates of past elections where topics were chosen). The sad tale is we will not know who can carry a purely factual and conceptual debate on what each sees as the right economic policies for the largest economy in the world. That is on Trump and his newly chosen spirit animal pictured above.

The above chart shows a milder week in UST deltas than what we saw the prior week (see Another Volatile Week: Mini Market Lookback 9-7-24, Footnotes & Flashbacks: State of Yields 9-8-24). The UST moves are the friends of the consumer, bonds, and housing sector dynamics with another week of bull steepening taking the Freddie Mac 30Y benchmark down to 6.20% by the weekly Thursday afternoon release. Mortgage rates cited in trade rags moved slightly lower again on Friday closer to 6.14%.

The above chart updates the UST 10Y UST and Freddie Mac 30Y benchmark across the trail of tightening woe since the low on mortgages as 2021 started and then ZIRP came to an end. We see the 30Y mortgages down to 6.2% from the 7.8% Freddie Mac peak (note: many 30Y mortgages hit 8% but not the benchmark with its down payment and quality assumptions across past years. This is good news.

The above chart looks back across a strong week in equities that was accompanied by favorable UST curve moves for bond ETFs. We see a score of 30-2 favoring positive returns and the material bounce-back in tech with the Tech ETF (XLK) at a +8.1% return well out in front.

The Tech ETF (XLK) was followed by the rally in the Homebuilder ETF (XHB) at +6.5% and then NASDAQ at a hair under the 6% line. That is a healthy rally even if more about retracement in tech. Lower rates are supposed to agree with Growth stock valuations, and the longer end of the UST curve is cooperating in the 10Y UST at below 3.7%.

The energy weakness has been all over the screen in recent days with China anxiety and supply question marks the main movers. Weather will drive natural gas while oil will be tied to OPEC supply and China demand playing the usual role. Few seem to be anxious around Iran in recent days, but it is not the days when geopolitical premiums used to spike in the 1990s just on harsh language. Now it takes repeated rockets and naval activity – and harsh language.

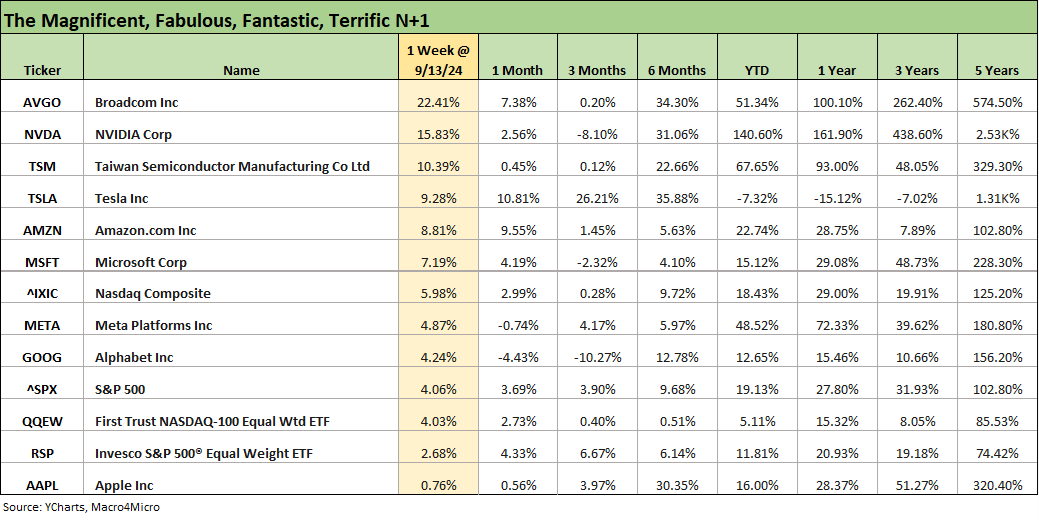

The above updates our tech bellwether table that includes the Mag 7 plus Broadcom and Taiwan Semi. We set the individual names against the S&P 500 and NASDAQ and some Equal Weight ETFs for the broad markets for the S&P 500 (RSP) and NASDAQ 100 (QQEW). The returns are lined up in descending order of total returns for the week. We see everything positive for the week after everything was negative last week.

We saw a “worst shall be first” rally as NVIDIA (NVDA) and Broadcom (AVGO) bounced off a very ugly prior week where they held down the bottom two rankings (AVGO at -15.9%, NVDA at -13.9%) back up the strong gains seen above this week with AVGO at +22.4% and NVDA at +15.9%. The rolling 3 months still shows NVDA at -8.1% and AVGO barely positive at +0.2%. The running YTD story is obviously very different.

The credit markets were very mild this week with HY OAS barely moving (-2 bps tighter) and the state of credit not showing much of a case of cyclical nerves as of this point (see Footnotes & Flashbacks: Credit Markets 9-9-24). Earnings season seems like a long way off, and the inputs from the dot plot could give some reassurance on where floating rate debt costs through year end might play out and into 2025.

