CarMax F1Q25: Ringside Update on the Used Car Market

We look at the latest details on the used vehicle market from CarMax as the leader in the space.

"Sourcing used cars is no picnic these days..."

CarMax (KMX) numbers continue to show lackluster price and volume trends in used cars as the recovery of new vehicle volumes and high consumer funding costs undermine the used space.

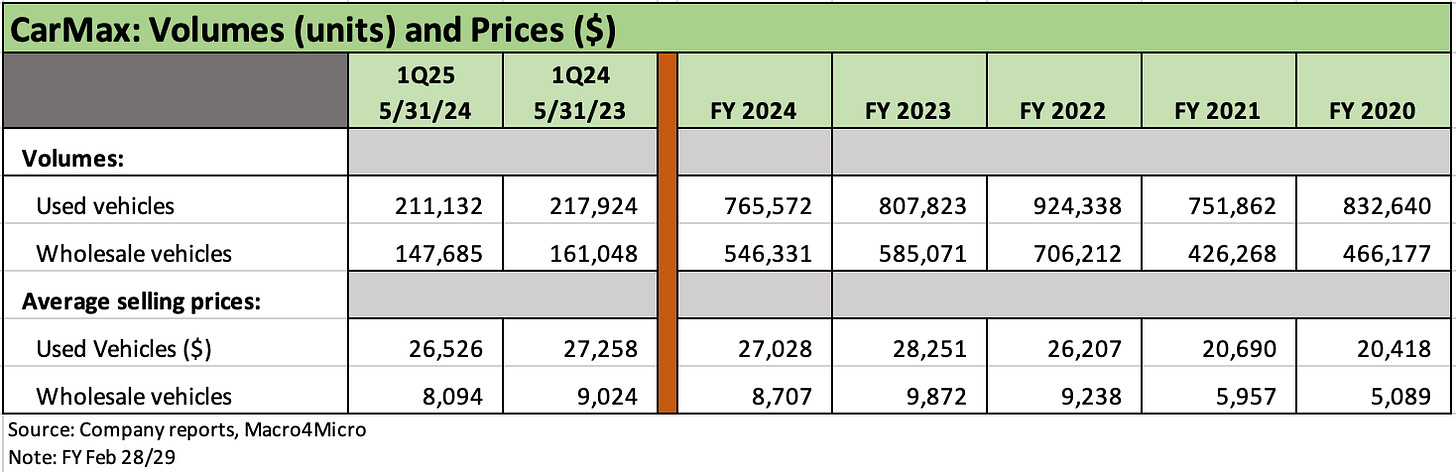

We update KMX used vehicle retail and wholesale prices, which are well off the inflationary peaks and down YoY. Prices to the consumer still materially higher than the pre-COVID period.

The peak spring selling season and summer is shaping up as a mediocre one for used car players. Coming headwinds include fewer lease returns and stubbornly high borrowing rates for consumers at north of 11% at KMX.

Sourcing challenges will remain a fact of life for the used car business into 2H24 and 2025 with the lease returns complicating the availability of late model used vehicles.

The chart above shows how a few bellwethers in auto retail have performed since the peak of the COVID crisis. We start the time series at 3-23-20 as the meltdown in the credit market was peaking and was the low point in HY bonds. Powell and Mnuchin were scrambling to keep the credit markets from shutting down.

The ride for digital retail player Carvana in the chart is an especially wild one given the tech bubble in 2021, the ensuing crash, and eventual distressed debt exchange (a default in substance). Meanwhile, the much safer and less volatile KMX did not see the wild price action but also has not been able to make its case that it can drive a growth story that merits a higher multiple or more optimistic earnings forecast. KMX now sits on the bottom of the returns over that time horizon even if owners were spared the Maalox moments of CVNA owners.

AutoNation, as a diversified “classic” franchise dealer model, has continued to throw off waves of free cash flow, buy back shares, engage in bolt-on deals within a consolidating dealer space, and can watch and plot out its next moves (likely M&A).

