CarMax: Credit Profile

We provide a detailed drill down on CarMax as a microcosm of a rapidly changing used car retail market.

We look at the financial profile of CarMax (KMX) as the company wades into the next round of competitive battles for market share with the franchise dealers and Carvana.

With no rated publicly traded bond debt, a strong balance sheet, free cash flow, an investment grade quality profile (in our view), and ready access to the ABS market, KMX is a formidable player in an auto retail market that is going through a wave of secular change in business models.

With Carvana bleeding cash badly and a clock ticking on its need to pay coupons and a few major franchise dealer players aggressively seeking revenue growth, auto retail should be an event-heavy subsector in coming quarters.

CarMax credit risk profile remains a key strategic pillar…

We take a different approach on a credit profile commentary for CarMax (KMX) since, as KMX states in the FAQ section of its website: “At present, we have no publicly traded debt, and therefore the credit rating agencies have no ratings on the company.” KMX does have two small $200 mn unsecured note issues (maturities 2026, 2028), but the KMX parent balance sheet is mostly about a recently renewed undrawn revolver (F1Q24, extended in June 2023 to June 2028), a mix of term loans, and nonrecourse debt. The liability side of the balance sheet is dominated by non-recourse ABS funding and warehouse facilities for its solidly profitable CarMax Auto Finance operations (“CAF”).

KMX has term loans and an undrawn revolver, and the fact that KMX has a $2 bn unsecured revolver is a statement from the banks on company credit quality. Some of those banks are extensively involved in the ABS and auto funding operations of this major automotive retailer. We look at the financial profile and key operating metrics of CAF in more detail further down at the bottom of this report after the balance sheet section.

KMX is a major counterparty in credit agreements and ABS, but credit quality is an important competitive issue that should also be favorably factored into its valuation in the stock market. The ability to keep investing through a recession and tactically buy back stock is a good part of the equity story.

We see the company as investment grade caliber with the strongest financial profile of the pack in publicly traded auto retail (excluding Berkshire Hathaway’s major auto dealer unit). The auto retail issuer base across the major public dealers carries a weighted average BB tier rating.

KMX has a strong balance sheet, healthy discretionary free cash flow, and boasts the largest market cap in the space at $13 bn (7/3/23 pricing). That means there is no shortage of opportunity for KMX to deploy capital for growth and improving its competitive position. That is true in the critical e-commerce operations side of the business where KMX is looking to become the omnichannel king and press its advantages.

Financial strength as a competitive edge for KMX…

Financial health matters in a competitive endurance contest, and the next few years will make for some intense scrambling for the edge in used car retail (see Market Menagerie: The Used Car Microcosm 11-29-22). Balance sheet strength in the core used car retail business is a key advantage for KMX vs. public retailers as well as the financially distressed upstart Carvana.

The risk profile of KMX leaves it at least on par with the franchise players who are also aiming at the used car space. In addition, KMX looks like a T-Bill compared to CVNA at this point. All other things being equal, the strongest balance sheet wins when the industry is struggling with affordability (even after the used car deflation that started in late 2022). High investment demands can be the deciding factor competitively. The industry will be measured and more tactical in capex in 2H23-2024, but the priorities to invest in tech and various sales, sourcing, and financing platforms are clear enough.

KMX vs. Carvana vs. the Franchise Dealers…

In the case of CVNA, that company remains a strategic wildcard as a financially collapsing asset with too much leverage and too much cash bleed. Those assets will have a lot of value to someone at some point if they can execute the right balance sheet restructuring. For those who had ridden the craziness of the stock price action at CVNA to $370 in Aug 2021 and down to the current $29 area (post-Friday rally, 7-7-23), the hope is that CVNA can find a solution to plug the cash flow hole.

We don’t see how any strategic (or financial buyer) could pay a price even at the beaten-down level without too much financial risk or dilution. That would take a major overhaul of the debt into equity. CVNA’s unsecured bond debt burden is almost triple the long-term debt of KMX while the most recent quarterly revenue run rate of KMX is triple that of CVNA. One is throwing off free cash flow and the other has negative EBITDA. Rational EV multiples don’t cover the CVNA debt even with a generous set of EBITDA assumptions out a few years.

