Trump Tariffs 2025: Hey EU, Guess What?

In one of the least surprising social media actions ever, Trump threatened the EU with tariffs in a post-midnight Truth Social post. We look at US-German trade.

Trump team preps for good faith trade talks with strategic allies….

In this update, we look at Germany as the epicenter of the Trump gripes with the EU trade deficit.

The broader EU complaint reflects the reality that the EU was formed for a reason and the Trump trade team cannot force bilateral negotiations by country.

The EU can respond as a bloc in retaliatory actions, and the EU combines the reality of being the #1 import and #1 export market for the US.

The next round with the EU will go back to the battle with a new playbook after limited success from tariffs on the EU during Trump 1.0.

We had already looked at some of the broader tariff risks to set the stage for the inevitable Trump attack on the largest trade partner with the EU as a bloc (see Tariffs: The EU Meets the New World…Again…Maybe 10-29-24). In this note, we look more narrowly at Germany as the main source of the deficit.

The problem with trade deficits as seen by Trump is one not worth revisiting and debating (see links). That topic of “good vs. bad trade deficits” goes back to Trump 1.0, and most people who have taken an econ class know there are good trade deficits and bad trade deficits depending on the reason they exist. His use of the phrase “ripping us off” is the usual Trump drama. Consumers choosing what they want to buy might disagree with that assessment. In simplest terms, choosing a BMW over a Cadillac is a choice. Unfair trade practices are a separate issue.

The US has been running massive trade deficits for a long time based on the US being the largest consuming nation on the planet and based on decades of private sector decisions and global supplier chain strategic evolution. It is hard (impossible) to unwind even in two terms. It is also a challenge with the cross-border ownership of assets and political factors by country and by state (and right to work vs. union).

Buy “guns” and oil/gas…

The EU topic has been more focused on forcing the EU to buy more energy from the US (Oil, LNG), and that makes sense for both sides anyway. The EU had already been planning that after Ukraine. The investment in infrastructure that would be desired/required to displace Russia and much of OPEC will make the climate interest go crazy, but it would play into what Trump might be planning for Canadian oil. To be a major exporter of oil, taking the much-desired discounted heavy crudes to use in the US for refining and exporting other cruse grades would limit inflation impact. Tariffs on Canadian crudes would be uniquely ignorant as economic policy and damaging to US interests and inflationary. That would free up more capacity to ship more oil to EU trade partners where the US runs a major trade deficit.

The recent demand (this week) that NATO partners raise their defense budgets to 5% of GDP will be interesting to watch since the US has an advantage there as well with the massive base of military infrastructure and prime contractors and extensive supplier chains. That would be sound trade policy to the extent it helps investment in the legacy US defense industrial base. We will see where that all goes.

The NATO partners will scream bloody murder about such a demand in the midst of a weak EU economy. There is always the risk that Trump’s end game might be to leave NATO with this demand as a pretense. The plot thickens. Using 3Q24 nominal defense GDP as a % of 3Q24 nominal GDP, we see 3.7% for the US. In other words, 5% is a very big ask. At the peak of the mid 1980s Cold War, the US was above 5% as US deficits started to grow massively. Recent peaks include 2010 with Iraq/Afghanistan at 4.5% of GDP (Source: Department of Defense). We would be curious to see what a 4.5% of GDP request in Congress would do the UST supply from the US.

