Durable Goods Apr25: Hitting an Air Pocket

An expected swing in aircraft orders leads a very large headline decline while core capital goods remain mixed.

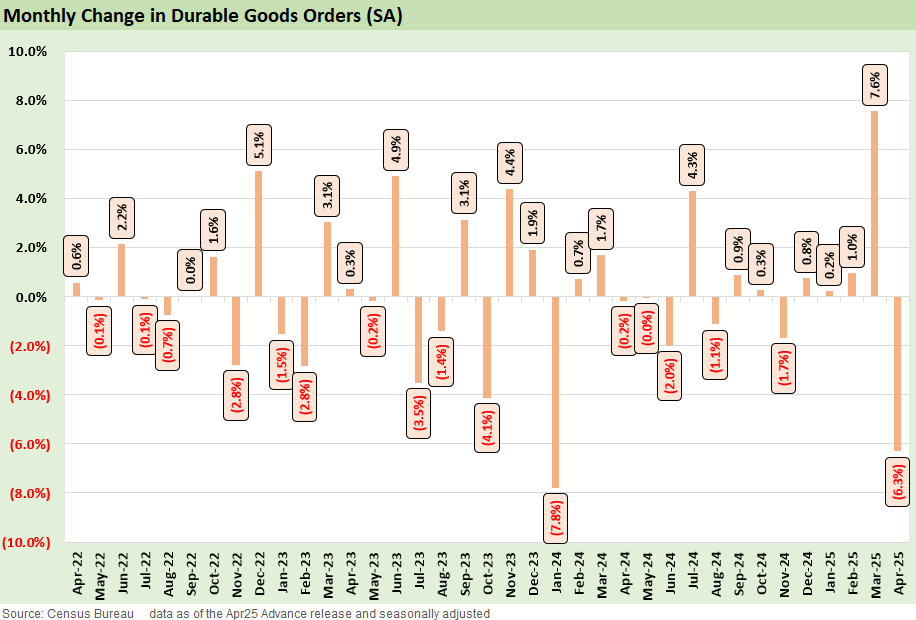

Headline durable goods declined -6.3% in April as Nondefense Aircraft and Parts orders fell -51.5%. This is the largest drop since January 2024 which saw a similar collapse in aircraft order volumes.

The collapse in aircraft volumes follows a +158% surge in March that leaves aircraft order volumes still above the February mark. Motor Vehicles and Parts also declined in April (-2.9%), contributing to an overall -17.1% drag from transportation in the headline figure. On an ex-Transport basis, Durable Goods Orders increased by +0.2%.

The small gains across core capital goods categories suggest some stability, but do not yet signal a renewed growth impulse with uncertainty in trade policy continuing on a weekly basis. An EU tariff pause is positive for markets to relieve anxiety from last week, but deals and details are still needed to support capex decision making.

The above chart shows the monthly headline changes for Durable Goods Orders with the large decline of -6.3% in April following up +7.6% in March. The pattern this month in Durable Orders is typical due to the lumpy nature of aircraft ordering. Aircraft sees concentrated ordering leading to a sharp increase and subsequent decline. Last month saw headline numbers surge with a large Boeing order and the decrease this month is the resulting aftermath.

On a side note on aircraft, the market still has to consider the recent opening of a Section 232 probe into commercial aircraft, engines and parts could mean at some point in the EU vs. US battle. Boeing and Airbus are two 1,000-pound gorillas with a history of trade disputes. The latest pause over the weekend on the 50% threat against the EU will necessarily need to look at those risks. With China such a major buyer of commercial aircraft and looking to make it a “duopoly + 1 new guy,” they will also be watching closely.

The 2025 results for durables to start the year reflected an incrementally positive trend in the pre-trade war numbers, but the manufacturing sector is clearly on edge given the degree of disruption that could unfold along finished goods and supplier chains under current trade war and bad blood backdrop.

The Boeing noise in the above results may continue but the chaos from shifting tariff levels and need to shift supply chains from breaking will keep uncertainty high and restrain new capex at the margins for now. Keeping such massive trade barriers in a paused or uncertain state leaves the budgeting process in constant flux where planning inputs are key.

