Carvana: Credit Profile

Carvana’s balance sheet is bad but the cash bleed from interest expense is worse.

Commitments Committee reconsiders merits of high leverage…

Carvana has a massive cash bleed problem generated from its income statement with negative EBITDA and a run rate of interest expense that is not sustainable at over $600 mn even before any capex.

The longer dated bond maturity schedule that came with waves of unsecured bond issuance brought a daunting coupon burden to go with the problem of negative EBITDA.

The lack of positive EBITDA is bad enough, but it is a high bar from here to get the market to embrace a high multiple framed against what will need to be a vastly more optimistic set of forward earnings estimates that implies an Enterprise Value that can even cover the debt

There is little mystery around the state of Carvana’s credit quality at this point with the unsecured bonds trading at distressed levels (par weighted price for the five bonds around 55) and the stock down almost 92% on an LTM basis. That bond price framework is after a healthy YTD rally with a few bonds in the high 30s to end 2022. The value of the CVNA assets will be much debated as 2023 unfolds, and a case can be made for those bond levels as a downside scenario longer term even if the company restructures its debt. You may still see a wild ride. More secured borrowings and encumbrances will not help that recovery story, and the company needs liquidity badly to service those coupons.

Bondholders could be looking at this credit exposure as worth more dead than alive at this point, but a merger rescue scenario is hard to envision with this balance sheet. In addition, the stock market has not been rewarding increased used vehicle exposure of late in the franchised dealer network or at CarMax. That may deter buyers even if they thought they could get the controlling family to agree to a deal. The insider control (88% voting control by family interests) adds an element of uncertainty on decision-making. The company is likely to keep playing this out through more secured borrowing and more cash bleeding. More layers will not help bondholder recovery scenarios.