Financial investors are already circling (with Apollo inside the circle), and bondholder groups need to see a better outcome on the other side of an inevitable balance sheet restructuring. The unsustainable cash bleed is a major headwind to CVNA’s expansion. Of course, not being able to pay your coupon from cash flow is also a problem.

In terms of the major dealers, we already have seen some major franchise players tap the brakes in their used car ambitions and some even retrench. The franchise dealers are the best positioned in terms of free cash flow and scale, but they need to aim where they can win profitably. Sonic’s recent news that it was suspending operations at some Echo Park locations is a sign of more reassessment from dealers. Penske lives by the luxury brands, so they come with an asterisk in the used space as to what tier of used car. That leaves Lithia and AutoNation as the main events among the big public retailers. We look at the scale of the various players in used cars (based on unit sales) further below.

The above chart plots three bellwether auto retail stocks from 2019 that come at the used car market from different angles. KMX is a legacy dedicated bricks and mortar player rapidly expanding into an omnichannel strategy. Carvana is best known as the leader in digital auto retailing in used cars. Lithia comes at the used car business through its Driveway branding and e-commerce initiatives that also brought a name change with it to Lithia & Driveway. So the chart frames CarMax up against two very aggressive high fliers with no company in the space flying quite as high and crashing as badly at Carvana (see Carvana: Wax Wheels 12-8-22). For its part, the KMX story from here will be about how it deploys capital into its omnichannel strategy and to what extent it gets back into stock buybacks.

KMX is the large cap industry incumbent in used car retail, and used car dealers are struggling relative to new car dealers who also have the benefit of more revenue offerings on the menu in F&I products and Parts & Services. The immediate visual in the chart above is the relative stability of KMX equity across the period from 2019 to 2023. KMX did not bring you a home run during that tumultuous period, but the fastball did not hit you in the head either.

KMX does not pay a dividend (and no plans to) and has a policy of investing in its core business at this point. In the past, KMX had been a major repurchaser of stock with excess free cash flow. The company maintains a strong balance sheet and has not been a major borrower in the bond markets. The ABS market has been its destination to fund its auto financing operations with nonrecourse debt. Subject to market conditions, KMX has a balance sheet with room to maneuver.

We have spent a fair amount of time and space dedicated to Carvana (CVNA) as the high profile and financially stressed digital retail player. The leveraged e-commerce operator is a headliner in used vehicle business (see Carvana: Smoke Signals Get Smokier 6-9-23, Carvana: Credit Profile 3-5-23). CVNA will be a major story line in 2H23 as the coupons come due and Apollo and the bondholder group hunker down for some sort of balance sheet restructuring proposal that cannot be avoided as time wears on.

The last timeline on the chart above is Lithia (LAD), which ranked #1 in used car unit sales among the major franchise dealers in 2022 (calendar year). LAD is a name we have been following but have not written on much to this point, but we will be stepping up the tempo on LAD publishing soon enough.

With the exception of AutoNation (see Signals & Soundbites: AutoNation 1Q23 4-23-23), the dealer names are clustered in the BB tier and will be busy growing in 2023 and 2024 subject to dealer valuations and used car plans. LAD has been the most acquisitive in the franchise dealer space with an aggressive plan to hit $50 bn in revenues by 2025 (from a record $28.2 bn in 2022). That takes more M&A.

The franchise dealer winner across the volatile period before the Fed tightening was Lithia as it grew rapidly and profitably and was one of the most ambitious in M&A as well as the usual bolt-on activity. LAD fell down sharply from the highs since it was highlighting its e-commerce expansion and wide range of online operations (including fintech) as part of its desire to get a more bullish multiple.

As the CVNA buzz faded and used car excess was getting trimmed by the markets, LAD faded somewhat since the start of 2022. LAD still has been a very successful player overall looking back across the past cycle through current times as detailed in the peer group comp chart below. The more diverse franchise dealers beat the used car space and auction services companies.

