The Used Car Microcosm: Industry Comment

Used cars feature inflation debates, digital retailing execution, consumer durables demand, and growth story valuations.

In this commentary, I look at some moving parts in the used car market, which is one of numerous important consumer sector subplots as financing rates rise and affordability gets squeezed.

The used car markets have captured more headlines than usual in recent years after the Hertz fleet drama in Chapter 11 and now the Carvana valuation meltdown shows the downside risk and unsustainable rise in used car prices.

New and used vehicles will keep getting a lot of scrutiny given the important role autos still play in the 2022 inflation picture (see CPI: The Big 5 Buckets and the Add-Ons and Automotive Inflation: More Than Meets the Eye) as used car prices show sequential weakness in a case of “micro pain” for companies but macro gain in inflation relief.

A very complicated year lies ahead for the auto cycle with many moving parts across inflation effects, recession risk, affordability pressures for households, supplier chain threats that still lurk, uncertain gasoline inflation, and all those variables set against a backdrop of geopolitical tension with direct impacts on the outcome.

Dealers and retail channels have been front and center this cycle…

Changing models of mobility and retail have brought impressive innovation and billions in capital invested in infrastructure and technology. The investment cuts across auto dealers, channels of distribution, and technologies designed to more efficiently source, appraise, and finance inventory. As used cars are major ticket items for the average household, used car markets have become a major of the fintech evolution in process and product innovation.

The investment has given rise to all-new public companies in the debt and equity markets. In the past, I watched the used car market in connection with prior roles where I followed Hertz and Avis. Looking into the trade rags over the years, I would see news flow highlighting waves of venture money aimed at the space, from small ventures to bigger gambits, in changing how auto retail operated. This mirrored capital flows seen more broadly in other service subsectors within the diversified mobility space (ride hailing, car sharing, subscriptions, fleet management, etc.) where a lot of tech initiatives were underway. Some summarize the whole show as the “Auto and Mobility Ecosystem,” and others with names like “Auto and Mobility Solutions.”

You can choose to group the mix of business lines in different ways (manufacturing vs. services vs. finance and insurance (F&I), but the bigger picture is about efficiency, price discovery, managing unit costs, and boosting margins. The timeline saw progress in the auto chain from manufacturing to selling and financing. The industry was also extracting more asset lite services revenues. The trend was one of evolution of mature industries, but the structural changes also brought a considerable amount of speculative business models hungry for debt and equity capital (Uber et al. at the top of the list in mobility).

The changes touched fleet management and car rental in a major way, but the retail side of the ledger is one that has been very active during a COVID period where vehicle prices were dislocated for a range of reasons. The “too far, too fast” effect is now coming back to haunt some companies who overleveraged (Carvana) or had business models that saw too much valuation hype (Vroom, Shift, CarLotz).

2022 brought a material adjustment to some major auto retail valuations…

Below we break out the trailing total returns for the franchise auto dealers and frame those against the dynamic duo of used cars – CarMax as the industry leader in used cars and Carvana as the digital ecommerce headliner and aggressively expanding upstart. Over longer time horizons, the franchise dealers frame up well given the steady roll-ups in a highly fragmented industry running in parallel with substantial investments in technology to support efficiency and F&I initiatives. In a bad year for equity benchmarks, the public dealers saw some dispersion among the leaders, but most beat the broader market. Interestingly, Lithia has been the most aggressive and the stock faltered YTD. Over 10 years, LAD is on top. Over 5 years, the dealer industry overall look great, but Penske wins. From the immediate pre-COVID period of late 2019 through today, Penske and AutoNation came out ahead.

The used car sector has had a much rougher ride relative to the franchise players. CarMax was soundly beaten in equity performance vs. the major dealers. I will be looking more at such topics in future commentaries. Obviously, the collapse of Carvana’s valuation jumps off the page at -97% YTD. With unsecured bonds running in the low to mid 40 dollar price range lately (reported 44 area to start the week), the situation there is much more dire.