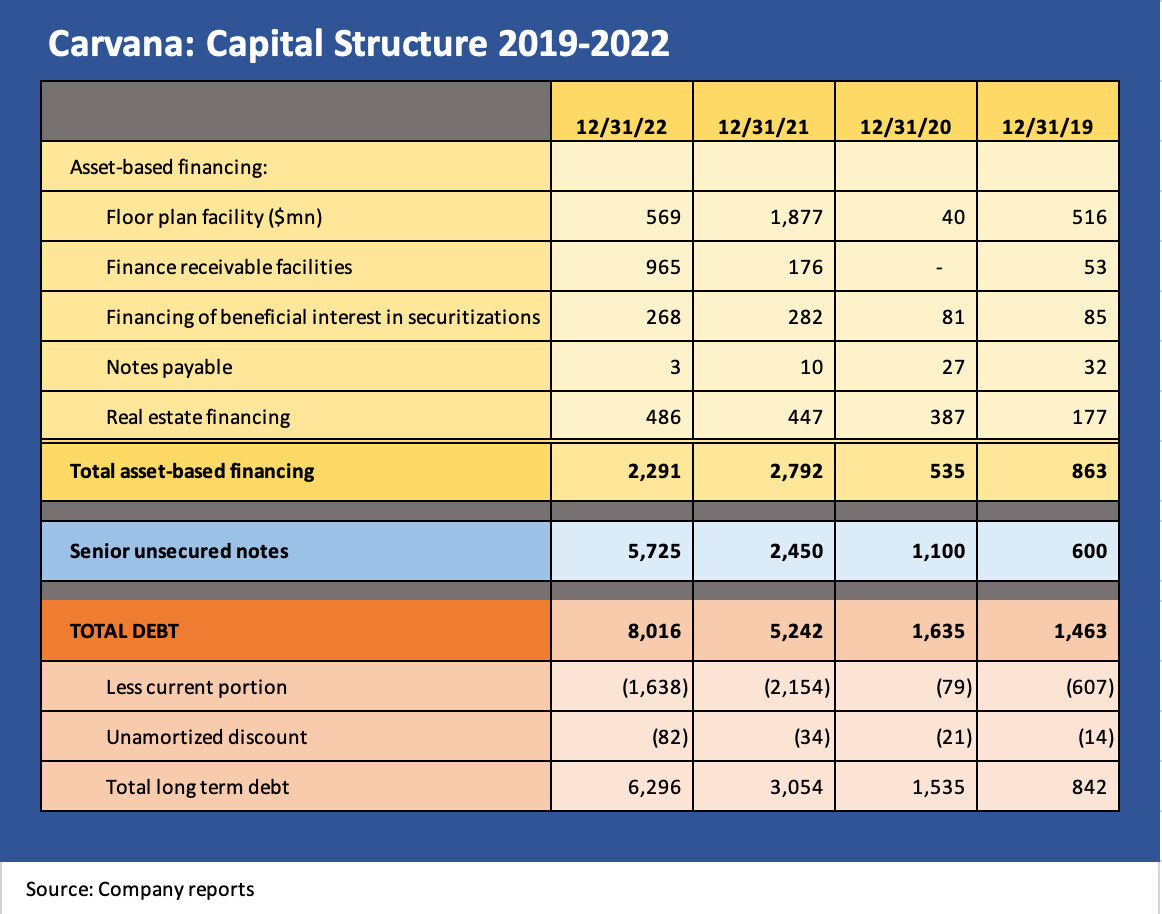

Meanwhile, the stock is down from $370 to the recent single digit levels before a rally Friday sent the stock back above $10. That plunge in the equity follows common stock issuance of $1.22 bn in April 2022 ($80 price) and $1.1 bn in 2020 (March 2020 13.3 mn shares at $45 per share, May 2020 5 mn shares at $92). Unsecured bond totals at year end 2022 reached $5.725 bn, up from $2.45 bn to end 2021, $1.1 bn to end 2020 and $600 mn to end 2019. The stunning rise in the stock arguably paved the way for a race to issue bonds to fund expansion, and the negative EBITDA now essentially leaves the stock worthless by any rational set of EV multiples and EBITDA estimates any time soon.

