Carvana: 3Q23 Quick Read, Long Road

We look at CVNA 3Q23 earnings, which were long on unit margins and short on revenue.

Carvana reported another quarter of solid gross profits per unit but more importantly posted material declines in dollar revenues (-18.1% 3Q23 YoY) as well as lower retail vehicle unit volumes (-21% for 3Q23 YoY).

The $878 million gain on debt extinguishment dressed up the bottom line, but that major gain was tied to the ironic twist of a lack of financial viability with its former capital structure and an interest payment schedule that could not be serviced.

The bondholder exchange leaves the bondholder group in the watchdog role and holding a second set of keys as CVNA scrambles to set the stage for a rebound in used car industry fundamentals that need to show up sooner rather than later.

We always enjoy the color commentary that Carvana offers to shareholders, and this one did not disappoint. Our favorite in this one was the observation that they are “incredibly well positioned for a return to profitable growth when the time is right.”

The time needs to be before the interest expense snapback and before any increased risk of a consumer led downturn. The good news is that there are few signs of a recession being likely over the near-term horizon. The bad news is fundamentals in used cars are not great, affordability is strained, and low-cost supply may not be on the menu. That will not allow for meaningful top line growth for a company that is valued like a high growth outlier.

Many would argue that high revenue growth and high margins running alongside in tandem is years away. For now, CVNA posts rising unit margins but substantial revenue declines. The LTM Adjusted EBITDA line is still in the red (EBITDA at -12 million LTM 3Q23) but will finally break into the black in 4Q23 when the unsightly 4Q22 negative EBITDA drops out of the timeline.

As we have detailed in past commentaries (see links at the bottom), revenue needs to be materially higher (instead of materially declining) and growing for the stock valuation to work. Margins are inherently unpredictable given the dynamics of sourcing vehicles and selling at a margin on the other side at a price that works for EBITDA growth.

One challenge is that leasing share is down, and that could mean tight late-model used supply looking out into 2024-2025. The dealers typically can gain that late model inventory on lease returns or trade-ins, so CVNA has seen its vehicle shift to an older mix.