Within used cars, CarMax was investing heavily in recent years in digitalization and ecommerce capabilities to stay at the front of the curve as upstarts such as Carvana were being assigned outsized valuations. Meanwhile, the traditional new car dealers debated the merits of aggressive used car expansion whether under new brands or traditional formats. You can debate how to rank the dealers (most recent quarterly revenue, retail revenues only, market cap, etc.), but Lithia has surged into Big 3 dealer status with AutoNation and Penske. Group 1, Asbury, and Sonic are in the next tier.

As the auto retail industry moves into a tougher earnings year in 2023, we will likely see some strategic shifts with some major dealers having a history of struggles in used cars going back decades. The opportunities were just too compelling when used car demand was in a secular rise before COVID and then became part of a price spike and inventory imbalances during COVID, as chip shortages strained the new car production chain.

Used cars will have a big bucket of uncertainty to carry in coming quarters. We already are seeing some financial carnage and valuation pain in used car startup operations in traditional dealers and some of the small cap tech names in auto retail business lines such as Vroom (-88% YTD return), Shift (-92% YTD), and CarLotz (-93%). This last group is in the “ecommerce” bucket. CVNA uses this label to describe itself in its filings. This category is not “great company” in a struggling market.

The Franchised Auto Dealers expanded impressively in recent years as M&A picked up in a space where private operators dominated the rankings by number of companies (but not the top tier of market share). The Big 6 of public dealers (LAD, PAG, AN, GPI, ABG, SAH) gained broader street coverage as they also got busy in used cars and executed on multitiered expansion of digital capabilities. Warren Buffet entered the space as a Top 10 player back in 2015 via Berkshire Hathaway’s purchase of Van Tuyl Group. In terms of dealer capex needs, all of these names will have to invest heavily to prepare for EV adoption and high OEM spending requirements for getting EV inventory.

For some time, venture capital has been aiming at the dealer sector services supplier chain for new and used car needs. The increasingly tech-centric and data-driven nature of so many aspects of the business (customer targeting, sourcing vehicles, F&I products, appraisals, wholesale auctions, etc.) was a natural for venture money. The used car sector was another frontier waiting to be streamlined by technology just as we saw in other personnel-heavy industries such as real estate brokerage. Digital transformation and online alternatives led the way, and that always brings big winners and big losers. Some of the hot new names on the block are feeling some pain now.

The used car market offers an important window on the consumer sector…

As I try to find some of the best proxies that reflect the life of the consumer, the housing sector and car markets are usually at the top of my list. A place to live and a means of mobility are arguably the two biggest outlays for the average household. If we consider automotive expenses as a recurring outlay across replacement cycles and drop in maintenance/repair and insurance, the numbers are second only to food among non-housing categories. That reality runs across all the economic tiers and layers of consumer credit quality. The used car market sees 40 million used car transactions a year vs. a more typical new car transaction volume of 15-16 million units. That is a lot of action.

Those consumer sectors (housing and autos) are also highly sensitive to interest rates and shifts of the yield curve given the important role of mortgage finance and auto loans. Even if student loans have blown past auto loans in terms of systemic scale, auto finance touches a very wide range. Historically, just under 90% of all commuters commute by light vehicle, and out of this group approximately 75% drive to work alone. The fact that student loans are such an onerous burden is another reason that used cars will remain a core menu item for those in need of mobility. Shelter costs are still very high vs. pre-pandemic levels and new and used cars are both high in absolute terms and higher YoY.

Beyond shelter and student loans, food as a category has stubbornly spiked (even if the rate of increase should slow at some point) and heating and electricity bills have soared. Together, these pressures are inciting a consumer culture of increased credit card use with the “buy now-pay later” trend very much in evidence on Black Friday. Stretched household budgets are going to keep vehicle buyers considering the used markets with the main decision point being “how used?” and what make and model. CarMax has cited the higher demand for older vehicles as it indicated that some of the older cars, that would traditionally be moved into the wholesale channel, were moved over to the company’s retail operation. That is a clear sign of the times for the consumer’s financial pressures.