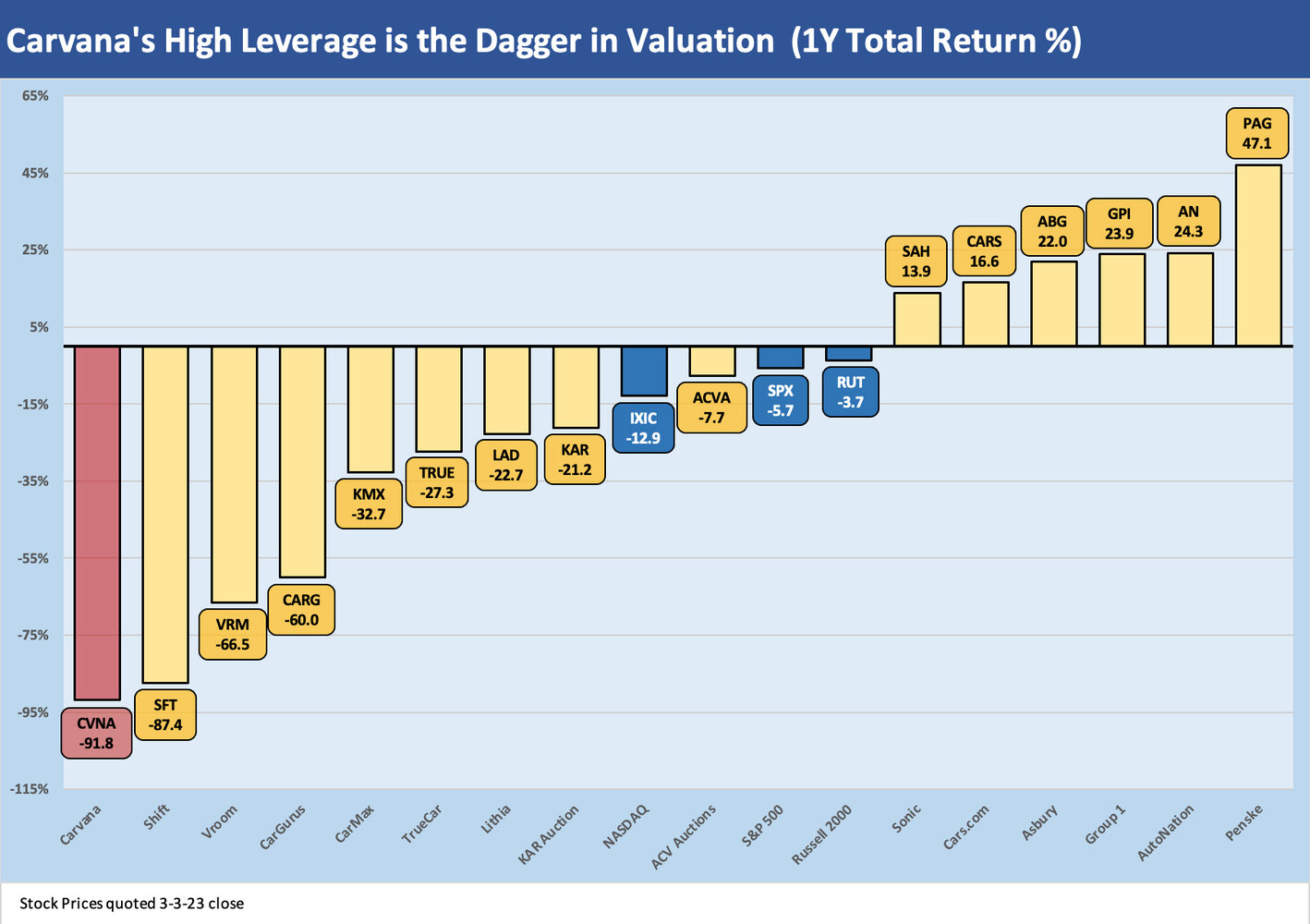

The stock chart above frames some of the auto retail and related services stocks in the market. That is a pretty dazzling Hi-Lo range. Carvana, Shift, and Vroom on the bottom make a statement. Asset-lite and used cars are heavily weighted on the left. Lithia is a very strong franchise dealer but also got caught up in the market’s rebellion against used cars and too much online retail with a hefty debt load. We looked at the auto retailers in a recent weekly and Lithia and Sonic are back on track (see Footnotes and Flashbacks Week Ending Feb 17, 2023).

Unlike the case with a convoluted auto services borrower such as Hertz back in 2020, the handicapping of valuation of CVNA bonds will still require scenarios that lack a history. Hertz at least could cite some past margin peaks and being part of an oligopoly. They also got into a situation where they were riding used car demand higher (as was CVNA). We looked at Avis and Hertz in the same weekly cited earlier. The industrywide competitive pressures for auto retail and used cars are only getting worse, and the likely stabilization of used car vs. new car demand as well as the “new vs. used price differential” leave the moving parts very uncertain.

Rising financing costs of ownership today follow a range of distorting variables seen in recent years. The signs from late 2022 for used cars and the correction of “new vs. used” are not good. Most of the critical history for CVNA has unfolded in a market filled with vehicle pricing distortions (especially for used) from the pandemic to broader supply chain problems for new cars. That makes extrapolation more than a little questionable in the new world of vehicles demand. We will see more used car retailers from well-established new car incumbents and a behemoth in used cars (CarMax) who is going the Omnichannel route and is aggressive as well as asset rich. The macro variables from recessions to fed policy to auto sector supply-demand dynamics are challenging for the “new vs. used” trade-offs. A new vehicle supplier chain meltdown on China stress could go one way while “peace in our time” could go another.

The secular shifts in the industry are also coming into play very quickly with more dealers moving in the direction of more online channels, more tech, more operations analytics, more tech staffing, and more direct-to-customer and dealer strategies by fleets. To top it all off, the EV wave is on the way, and that will remain dealer-intensive in trade-ins, financing, and remarketing complexity. EVs also require working closely with the OEMs, and that favors the franchise dealers.

The simple way to sum up the direction of financial risk at CVNA could look like this:

Record negative EBITDA in 2022 is 5x higher than the negative EBITDA of 2019.

Total debt (including asset-based financing) climbed over 5-fold since the end of 2019.

Unsecured bonds climbed over 5-fold since 2020 and almost 10-fold since the end of 2019.

The 4Q22 run rate on interest expense almost tripled since 4Q21 and is 5x the rate of 1Q20.

The overall situation seen in those financial trend lines is extremely grim. The transmission mechanism to bankruptcy is more discretionary than simply losing money with a totally uneconomic EV structure. You need to run out of cash and have no alternative liquidity sources. Using the old phrase that “balance sheets maim, but liquidity kills” applies here, and the liquidity problem is arriving soon from the interest expense line. The EBITDA rate is already very bad, but it is the “I” (interest) in the equation that is likely to prove overwhelming in 2023.

