CPI July 2024: The Fall Campaign Begins?

We frame the CPI lines and challenge the assumption that the Jan 2001 and Sept 2007 easings of 50 bps is a model for today.

The UST bulls are looking for 50 bps of easy waters…

The next FOMC action got a lot of cable airtime on what comes next in Sept as some economists cited the Jan 2001 and Sept 2007 easing cycle kickoffs as good examples of making the first move a -50 bps cut.

The problem with that “past is prologue” angle on starting an easing cycle is that Jan 2001 was shaping up as a post-TMT train wreck and Sept 2007 was after a summer of credit market suspended animation and growing stress in the financial markets on RMBS and counterparty risk (see Fed Funds, CPI, and the Stairway to Where?10-21-22). Very different conditions.

With inflation in check and a desire to be ahead of more payroll pain, could the better parallel be the late cycle actions of 1998 or 2019 with a series of -25 bps moves while watching more data unfold? Only Powell’s hairdresser knows for sure.

Headline CPI of +2.9% for July had the question mark of a sequential MoM rise to +0.2% vs. -0.1% in June 2024 CPI while the Core CPI ticked up to +0.2% from the +0.1% in June, taking some of the tailwinds out of a -50 bps assumed move.

We update our Big 5 charts and Key Add-Ons that comprise around 86% of the CPI index while the special aggregates indexes bring solid enough news with All Items less Shelter at +1.7%.