New cars and light trucks part of the supply-demand equation…

The new car cycle exerts a major influence on used cars based on supply-demand and ATP trends (Average Transaction Prices) and any related incentives. That new car supply effect on used was dramatically in evidence across 2021 as used cars soared. The consumer chasing used cars raised the worries around buyers circling more car than they could really afford, thus jeopardizing their ability to pay in a downturn.

On new vs. used pricing dynamics, if too many cars get made and generous incentives are offered, used vehicle valuations suffer. (This was a problem well before the pandemic, but excess new car supply certainly is not the main event now.) Conversely, if production is derailed by either a pandemic or a “chipdemic” (as one of the trade rags dubbed the semiconductor shortage), then supplier chain issues lead to inventory shortages in new cars and inventory shortfalls. In this case, the market sees higher prices for both new and used vehicles, but with a narrowing price gap between the two.

If new cars are not selling in higher numbers, there also are fewer trade-ins. That tightens up used car supply as well. If travel temporarily melts down (as in 2020) and car rental fleets shrink, then there are fewer late model used cars to buy as they get remarketed across travel seasons when those fleets get downsized. Similarly, slower new vehicles sales mean less retail leasing activity and thus less lease roll-offs at the usual lag around travel seasons. In recent periods, new car dealers have seen lower lease share.

Off-lease retail or rental fleet downsizing have always been a major source of late model used cars. We now have a very strong travel market and new car inventories are picking up, but the monthly payments associated with buying a light vehicle are rising and staining affordability. This means used car prices will be feeling the “payback” effect of the distortion of 2020-2021, but used cars will see solid demand over time as the more economic and rational “new vs. used” price differential finds its equilibrium. This transition period is going to see squeezed margins and essentially marked down inventory via higher depreciation. In this case, the depreciation is, in substance, an inventory markdown.