Germany and trade in a few visuals…

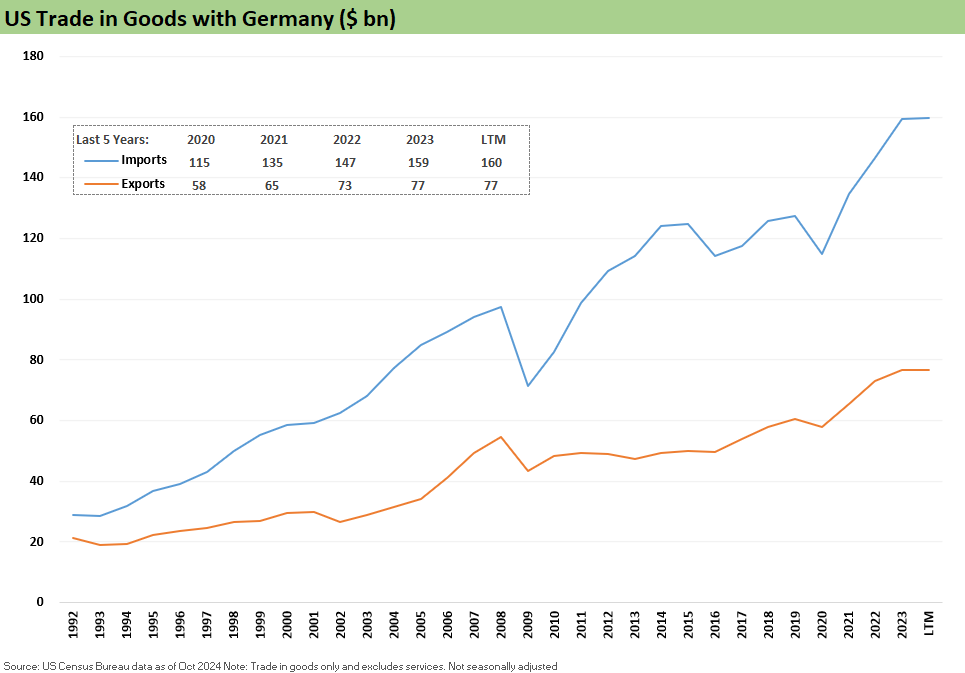

The above chart updates the US-Germany goods trade deficit history. It is running at a record high in 2023-2024. Trump will focus on why Germany does not buy more US cars, but he will have a better conceptual case coercing them to buy more US energy and more US defense products. This will all be food for thought as the process unfolds in 2025.

The evolution of the trade deficit with Germany shows that it steadily grew until the first Trump term amidst the first round of tariff tensions saw minor trade balance reductions. The post-pandemic economic boom in the US included a surge in durable goods demand that drove increased import activity from Germany.

We see other factors driving the overall increase in trade activity and trade deficits alike, such as diversification of supply chains, changing steel and aluminum tariff policy, and increases in US energy exports after the Russian invasion of Ukraine. As we detail below, the export trends have been favorable but not the trade deficit.

As noted in the chart at the top of this piece, we plotted the timeline of goods trade between the US and Germany that totals around $237 bn using LTM imports and exports. No matter how you slice it, that trade volume generated a lot of economic activity going in both directions and within the US. That is beyond the measurement of the import and export value at the border. German interests have been massive investors in US capex to grow auto and truck operations and supplier chains among other industries (chemicals, manufacturing, etc.).

The Trump approach is “you need enemies to get people excited” and somehow German expansion in the US is seen as “ripping us off” and treating us badly. The transplant belt (almost all red states) might not agree. The German investments have driven a lot of jobs and economic growth.

That expanded US presence flows all the way downstream in major US economic interests such as dealers, financing businesses of all types, and community-level multiplier effects (supporting service providers, infrastructure investment, tax base etc.). There is also the expanded manufacturing presence which such downstream operations attract to many states and MSAs after the German operations “set up shop.”

Germany is the 4th largest trade partner (not including EU as a bloc). Though less than half of the total of China trade and well behind Mexico and Canada, it is still another key trade relationship that spans myriad advanced, high-value sectors. The trade relationship continued to grow post-COVID with both import and export lines seeing about 25% growth since 2019, with notable growth in autos and other industrial equipment imports.

The chart above outlines the top import categories from Germany which are those that could be targeted for tariffs by Trump with autos one of his favorite targets. Skimming the top categories, we see several high-value industrial and pharmaceutical goods with Autos at #1, Pharma at #2, and Navigational and medical instruments at #3.

Autos make up almost 20% of the imports before adding in a range of component and parts that come in as part of vehicle assembly within the US. Aerospace parts at #5 on the list are key inputs for US based aerospace production. With such critical components coming in for downstream production, tariffs would create inflationary ripple effects or even lead to retrenchment. We have covered that dynamic ad nauseum at this point.

