Another Volatile Week: Mini Market Lookback

Before we publish our more in-depth Footnotes series, we look back at a painful week as recession angst clashes with lofty tech valuations.

Hey, are there tariffs in that thing?

Stocks posted the worst week since March 2023 with the NASDAQ -5.8%, S&P 500 -4.3%, the Russell 2000 -5.8%, the Dow -2.9%, and oil (WTI) dropped back into the $60 handle range as “retreat” was the order of the day.

The recession focus was based more on forward-looking expectations and fears of a broader repricing rather than the actual payroll data or broader mix of economic data in historical context. CPI and PPI up next.

HY spreads widened notably to +339 bps but remain well inside the early August spike to +393 and dramatically below the long-term median HY OAS of +446 bps (since the start of 1997).

IG spreads once again demonstrated their resilience at +99 bps and IG remains more of a play on the UST curve in the fall.

The UST reaction moved back into a bull steepener pattern one week after a bear steepener as headlines recounted the traditional sequence of inversion, un-inversion, and then recession but this monetary vs. economic cycle has been anything but normal.

The week was supposed to be more a post-payroll swing vote on whether the FOMC would go with a cut of -25 bps or -50 bps, but the markets showed the stakes were higher than just the Fed. After the payroll release, the immediate reaction was to narrow the odds of -25 vs. -50 bps before the odds swung back toward -25 bps later in the day.

The 2Y to 10Y shifted into slightly upward sloping, but that is being seen by many as part of the recession playbook as curve will un-invert before the cyclical bell tolls after a tightening cycle. We have seen short end inversion moves into upward sloping very quickly in problem years such as 2007 (see Wild Transition Year: The Chaos of 2007 11-1-22). There is so much that is different now vs. Jan 2001 and Sept 2007.

The 2006-2007 market was a case study in excess with a systemically threatening oversupply of bad mortgages hanging over the consumer as well as the financial system. It also featured a structured credit market bender where counterparty qualifications required a light pulse (or a delayed death certificate). In the current markets, the 3M UST to 5Y UST and 3M to 10Y UST remain in a steep inversion. The 2Y to 10Y is either normalizing or signaling a step on the way to recession.

We believe that will depend on the election and how the Fed and consumer are addressed. The market is waiting to see what the FOMC might do to get the 3M UST to follow the 2Y UST.

FOMC cut debates continue…

Some of the brand name street economists are saying the first move will be -50 bps since that was the move in the last two big easing cycles starting on Jan 2001 and Sept 2007, but those markets looked very different than what we face today. The manic pace of easing after Jan 2001 was into a modest recession (the mildest in postwar history) but came heavily in response to the TMT bubble implosion and unfolding NASDAQ plunge and the longest (not the highest) default cycle in HY market history (see Greenspan’s Last Hurrah: His Wild Finish Before the Crisis 10-30-22).

The Sept 2007 easing cycle came after a summer of suspended animation in the credit markets as LBO deals were pulled, hedge fund canaries were going up in flames, Bear Stearns execs were being sacked, subprime RMBS was in a panic, Countrywide was looking for a savior (found one in BofA), and the recession would later be billed as starting in Dec 2007. The market was not calling it yet, but the global bank system was on death’s doorstep as that door opened later in 2008 and the great derivative counterparty crash rose up as a specter.

Overall, the payroll numbers for August 2024 were not that bad (see August 2024 Payrolls: Slow Burn, Negative Revisions 9-6-24), but the mix and negative revisions of June and July definitely were in line with a rolling series of weaker months. That has allowed for a shift in focus by the Fed more towards the employment mandate.

We will revisit the curve issue in the Footnotes publication on yields to be posted later this weekend. We get a look this coming week at the other side of the Fed mandate as CPI and PPI get reported.

The above chart updates the 1-week returns for the 32 benchmarks and ETFs we track each week. We see a score of 9 positive and 23 negative. 7 of the 9 positive ETFs are bond ETFs and 7 of the 8 in the top quartile are bond ETFs. The long duration UST 20+ year ETF (TLT) ranks at #1 by a healthy margin. The non-bond ETFs in the positive range included the interest rate sensitive Real Estate ETF (XLRE) and the defensive Staples ETF (XLP).