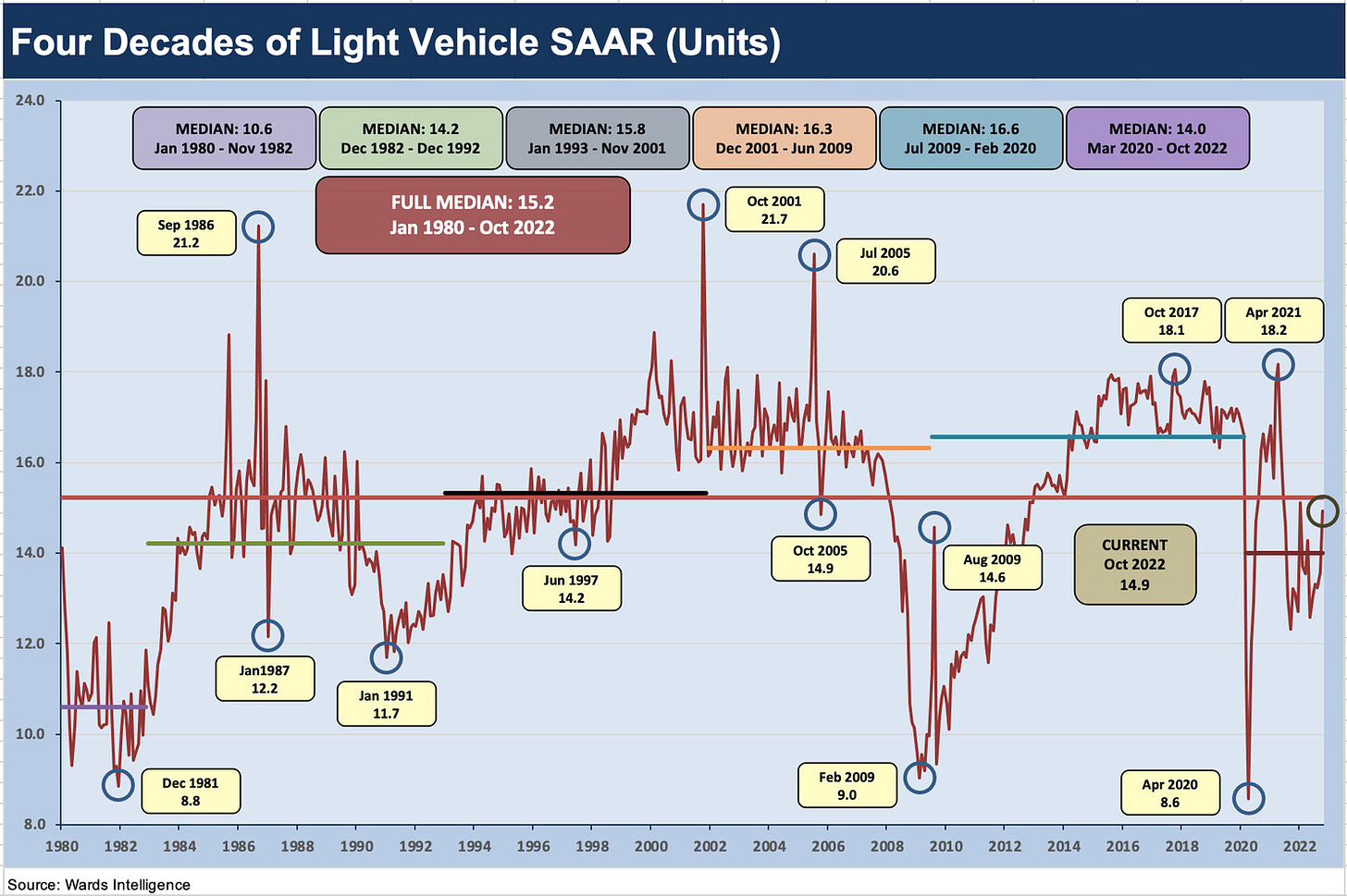

The above details the SAAR history (“seasonally adjusted annual rate) across the months from 1980 to Oct 2022. The new car time series for light vehicle sales posted above has a lot of history in it for discussions on other days and in other commentaries, but for now we would highlight the 15 million handle long term median for SAAR rates from 1980 to Oct 2022. We plot the monthly for a reminder of how volatile life can get in the new vehicle business from time to time (clearance sales, tax law changes, systemic meltdowns, bankruptcies, strikes, cash-for-clunker programs subsidized by the government, and of course pandemics and supplier chain disruptions more recently.

We chose some medians using NBER dates and some using our own memory banks of interesting starts and finish dates. We detail “official” expansion and recession dates in earlier commentaries (see Business Cycles: The Recession Dating Game and Expansion Histories: Recoveries Lined Up by Height). The median from the start of the longest postwar expansion, July 2009, through Feb 2020 (cyclical peak just ahead of COVID) was 16.6 million units. That was just above the median from Dec 2001 (start of the business post-TMT business cycle expansion) to June 2009 (credit crisis recession trough) during the housing bubble and ensuing credit crisis. That period posted a median of 16.3 million units. Since March 2020, the median has been 14.0 million units, which is quite low for new light vehicles in historical context.

We see 14.2 million units from Dec 1982 through Dec 1992. That timeline covered the period from the end of the 1980-1982 double dip recession on through the July 1990 recession and rolls into the next expansion. I was covering autos at the time, and that was a tough cycle, especially for Chrysler as its long bonds went to around 50 cents on the dollar. 1992 marked a major rebound for Chrysler bonds but GM stayed in a struggle and saw a lot of management turmoil into late 1992-1993. The CEO was sacked as GM was seeing a fair amount of financial stress. GM was downsizing its operations in a process that took multiple cycles on the way to its 2009 bankruptcy.

