Carvana and Uncertain Used Car Dynamics

Carvana wades into a shifting period of used car supply and demand.

We consider some of the moving parts of used car uncertainty including increasingly scarce supply and the potential for a protracted US strike bringing new car delivery disruptions that would slow trade-ins and shift supply-demand relationships.

Rising rates and double-digit financing costs for used cars is a tough combination with tighter credit standards while the to-and-fro on whether consumers tap the brakes remains a hot topic in the home stretch of 2023.

For used car players, the need for both higher margins and high volumes is going to face mixed prospects in the months ahead even if there are ample scenarios for firm prices and unit profits as volumes might struggle.

The recent CarMax sell-off underscores the challenging backdrop on volume, and the facts are that Carvana needs a very strong volume story and not just a good unit margin result.

For a fresh look at the dealers and used car markets, we await reporting season ahead. We also hope for a little more clarity on how ugly the UAW contract round might end up in this very unusual contract process (see UAW: Going to the Mattresses 9-23-23, Autos: War Stories & Anecdotes 9-23-23).

New light vehicle inventories on the dealer lots were healthy at the end of Summer, but the potential for protracted disruptions in deliveries from the legacy Detroit 3 could start to wear on trade-in volumes and pressure used car prices and further undermine affordability.

The stories of used car scarcity are making the rounds in the trade rags and especially for vehicles in the 1-year to 5-year bucket priced below $20K. That fact tells a story about how much affordability has been damaged even before considering higher borrowing rates. The tight new car supplies of 2020-2022 on supplier chain issues and various freight and logistics problems flowed into the used car supply at a lag, so watching for the next round of lag effects this fall could mean some trouble for used car supply also.

The fleet, consumer retail leasing and car rental replacement cycles of recent years have also kept the used car supply in check. That in a nutshell could mean decent pricing for those that have inventory but not enough wheels turning for those who need “price x volume” in their favor and not just price (such as Carvana).

Carvana needs a lot more than unit margins…

For Carvana bondholders, watching the wild price action in CVNA equity was in part a sporting activity (more like Las Vegas), but relative serenity has been seen on the bond pricing side with the exchange offer. Bondholders as a group have worked together to manage their own destiny while CVNA stock has been more about speculation around what might be short squeeze effects, what might be long term value seekers with a view, and what could just be meme stock players on a bender.