Above, we produce one of our peer group time horizon total return tables. We line up the dealers and related auto services companies in descending order of total return for the period from Jan 2022 to June 2023 to include the end of ZIRP and the steady Fed tightening cycle. It also frames how the post-pandemic period shook out after the tech excitement of the 2021 mini-bubble.

The numbers show how the major auto retail and services operators navigated one of the wilder consumer backdrops since the credit crisis of 2008-2009. The recent periods saw the most dramatic reshaping of the auto retail sector seen in a long time or at least since the Big 6 of public dealers started to more aggressively roll up dealers across regions and expand their range of products and services.

A number of ambitious digital players burst onto the scene in recent years (some are already gone), but the biggest news was the rise of Carvana and the strategic push of more franchise dealers into used cars as a dedicated business and in some cases as all-new rebadged brands.

The franchise dealer new car business has been a proven model with free cash flow generation and readily available means of expansion as more private dealers slowly and steadily monetize their franchises. The boutique investment banking business has attracted a high rate of deal flow from selling to the strategics (public or private) to bringing in private equity investors.

Retail businesses of all sorts have gone through the radical reshaping of e-commerce and auto retail and real estate brokerage have been on the tail end of the decades-old bricks vs. clicks revolution. The beauty of the traditional franchise models is it lends itself to extensive automation from the customer to finance and insurance (F&I) to higher-margin Parts & Services operations. The tech-centric vehicles (and the next-gen EV demand) requires investment in capex and manpower where labor is tight. That takes capital and credit quality, so the start-up cash flow bleeders have found sustaining their hot post-IPO buzz a major challenge.

The above chart lines up auto retail players from highest to lowest based on market value of equity (7-3-23). KMX sits at the top of the list at $13.0 bn ahead of #2 Penske ($11.5 bn) with Lithia a more distant #3 ($8.4 bn) and AutoNation at #4 ($7.6 bn). In considering balance sheet risks at KMX, a $13 bn market cap makes a statement against net debt of $1.65 bn and $5.8 bn of book stockholders’ equity at 1Q23. That is for a company with a leading market position, a solid base of profitability, a healthy balance sheet, and a history through downturns that shows a positive bottom line in the worst year in the credit crisis.

The battle will heat up in its space, but KMX boasts a good starting point against those other names on the list. For the major dealers extending into used cars, they need to be “in it” but do not need to “win it.” CVNA lacks the resources and cash flow at this point without a balance sheet overhaul that includes less debt and new equity.

The evolution of the used car business is ongoing for good reason with almost 40 million units a year on transaction volumes across all price tiers. It lends itself to e-commerce but also to personnel-intensive operations such as more complex F&I offerings and certainly Parts & Services. That opens up opportunities for franchise dealers as well.

The next leg of the journey cuts across fintech and used EV remarketing with the OEMs and finance operations. Parts and repair business lines are showing soaring profitability in a segment where manpower and skill shortages are a fact of life. Maintenance and repair inflation is soaring, and someone is collecting that revenue. The ability to attract employees and investment in tech and facilities requires high earnings and cash flow. There are only a few on the list above that flunk most of those tests. That is usually the e-commerce players.

One of the numbers worth highlighting is the Carvana market cap of $4.7 bn that uses the combined share count of the Class A plus B shares. Some databases just plug in the Class A shares count (~106 mn shares) for a market cap of approximately $2.8 bn (using same stock price date in the above table). This calculation skips the Class B shares (82.9 mn shares at 1Q23). The total Class A+B count rounds to 190 mn shares, and that gets set against the July 3 stock price in the chart to get you to an eye-popping $4.7 bn market cap. That multibillion market is for a company that is still looking to finish a fiscal year with positive EBITDA for the first time (2023 will not be that year). After negative EBITDA you get to deduct interest and capex. That is not pretty. The quirks of the Class B stock is a separate topic, but it gets back to the governance control wildcard.

The street uses the 190 million number in its Enterprise Value handicapping and models. Some just call it “adjusted Class A shares” on the theory that Class B can be exchanged for Class A. Reading the stock offering materials helps you understand why the street equity reports on the name don’t discuss the issue very much (the company presumably does not like the Class B shares to be a major topic of discussion at a time like this). After all, the Class B shares get 10 votes per share for a dominant majority control above 80% at last count.