I will look at new car trends more in other commentaries but would highlight the early 2009 collapse as the credit crisis escalated and as GM and Chrysler were heading toward Chapter 11. The light vehicle SAAR saw a string of 9-handle and 10-handle SAAR numbers after Lehman. The Cash for Clunkers program in the summer of 2009 shows up as a spike during 2009 in the chart above. COVID rivaled that plunge briefly. The utter insanity of the moves in new vs. used cars after COVID included the dealers and manufacturing operations closing and the general panic across dealers around what to order and how much. April 2020 saw the first 8 handle SAAR since 1981, and the market then turned around and put up an 18-handle month only a year later.

Used Car Topics to Ponder

Carvana is in the headlines for a reason: The de facto collapse of Carvana in the markets is not without easily identifiable, objective reasons. The wild ride in CVNA stock included the same type of growth equity frenzy seen in many other names in the post-COVID speculative stock wave. The equity valuations at the time made no sense in the context of peers. The valuation was tied to the same type of assumption-heavy forward valuation methodology that brought the world the TMT bubble in 1999, and the market is now looking at a company with LTM negative EBITDA of -859 mm set against a total debt number of $7.1 bn. That is just ugly.

The unsecured senior notes within that $7.1 bn in total debt that more than doubled during 2022 from $2.45 bn to $5.7 bn just as inflation was rising and the used car market was overdue for a material “normalization” (aka “major decline”). The income statement and cash flow at CVNA have not even felt the full force of the adverse conditions now hitting used car markets and unit profitability. So the 4Q22 quarter into the 2023 period will be a wild one.

Carvana can make a good case that it has built a very valuable franchise value, but the near-term demands will rule the story line. Today’s earnings and cash flows trumps the discounted value of tomorrow’s promises. Negative EBITDA will remain the reality and the potential for material losses in 2023 is tied to high embedded costs after all the expansion and very competitive marketplace for used cars. CVNA will still be going head-to-head with the financially solid franchise dealers and a very well positioned used car incumbent and industry leader (CarMax), who will not be standing still watching.

A situation with a heavily leveraged tech-centric enterprise bleeding on the EBITDA line, seeing material headwinds, and possibly in need of debt restructuring is not a new concept in US HY or in growth stock history (think TMT bubble). Overpriced acquisitions (e.g., ADESA auction assets) with bullish assumptions framed at exactly the wrong time in a highly unpredictable cycle is not a new phenomenon. That is especially the case when companies scramble to accelerate their lead in a particular area (in this case digital retail and online used car sourcing and selling). The setbacks in the market will give competitors an opportunity to play catchup. We are not diving into the full Carvana financial risk story line now, but the picture is a very grim one as the stock (-97% total return YTD) and unsecured bonds (the 2030 bonds trading in the low to mid 40s of late) have made clear. I will look at CVNA in later commentaries.

To be clear, I am not offering an investment opinion on Carvana here. The market has made a strong statement at this point. The risk for stockholders is that bondholders may end up seeing a solution like Hertz as workable (full recovery). In that outcome, the idea is that debt investors sit tight while distressed debt players patrol for weak holders or those who just don’t need the headache. If it were only that easy. Unlike Hertz (and more like Hovnanian), CVNA has insider family control of voting via super voting shares. That complicates the scenario spinning when the family controls all decisions.

The voting control in theory makes it hard to bring in private equity capital partners who don’t have a major seat at the governance table. New equity capital could just wait or seek to play the distressed unsecured debt and then see the game play out. For CVNA leadership, limping along and gathering more liquidity (getting fully encumbered) is likely to be Plan A (and B). Seeking a sale of the entire company at such distressed equity valuations is a last resort in theory for super voting shares (the HOV parallel again). In the memory banks, homebuilder William Lyon had a dual class structure and had filed Chapter 11 after its LBO was crushed by the housing crisis. Lyon later emerged, went public again and had a happy ending for the family with a multi-billion-dollar merger (Taylor Morrison). The dual class shares worked out with acceptable terms in the end for Lyon in their restructuring, but that was with a close group of hedge funds.