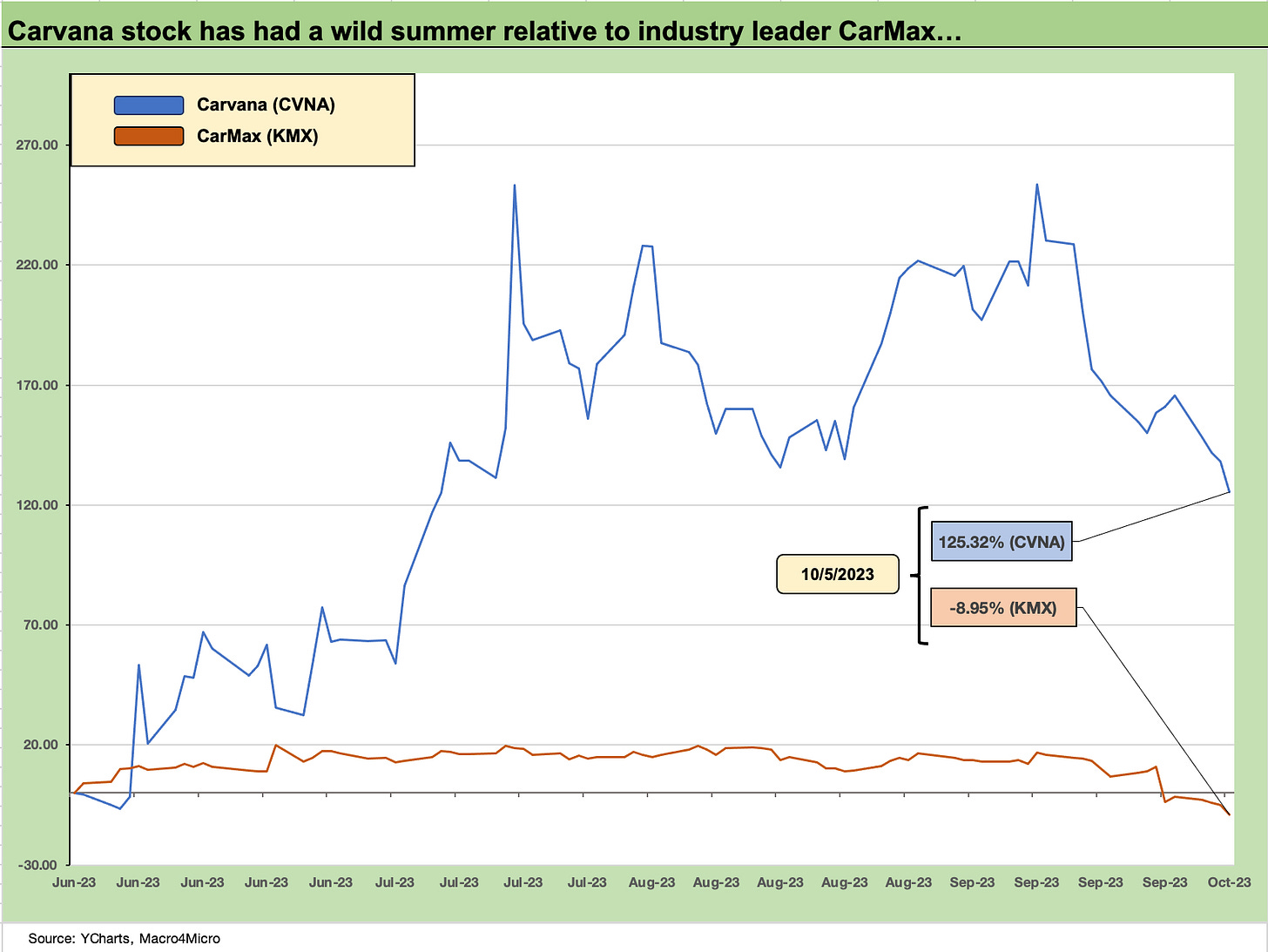

As we see in the charts, the stock has soared since the bankruptcy panic of the late 2022 period as the bondholder “cash interest vacation” and bond exchange took Chapter 11 off the table in 2023. The exchange process and requirements had the effect of lowering total debt by over $1.3 bn and lowering cash interest by “$455 million each year for the next two years.” Carvana breaks out the exchange details with the various Tranches and terms in their September slide presentation on their website.

The bondholder group clearly sees value in the asset mix and franchise. They also saw a company that was not financially viable. They in effect see a floor scenario and can plan on the other side if the company execution or markets preclude the upside outcome. We remind people of the Hertz backdrop where the CDS cleared at 26 but the exit was par plus and equity value. A lot can happen in a hurry. Some of the same players circling that deal show up in the current one for CVNA.

The interest relief in the exchange allowed CVNA to avoid a liquidity crisis and potential bankruptcy while the haircut on total debt in the exchange helped the Enterprise Valuation story line (less debt to cover). It did serve to avoid a more immediate crisis. That said, the debt/EBITDA level is pretty grim, and the ability to craft an EV story line involves looking out years and pumping up EBITDA and EBITDA multiple assumptions.

The reality at sea level is that this company was still essentially bailed out by bondholders who handed CVNA relief on interest rates as well as a haircut on face value in exchange for structural seniority and some collateral rolled back into the asset protection metrics (CVNA had earlier removed it).

The tough valuation math for CVNA is the need for an EBITDA line and a rational multiple that covers their debt and has room for a meaningful equity market value. The debate around which year for EBITDA (2026? 2027?) and which multiple tends to sound like a late 1990s TMT cycle throwback with quite a few assumptions of what the backdrop will be in those future years. When looking forward a few years, the EBITDA multiple will need to worry about that big snapback in “I” as cash interest spikes.

