Total Return Quilt: Annual Lookback to 2008

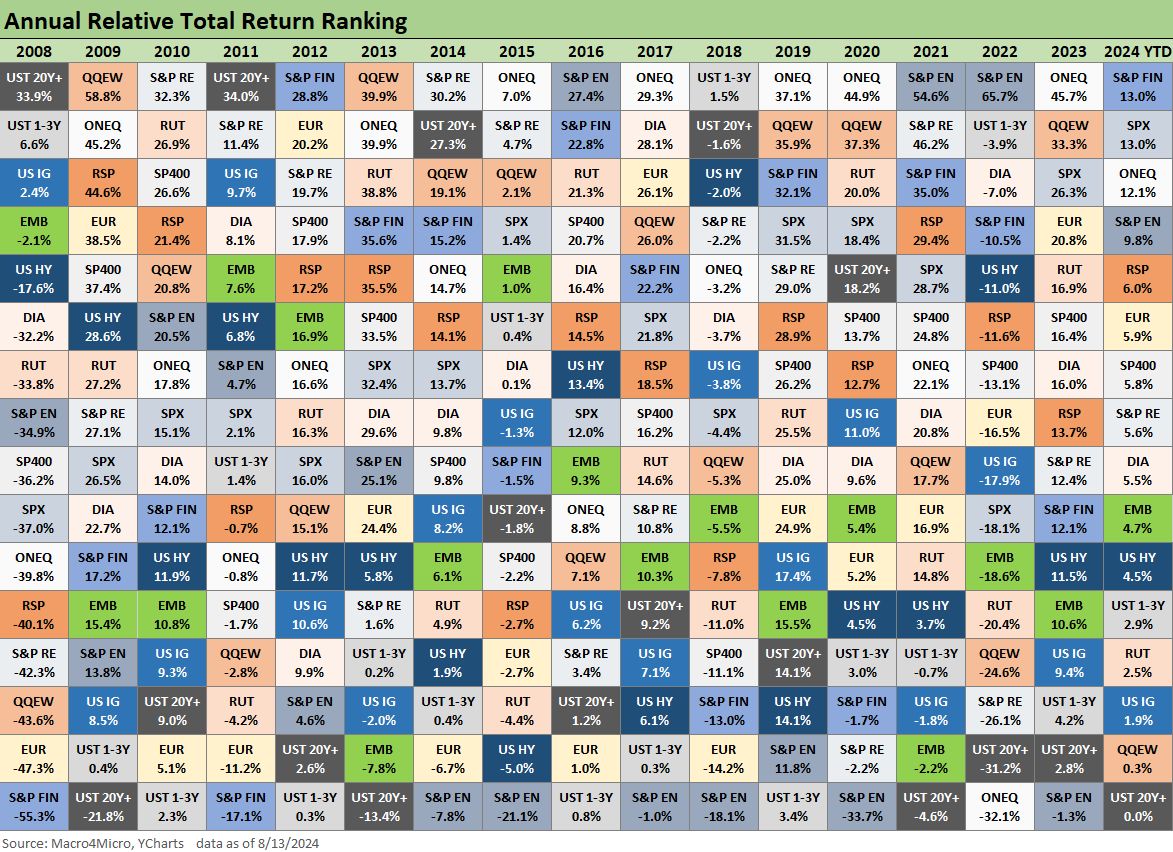

We look back at annual total returns from 2008 in our multiasset class quilt with 16 debt and equity categories.

That ride wasn't so bad...

We update the annual total return quilt for 16 asset classes since 2008 as tech-centric benchmarks keep riding to the top of the list for almost half of the years.

The healthy position of Financials YTD is a vote of confidence that clashed with the recent VIX noise with the broad market benchmarks just behind.

The worst winning score since 2008 was the minimal #1 return for short UST ETF in 2018 that also had a few 1,000-point drops in a late cycle year that eventually required the Fed to ride to the rescue in 2019.

The above chart updates our total return quilt across a range of debt and equity benchmarks of asset subsectors or broad major industry proxies in the form of ETFs (Energy, Financials, Real Estate). We use annual numbers from 2008 and wrap the quilt with YTD 2024. The 16 asset classes thus cut across the returns during 16 full calendar years and for the 17th year is 2024 YTD.

The mix of asset classes and sectors or their ETF proxies were chosen to offer some variety and based on our desire to have a data series that includes 2008 as the “year of years” with a systemic debt crisis and market meltdown. The bounce into 2009 saw a continuation of ZIRP as the longest recession since the Great Depression hit a trough in June 2009.

