Mini Market Lookback: Simply Resistible!

If you expect erratic and conceptually inconsistent proposals, we assume that should mean predictable?

The tariff scare promised on Day 1 came late and then was scrapped for 30 days while a new approach (Reciprocal Tariffs) is about to get more broadly tried on for size. Of course, “reciprocal” had nothing to do with the Canada and Mexico tariff plan (see The Trade Picture: Facts to Respect, Topics to Ponder 2-5-25, US Trade with the World: Import and Export Mix 2-6-25, Trade Exposure: US-Canada Import/Export Mix 2024 2-7-25).

The interest rate focus of the White House is now on the 10Y UST per the Treasury Secretary as they presumably give up trying to intimidate the Fed (it did not work on Volcker or Greenspan or Powell 1.0). Trump even reversed himself and deemed the recent Fed action as the correct one after saying the opposite the week before. The 10Y posted a rally to just inside where the year began.

The misdirection plays and the flood-the-zone approach for distraction will not divert the market from asking about inflation and consumers from making the call as evident in a startling rise of consumer inflation expectations on Friday.

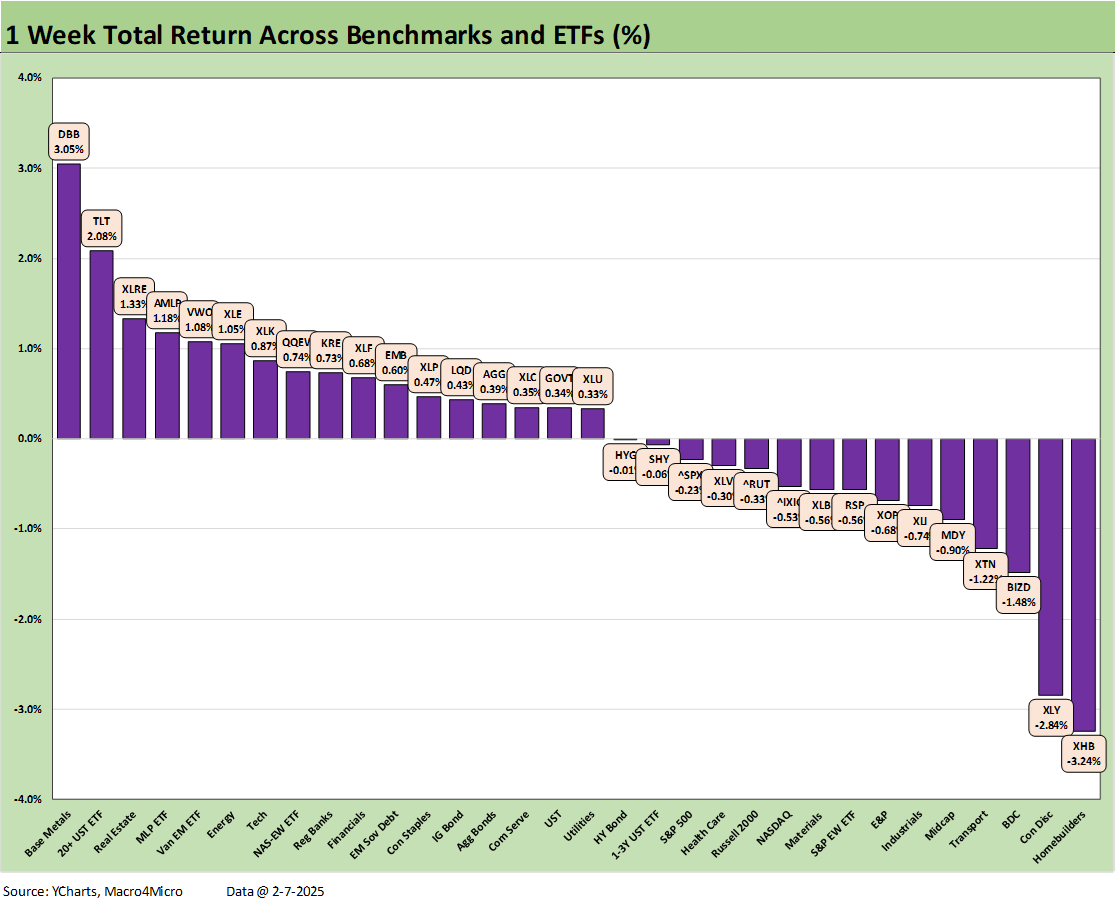

Meanwhile, the credit market fundamentals are constructive as the week showed a balance of positive and negative performance across the 32 benchmarks and ETFs we track.