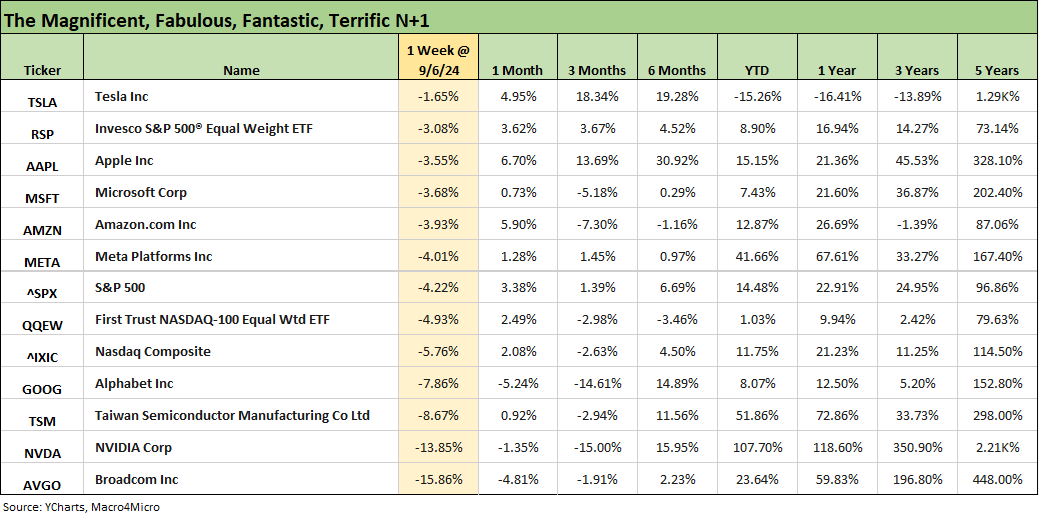

The above chart updates the weekly performance of the Tech bellwethers, which include the Magnificent 7 plus Taiwan Semi and Broadcom. We plot those each week against the NASDAQ, the S&P 500, the Equal Weight NASDAQ 100 ETF (QQEW), and the Equal Weight S&P 500 ETF (RSP). There was not much mystery to the week when the smoke cleared with all negative and NVIDIA and Broadcom in double digit negative range.

For the trailing 1-month period, only Alphabet (-5.2%), Broadcom (-4.8%), NVIDIA (-1.4%) were negative. NVIDIA posted -15.0% over 3 months with Alphabet at -14.6%. For the YTD period, the worst performer is Tesla at -15.3% with the rest all positive.

It may not feel like it right now, but the S&P 500 YTD is +14.5% and ahead of the long-term nominal returns on equities. To this point, the S&P 500 is ahead of the NASDAQ YTD. The S&P 500 is still +5.6 points ahead of the Equal Weight S&P 500 given where the running YTD Mag 7 numbers are to date.

The above chart updates the running excess returns YTD for HY and IG. HY remains ahead of IG in excess return and total return YTD through Friday, but the duration part of the return story could be in for a wild finish in the fall that includes a vote from the UST market after the election with respect to who will damage the UST curve (or damage it more).

The above chart details the reaction this week to the equity market beatdown. At +26 bps wider, the HY spread move was meaningful but mild compared to the early Aug whipsaw (see HY Industry Mix: Damage Report 8-7-24). HY OAS at +339 bps remains tight.

The above chart updates the “HY OAS minus IG OAS” differential. At +240 bps, the incremental compensation for stepping down the credit spectrum into the speculative grade basket is still very tight vs. the median of +328 bps. We see the 2024 low of +209 bps in July. This past week, IG spreads hung in well and HY widened more notably in the B tier by +39 bps.

The above chart updates the “BB OAS minus BBB OAS” for this week’s more modest HY whipsaw relative to the VIX panic of early August. At +82 bps, the incremental compensation is well above the July lows of +55 bps. The BB tier widened by +24 bps this week while BBBs only moved +6 bps.

Overall, the credit markets did not get too mangled in the tech selloff, and that can make for another distinction between 2024 and the 2001 and 2007 fed easing kickoffs. The Jan 2001 market especially had many leveraged TMT names that were ticking and revenue models failing as part of the tech overvaluation risks in equities.

See also:

August 2024 Payrolls: Slow Burn, Negative Revisions 9-6-24

Trump's New Sovereign Wealth Fund: Tariff Dollars for a Funded Pool of Patronage? 9-5-24

Goods and Manufacturing: Fact Checking Job Rhetoric 9-5-24

JOLTS July 2024: Mixed Bag, Hires Up, Layoffs/Discharges Up, Quits Flat 9-4-24

Construction Spending: A Brief Pause? 9-3-24

PCE July 2024: Inflation, Income and Outlays 8-30-24

2Q24 GDP 2nd Estimate: The Power of 3 and Cutting 8-29-24

Harris Housing Plan: The South’s Gonna Do It Again!? 8-28-24

Payroll: A Little Context Music 8-22-24

All the President’s Stocks 8-21-24

CPI July 2024: The Fall Campaign Begins 8-14-24

Total Return Quilt: Annual Lookback to 2008 8-14-24

HY Industry Mix: Damage Report 8-7-24

Volatility and the VIX Vapors: A Lookback from 1997 8-6-24

HY Pain: A 2018 Lookback to Ponder 8-3-24

Payroll July 2024: Ready, Set, Don’t Panic 8-2-24

JOLTS June 2024: Countdown to FOMC, Ticking Clock to Mass Deportation? 7-30-24)

Presidential GDP Dance Off: Clinton vs. Trump 7-27-24

Presidential GDP Dance Off: Reagan vs. Trump 7-27-24

2Q24 GDP: Into the Investment Weeds 7-25-24

GDP 2Q24: Banking a Strong Quarter for Election Season 7-25-24