The above chart details the quarterly average used car retail price for KMX from 4Q18 (Feb 2018) through 1Q24 (May 31, 2023 quarter). It is a good proxy for the used car market from a company that is by far the #1 used vehicle retailer across the broadest footprint. The peak sales prices for used cars were unsurprisingly in the Feb 2022 4Q22 reporting period for KMX just ahead of the start of the Fed tightening cycle the following month (March 2022). The rising financing costs and spiking inflation into 2022 had the expected effect of pressuring demand and used car prices. (Note: we highlight the confusing fiscal year labels because it makes your head hurt when looking at charts.)

The price erosion was not a materially negative event. The milder trend line can be traced to the fact that new car supply and used car supply alike were both still tight relative to the need. Calendar 2022 still saw what was in effect recession levels in new car sales tied in part to supplier chain problems (notably chips). Jobs in the broader economy kept on climbing, and the need for mobility was still very much a demand tailwind. The main question was “How much car?” (e.g., New or used? What brand/make? Etc.) and “At what price and financing costs?”

The above chart frames the price trends on wholesale vehicles with a similar pattern. We see the peak quarter also in the Feb 2022 quarter ahead of the rising financing costs and inflation/recession jitters. The obvious visual is that wholesale used cars still are materially higher than in the pre-Covid period. They just cannot rival the unsustainable spike of calendar 2021 (FY 2022 for KMX).

The tight supply of new cars due to supplier chain problems was a factor in the supply-demand balance since the depressed production of new vehicles slows down trade-ins and lease roll-offs. Meanwhile, the aftereffects of the COVID shutdowns and travel problems had distorted the usual fleet replacement cycles. The Hertz bankruptcy and the fleet downsizing in car rental during 2020 and into 2021 generally were all part of the distortions that impaired seasonal comparability especially for late model used cars. New cars were pricier for fleets, and that created some decisions on fleet aging and the pace of replacement.

The used car retail landscape…

The chart below frames up the leaders in used car retail sales during calendar 2022 (most of KMX FY 2023). The chart offers a frame of reference for the franchise dealers vs. KMX as the industry leader. The dealers were running low on inventory and used car demand was soaring and dragging prices higher in the process to uneconomic levels. That in turn fed the inflation anxiety across households just in time for the cost of financing to spike as the fed tightened. The demand was there, and the need for mobility was only going to rise with record payrolls. The ability to efficiently reach the maximum possible potential buyers was fueling the next big push in digital retail. That scramble set the stage for the next wave of e-commerce stories.

With a typical range of 37 million to 40 million used car transactions annually, the push into used cars energized the increased use of digital sales and financing tools. The frenzy made complete economic and strategic sense, but as usual excesses eventually generate disappointment. The trick as always is to see who could execute well and not take too much risk in the process.

The franchise dealers needed to increase investment in more technology on multiple fronts from retail to finance & insurance (F&I) to parts and service. That focus complements cash flow accretive business and offers some incentive to take more risk on new areas (e.g., branded used cars). The move into more used car stand-alone P&Ls was a natural but would come with a lot of other tech and capex initiatives underway across multiple business lines and to gear up for the EV revolution as well.

Carvana and a few other all digital players also went in with both feet and issued heavily into the debt and equity markets to expand. CVNA then pushed into the physical auction space with a heavily debt financed acquisition of ADESA assets. CarMax ran a balanced attack as the clear industry leader and sustained its strong balance sheet.

The above chart puts the KMX sales volumes in context of the broader auto retail sector for used cars. We line up KMX and CVNA as the leaders in used car retail sales (i.e., ex-wholesale volumes). We see KMX way out in front and CVNA at a distant #2 ahead of the next tier which includes the Top 3 franchised dealers in used volumes including Lithia at #3, AutoNation at #4, and Penske at #5.

