Carvana - Smoke Signals Get Smokier

We look at CVNA bond price action since termination of the exchange and over the quarter as the restructuring plot thickens.

“Okay, but I get the vending machines.”

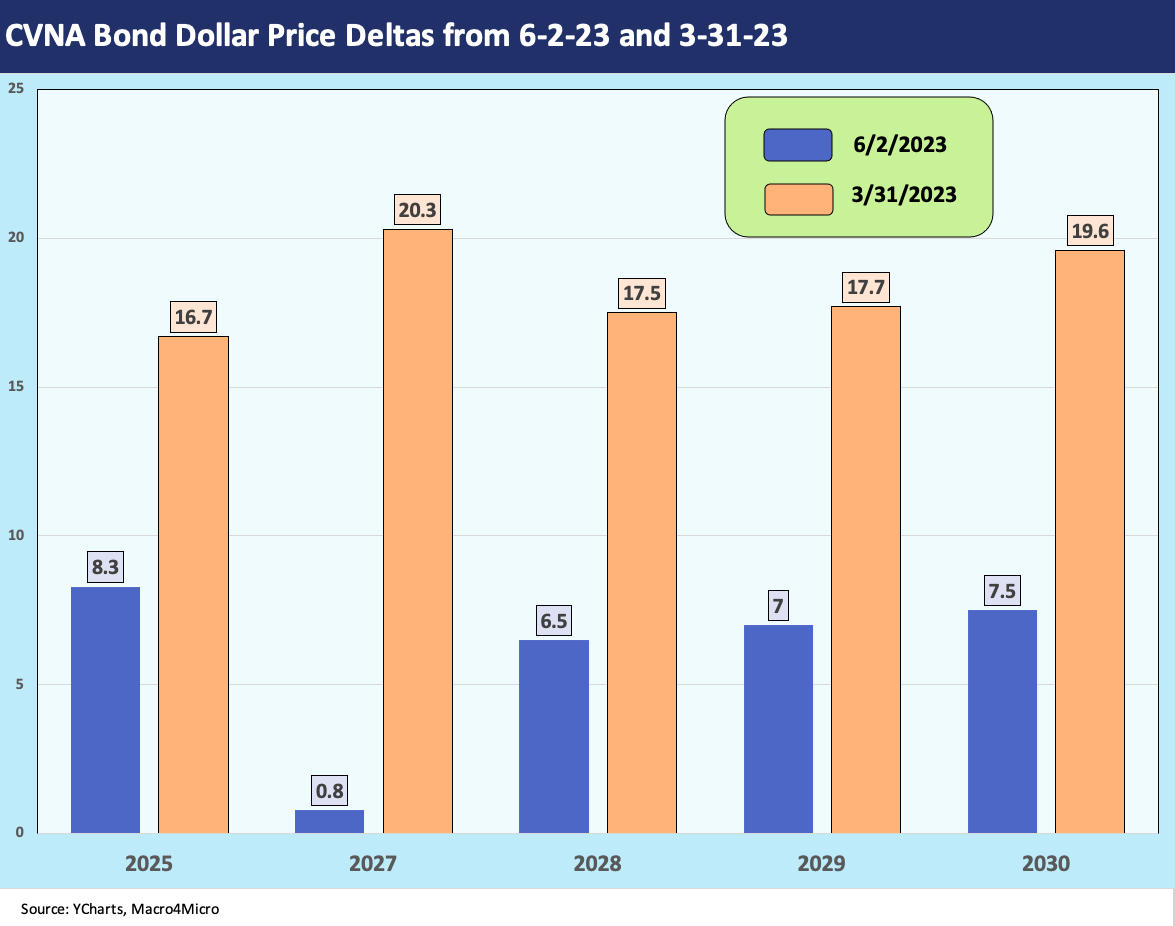

We look at Carvana bond price deltas from last week and since the end of 1Q23.

The pattern signals that something more is going on out there for the big holders after the termination of the exchange last week as the very unforgiving cash burn continues.

With the debt exchange now dead, the handicapping of what is going on “over the wall” is picking up and most likely leaking out.

(Prices as of 6-8-23 close.)