Many firms appear to be defaulting to a ‘wait-and-see’ posture, especially as tariff policy remains unsettled. Longer-cycle capital spending is particularly vulnerable, with planning continuing to be strained by rapid policy shifts. This pattern could even extend further out given multi-year budget planning that would have to consider 2026 midterms.

The threat of congress reeling in Trump’s excess in the use of legislated national security and unfair loopholes to usurp the constitutional role of Congress remains low. The ability to restrict the unilateral decision making around tariffs Trump enjoys now requires legislation, and that would not make it past two bodies (House and Senate) and would be vetoed by Trump anyway with zero chance of override.

Longer-tailed capex projects and investments to reshore are a decidedly mixed bag at this point. An inflated headline on promises to invest is not a contractual commitment or shovel in the ground. Some are charging ahead since they already made economic sense, so we will see what adjustments are made in the coming months as tariffs come into play in a bigger way. Cyclical pressure can also override decisions near term and “pause” is a word that cuts both ways.

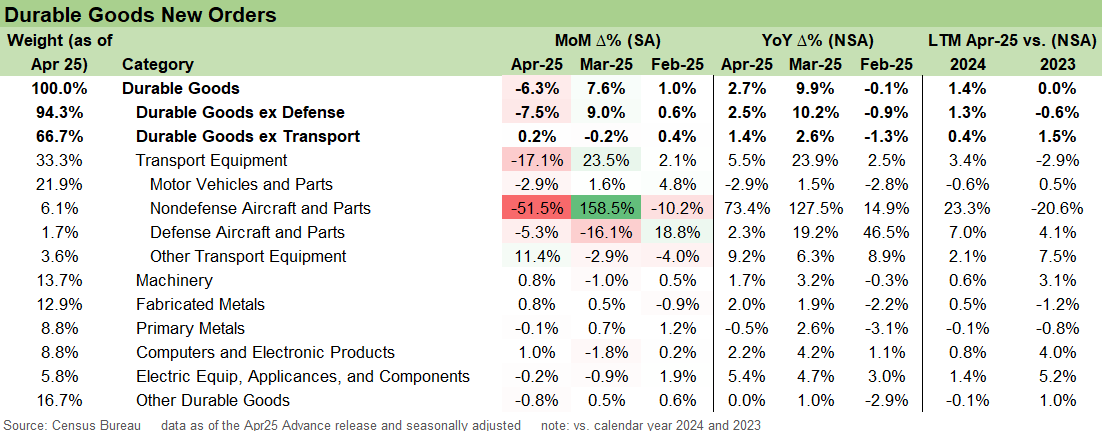

The above table frames the underlying details and the key ‘ex-defense’ and ‘ex-transport’ cuts. The Transport line at -17.1% this month is related to the -51.5% drop in Nondefense Aircraft and Parts but also a modest but significant -2.9% decrease to Motor Vehicles and Parts. Motor Vehicles and Parts saw some steady build rates in recent months, but April results point to those increases reflecting tariff-driven inventory build rather than sustained bullishness.

We have spent a fair amount of time reviewing franchised auto dealer results and earnings call commentary, and confidence levels are reasonably high there relative to the more dire financial views of high fixed manufacturing cost suppliers and OEMs. For auto retail, the consensus is that they can just make working capital adjustments to their mix subject to the final tariffs decisions that get worked out on imports and domestic content. While they see that everyone will bear some costs, they present much less risk than the manufacturers.

For autos, there also appears to be a view that the OEM manufacturing partners will need to be the ones to plan how to deal with Trump, address cost pressures along the supplier chain, and develop the right balance of incentives to support dealers and their customers. Headline expectations for light vehicles remains at a 16-handle for 2025 (for now).