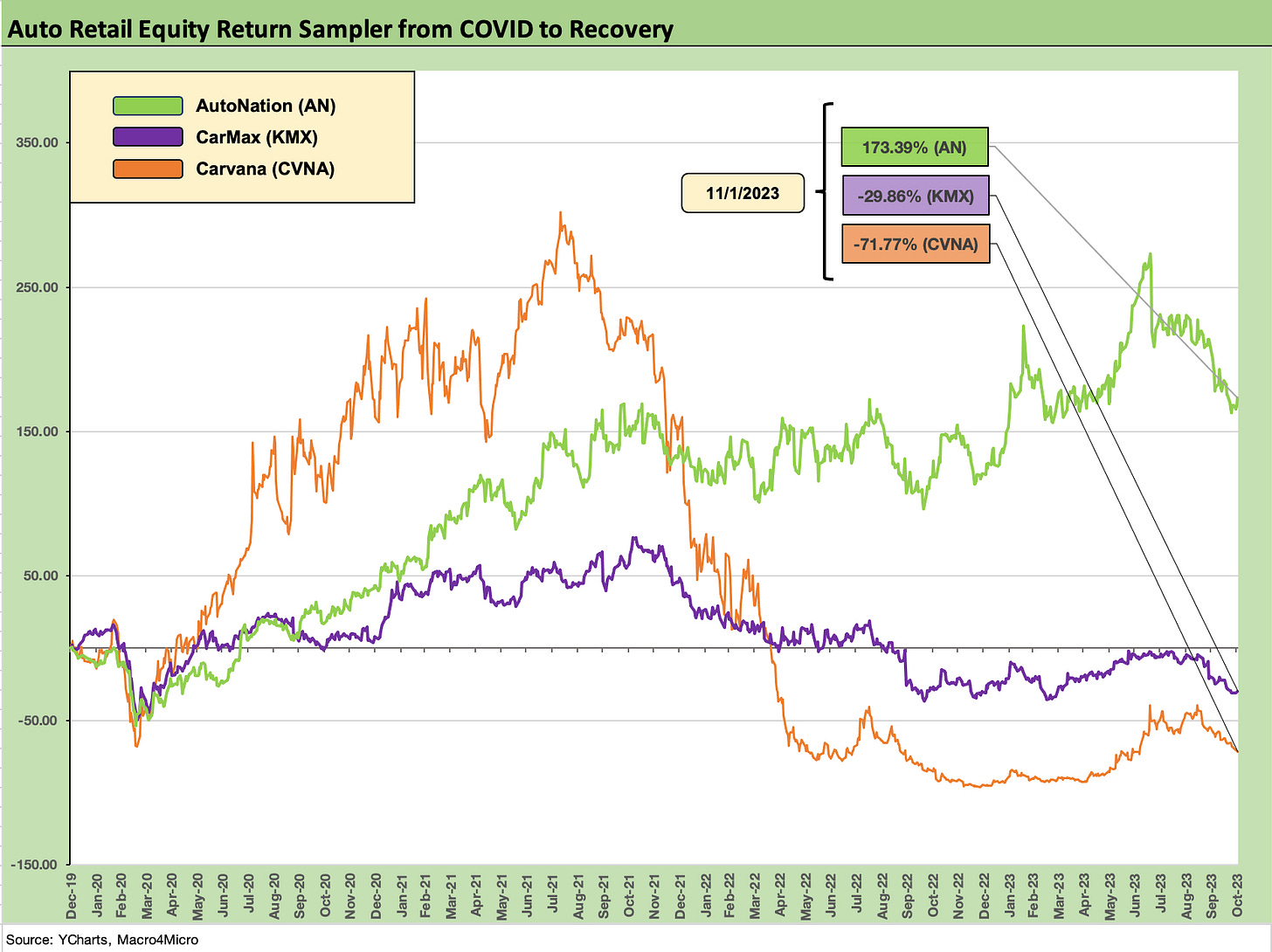

We also have the usual vagaries of the consumer cycle and more pressing questions of late on when vehicle financing costs will decline and improve affordability. Competition for used vehicles is still a problem with major car dealers having one leg in the mix and having a good handle on trade-in opportunities with new vehicle sales on the rise this year. We also have industry behemoth CarMax in the mix who is not shrinking from bidding on used cars and leveraging its omnichannel strengths (see CarMax: Credit Profile 7-9-23).

The good news is that the bondholder group that will control the future knows the story, which is that CVNA needs to be materially higher in revenue to generate the necessary higher EBITDA run rates. That is not lost on anyone. The LTM adjusted EBITDA is now at least down to only slightly negative as of LTM 3Q23 with a -$12 million run rate, but the -$291 million EBITDA line in 4Q22 will drop off at year end and spruce up the optics.

After spending a lot of time over the years watching car rental companies, I tend to be a bit jaded on the predictability of used car valuation as the depreciation rates of those vehicles can really whip around as we have seen. The COVID boom in used cars provided great news for those who were long inventory of used cars or selling fleet vehicles into that backdrop. You can’t always depend on favorable symmetry.

In the end, the bondholder group is hunkered down and rooting for the cycle, favorable used car dynamics and a better cyclical pattern of sales that will support the company into 2024-2025.

The company cited the fact that over 96% of bondholders took the exchange. We would point out that was not a compliment. They also could be hoping for some positive event risk symmetry or the overall conditions for used cars to get a lot better than they are now.

See also:

Carvana and Uncertain Used Car Dynamics 10-5-23

Carvana 1Q23: Company Comment 5-4-23

Carvana: Prisoner’s Dilemma, Used Car Getaway 3-22-23

Carvana: Wax Wheels 12-8-22