First, we apologize for the focus on “smoke” images this week, but a residence in NYC will not allow one to escape it these past few days. In this note, we update some of the material changes in the Carvana unsecured bond stack that have unfolded over the past week after the termination of the exchange. The assumption will be that something needs to happen with the bondholder group (or Apollo) sooner rather than later. Where there is smoke, there might be a transaction. A few questions are worth considering:

How can the bonds rally so much this year, since the end of 1Q23, and since last week when CVNA terminated an exchange offer that was doomed to fail?

How can the bonds rally even as CVNA is destined to keep hemorrhaging cash after coupons and capex in 2023 and 2024 and CVNA is absolutely in need of a financing to plug that hole?

How can bonds rally when CVNA took the action of removing the ADESA entities with all those hard assets as guarantors of the unsecured bonds under the indenture?

How much can CVNA raise in a new secured financing or in a Pref deal when a bondholder group led by Apollo and major institutional holders is staring them down?

The December dollar price curve was flattish and or in line with fears of imminent bankruptcy. That late 2022 panic was way overdone and was mostly freezing the market in place or looking for weak holders. The price framework is very different now with the rally well into the 80s on the 2025. That action on the shortest maturity perhaps signals some machinations somewhere and position building going on to set up for clearing out those 2025s at some point.

The ability to equitize much (or all) of the debt and rebuild the CVNA franchise financial health with a financial sponsor at the head can be crafted on the white board a la Hertz. It is just much harder with a company that never had a profitable year. You get back to making up a bullish forward set of numbers and generous multiple. That is not an unusual exercise but the governance barriers to any such decision are very high outside an immediate crisis. That crisis can be seen but it comes later in the year or early in 2024 unless CVNA can find a new infusion from a transaction. The fall season coupons will add up quickly.

The moving parts of the bond pricing is where the speculation comes into the picture on what a potential restructuring of the balance sheet might look like (debt-equity exchange, new equity-linked security with a deal on governance and voting rights, etc.). We have no information whatsoever on what is cooking in the rooms of the various constituencies (family-controlled voting bloc vs. bondholders) but something has to give. The liquidity crisis is a fuse where the main debate is around how long that fuse is – not whether it is burning. There is a company with a valuable franchise but one that also has too much debt, negative cash flow, and the need for relief.

The 2025 bonds were the lead target on the exchange to clean up the near maturity. The recent spike higher in those bonds reflects the fact that liability management actions (the polite term for debt restructuring) still badly needs to happen. CVNA status quo is not viable from a liquidity standpoint or from an equity valuation perspective. The price action has been an eye-opener and there is a rationale for the bonds. CNVA’s history in equity markets makes it hard to generalize about what the stockholders are thinking or doing. The term “short squeeze” was making the rounds in the financial trade rags.

The not-so-coercive exchange that was terminated at the end of last week basically amounted to “yo, help a billionaire brother out with a haircut” (see Carvana: Prisoner’s Dilemma, Used Car Getaway 3-22-23). As coercive exchanges go, it did not have much in terms of carrot or stick. The bondholders were well organized and Apollo and PIMCO have other ideas, so the exchange failed. We just don’t know what those ideas are in the lead at this point, but the price action on the 2025s are logical even if event-dependent.

The street is resurfacing again on CVNA…

We can watch models from the street that offer timelines and DCF estimates at assumed multiples keying off intermediate and long term forecasts, but the reality of the cash flow is that the target dates cannot be reached outside of a major action to take debt materially lower. You can put a forward multiple on the company a few years out at an assumed EBITDA. Unfortunately, even under a bullish scenario, EBITDA turns negative after interest expense and even more negative after capex. That is a tough sell to raise equity.

The above chart revisits the wild ride to record highs before a drive off the cliff. CVNA soared in the 2021 bubble markets on more than a little speculative fervor. The equity valuation cleared the decks for more stock issuance and extreme amounts of debt funding. A lot of bonds were issued leaning on the optics of market cap adjusted leverage at times when EBITDA was decidedly negative (see links at the end of the piece for some history). We also plot CarMax (KMX), the massive incumbent player in the space and Lithia (LAD), a highflying major franchise dealer who has been very aggressive in e-commerce initiatives and expansion via M&A.

The industry is evolving quickly, and CVNA simply flew too close to too many underwriters and lenders. The idea that there is a consolidation play on the other side of a restructuring of CVNA does not take a lot of imagination, but the potential for more deals expands after a cleaner balance sheet and less cash bleed.