Cost cutting is important, but cutting your way to profitability is not a sign of revenue strength or valuation building. Taking out costs will stem the losses, but it will not supply capital from constituencies that have already been burned. Realigning the balance sheet to offer relief would not be likely without some governance conditions attached. Equity deals have ended badly. Bond deals have ended badly. In the aftermath of the credit crisis back in 2009-2010, this was when the liability management advisors might tag team (private equity?) would trot out the coercive exchange handbook. That would seem to be a weaker hand in this case when management has insider control that they would lose if they followed through on the end game of coercion – which is to threaten to file Chapter 11. Management wants to keep control, so that defangs the coercion. In theory.

The balance sheet and negative cash flow are both fighting for pole position, but we vote with the bleed first and the debt load second. The first one leads to restructuring the second. Starting out in a negative EBITDA hole before with over $600 mn in interest ahead that has to get paid and some limited capex has to be funded is a bad view of a gloomy near horizon.

4Q22 interest expense was $153 million, so we can round down to $600 million. Capex is a number that was a bit murky but assume $100 mn to $200 mn range with the $600+ mn in interest, and the problem is stark even with generosity on what they generate from a series of real estate transactions. Monetizing assets only to run out of cash again is not the right playbook. For bondholders, you are better off without additional liens ahead of you.

The Carvana drama has been with the market for a while now (see Carvana: Wax Wheels 12-8-22). The overleveraged balance sheet for a loss generating company is not even the main event since the maturity schedules are fairly friendly with so many long dated bonds. CVNA can try to take some corrective action in the meantime, but they need a lot more EBITDA and need it in a hurry.

That said, borrowing or monetizing assets to pay interest (as opposed to investing in expansion) is a bad look that will not attract equity interest. The unsecured bond plunge into the 30-handle range in late 2022 was in part panic and in part the “slow down bid” (or “don’t even think about it” bid) to avoid seeing much happen. Market makers needed to “make it hurt” if a holder insisted on selling into weakness after a bad year in the markets.

CVNA likes to highlight unpledged real estate including IRC and ADESA locations and some vending machines. We wonder how deep the bid is for reconditioning centers, auction sites, and gigantic vending machines. The alternative tenant peer group is not likely to be a long line. The values they include in presentations and financial filings for those unpledged real estate assets stood at $1.97 bn. The ability to translate those assets into liquidity will make for an adventure in speculation. If we assume 50%, then the cash proceeds delay the inevitable liquidity crisis until early 2024.

The valuation challenge runs from the EV multiple to the EBITDA to the debt load…

We have seen some sell side equity research withdrawing price targets with some simply stating there is no equity value at this point. That is clearly what the bond pricing implies, so that is not conceptually controversial by any means. The coming debates will pick up around the valuation of the left side of the balance sheet and what it means for the right side of the balance sheet. CVNA just went through a drill of evaluating ADESA physical auction assets for the acquisition in the spring of 2022. The price tag for the acquisition generated $838 million in goodwill on the books. That deal has already seen the goodwill entirely written off in the same year. You don’t see that too often.

The used car vs. new car supply-demand balances and the rate of inventory turnover (new and used) as it flows into volume is going through a major rethink in the markets beyond CVNA. The ability to source used vehicles at a price that locks in an assumed margin is a very tough one to generate confidence for purposes of valuation. If confidence has been in place for EBITDA expectations for valuing Carvana, it just got shattered in 2022. That impacts the ability of CVNA to get the right valuation or a loan or sale-leaseback or for the controlling family interests to find a high value offramp.

Online auto retail generated a lot of buzz for a while, but stockholders have been pounded (see Market Menagerie: The Used Car Microcosm 11-29-22). The brand name equity players were on board for the bullish forecasts. Some even argued for $400 handle price targets during 2021. The problem with 2020-2021 is that the dramatic dislocations were badly distorting the new car-used car price differentials. Taking those relationships and running with them did not work. Those deadly viruses and supplier chain variables are somewhat hard to predict, but the correction in such distortions is easier to assume. The collapse of new and used prices was not sustainable any more than over $600 million in interest.