I do not have a detailed drill-down view at this point to share on the liquidity pressures now and getting worse ahead, but the EBITDA line speaks for itself. The details provided in the 10Q on unencumbered real estate are interesting, but making a deal happen is a mild treatment since it will be plugging holes. CVNA is the main counterparty so that is not the easiest scenario to envision in a sale-leaseback. I am curious what value that collection of properties could garner regardless of the $1.1 bn disclosed for unpledged ADESA real estate. That pledging scenario requires more review of the bond carve-outs (there are plenty of covenant experts out there in the research markets). I assume CVNA has a lot of room to maneuver on asset dispositions and sale-leasebacks given the acquired status of ADESA assets and forward planning by management and its advisors. ADESA real estate is around half the unpledged real estate value as detailed in the 10Q.

On the whole, CVNA is a working capital-based retailer. That inventory line of the balance sheet will likely keep shrinking vs. competitors, and the higher bar it needs to clear to get inventory contrasts with the franchised dealers and their semi-captive audience on trade-ins and lease returns. Most all dealers offer financing products of their own or in tandem with partners, and they are all pushing digital initiatives. The competitive edge in a down market gets harder to see at CVNA. The ecommerce platform edge is not bringing much cachet these days as some of the ecommerce peers in digital auto retailing have shown. The multifaceted omnichannel by Carmax seems convincing to a wider audience as it picks up market share.

CarMax is the bellwether to watch for the evolution of used cars: CarMax (KMX) has been building out its infrastructure early and often over time since it was spun off from Circuit City back in 2002. KMX has the financial health, balance sheet, track record and flexibility to absorb recession impacts as it already has demonstrated. CarMax can keep the competitive pressure up on Carvana but also the major franchise dealers looking to cut into its space. Not all of the franchise dealers will execute well, so used car fundamentals will test strategic commitments. CarMax was profitable right through the credit crisis including 2008-2009 that saw OEM bankruptcies and nervousness around used car residual values in 2008-2009. In that context, the current challenges look minor to them. Their challenge is continuing to invest and take share with their omnichannel investments and commitment to also being a leader in digital as well as in traditional channels (i.e., whatever works for the customer). That is going to keep the heat on Carvana.

The used car market is also likely to see a favorable consumer preference shift toward used cars in leaner economic times. The problem is that demand for used cars will require rational price differentials vs. new cars, and that has been anything but the case. The trick for CarMax and all the used car players (including the legacy franchise dealers with their steady supply of trade-ins and expansion in used car initiatives) is sourcing vehicles at the right price relative to where they can be sold. Sounds simple enough, but sourcing has its own mix of complexities with the most straightforward being new car dealers benefit from trade-ins and lease returns. The rapid adjustment of used car prices unfolding sequentially will take a toll on all, and CNVA’s ability to take the hits is questionable while KMX’s is not. To use a boxing term, “leading with your chin” with riskier lending habits is a means to an end. That takes balance sheet health in case that strategy impairs earnings.

Used car prices and the wild ride from 2016 to today: Those who may have owned or followed Hertz and Avis can remember the chaos of the used car markets as Hertz mismanaged its fleet and missed badly on residuals as 2016 played out. The used car market saw material used car volatility in 2017 as Hertz realigned its fleet. There were all kinds of wildly pessimistic forecasts on the direction of used car prices back in that period that did not make a great deal of sense (50% cuts in an expanding economy, etc.). In part, ICE obsolescence was being “present valued” as a risk that would (in theory) roll into effect upfront. Cars that would be heavily depreciated long before high volume affordable EVs were available were somehow supposed to plunge in value 5 years ago. As the market in fact saw, used car prices held in well after an initial disruption (with an assist from Hurricane Harvey) as the peak rental season wound down. The differentials between new and used vehicles (late model used vs. like-model new) soon widened to near record levels, and that favored relative value in used cars.