The circumstances create a wide array of back-of-napkin outcomes for someone pondering what CVNA could look like if a truckload of debt and bondholders were not bearing down on them. A lot of the same type of conversations were being had around Hertz with the evolution of integrated mobility and fleet management. That type of scenario spinning captures investor interest. Away from the dream of what might be, CVNA faces the day job of meeting coupon payments.

The reality of CVNA financial risk is that the cash bleed is not sustainable, and with each passing coupon payment the stress will grow. Companies always want to preserve cash and don’t wait until they run out, so the timeline is shorter than 2025 for some major changes in the capital structure. The 2030 bonds alone run at around $336 million in cash interest just looking at the 10.25% coupon and $3.275 bn face. That ADESA deal and mega-financing was the Rubicon moment for the company’s financial stress. Or maybe it was the Las Vegas moment.

Revised guidance is minor relative to the recurring cash flow challenge…

The sharp and sustained moves higher this week on the 2025 bonds cannot help but raise antennas on a deal since CVNA will likely run out of cash before 2025 in the absence of major financing and realignment. That is the case no matter how well the used car market does this year (the most recent headline was used car price weakness sequentially and YoY).

The positive revision in guidance this week for CVNA at the William Blair Conference was good news. That would have helped more for an asset lite, cash burning operator than a company heavily encumbered by debt and no realistic path in place right now to service it. In the Blair conference presentation, I stumbled on the bullet point that said, “positive adjusted EBITDA is a milestone, but it is not our goal.” That came in the context of free cash flow being an objective. They need both, and they also need a major inflow of cash via financing to plug the giant hole of negative cash flow.

Even a secured financing on the ADESA assets might not be sufficient to take care of the demand, and it is not clear yet what restrictions would be placed by any lender on the use of proceeds to service other debt. Presumably a lender would want to see the consolidated entity raise equity. Use of proceeds on the theoretical outcome of a secured financing could mandate a portion of the proceeds used for value-accretive investments/capex. That again is purely speculative.

What next?

We are perhaps reading too many tea leaves on this one in terms of the uneven bond price movements of the past week. The price increases across the spring are more consistent. We restate we have no specific information on it – but the time to do something would be sooner rather than later given the coupon flows over $600 million on what has been a negative EBITDA operator. Even if CVNA does in fact flip to a full year of positive EBITDA in 2025, the cash burn rate after coupons and capex will still be north of $500 mn (being generous). Coupon relief usually comes via debt restructuring. That can come the hard way or the very hard way.

With some of the brand name equity analysts stoking up their coverage and commentary again lately, the heightened price action so soon after the exchange offer was terminated cannot help but feed the sense that the timeline is shortening to some sort of balance sheet restructuring. With Apollo on the other side of the table, the bondholder interests are being led by a party who can take this to the next stage.

Investors can use the Hertz outcome more as a guiding light (or a hope). The difference is that Hertz had a path to material unsecured recoveries using historically achieved results and just adding on some more multiple to the valuation. The CVNA historic results are across the board negative EBITDA. As a reminder. Hertz unsecured bounced from a 26 handle in the CDS auction to full recovery in its exit plan. That was about who played in the reorganization and who bid on the assets.

There would certainly be interest from strategic players as well as financial investors in CVNA. The CVNA situation has some parallels and some material differences vs. Hertz including majority insider voting control and a history of material losses. The scenario of a lot of equitized debt and a new capital structure to create a more financially viable entity is what keeps unsecured bondholders in the game for upside.

In the end, the preference for all is that the end game can be a compromise deal that works for both sides (unsecured bondholders and the controlling family). The inevitable sticking point is decision making and governance. There is a “victory to be had” for all on the other side of a deal, but we always need to guess at the weighting of how major a sticking point the Class B share voting rights will be (10 vote per share). This issue could derail the whole show.

See also:

Signals & Soundbites: Carvana 1Q23 5-4-23

Carvana: Credit Profile 3-5-23

Carvana: Wax Wheels 12-8-22

funny how some things never change as bond prices move alot on no public info...almost like the last 40 years had never occurred

excellent write up today and comp with Hertz very interesting Thanks