Those leaders of the franchise public dealer group were clustered at the top of the peer group for FY 2022 with each around $27 bn to $28 bn consolidated total revenue lines, or just behind the $29 bn handle of KMX for its FY 2023 year.

Another way to look at the chart is that the Big 6 public dealers sold just under 1.4 million used retail units in their most recent fiscal year. That is more than the combined total of 1.22 million units of KMX and CVNA. Dealers have diverse strategies by brand and the relative priority of used vehicles as a stand-alone business. We will cover those topics in separate commentaries, but they have the staying power for the long game in e-commerce. A major setback in used cars even buys them time to stay the course in e-commerce investment while CVNA stalls and KMX stays on target.

The steady growth of the franchise dealers in both new and used is no surprise. The push by the dealers into used cars comprises a significant competitive issue as the dealers continue to invest in a range of technologies serving customers and operations alike from inventory management to finance and parts and services.

The franchise dealers have the inherent advantage of trade-ins, certified pre-owned vehicle capabilities, and parts and services operations to drive cash flow for more investment. For readers of Automotive News, the amount of space dedicated to the demands on the retailers/dealers in tech, services evolution, manpower needs, and management training (EV and F&I) underscores how involved these businesses are and how many new revenue streams can be grown.

CarMax operating results…

The above chart gives the high-level line items of KMX operating results for the most recent quarter (1Q24) and YoY and for the prior three fiscal years. Auto retail is a low margin business at the bottom line. As a reminder, the February fiscal year means that FY 2021 was essentially the year of COVID. The ensuing distortions in used car demand and soaring used car pricing set a very high bar for used vehicles that is not likely to be matched any time soon. Net margins did tick higher YoY in F1Q24, which is usually the highest margin quarter on the way into the spring selling season ahead of the peak summer driving period.

The overall theme on the earnings call was about sequential quarterly improvements after the worst of the YoY comps in F4Q23 (Feb 2023 qtr) and 3Q23 (Nov 2022 qtr). Growth in total earnings and cash flow will need to be driven by some combination of stable unit margins and rising volume off the recent declines. That in turn will take cost effective sourcing and good execution in its growing omnichannel operation. The execution runs from vehicle sourcing to sales (retail and wholesale) and having the right mix on hand in the right markets. Growth of the e-commerce operations and financing business are tied to the cycle, so there are more than a few variables at work from macro to micro.

The ability to source lower cost used vehicles from customers online (vs. dealers) and resell to retail online is the new white whale for the industry. Sourcing from dealers online for resale into retail or wholesale while shortening those working capital cycles is where the tech investment also comes into play.

The online experience in finance operations is an integral part of the omnichannel strategy. The vehicle retail operation needs to be supported by a prudent balance of auto finance earnings as provisioning requirements rise with the mixed outlook for consumer credit quality. That connection of the retail customer to financing gets a lot of airtime in the company presentations including pre-qualification online.

The above chart frames KMX’s volume in used retail and used wholesale. As a reminder, the Feb 2021 fiscal year was dominated by COVID effects that started immediately after the start of the fiscal year. Total activity was obviously low on the myriad disruptions from COVID.

The soaring demand and supply-demand imbalances of the Feb 2022 fiscal year does not need a lot of explanation at this point as used car inflation soared with some late model used cars selling at prices at or above the same model new car (which were not available). Volumes also rose sharply in used cars on a tight supply of new cars.

The price action as detailed earlier in the commentary will stand out across the cycles. Notable used car inflation months in the CPI data included +45% in June 2021, +37% in Dec 2021, and +35% as recently as March 2022. We had flipped into used car deflation mode in Nov 2022 as the YoY comps got easier, and we saw more rational used vs. new car differentials even if not fully back to normal.

The level of trade-in activity and post-pandemic fleet rebalancing impairs the usual working capital cycle with car rental fleet downsizing in 2020 (Hertz Chapter 11, air travel collapse, etc.) and extended holding periods in 2021, etc. It takes a few travel seasons to normalize and especially with new car prices so high. Supplier chains in new vehicles are loosening up, and that brings more trade-ins that can now support sequential trends.