The asset value is in the eye of the beholder as to how it fits into the operating plan of that buyer. Would CVNA be worth more to a franchised dealer than private equity? Would both types of buyers sit back and wait to bid in Chapter 11? The logical buyer mix in theory would be the more established auto retail players where used cars are an important part of their business looking ahead. For some, the used car expansion has been a priority. They were hit in 2022 with many of the same used car headwinds. We will be spending more time on each of the Big 6 Auto Retailers as well as CarMax in the weeks ahead since so much is going on in the space. Such sectors also offer a very useful window on the consumer sector broadly.

Will trouble at CVNA prompt more deals and more change?

Events in the space could also set off more chain reactions to the extent asset divestitures get into gear so soon after major asset purchases by CVNA. The ADESA physical asset purchase was followed by goodwill impairment in record time. The ability to extract value from that purchase may be seen as diminished and create opportunity for another company. Creditors in a Chapter 11 might insist later anyway.

Online auto retail has a great future, and everyone from CarMax to Lithia and Sonic among others give it a lot of airtime and strategic focus. The ability to make a stand-alone online auto retail business like CVNA superior to an operation like those seen at the Big 6 or at CarMax (the 800 lb. gorilla of used car incumbents) will remain unlikely. The online pure plays took a beating, and that is saying something about changing strategies to a convergence of the models.

The failure of so many online specialty players (including CVNA at the top of the list) to execute profitable growth plans to date will be a challenge from here to raising capital or getting the benefit of the doubt on asset protection from a service company with a heavy debt load.

The distortions of the COVID crisis offered an opportunity, but the experience has tainted the bottom line potential and the stock market view of such assets. The models can work on paper, but there is the matter of financially strong dealer networks with free cash flow to invest, new cars generating trade-in volumes, leased vehicles being returned, established F&I channels, strong geographic reach, and parts and services operations that are very good profit centers.

CVNA operating results show margin challenge…

An online retail operation is mostly about the ability to source used cars at a price and resell them at a higher price. The assumption is a retail gross profit per unit and a volume level. The concept is not too hard, but the actual cost of sourcing vehicles and turning it around is a different story during a time of more competition, uncertain retail demand, and the pricing framework of used vehicles that has consistently proven a challenge to handicap.

The pricing estimates have been tough looking out even one season – let alone in a year of moving targets for inflation and the Fed, rising cost of funding for consumers, intermittent recession fears and how that flows into retail demand, and the usual question marks around new vehicle production rates and the supply-demand shifts for new vs. used.

The pressure to perform on gross margin, volume, and execution means pressure is high for CVNA with this magnitude of debt load and the evidence of a serious earnings shortfall. That requires very good execution, good market conditions, and beating out the competition who most certainly will not be standing still.

The competition can afford to be aggressive in this market with strong financials and captive supply from trade-ins and more advantages in manpower, physical assets, and services. In contrast, CVNA will need to reel in SG&A and do it very quickly. Their answers on the conference call on how to deal with the debt and interest expense was they needed more EBITDA. They did not adequately explain how they fund that interest line in 2023.

