PulteGroup: Strong Volumes, Stable Pricing

In a busy week for homebuilder earnings, we update the financial and operating metrics for Pulte as one of the top-performing builders on the equity side.

The homebuilders song…a time to sell specs…

Pulte (PHM) posted a fresh round of solid numbers with sequential orders and backlog increases setting the company up for a busy peak period with average selling prices off the peak but gross margins resilient.

As with the other larger cap, high quality builders, PMH’s balance sheet liquidity is impressive, leverage very low, inventory coverage of total debt climbing. It is easy to make the case that Pulte is much safer than a BBB tier credit.

The regional color on demand and pricing dynamics were relatively positive and showed up in the numbers with Pulte raising full year gross margin and closings guidance.

Some top-down flavor included a statement on the housing market being short around 4 million units in a common demographic theme.

The above chart frames the performance of PHM equity vs. the Builder ETF (XHB) and the broad market benchmark (S&P 500). The builders have tended to surprise many with their performance in this tightening cycle, and Pulte has been high in the rankings of relative stock performance as we have covered in a recent note on D.R. Horton (see D.R. Horton: Ramping Up in 2024 Despite Mortgages 4-19-24). PHM has outperformed the peer group in margins and in equity returns and has also trounced the S&P 500 looking back across periods since COVID.

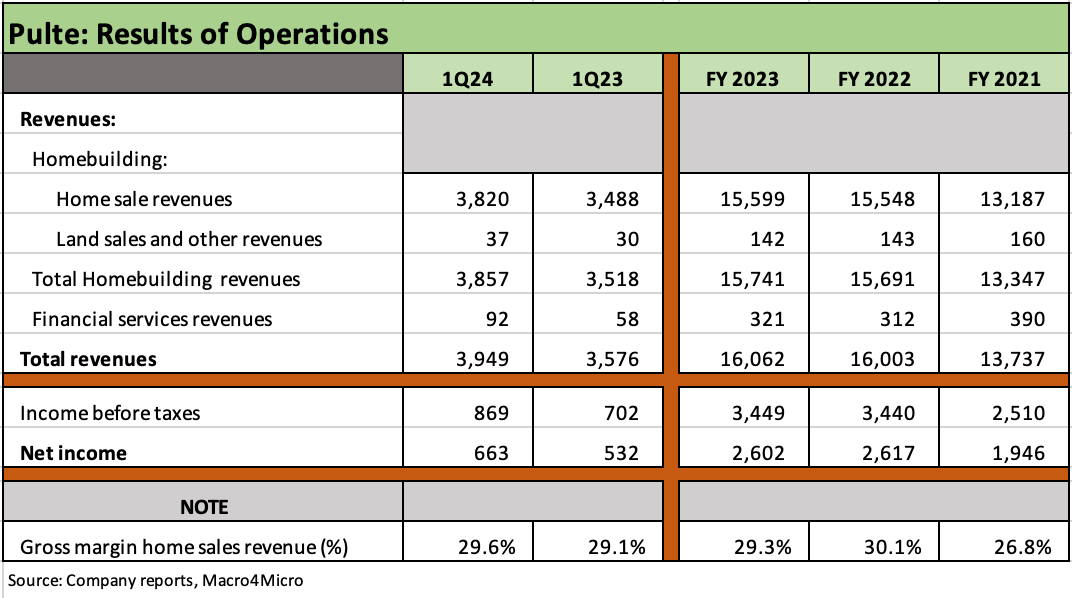

During 2023, Pulte restated how it treats incentives (in cost of sales vs. home sales), so the home sale numbers above differ from some earlier historical commentaries. We started the timeline in 2021 to keep the historical apples to apples. The restatement in no way changes the conclusion of the obvious strength in the results and favorable trend line.

The $2.6 billion net income for FY 2023 is a long way from the $1.0 billion in FY 2019 and the $1.9 bn in FY 2021 when rates were low and housing orders and backlogs were at highs with a soaring stock market, ZIRP, and the highest quarterly GDP growth rates in decades off the COVID bounce.

Housing starts for the industry had peaked in late 2020 with the vaccines just getting underway as the flight to the suburbs was at full steam ahead and expected to increase in 2021 (see Housing Starts March 2024: The Slow Roll and Ratchet 4-16-24).