Used vehicles cut a wide swath across the consumer markets…

We update some trends in the used car market using industry leader CarMax as a microcosm of the used auto retail subsector. The role of used cars in framing macro risks runs the gamut from the availability of auto consumer credit across car rental company risks (residual value cash impact), auto lender risks (loss on repossession) to ABS health (overcollateralization, etc.). See the links below for more of the background on those topics.

That used car rental connection has been hammered into us over the years with the travails of Hertz and how residual value risk can translate into cash flow stress and setbacks in both stocks and bonds. HTZ has already revisited more pain in this cycle (see Credit Crib Note: Hertz (HTZ) 5-14-24). The only name in this chain that can rival Hertz for drama is Carvana (see links at bottom for more on this high flyer, deep diver, and recent rebounder).

For CarMax narrowly, they are not a rated public bond issuer but KMX is a major counterparty exposure with a large securitization and auto lending presence (see CarMax FY 2024: Secular Neutral? Or Cyclical Gear Shift? 4-16-24). We view KMX as investment grade caliber or equivalent risk.

We can look to the Big 6 public dealers for a read on used car markets and shifting consumer tastes in a high inflation and high interest rate market, but KMX offers a very good read from the trenches. The vast majority of its used vehicles are sourced from customers (vs. dealers), and KMX has a large base of retail used car buyers (#1 in the industry). Much of that sourcing is off KMX’s Instant Appraisal service. KMX uses the two-way traffic of its online appraisal and offer capabilities to drive volumes across its omnichannel model.

The bottom line signal we see in the KMX numbers is a mild fade in the consumer, lower prices, lower volumes, and the toll of a lingering strain on affordability that understandably has taken KMX off growth mode. How Carvana can make a revenue growth story in such a market will continue to be tested, but CVNA at least has finally posted some meaningful revenue growth again last quarter and broke through the barrier of covering their post-debt exchange interest expense and minimal capex (see Carvana: Counterattacking in Style 5-6-24). The franchise retailers have Parts and Services and a range of Finance and Insurance products (F&I) that they lean on to mitigate cyclical risks.

The above chart updates the retail used vehicle market prices for the KMX revenue line. The jump in prices since COVID and the new vehicle supplier chain meltdowns brought a mix of curses and blessings. The blessings were for those who had used car supply, and the curse was to consumer affordability.

The supply-demand imbalances and disarray in components (notably semis) saw used vehicle prices increase from a mix of $19K handles in parts of calendar 2019-2020 to the high $20K range. When looking at the LMX “fiscal quarters” above, it is important to keep in mind the February fiscal year. That is, FY 2021 is mostly the 2020 “year of COVID.” The peak used car price quarter of over $29K occurred as the 2021 calendar year flipped into calendar 2022. That was a time when used car CPI lines ran off the charts to the 40% area (see Automotive Inflation: More than Meets the Eye10-17-22).

The above chart details the KMX wholesale history for used vehicles, and we see a move from $5K and even $4K handle up to north of $11K at the peak. We see the market back to the $8K range now after the new vehicle market came back to life in a big way in calendar year 2023, but that is still a massive spike from pre-COVID.

The new vehicle SAAR rates of 12-13 mn units were seen in numerous months of 2021-2022 (the low tick was 8.5 mn in April 2020). Those were recession-level volumes despite high demand. The new vehicle production recovery in calendar 2023 and into 2024 has given a lot more product options and bolstered supply to new car buyers. That brings more trade-ins as well. We also have seen a rising base of incentives provided by the OEMs.

Beyond the headwinds of the price increases for both new and used vehicles from the pre-COVID periods, the increases in customer financing costs are well known to the potential buyers but do not show up in the headline inflation numbers. For KMX, with its relatively higher quality borrower base in used car financing, the contract rates as of F1Q25 rose even higher above the 11% threshold to 11.4%, up from 11.1% in F1Q24 and from below 10% at the end of FY 2023. Higher prices and higher monthly payments literally add up for the consumer facing a spike in auto insurance at the same time. Russia did not help with gasoline starting in 2022. Maintenance and repair costs have also been painfully inflated.

