Industrial Production Jan 2025: Capacity Utilization

The manufacturing sector held firm in sequential context but Durables and Nondurables edged very slightly lower.

Capacity utilization in Manufacturing is running slightly below 2024 levels in recent months and below long-term averages in total Manufacturing and the important multiplier effects industry group of Durables.

Tariff and related supplier chain disruptions is “tomorrow’s worry” as the 30-day tariff game clock on Canada and Mexico keeps ticking. The production schedule of vehicles could face some turbulence that flows back along the supplier chain from steel and aluminum to components. The industry braces for auto tariffs.

Autos weakened materially in Jan 2025 while Aerospace is climbing again as the strike recovery and model production setbacks fade as a factor for Boeing (and hopefully stay that way).

Utilities moved materially higher in Jan from Dec and overall 2024 levels even if still well below long-term averages. Utilities will remain a focal point as a downstream economic catalyst for a lot of upstream economic activity in investment to the extent the power shortage themes stay intact.

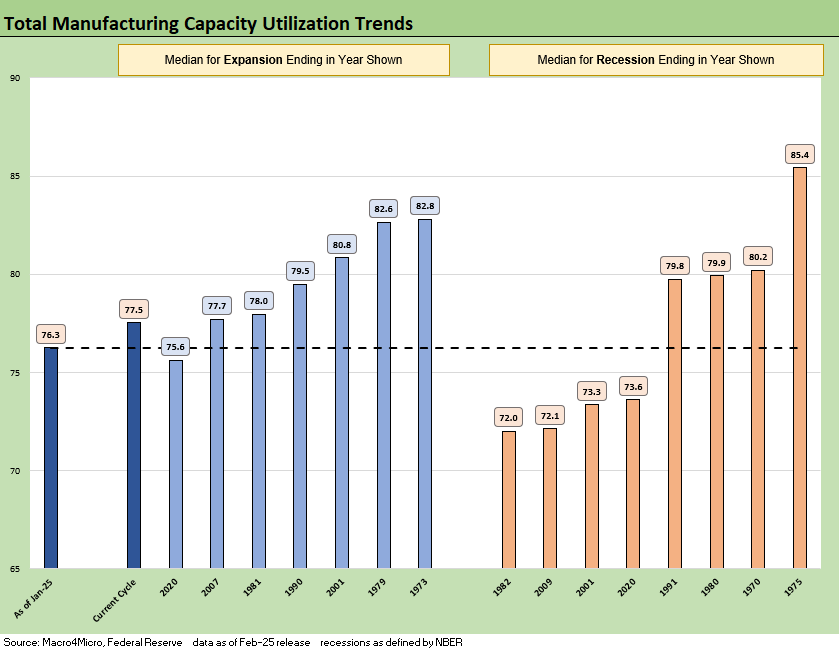

The above chart frames the long-term time series for Manufacturing capacity utilization. The current 76.3% capacity utilization is below the long-term median of 78.7% and only surpasses the median of the July 2009 to Jan 2020 cyclical median of 75.6%.