The Hertz implosion was a monkey wrench in the stabilization of the used car market when Hertz financially collapsed. As a reminder, the market had to get past Hertz aiming a gun at its own head in Chapter 11 and threatening to disavow the generally accepted legal interpretation of auto leases that anchored the ABS market. That Chapter 11 had a happy ending as the lenders blinked, and the rental fleets were downsized in orderly fashion.

A secular shift toward used cars still seemed to be able to get underway. Like too many “secular” shifts, that one did not last very long as the COVID fallout sent new car supplier chains into total turmoil. The production and supply of new cars was turned on its head even as supply chains were disrupted well into 2021 on chip shortages. That led to the availability of new cars plunging and auto production hitting recession levels. Parking lots for new and used were emptying out at the dealers.

The need for mobility after massive COVID disruptions and a shortage of used cars (in part tied to the travel collapse and rental fleet downsizing and in part tied to production declines and fewer trade-ins) caused the differential of new and used to tighten dramatically and even collapse (some used cars even traded better than new cars on the sheer lack of availability). That 2021 used car inflation spike really picked up pace in 2022 for used cars. Used cars (around 4% of the CPI index at the time) saw used car inflation at 35% in March 2022 after earlier hitting 45% in June 2021. Used car inflation got all the way down to 2.0% in October 2022. Used car prices will be deflating very soon YoY and already is in deflation mode sequentially.

The Fed and the curve on used car finance: While we look to the 10Y UST for 30Y mortgages, auto finance typically keys off the 2Y UST as a benchmark. High and flat or inverted does not offer much solace with the UST curve shifting higher. Used car auto finance gets a diverse range of borrower credit quality. Recent metrics show used cars growing in auto lending even if a small majority is still found in the combined categories of prime and super prime. I will look at more auto finance trends in a separate commentary, but it will be a hot topic in tracking asset quality. We can assume that nonprime and subprime tiers will feel the pressures of inflation and the monthly payment burden to a greater degree even if the low personal credit rating can be about more than income levels (e.g., payment history, relative balance sheet risks). Some recent quote details (Source: Experian) showed average subprime auto loan rates for Nonprime (FICO 620-659) at 10.3% and Subprime (580-619) at 16.9%. We saw Carvana post a range of 3.9% to 27.9% rates on an auto loan website. You get the picture - it is a very wide range, and it is expensive.

Subprime lenders and their delinquency rates, reserving adequacy, and charge-offs data will get very interesting from here with customer credit quality already under pressure and eroding into 2023, residual value/collateral value likely to follow, and thus loss on repossession is going in the wrong direction. Accounting quality in reserving policy will be under scrutiny. A 20% loan leaves a lot of room to profit at the same time a lot can go wrong.

New vehicle inventory builds: Production rates are ticking higher in 2022. The fact that new vehicle inventories are climbing is supposed to relieve some of the upward price pressure on new vehicles. The reality of strained affordability and higher financing rates plus the concerns around rising unemployment and recession anxiety should also temper demand. The macro conditions are worse now than during those periods in 2021 when demand was driving all sources of mobility materially higher in price as supply was at all-time lows.

New or used cars are usually part of a discretionary replacement cycle, and the household budget buys less goods and services now than it did a year ago. The decline in used car prices ahead will likely include a return to a more normalized new-used relationship, and the price gap should favor used cars again after a period of material distortion. With just under 285 million light vehicles on the road, there will always be a high volume of used transactions and a natural buyer base that is getting larger and borrowing more.