The above chart reflects the trend lines that are impossible to escape since the supply-demand imbalances of new vs. used cars. The biggest price pops in used vehicle revenues overlap mostly with FY 2022 and FY 2023. We see lower volume and lower prices in FY 2024 and into FY 2025 as detailed in the charts below. Gross profits and volume peaked in FY 2022 (i.e. mostly calendar 2021) in a ZIRP world short on a helpful supply of new vehicles. Prices for used retail vehicles peaked in FY 2023 (primarily calendar 2022) and the same for wholesale prices as detailed in the chart below.

The above chart offers granularity on prices and volume across the retail used vehicle side of the business as well as in wholesale. The earlier price bar charts above showed sequential upticks in F1Q25 but with prices lower YoY.

The above chart shows gross profits in total and per unit by category for retail and wholesale. The trends have been unfavorable after the earlier boom. Rising volumes of new cars can increase the supply of used, and so can the car rental fleet activity. However, there is more than a little competition in used vehicles across CarMax, Carvana, and the major dealers.

Total gross profit in retail used and wholesale was weaker in 1Q25. The gross profit per unit (GPU) performance was down only slightly in F1Q25 but ticked marginally higher in wholesale GPU.

The above chart updates the available disclosure for CarMax Auto Finance that comes with the KMX press release. Note: We updated the four quality trends data points for 1Q25 1 day after the original report was published since we needed the 10-Q for those last items. The trends in those stats is directionally in line with expectations as all four (credit losses, past dues and recoveries) show an erosion in quality. The rise in credit losses is in line with the FY 2024 experience vs. FY 2023.

One trend we have seen with more dealers in new and used alike is more focus on Finance & Insurance products. CarMax will be in that mix with dealers such as AutoNation (AN) (see Credit Crib Note: AutoNation (AN) 6-17-24) and Lithia (LAD). Both AN and LAD are building out captive finance operations and are distinctive in that regard within the major public franchise dealers. LAD is the #1 in both new and used among franchise dealer peers (i.e. ex-KMX and CVNA) and AN is #2 in both.

We already covered the finance operations in earlier commentaries (see links) and to this point the use of more securitizations and ABS funding alternatives gets more airtime from the company with respect to both prime and nonprime. The average managed receivables balance is at a multiyear high on modest growth.

As noted in the earlier tables, CAF income was at a 3-year low in FY 2024 but ticked higher in 1Q25 YoY. Provisions were down only slightly YoY in FY 2023. Net loans originated in 1Q25 were down slightly vs. 1Q24 after FY 2024 was down more meaningfully vs. FY 2023 on declining unit sales volumes.

The higher credit loss stats for 1Q25 clash somewhat with the sideway loss provisions and lower loan allowance % receivables YoY. That is something to watch. With credit loss experience rising in 1Q25 and FY 2024, past dues rising, and recovery rates on repossession declining, the allowance should be higher and the same for provisions (in theory). Otherwise, you start to get concerned about earnings quality along with asset quality.