The Feb 2023 fiscal year combined the headwinds of rising costs and affordability to undermine volumes. The fears around recession probabilities can influence purchasing timing while a general tightening of consumer credit by lenders (including KMX) was unfolding and continues into calendar 2023 (fiscal 2024 for KMX).

KMX offers a lot of quarterly statistics on omnichannel volumes tied to online transaction activity. Omnichannel applies when online actions touch on some part of the process whether reserving the vehicles, financing, trade-ins, sourcing, or creating a remote sales order. An “omni sale” is one that involves any of those online features, and that translated into 54% of retail sales being “omni” in F1Q24.

The rationale of letting the customers shop the way they want to is common sense. Sourcing vehicles online or at a location widens the opportunity. The concept behind omnichannel is that KMX reaches the widest range of customer types (and shopping preferences) and can leverage the widest range of assets from physical to personnel to financing products using its strong balance sheet and funding alternatives.

For the most recent quarter (1Q24), online retail sales were 14% of unit retail sales, up from 11% in 1Q23. Revenue from “total online transactions” can cut across any element of financing, extended protection plans, and online wholesale transactions, and using that mix comprised 31% of net revenues. KMX indicated it bought 323K units from consumers during the recent quarter including half from its online instant appraisal program. That translated into over 70% self-sufficiency according to management comments on its earnings call. KMX sourced another 20K units through dealers.

The above chart breaks out gross profits in dollar terms for used retail and for wholesale. KMX posted a strong performance in absolute terms, but it was still lighter in the context of the boom year of fiscal 2022 (ending 2-28-22). The declines in FY 2023 are part of a broad trend in used car profitability pressure relative to the distorted economics of used cars in FY 2022. Profits are weakening on price and volume factors as well as from adverse mix shifts (lower-priced, older).

The lower gross profits were a function of volume declines as well as price declines. Unit margins held up well, but volume was the overriding variable. We notice the market celebrated when Carvana cited strong unit margins, but this gets back to old time math of “volumes x unit margins” to drive cash flow. For KMX, lower volume weakness can also feed into weaker extended protection plan revenues and financing fees internally or with third party providers (such as the financing partners serving the riskier borrowers). Credit contraction is also a factor in the volume and revenue picture.

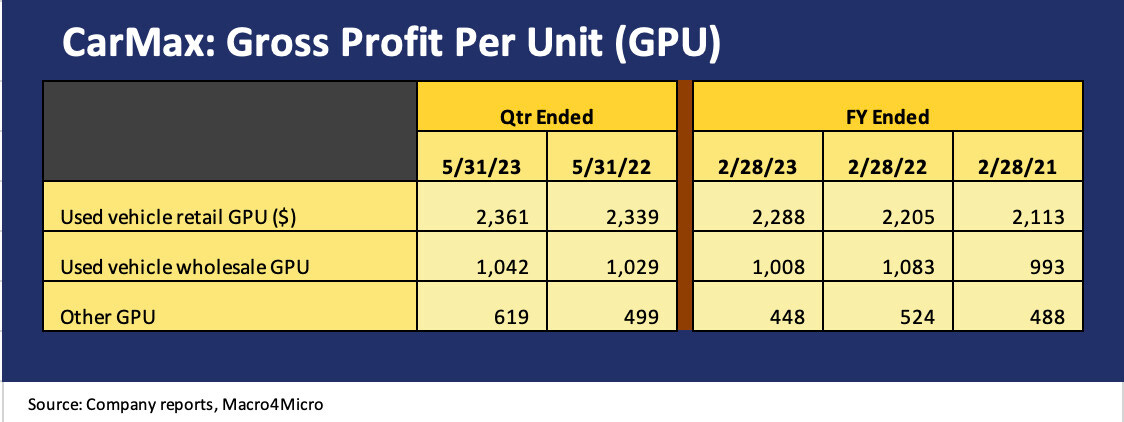

The above chart highlights that gross profit per unit is holding up well enough even if volume has been flagging on affordability and financing costs and a better supply of new vehicles. There is a lot of focus on GPU trends, but the volume risks still are not going to offset the total impact on cash flows for some of the players.