The 32 benchmarks and ETFs weighed in at 17-15 for the week. The lineup shows 5 of 7 bond ETFs positive and the long duration 20+Y UST (TLT) grabbing the #2 spot with 4 of 7 bond ETF in the second quartile. The short duration HY ETF (HYG) and short duration UST 1Y-3Y (SHY) are slightly in negative range.

In a troubling sign for builder confidence, we see the Homebuilding ETF (XHB) in last place for the week with a poor Friday finish for XHB as the favorable UST shift on the week succumbed to the material erosion of inflation expectations reported in the U Michigan consumer sentiment survey.

The tariff scares and fresh round of inconsistent tariff rhetoric to end the week (reciprocal tariff plan) seems more swerving and out of control than methodically evaluated.

The fact that XHB performed badly when the long duration UST ETF (TLT) and Real Estate ETF (XLRE) performed well was notable. There is a sense that rates and mortgages will remain erratic until the market gets a sense of the debt ceiling plan, the budget process, and how big the record deficits and UST supply will be. The Materials ETF (XLB) was also weak and in the red but edged into the third quartile.

The tech bellwethers were a mixed bag again this week with more in the red than positive. The above table lines up the Mag 7 + Broadcom and Taiwan Semi against some broader benchmarks in descending order of total returns for the week.

We see 5 of the Mag 7 in the red for the week with Tesla on the bottom in double digit negative range and Alphabet a close second to last. NVDA had a good week but is still at -12.8% for the trailing 3 months.

The 1-week UST delta shows a flattening from the rally from the 5Y UST out to 30Y. That in turn rewarded duration as we laid out in an earlier chart. The 2Y UST whipsawed higher and compressed the 2Y to 10Y slope. The optimism around the short end easing sooner rather than later is waning. Inflation expectations are facing some anxiety around tariffs and deportation. For the latter, the inflation transmission mechanism is tied to potential labor imbalances.

The above chart updates the YTD deltas with the 5Y UST and 10Y UST now back slightly inside where the year started. The 6M to 3Y is modestly higher as the FOMC is in a holding pattern for now.

We update the running yields for the 10Y UST and Freddie Mac 30Y mortgage benchmark. Both are still well above the Sept lows and heading into a period of considerable uncertainty around tariffs, the debt ceiling, and budget shortfalls that will need a lot of assumed tariff revenue to get past the reconciliation process.

Many equity market players believe the credit markets have to start cracking to signal real problems. For now, the HY market is not sending any such signals. For this week, HY OAS barely moved on “25% tariff day” (see Footnotes & Flashbacks: Credit Markets 2-3-25). HY OAS tightened 1 bps on the week to +267 bps or well inside where June 2007 ended.

The “HY OAS minus IG OAS” quality spread differential narrowed by 3 bps on the week to +183 bps. The HY investors will wait for real action and the variables to be settled before getting anxious. HY funds continue to throw off cash flow for reinvestment or income. Some asset allocation strategists are more on edge about duration, inflation, and tariffs at this point than the broader credit cycle and immediate economic trends.

The BB OAS minus BBB OAS differential tightened on the week to +59 bps from +64 bps last week.

The overall spread action this week was a nonevent and the market remains patient, has an eye on earnings trends, and awaits more clarity from a predictably unpredictable White House on tariffs.

See also:

Payroll Jan 2025: Into the Occupational Weeds 2-7-25

Payroll Jan 2025: Staying the Course, Supports FOMC Hold 2-7-25

Trade Exposure: US-Canada Import/Export Mix 2024 2-7-25

US Trade with the World: Import and Export Mix 2-6-25

The Trade Picture: Facts to Respect, Topics to Ponder 2-5-25

JOLTS Dec 2024: Before the Tariff JOLT Strikes 2-4-25

Footnotes & Flashbacks: Credit Markets 2-3-25

Footnotes & Flashbacks: State of Yields 2-2-25

Footnotes & Flashbacks: Asset Returns 2-2-25

Tariffs: Questions to Ponder, Part 1 2-2-25

Mini Market Lookback: Surreal Week, AI Worries about “A” 2-1-25

PCE: Inflation, Personal Income & Outlays 1-31-25

Employment Cost Index 4Q24: Labor Crossroad Dead Ahead 1-31-25

4Q24 GDP: Into the Investment Weeds 1-30-25

4Q24 GDP: Inventory Liquidation Rules 1-30-25

Credit Crib Note: Lennar Corp 1-30-25

D.R. Horton: #1 Homebuilder as a Sector Proxy 1-28-25

Durable Goods Dec 2024: Respectable ex-Transport Numbers 1-28-25

New Home Sales Dec 2024: Decent Finish, Strange Year 1-28-25