We view the metrics time series as more interesting across the tightening cycle and affordability pressures plaguing many potential homebuyers. Average selling prices are up by almost 28% for PHM vs. 2019, and new orders have risen sharply since 2022 after the onset of the tightening cycle. Orders are well ahead of 2019 but below 2020 when fear and low rates sent many “packing” for safety and work-from-home space. The geographic and price tier mix shifts bring an asterisk to the time series, and PHM cited favorable mix support in the 1Q24 numbers.

The high 30Y mortgage rates of 2023 briefly touched 8% and crossed the 7% line again for the first time in 2024 this past week (see Footnotes & Flashbacks: State of Yields 4-21-24), but PHM pushed through.

Builders have the advantages of being able to produce inventory and offer incentives at a level that still allows them to be highly profitable and generate healthy cash flow. The proof is in the numbers and the capital market response (i.e. PHM stock returns). The sweet spot of mortgage buydowns tends to be in the high 5% handle range, and PHM cited 5.75% and the fact that 25% of their buyers were involved.

The metrics by quarter show the rebound in orders and the needle moving in the backlogs on both units and total dollars. We also see average selling prices up from the onset of tightening even if fading from the $561K peak at 4Q22. PHM expects average selling prices in the $540 to $550K range in 2024.

As noted above in an earlier chart, gross margins held in very well at 29.6% for 1Q24 and 29.3% for FY 2023. Normalizing supplier chains, shorter build times from the COVID crunch, and better inventory turns has been a theme on a number of the builder calls for FY 2023. Monitoring any risks tied to rising mortgage rates vs. spec inventory is always a factor to watch in the peak selling season ahead.

The balance sheet profile of Pulte is the most reassuring part of the story given the buildup of balance sheet liquidity vs. total debt and the intrinsic flexibility to manage working capital in line with closings and order rates. The cash balance leaves Pulte with minimal net debt while the rise of inventory balances vs. total debt is reassuring. Unrestricted cash is 88% of total debt and net debt to cap is 1.7% vs. total debt % cap of 15.4%. Using PHM’s market value of equity (4-24-24) lowers total debt to market adjusted cap to 7.9%.

The inventory coverage is always reassuring with the major builders and has only gotten stronger as the inflation war has moved into what most expect will be the final stages – even if it is a slow wind down. The inherent protection provided by the inventory is tied to the process by which inventory translates into cash flow if the market slows down. Total inventory as a multiple of total debt is 6.2x at 1Q24 while cash + inventory is 7.1x. Both are at timeline highs and are up from 2.8x and 3.2x, respectively, at year end 2019.

When builders ramp up, they are using cash. When the sales process slows down, the builders generate cash. That is an empirically supported pattern across some wild housing market years over the past two decades. It is also common sense. The ability to turn inventory over more rapidly at solid margins is the goal and that is within sight for more builders as supplier chains normalize and the builders pick up share with constrained existing home sales inventory (see New Home Sales March 2024: Seasonal Tides Favorable 4-23-24).

See also:

Macro:

Systemic Corporate and Consumer Debt Metrics: Z.1 Update 4-22-24

Footnotes & Flashbacks: State of Yields 4-21-24

Footnotes & Flashbacks: Asset Returns 4-21-24

Credit Cycles: Historical Lightning Round 4-8-24

Credit Markets Across the Decades 4-8-24

Homebuilders:

New Home Sales March 2024: Seasonal Tides Favorable 4-23-24

D.R. Horton: Ramping Up in 2024 Despite Mortgages 4-19-24

Existing Home Sales March 2024: Not Something Old, Something New 4-18-24

Housing Starts March 2024: The Slow Roll and Ratchet 4-16-24

D.R. Horton: Credit Stronger Even if Stock Takes a Step Back 1-29-24

KB Home: Wraps Industry Rebound Year, Exiting on Upswing 1-14-24

Lennar 4Q23:Buyer Buzz, Curve Support 12-15-23

Credit Crib Note: Lennar (LEN) 11-22-23

Pulte: Relative Value Meets “Old School” Coupons 11-15-23

Credit Crib Note: PulteGroup (PHM) 11-15-23

Credit Crib Notes: Toll Brothers (TOL) 9-11-23

Credit Crib Notes: D.R. Horton (DHI) 8-29-23

KB Home: Credit Profile 6-24-23

Toll Brothers: Company Comment 5-25-23

D.R. Horton: Credit Profile 4-4-23