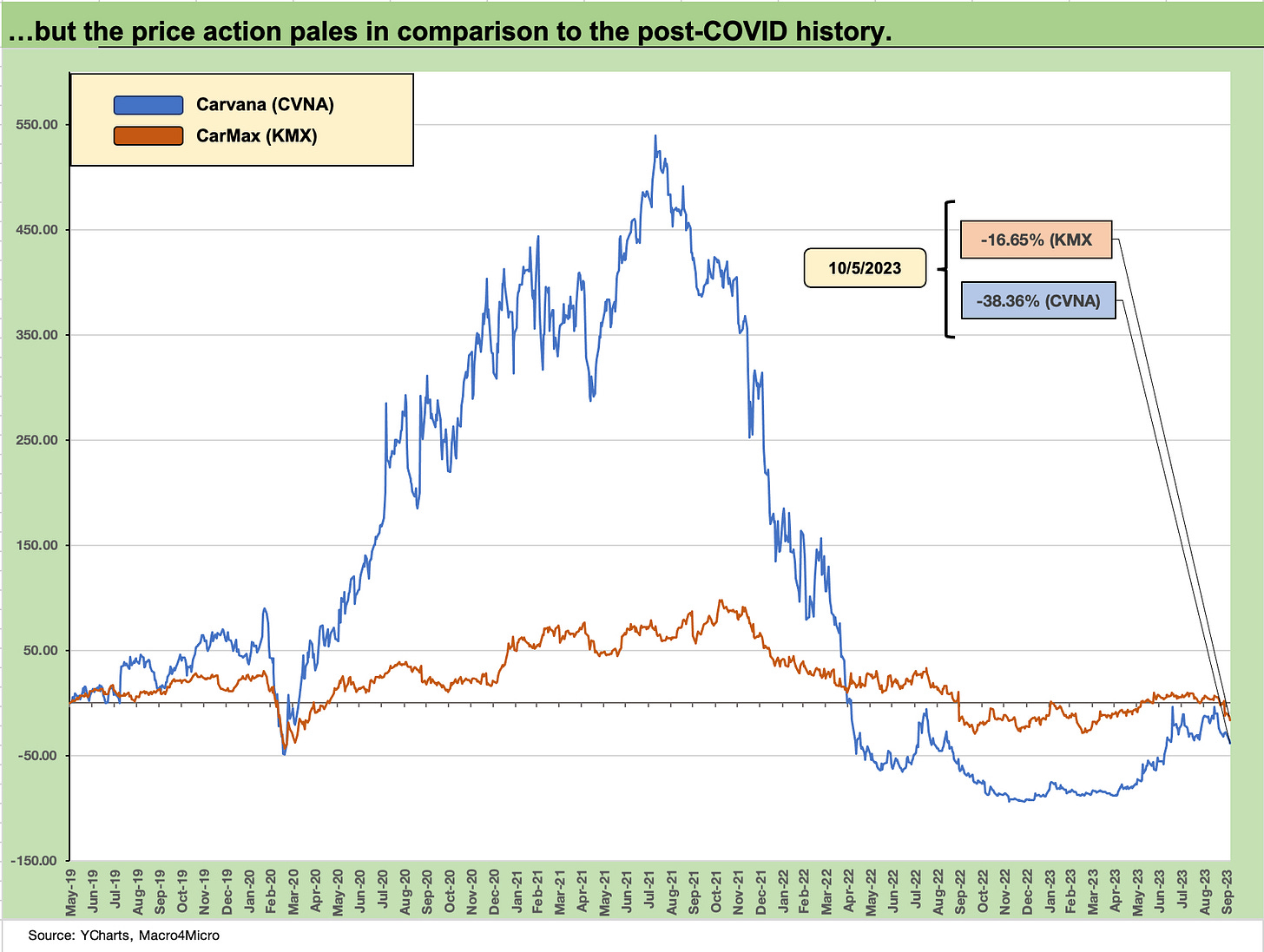

The above chart shows the big moves across the summer including a sharp rise and then sell-off this past month. The timeline below tells a bigger tale of volatility, big gain, and then a tale of woe.

CVNA is in effect an asset-lite service operation with the inventory pledged. With the remainder of physical assets now also pledged and a very leveraged balance sheet still in place, we believe the multiple should be haircut and not topped off. We would note that the debt taken on to buy those physical auction assets was a big part of the problem in the first place (see the links below).

If CVNA executes on cost and manages margins effectively while also materially growing the volumes, the profit growth story will get much better. The problems on the volume side, however, include tight used car supply and the worsening headwinds of affordability from high rates. The consumer cycle and credit availability could further deteriorate. The intense competition for used car supply in auto retail is no small challenge. We see that in the trade rags, and the recent CarMax earnings report does not inspire confidence either. Volume was a problem.

The CVNA equity valuation math in part revolves around going back to 2021 for a game plan and framing CVNA as a high growth story separate and distinct from the franchise auto retail sector and eligible for high teen EBITDA multiples. That takes a lot of faith and is clouded by the lack of narrow, apples-to-apples peers in auto ecommerce. It is a big enough challenge for the EBITDA multiple just to cover the debt.

The wild price action in the CVNA stock has more factors in the picture around short squeezes and the usual theories around meme stock distortions. The overall approach to valuation goes under the heading of “faith based” multiplication.

The good news for CVNA bondholders is that they are well organized and would easily control any restructuring that would come down the pike. Whether they can hope for “Hertz Part Deux” (full debt coverage plus equity value) is a reach since at least Hertz was at one point a 10% EBITDA margin type of company when it should have been a high teen EBITDA margin operation.

The “mobility kicker” was also a good story line to pump up the HTZ valuation. In the case of CVNA, the story would be equitizing some debt and allowing for a viable financial profile. Just generating positive EBITDA for a quarter allowed them to say “record earnings” since the company had always posted negative EBITDA. The 3Q23 earnings season beckons. The guidance had already been revised higher by the company, but the volume story will be one to focus on as well – not just their unit margin pitch.

See also:

CarMax: Credit Profile 7-9-23

Carvana: Smoke Signals Get Smokier 6-9-23

CarMax 4Q23: Wacky Market, KMX Stays Steady 4-11-23

Carvana: Prisoner’s Dilemma, Used Car Getaway 3-22-23

Carvana: Credit Profile 3-5-23

Carvana: Wax Wheels 12-8-22

Cant wait to read the business school case on this name soon...my kid is off to spend to much money getting an MBA in the next year and certain your write ups will be part of that story

Thanks for coverage of this racey enterprise