Some of the expanded buyer base will be driven by demographics (new households, family expansion, etc.) with the “more bodies, more cars needed” rule. There will be some discovery ahead on how changing car ownerships patterns in urban areas might play out and what car sharing will mean longer term in the coming age of EVs. To this point, car sharing is more talk and concept than reality on the ground. The stock market got very excited when Avis bought Zipcar back in 2013, but the reality was Zipcar was a tiny part of the fleet and immaterial to EBITDA.

Car sharing and fleet management will have their day with emerging technologies. Infrastructure and personnel will be needed as will service providers who can work with OEMs and have the capital to buy, build and maintain fleets, whether on their own books (e.g., car rental) or as low-risk lease arrangements with corporate fleets. The OEMs have been developing very specific views on battery recycling and EV remarketing that requires close cooperation. The overall demands in EVs might be harder to achieve for smaller dealers.

The rise of EVs could be a real catalyst for expansion of fleet and car sharing business concepts. The same is true with subscription ownership. COVID brought some added demand for vehicles with some migration from the city, but there is a lot of work to be done to understand what comes next in EVs and the relative role of franchised dealers vs. other operators in the space (CarMax, ecommerce, digital retail competitors). The OEMs themselves may want to control the used and recycled components of EVs (notably batteries). Chatter about agency models for EV that work around dealers seems questionable. That would mean war with dealers. It would create serious pushback and likely fail. The dealers are crucial to the legacy OEMs even if Tesla makes it work.

The EV transition period, pace of change, required investment, and used EVs: The franchise dealers will be required to make material capex investments in facilities and personnel and training in EVs to make the grade for the OEM ambitions in EVs. The role that can be played by companies that, historically, have been light in Parts and Services, and not as well positioned to make substantial investments, will determine the fate of some asset lite (or formerly asset-lite) operators such as CVNA. The used EV market gets a lot of war gaming in the trade rags, but it is not clear how the evolution of the used EV market will play out given the inherent needs for facilities and skilled personnel and the possible need for resale infrastructure and F&I functions to finance sales. CarMax is in the used EV market now and it is a strategic focus from them to be an expert in that space. As this grows, so will the opportunities, investment and training demands. A logical question is “How does Carvana cut SG&A with such demands ahead?” These are topics for another day.

Geopolitics: The icier nature of the new cold war will remain a complicating variable in framing scenarios for supplier chain stress (notably chips and tech-based auto component systems). The COVID challenges of China and effects of lockdowns are on the screen this week again. Whether the bouts of freight and logistics worries kick into gear again remains to be seen. (For now, a rail strike is the main worry in the “geopolitics” of labor vs. management). There is no question that China is a systemically critical supplier to the US. Those supply chains were built by the US companies by design. The ability to quickly change supply chains is much harder in specialized components that integrate regional suppliers (e.g., the Taiwan to China supplier chain connection). It is not as simple as tariffs and politics.

Meanwhile, the Russia side of geopolitics has been driving all costs higher from oil to natural gas, including power and petrochemical feedstock applications. That cuts into household cash flow for new or used vehicles, keeps rates high on the inflationary response, and slams major trading partners such as Europe, who is the #1 trading partner in total (Imports + Exports). The recession risk in theory could have the effect of tempering new car production and directing more buyers toward used cars again. The argument can be made that the new car market was already in a production recession in much of 2021 and 2022. The need to develop battery capacity in friendly nations and supplier chains that are less exposed to geopolitical disruption is a tough variable to put into specific near-term disruption risk.

Bottom line: used cars are going lower in price, differentials between new and used will widen, financing is seeing more demand from used cars, delinquencies and defaults will rise, and the strategic winners and losers in used cars and digital retailing will get resolved in a recession if some of the strategics blink at the losses. For Carvana, a liquid crisis has arrived as EBITDA keeps on running red. This negative EBITDA is set against a much higher unsecured debt level. CarMax will stick to its knitting and keep looking to build on its leadership role and exploit CVNA’s pain.