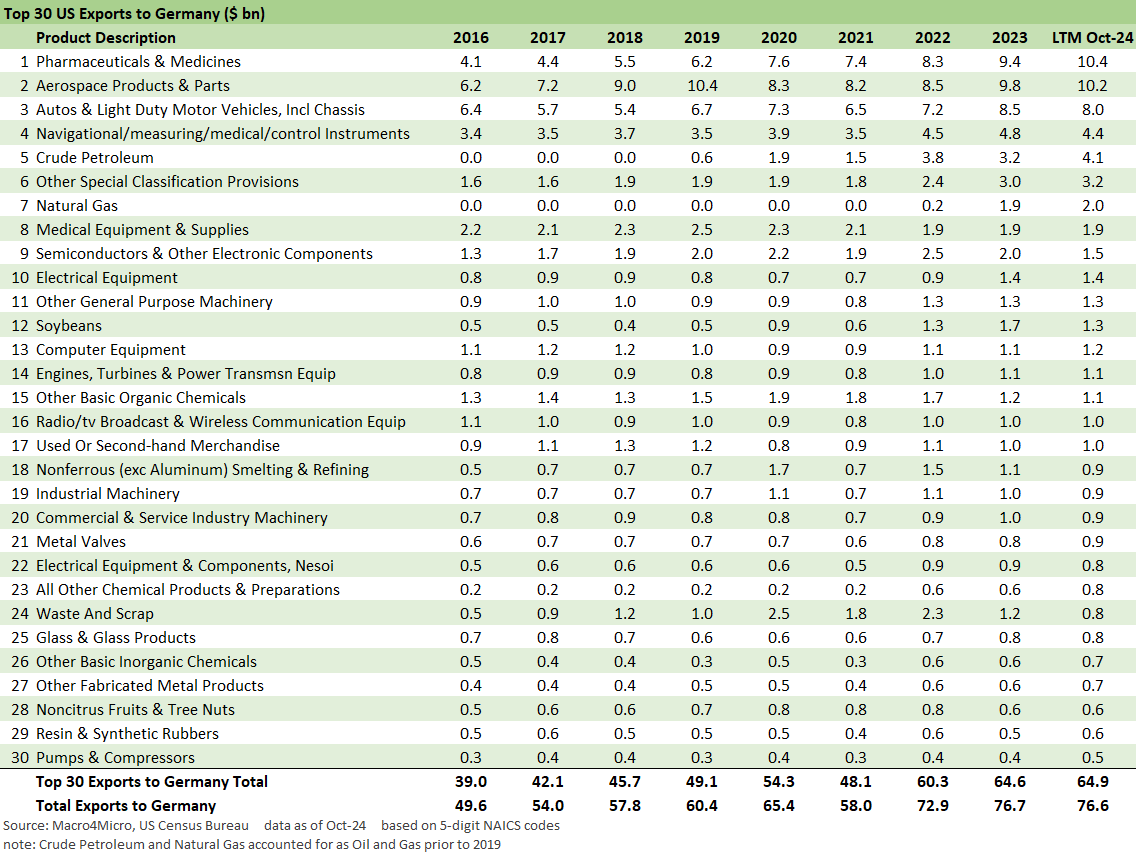

The above shows largest exports to Germany that would form part of the retaliatory menu if tariff actions were taken. Though the trade deficit means Germany has less to aim at in magnitude, the lesson from previous tariff bouts is that the EU will look for strategic targets that make the tariffs as unpalatable as possible. The real differentiator – unlike Canada and Mexico – if that the EU can plan retaliation on an EU-wide basis using all the totals of the various product lines for maximum impact and political “messaging.”

These topics are not going away, but it would be helpful if facts were stated by Trump (like “buyer pays” tariffs). As of now, around 2/3 of trade is targeted. We can assume he will get to the #2 (Japan) and #3 (South Korea) importers of motor vehicles and parts soon. Mexico is #1 in that group and Canada #4.

See Trade Related:

Trade: Oct 2024 Flows, Tariff Countdown 12-5-24

Tariff: Target Updates – Canada 11-26-24

Mexico: Tariffs as the Economic Alamo 11-26-24

Tariffs: The EU Meets the New World…Again…Maybe 10-29-24

Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24

Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24

Tariffs: Questions that Won’t Get Asked by Debate Moderators 9-10-24

Facts Matter: China Syndrome on Trade 9-10-24

Trade Flows: More Clarity Needed to Handicap Major Trade Risks 6-12-24

Trade Flows 2023: Trade Partners, Imports/Exports, and Deficits in a Troubled World 2-10-24

Trade Flows: Deficits, Tariffs, and China Risk 10-11-23

Midyear Trade Flows: That Other Deficit 8-10-23

State of Trade: The Big Picture Flows 12-18-22

See also:

Existing Home Sales Nov 2024: Mortgage Vice Tightens Again 12-19-24

GDP 3Q24: Final Number at +3.1% 12-19-24

Fed Day: Now That’s a Knife 12-18-24

Housing Starts Nov 2024: YoY Fade in Single Family, Solid Sequentially 12-18-24

Industrial Production: Nov 2024 Capacity Utilization 12-17-24

Retail Sales Nov24: Gift of No Surprises 12-17-24

Inflation: The Grocery Price Thing vs. Energy 12-16-24

Footnotes & Flashbacks: State of Yields 12-15-24

Footnotes & Flashbacks: Asset Returns 12-15-24

Mini Market Lookback: Macro Grab Bag 12-14-24

Toll Brothers: Rich Get Richer 12-12-24

CPI Nov 2024: Steady, Not Helpful 12-11-24

Mini Market Lookback: Decoupling at Bat, Entropy on Deck? 12-7-24

Credit Crib Note: Herc Rentals (HRI) 12-6-24

Payroll Nov 2024: So Much for the Depression 12-6-24

Trade: Oct 2024 Flows, Tariff Countdown 12-5-24

JOLTS Oct 2024: Strong Starting Point for New Team in Job Openings 12-3-24

Mini Market Lookback: Tariff Wishbones, Policy Turduckens 11-30-24