The +337 bps HY index OAS is near numerous post-credit crisis lows and well below the long-term median of +466 bps. In the half-empty school, that flags the scary decompression potential. The half-full take is that the credit markets are healthy right now.

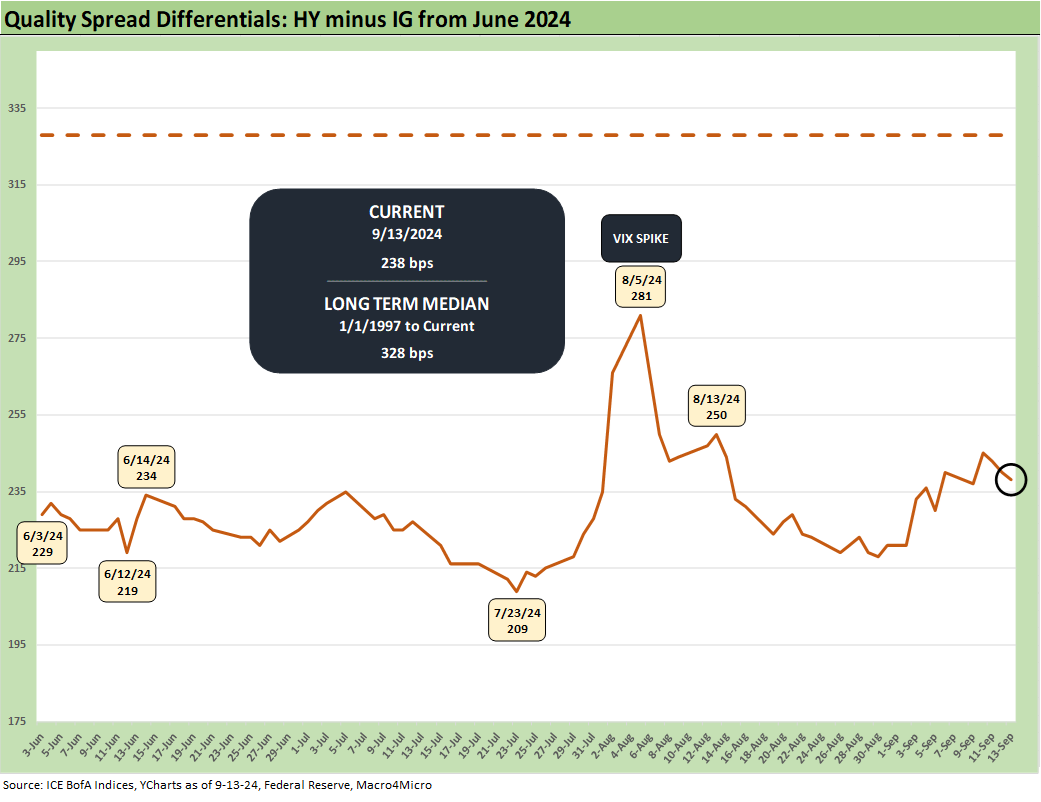

The above chart updates the quality spread differential (HY OAS minus IG OAS) as a proxy for the additional compensation received for dropping down from the IG basket into the speculative grade realm. The +238 bps is also materially inside the long-term median of +328 bps.

The “BB OAS minus BBB OAS” differential of +82 bps is above the recent lows of +63 bps earlier this month and the multicycle lows of +55 bps in July 2024. We look at those histories in more detail in the Footnotes commentaries.

See also:

Consumer Sentiment: Inflation Optimism? Split Moods 9-13-24

CPI Aug 2024: Steady Trend Supports Mandate Shift 9-11-24

Facts Matter: China Syndrome on Trade 9-10-24

Tariffs: Questions that Won’t Get Asked by Debate Moderators 9-10-24

Footnotes & Flashbacks: Credit Markets 9-9-24

Footnotes & Flashbacks: State of Yields 9-8-24

Footnotes & Flashbacks: Asset Returns 9-7-24

Another Volatile Week: Mini Market Lookback 9-7-24

August 2024 Payrolls: Slow Burn, Negative Revisions 9-6-24

Trump's New Sovereign Wealth Fund: Tariff Dollars for a Funded Pool of Patronage? 9-5-24

Goods and Manufacturing: Fact Checking Job Rhetoric 9-5-24

JOLTS July 2024: Mixed Bag, Hires Up, Layoffs/Discharges Up, Quits Flat 9-4-24

Construction Spending: A Brief Pause? 9-3-24

Labor Day Weekend: Mini Market Lookback 9-2-24

PCE July 2024: Inflation, Income and Outlays 8-30-24

2Q24 GDP 2nd Estimate: The Power of 3 and Cutting 8-29-24

Harris Housing Plan: The South’s Gonna Do It Again!? 8-28-24

New Home Sales July 2024: To Get by with a Little Help from My Feds? 8-25-24

Payroll: A Little Context Music 8-22-24

All the President’s Stocks 8-21-24