Some of the ETFs that we use in our weekly “Footnotes” publication did not go as far back as the year 2008, so we selected others. We include a mini glossary of the ETFs at the bottom of this commentary, but most are easily identifiable.

The scoresheet shows the major tech-centric benchmarks (NASDAQ Composite, Equal Weight NASDAQ 100) ranking #1 in 7 of the 16 full calendar years with the S&P Financials and S&P 500 in a dead heat YTD 2024 (8-13-24 pricing). Tech was the runaway winner in the ranking contest, and that outcome reflects both competitive advantages in the US and the tailwinds for growth stocks across a period of easy money and protracted ZIRP, QE, and slow normalization periods. 2021 was a bubble for anything that remotely hinted tech (including services such as Peloton and Carvana).

Some other interesting swings in the chart include the following:

Energy: The energy sector comes in second with a #1 ranking 3 times. The bounce off the distressed lows in early 2016 shows energy racing to the top. The bounce off the COVID collapse drove a very strong 2021 and then Ukraine-Russia kept Energy on top in 2022.

Real Estate: Low rates also led to a protracted real estate cycle and made income stocks such as REITS that much more attractive. Real Estate is trying to make a comeback in 2024 (see Footnotes & Flashbacks: Asset Returns 8-11-24) but dividend stocks have a long way to go and need more UST yield curve support.

Financials: We see the S&P 500 Financials sector winning the top ranking twice with 2012 the year that Mario Draghi’s “Whatever it takes!” in July 2012 sent systemic anxiety back into hibernation. That was after some very rough flashbacks to 2008 with Greece in 2010 and the broader Europe sovereign worries after and UST downgrade and debt ceiling default risk in the summer and fall of 2011. The bounce in bank equities and subordinated layers of bank paper was impressive.

Long duration UST: We see the 20+ Year UST ETF (TLT) on top in 2008 as the world’s bank system was collapsing on fears from interconnectedness risk and bailout panics. ZIRP was rolled into place, and the flight to quality was more like a wave of freighters carrying the panicked. The long duration ETF was right back into systemic panic mode in 2011.

Cash and short UST: In this quilt we use a 1Y to 3Y UST ETF (SHY), and that carried the day on one awful year for the markets in 2018. That was a year where duration and risk lost whether in stocks or credit (see HY Pain: A 2018 Lookback to Ponder 8-3-24). Given the historical yields on cash and short UST, that year qualified as the worst return for a #1 ranking in this mix of asset classes going all the way back to the founding on bond indexes and use of money market funds. That is not much bragging rights for the “greatest economy in history” as the Trump years have been billed (by Trump). During 2019, the FOMC eased 3 times and risky assets got rolling again and got a little support from the post-election split in Washington to prevent crazier actions being taken on the legislative side even as tariffs and trade retaliation stalled corporate investment and exports.

We go through our share of historical lookbacks to ponder past and prologues angles. These sorts of charts are useful as a mental exercise in looking at the swings across market events, policy actions, cyclical changes and even strange one-offs such as bank system crises and pandemics. Since 2008, the market has had a few 100-year floods. Given geopolitics (China, Russia, Iran) and refusals to honor elections, Jan 6 as a warmup (?), and some deranged people on the ascent in Washinton, it is hard not to consider a very wide range of potential outcomes.

Glenn Reynolds, CFA glenn@macro4micro.com

Kevin Chun, CFA kevin@macro4micro.com

See also:

Footnotes & Flashbacks: Credit Markets 8-12-24

Footnotes & Flashbacks: State of Yields 8-11-24

Footnotes & Flashbacks: Asset Returns 8-11-24

HY Industry Mix: Damage Report 8-7-24

Volatility and the VIX Vapors: A Lookback from 1997 8-6-24

Footnotes & Flashbacks: Credit Markets 8-5-24

Footnotes & Flashbacks: State of Yields 8-4-24

Footnotes & Flashbacks: Asset Returns 8-4-24

HY Pain: A 2018 Lookback to Ponder 8-3-24

Payroll July 2024: Ready, Set, Don’t Panic 8-2-24

Employment Cost Index: June 2024 8-1-24

JOLTS June 2024: Countdown to FOMC, Ticking Clock to Mass Deportation 7-30-24

Footnotes & Flashbacks: Credit Markets 7-29-24

Presidential GDP Dance Off: Clinton vs. Trump 7-27-24

Presidential GDP Dance Off: Reagan vs. Trump 7-27-24

2Q24 GDP: Into the Investment Weeds 7-25-24

GDP 2Q24: Banking a Strong Quarter for Election Season 7-25-24

The B vs. CCC Battle: Tough Neighborhood, Rough Players 7-7-24