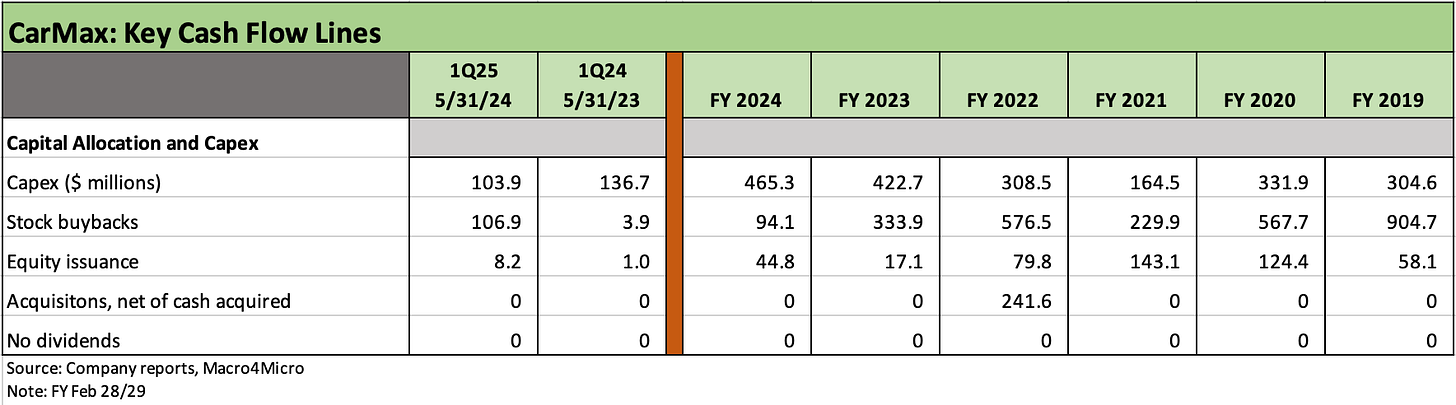

The above chart breaks out the cash flow lines over the year. We already looked at these histories in other recent reports and the main point is that KMX has done minimal M&A. KMX does not pay a dividend as a matter of choice and has indicated it does not intend to. KMX buys back stock opportunistically.

KMX posted a recent market cap of $11.4 bn (6-25-24), which is above the #1 public franchise dealer market value at Penske ($10.1 bn). PAG’s market cap is followed by Lithia at $6.9 bn and AutoNation at $6.4 bn (see Auto Sector Equity Performance Update: The Dealers 6-17-24).

In fantasy land event risk scenarios (nothing in the news, just a thought), one cannot help but wonder whether an omnichannel player such as KMX could merge with a major public franchise dealer and look to expand opportunities in high margins parts and services and broaden the scale of F&I products and digital capabilities. Facilities, personnel, OEM relationships, and the evolution of business models would seem to make it a workable scenario. That is “make believe” and for another day. If slow growth continues, consolidation noise will also continue in auto retail.

The above chart updates the KMX balance sheet. KMX is not aggressive in its use of debt and has not been an event risk story as a distinctive and unique player in the auto retail space. Net debt of $1.4 bn sitting above over $11 bn in equity market value, healthy cash flow, and a considerable amount of owned real estate with an established brand in a core consumer market does not make for a risky financial story. Lately there also has not been an earnings growth story for equity holders.

See also:

CarMax:

CarMax FY 2024: Secular Neutral? Or Cyclical Gear Shift? 4-16-24

Credit Crib Note: CarMax (KMX) 2-21-24

CarMax: Credit Profile 7-9-23

CarMax: Credit Profile 4-11-23

Auto Retail:

Auto Sector Equity Performance Update: The Dealers 6-17-24

Credit Crib Note: AutoNation (AN) 6-17-24

AutoNation 1Q23: Company Comment 4-23-23

Automotive: Comparative Performance for Auto Retail, Auto OEMs, and Suppliers 4-2-23

Auto Retail: Industry Evolves with Steady Bolt-Ons and Expanding Services 2-27-23

Penske and Auto Retail: Not Signaling Consumer Weakness and the Market Agrees 2-10-23

The Used Car Microcosm: Industry Comment 11-29-22

Car Rental:

Credit Crib Note: Hertz (HTZ) 5-14-24

Not Your Father's Hertz 2-7-23

Credit Crib Note: Avis Budget Group (CAR) 5-8-24

Avis: Gearing Up for a Transition Year in Fleet Costs 5-2-24

Avis: Credit Profile 8-3-23

Avis: Cash Flow Boom and the Swing in Car Rental 2-17-23

Carvana:

Carvana: Counterattacking in Style 5-6-24

Carvana: Mornings After and Crowd Chasing 3-4-23

Carvana: Solid EBITDA, but Does Not Cover GAAP Interest 2-25-24

Carvana: 3Q23 Quick Read, Long Road 11-2-23

Carvana and Uncertain Used Car Dynamics 10-5-23

Carvana: Smoke Signals Get Smokier 6-9-23

Carvana 1Q23: Company Comment 5-4-23

Carvana: Prisoner’s Dilemma, Used Car Getaway 3-22-23

Carvana: Credit Profile 3-5-23

Carvana: Mornings After and Crowd Chasing 3-3-23

Carvana: Wax Wheels 12-8-22