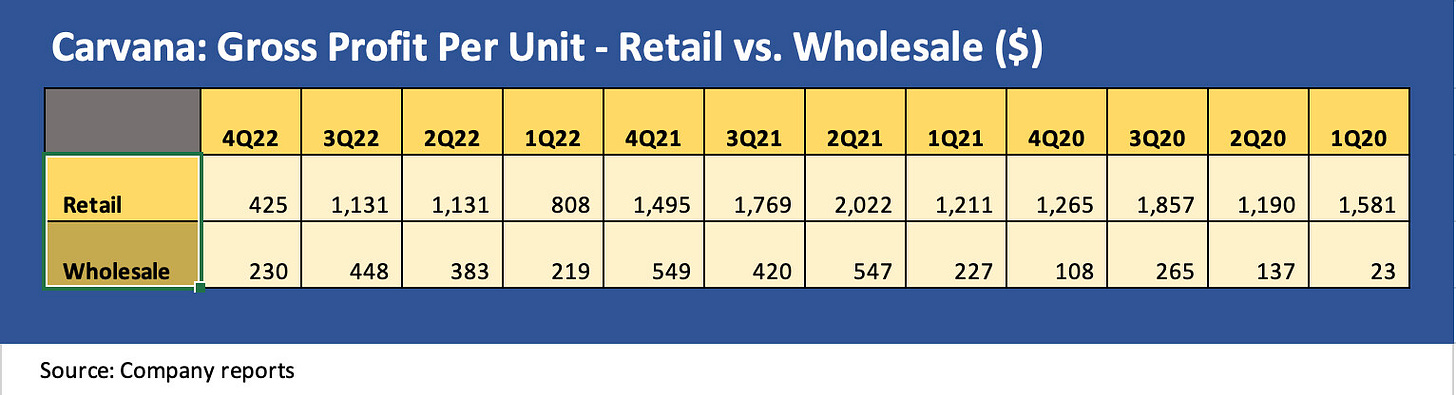

The above table on Retail and Wholesale gross profits shows how even the best quarters of 2022 for Retail GPU fell short of all the quarters of 2020 and 2021 on gross profit for retail units. Included in the gross margins are the effects of swinging prices and inventory adjustments during a time of moving price targets for customers. We went from a rapid shift into deflationary mode for used cars in 2022 into a recent uptick in used prices, so these numbers will be fluid in 2023. Below we also plot the total GPU annual levels.

The return of the car rental players and travel sector to high volumes and the enlarged car rental fleets will also bring back the usual questions around fleet planning and remarketing cycles in 2023. As anyone who watched Hertz and Avis back in 2016 and 2017 will recall, the fleet remarketing actions can create some disturbances in the depreciation rates for used vehicles. The vehicle mix issues can also swing around at a time when new vehicle prices are near all-time highs.

The balance sheet load and leverage do not work for this company…

As discussed above in the credit outlook section, the level of financial aggression has caught up with this CVNA business model. The asset based financing and ability to work with Ally and finance used car sales all makes for a sound story, but the unsecured debt burden to fund growth leaves a capital structure that is not viable for any meaningful equity value unless some unrealistically high forward valuation assumptions get used at low discount rates. Retreating to revenue multiple models is a game that is spent at this point. The bullish scenarios analysis and purely optimistic assumptions that helped rationalize the lofty stock valuations are now gone.

The level of unsecured bonds that the company could raise in 2020-2022 from the market was more likely riding on the coattails of the stock market excess that slapped such high values on CVNA. When a company has a high stock valuation, there has often been a tendency to offer the benefit of the doubt (think TMT bubble of late 1990s). When a high market cap operator in turn raises billions in equity to go with the debt, that leap of faith gets even easier. The problem in CVNA’s case was cash flow could not handle this debt load and the valuation of equity was way over the top.

The belief that an online auto retailer can generate that much earnings growth in the future despite the lack of current cash flow was a major error in assumptions. The real dagger for those voting with the revenue and earnings expectation was the recurring interest burden that came with the expansion funding. The used vehicle distortions that we saw in COVID and the plague of supplier chain breakdowns will not allow the same pricing dynamics in normal times. While the market could always see a replay of COVID and supplier chain upheavals given tensions with China, the recent cycle disproves the rosy volume and forward margin scenario spinning.

The barriers to entry realities were not as helpful to the CVNA story. The capital and tech barriers were just not high enough, and the natural competitive advantages of franchised dealers did not get enough respect. The strong income statement and cash flow fundamentals of the franchised dealers have since reminded everyone. Those auto retailers are not standing still on tech investment and development of “omnichannel” capabilities for those that want to morph their business models. They are not ceding anything to CVNA now and especially with CVNA scrambling to avoid a liquidity crisis. The industry could see some consolidation around the online auto retail sector, but the question is “At what price for strategic assets?” The price likely would not cover the CVNA unsecured debt.

The upside story for CVNA is now an “absence of disaster” outcome more than a winning hand. The physical real estate and sales-leaseback scenario has potential. However, the tenant risk and counterparty worries as part of a sale-leaseback will be daunting for the buyers. Any advance rates on a secured financing will have to get a haircut in such a fundamentally unfriendly market for the core business in 2023. The interest and coupon payments will keep coming due, and that is a big expense line item.