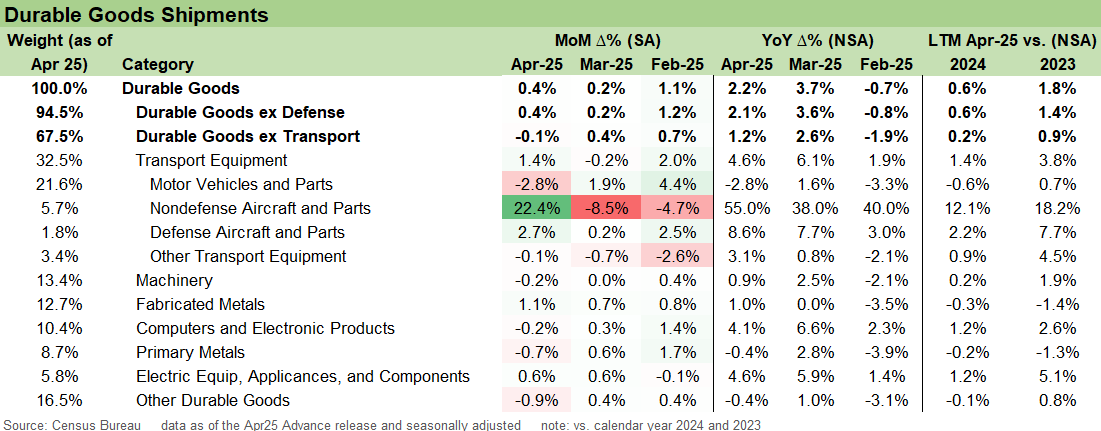

Below the transport lines into the durable goods ex-Transport mix, we saw a +0.2% increase in order activity. The mix of results sees some rebounds in industries like Computers and Electronic Products and Fabricated Metals where there are outstanding tariff concerns. The Machinery results are the most positive in the trailing two months but do not by itself point to a major increase beyond maintenance levels. Overall, the capex results are mixed and show investment that is not yet deteriorating but tepid with so much uncertainty around.

In the end, we see some material moving parts ahead subject to tariff uncertainty and final deals being struck – or unilateral take-it-or-leave-it tariffs being assigned. Small business confidence is in the tank, consumer confidence rallied slightly in this morning’s release with some tariff pauses and truces mitigating the chronic crisis backdrop.

We have a hard time finding pockets of optimism as opposed to reduced pessimism in areas such as the automotive chain or across home builders. We don’t see contraction nerves rising broadly, and the 1Q125 numbers were constructive. The painful tariff policy waiting game is now a 2H25 issues for feeling the full effects of the final tariffs assigned. That would be when it is too late to pre-buy and the unit cost and pricing damage would be more in evidence. That is when the FOMC gets to cast its vote.

See also:

Footnotes & Flashbacks: Asset Returns 5-25-25

Mini Market Lookback: Tariff Excess N+1 5-24-25

New Home Sales April 2025: Waiting Game Does Not Help 5-23-25

Existing Home Sales April 2025: Soft but Steady 5-22-25

Credit Snapshot: Lithia Motors (LAD) 5-20-25

Home Starts April 2025: Metrics Show Wear and Tear 5-19-25

Footnotes & Flashbacks: Credit Markets 5-19-25

Industrial Production April 2025: CapUte Mixed but Time Will Tell 5-15-25

Retail Sales April 25: Shopping Spree Hangover 5-15-25

Credit Spreads: The Bounce is Back 5-13-25

Recent Tariff Commentaries:

CPI April 2025: 1st Inning for Tariffs and CPI 5-13-25

US-UK Trade: Small Progress, Big Extrapolation 5-8-25

Tariffs: A Painful Bessent Moment on “Buyer Pays” 5-7-25

Trade: Uphill Battle for Facts and Concepts 5-6-25

Tariffs: Amazon and Canada Add to the Drama 4-29-25

Ships, Fees, Freight & Logistics Pain: More Inflation? 4-18-25

Tariffs, Pauses, and Piling On: Helter Skelter 4-11-25

Tariffs: Some Asian Bystanders Hit in the Crossfire 4-8-25

Tariffs: Diminished Capacity…for Trade Volume that is…4-3-25

Reciprocal Tariff Math: Hocus Pocus 4-3-25

Reciprocal Tariffs: Weird Science Blows up the Lab 4-2-25