Better GPU margins are good news, but the volume and margins together drive cash flow. You need volume to be resilient as well or earnings will remain under pressure. Those dynamics have encouraged more of a cost focus, a pause in buybacks, and more measured capex planning until cyclical signals and inflation trends get better visibility.

CarMax still holds the balance sheet advantage…

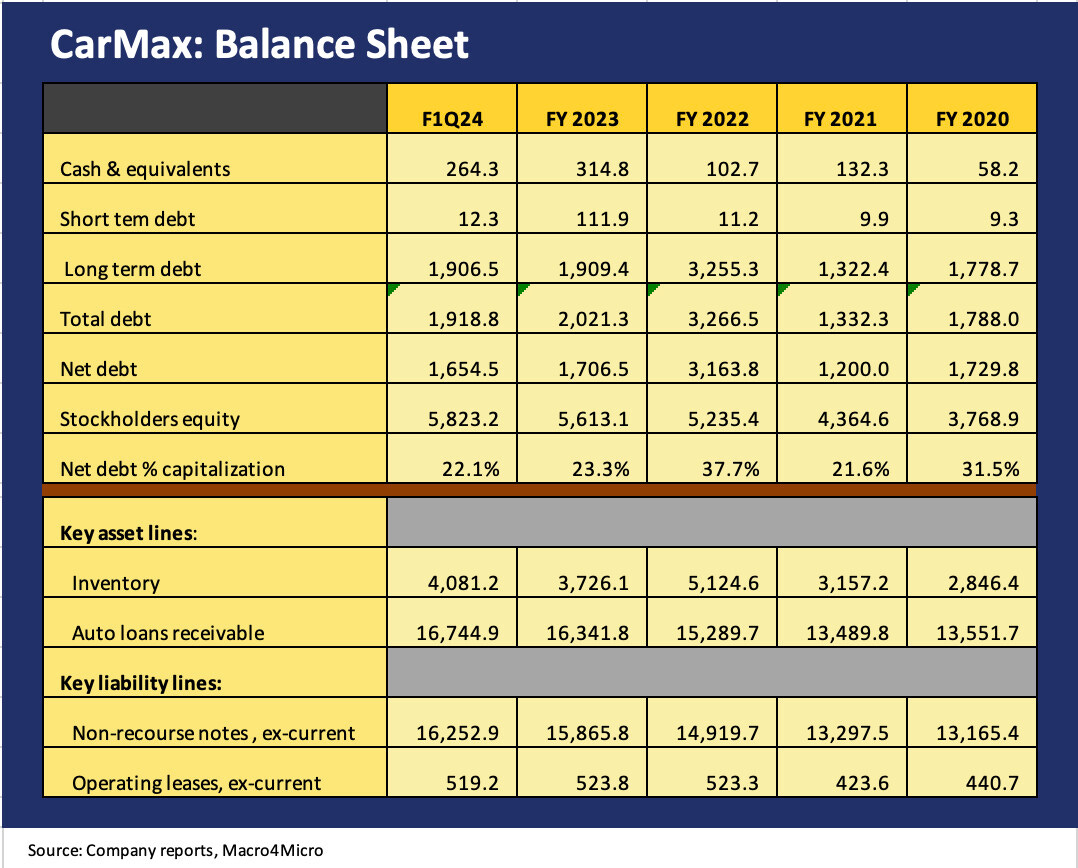

The above chart frames up the liability structure of CarMax while also highlighting some important asset and liability lines. The top section of the chart details the net debt and book capitalization levels that flow up into a very strong balance sheet for the core services business. The 22.1% net debt to capitalization is an investment grade caliber balance sheet. Adjusting capitalization for the market value of common, that translates into an 11% leverage metric. The longer-term target for adjusted debt to total capital is between 35% and 45%. That metric excludes nonrecourse debt but adds in 8 x rent expense. We estimate that KMX is around 30% using that metric at 1Q24.