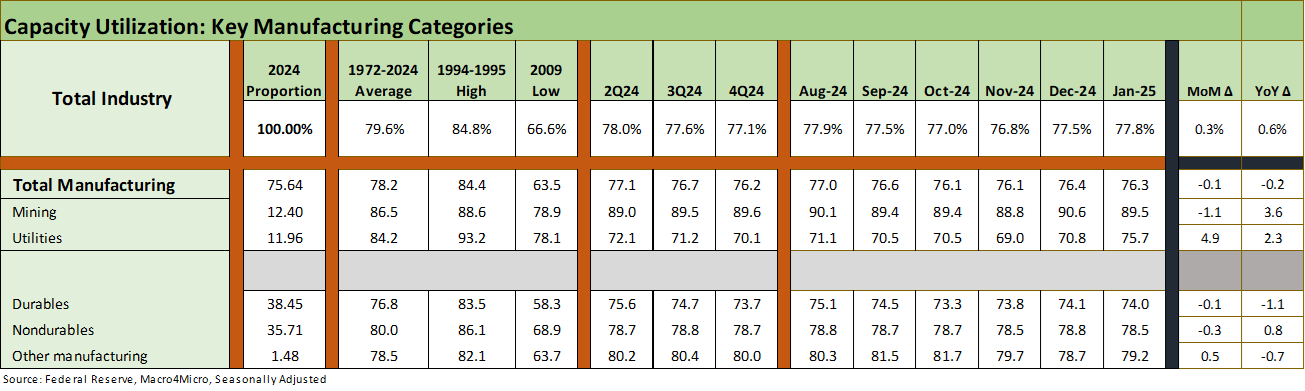

The above table breaks out the mix of high-level capacity utilization categories as Total Industry ticked up but Manufacturing ticked very slightly lower as did Durables and Nondurables. There are more than a few question marks around trade, tariffs, and supplier chains that could disturb trend lines from the supplier side or in terms of inventory planning depending on the industry.

The steel and aluminum tariffs will have major effects on construction costs while the tariffs framework on a product category such as lumber could go either way with the California rebuilding needs. If there was ever a time to be creative on natural resource tariffs coming off an inflation cycle, this would be the time to show some creative improvements for construction and not ideologically rigid destruction. We address many of these issues in the tariff links at the bottom of this note.

For the narrow industry groups that we like to track each month, the 5 largest Durables lines and 2 largest Nondurable lines were mixed. In Durables, we see 3 negative and 2 positive sequentially with only Motor Vehicles (lower) and Aerospace (higher) making significant moves. Nondurables saw both of the group leaders move lower.

Across the economic cycles…

The above table updates the capacity utilization history for expansions and recessions. The ability of more companies to generate solid profits at lower capacity utilization in today’s markets is tied in part to automation and in part to the development of low-cost supplier chains.

The concept of low-cost supplier chains has been a challenge for Trump to grasp, and his tariff policies will serve to raise breakeven volumes again on costs. That means raise prices or take out other costs to preserve margins. Trump’s cowed advisors we assume understand that, but they don’t have his permission to speak about it. The same for the GOP Senate that will not voice such views after seeing Senators Toomey and Corker purged during Trump 1.0 for understanding economics.

The above chart takes expansion and recession averages and lines them up by height as a frame of reference. We see the current level on the left.

See also:

CPI Jan 2025: Getting Frothy Out There 2-12-25

Footnotes & Flashbacks: Credit Markets 2-10-25

Footnotes & Flashbacks: State of Yields 2-9-25

Footnotes & Flashbacks: Asset Returns 2-9-25

Mini Market Lookback: Simply Resistible! 2-8-25

Mini Market Lookback: Surreal Week, AI Worries about “A” 2-1-25

4Q24 GDP: Into the Investment Weeds 1-30-25

4Q24 GDP: Inventory Liquidation Rules 1-30-25

Credit Crib Note: Lennar Corp 1-30-25

D.R. Horton: #1 Homebuilder as a Sector Proxy 1-28-25

Durable Goods Dec 2024: Respectable ex-Transport Numbers 1-28-25

New Home Sales Dec 2024: Decent Finish, Strange Year 1-28-25

Tariff links:

Reciprocal Tariffs: Weird Science 2-14-25

US-EU Trade: The Final Import/Export Mix 2024 2-11-25

Aluminum and Steel Tariffs: The Target is Canada 2-10-25

US-Mexico Trade: Import/Export Mix for 2024 2-10-25

Trade Exposure: US-Canada Import/Export Mix 2024 2-7-25

US Trade with the World: Import and Export Mix 2-6-25

The Trade Picture: Facts to Respect, Topics to Ponder 2-6-25

Tariffs: Questions to Ponder, Part 1 2-2-25

US-Canada: Tariffs Now More than a Negotiating Tactic 1-9-25

Trade: Oct 2024 Flows, Tariff Countdown 12-5-24

Mexico: Tariffs as the Economic Alamo 11-26-24

Tariff: Target Updates – Canada 11-26-24

Tariffs: The EU Meets the New World…Again…Maybe 10-29-24

Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24

Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24

Facts Matter: China Syndrome on Trade 9-10-24

Trade Flows: More Clarity Needed to Handicap Major Trade Risks 6-12-24

Trade Flows 2023: Trade Partners, Imports/Exports, and Deficits in a Troubled World 2-10-24

Trade Flows: Deficits, Tariffs, and China Risk 10-11-23