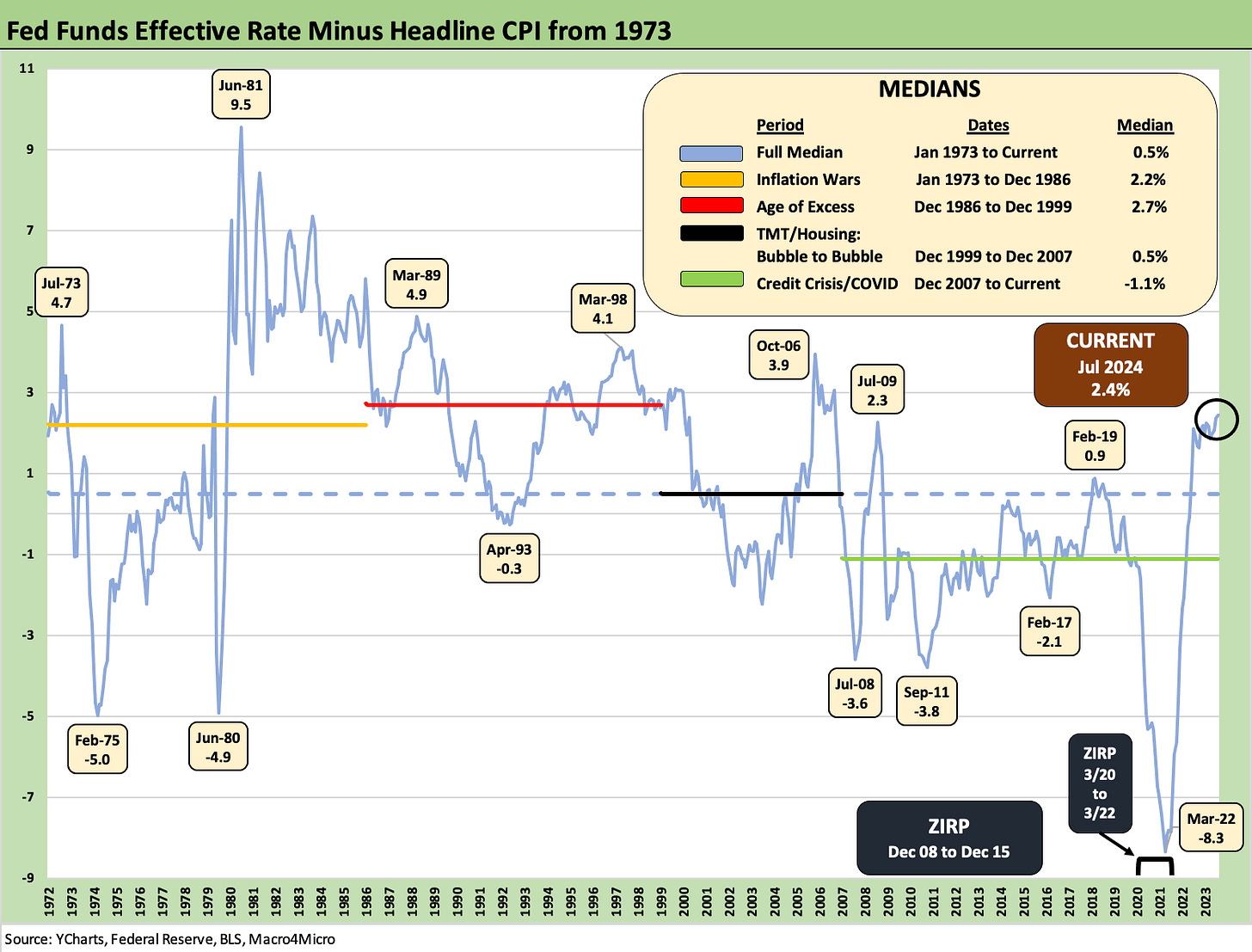

Before we get to the CPI lines in the next few charts, we thought the “Fed Funds minus CPI” differential was worth an update even though the Fed locks in on PCE inflation and that level of real fed funds vs. Core PCE (see PCE June 2024: Inflation, Income, and Outlays 7-26-24).

The +2.4% differential for fed funds vs. CPI detailed in the chart certainly has some room in it just as we saw with the fed funds vs. PCE differentials covered separately. The history of fed funds vs. CPI at the very least offers food for thought (see Fed Funds-CPI Differentials: Reversion Time? 10-11-22). The fact that the fed funds level lagged CPI and PCE inflation back in 2022 was very relevant at that time as many market watchers were yelling “the recession is here” and asking for pause when fed funds was actually below inflation (see Unemployment, Recessions, and the Potter Stewart Rule10-7-22).

The payroll softening seen this past month and some recent financial market turmoil (even just for 2 days) also can give the Fed ample room to ease (or more useful rationalizations). The inversion right now is starkly different from what we have seen across economic cycles and monetary policy history given that we’re now in what has been a sustained expansion. The current expansion overall frames up as the best in overall GDP and employment growth in the post-2000 period even if the post-2000 administrations saw nothing like the booms of the Clinton (see Presidential GDP Dance Off: Clinton vs. Trump 7-27-24) and Reagan years (see Presidential GDP Dance Off: Reagan vs. Trump 7-27-24).

The limits of Jan 2001 and Sept 2007 history…

Some of the brand name street economists were weighing in that -50 bps would be a good start since that is how the Jan 2001 and Sept 2007 easings kicked in. We would highlight those were starkly different markets under extreme stress. The 2007 transition from the credit market peak of June 2007 (recession began Dec 2007 as designated much later by NBER) saw the frozen credit markets follow into a material deterioration of risk pricing across the summer (see Wild Transition Year: The Chaos of 2007 11-1-22). The crisis was at the doorstep knocking.

The Jan 2001 easing came as TMT excess was bringing severe fallout. The recession risk and market turmoil was sending the economy into “the tunnel,” and that pushed Greenspan into extreme action (see Greenspan’s Last Hurrah: His Wild Finish Before the Crisis 10-30-22).

The year 2000 had seen +100 bps of hikes on the way to the Jan 2001 easing including a +50 bps hike in May 2000 while the current market has not seen a move in over a year (since July 2023). The TMT bubble parallel was very different than the Mag 7 excess given the role of debt (and seriously bad underwriting) across the late 1990s. Sept 2007 saw Bear Stearns in turmoil, Countrywide looking for a merger (de facto bailout) by BofA, and hedge funds were set to start dropping like flies. That was a financial stability threat via counterparty risks and asset price dislocation potential. Different world.

From our vantage point, the years 1998 and 2018 have more in common with today’s markets than Jan 2001 and are most definitely different than Sept 2007. The strange inversion backdrop from 3M to 5Y leaves room for -50 bps in theory, but the inflation worries are also different now. The Jan 2001 markets were coming off a mild inflation scare while 2007 was coming off a slew of small hikes across a bear flattening cycle from 2004 into 2006.

The next few rounds of releases this week such as Retail Sales and Industrial Production and then PCE later in the month will perhaps give the FOMC the ammo it needs to “make the call” on -50 bps, but -25 would seem more rational if we avoid more VIX turmoil and tech panics. The inflation relapse anxiety at the Fed is hard to gauge objectively.

The above chart breaks out the specialized CPI aggregates we like to watch each month. The “All items less shelter” line has been a recurring source of comfort. That is especially the case for those of us who see the implied, derived, Shelter line of “Owners’ Equivalent Rent” (OER) at almost 27% of the CPI index as a theory hatched during a “bad day at the faculty club.”

OER is disconnected from the household cash flow experience of most households. That is notably the case for those homeowners with no mortgage and rising home value or those with a locked-in low coupon, no change in monthly payments for the next two decades and a more valuable home. It is hard to capture inflation of an asset/service (lodging) that can vary so widely in its profile.

On a very small positive note, we see the “Services” line above with a 4% handle finally at +4.9%. We see more good news out of Goods again with deflation in Durables at -4.1% and low 1% handles on Nondurables at +1.3%.

The above chart breaks out the Big 5 CPI index buckets that comprise over 75% of the index. When we combine those with the “Add-Ons” we break out below, the line items in the two charts are almost 87% of the index. While most of these buckets are well known and broken out logically in the BLS data, we generated our own version of “Automotive” since it is such an important part of household economics (see Automotive Inflation: More than Meets the Eye10-17-22).

We covered each bucket in detail last month (see CPI June 2024: Good News is Good News 7-11-24), and this month showed very slight improvement overall in the YoY trend line on the back of Automotive with Food, Energy, Medical, and Shelter showing minimal action.

The above table details the YoY CPI numbers for a range of notable add-ons that factor into the lives of most households even if airline fares might be more a luxury for many. The lines add up to over 11% of the CPI index. We see a mixed trend line with 4 posting lower YoY inflation and 2 higher.

Recreation Services are well down from the peaks and Apparel is as well as two important goods and services lines. We would flag Apparel as a line that could be a major risk factor into 2025 if tariffs go off the rails. The dialogue on tariffs in the political discourse has been especially bad and disjointed as Trump was filibustering nonsense and Biden was mumbling on other subjects.

Maybe Harris will try to nail the topic down if they can get some moderators with backbones looking for facts. Then again, a backbone disqualifies the moderator from consideration. In the end, tariffs are inflationary although it is a challenge to get anyone and especially tariff advocates to admit the buyer pays and then explain the economic chain of transactions from there and how it flows into Goods and Services pricing.

As we have covered in other commentaries, blanket tariff threats (“across the board”) on all imports and a desire to see a weaker dollar clearly stated by Trump makes for a negative case on inflation risk in 2025. The House of Reps had their Border Adjustment Tax proposal of 2017 from the Ryan/Brady tag team (20% import tariff), and that bill indicated that it was predicated on a much stronger dollar being the outcome. Those guys should all get together and chat. The retail industry was making it clear at the time that such a plan would bankrupt the industry with their very skinny margins.

See also:

Footnotes & Flashbacks: Asset Returns 8-4-24

HY Pain: A 2018 Lookback to Ponder 8-3-24

Payroll July 2024: Ready, Set, Don’t Panic 8-2-24

Employment Cost Index: June 2024 8-1-24

JOLTS June 2024: Countdown to FOMC, Ticking Clock to Mass Deportation 7-30-24

PCE June 2024: Inflation, Income, and Outlays 7-26-24

2Q24 GDP: Into the Investment Weeds 7-25-24

GDP 2Q24: Banking a Strong Quarter for Election Season 7-25-24

CPI June 2024: Good News is Good News 7-11-24

Inflation Timelines: Cyclical Histories, Key CPI Buckets11-20-23