Auto loans receivables and non-recourse notes are part of the working capital management cycles where KMX funds its loan receivables through non-recourse funding vehicles such as ABS term funding or warehouse facilities. The auto loans and auto non-recourse facilities are essentially covered by the liquidation of receivables, restricted cash in the structures and equity cushion that allows those ABS structures to get rated and placed with investors. Before loan loss reserves, auto loans at May 31, 2023 are funded by $12.0 bn in nonrecourse ABS funding and $4.2 billion in warehouse facilities. Among some other reconciling items in the receivables footnotes, the 10-Q shows $757 million in overcollateralization.

Among other ways to get into the comfort zone on the ability of KMX to weather a brutal downturn was the example of the credit crisis where KMX stayed profitable and net credit losses peaked at 1.74% in 2009. The recovery rate (vs. receivables balance) on repossessed vehicles hit a low of 44% during 2009 and hit 55% during the year of COVID before bouncing back up to 70.8% in FY 2022. We look at those metrics in the CAF section further below.

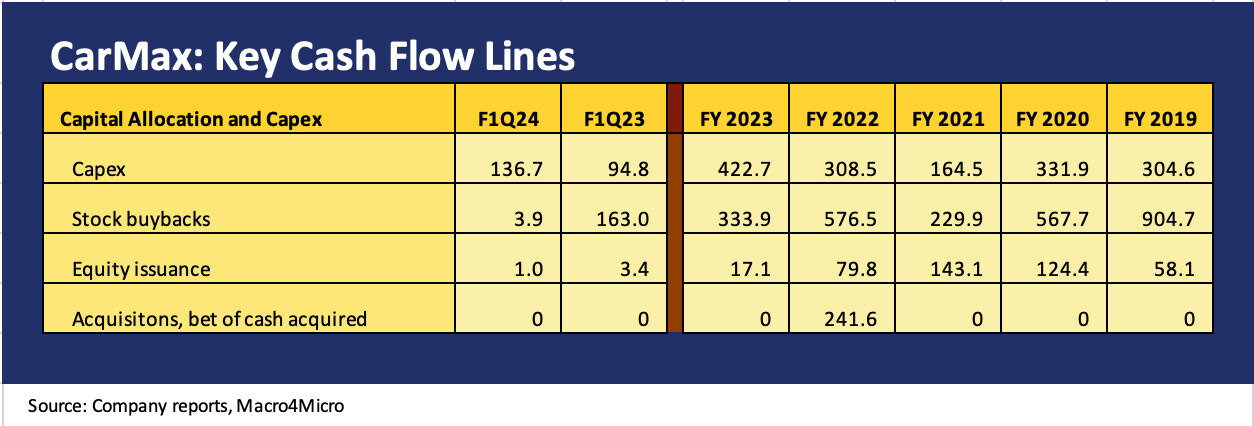

The above chart frames some major lines from the cash flow statement that show capex and stock buyback levels in recent periods. KMX is a working-capital-intensive retailer in substance, so the working capital movements are a core part of the cash flow cycles. The company saw a downsizing in inventory during FY 2023 that drove a material increase in cash flow after working capital.

The two key capital allocation lines in the chart above are capex and stock buybacks. Capex was trimmed back during COVID (FY 2021) but picked up pace again during FY 2022 and hit a multiyear high in FY 2023. KMX does not pay a dividend by choice, but the company has been aggressive in buybacks opportunistically as evident in the chart above including $905 mn in FY 2019 and almost $2.6 bn from FY 2018 to FY 2023. KMX still has a $2.45 bn authorized buyback remaining but paused the program to sort out the direction of the market.

The company has been very measured in M&A with only the FY 2022 acquisition of Edmunds for $402 mn (cash, stock, preexisting investment at fair value). KMX is more about core business reinvestment. For those not familiar with Edmunds, the company was a well-regarded automotive content and data platform with strengths in digital vehicle shopping.

Among other items on the financial flexibility checklist, KMX owns 158 of the sites for its 240 used car stores with the remainder leased. That offers one more angle on financial flexibility to free up cash for capital allocation. That is also incremental asset protection for lenders to KMX. The overall profile of the KMX balance sheet should reassure stockholders as they ponder the direction of the cycle and how those risks frame up vs. peers (auto retail, asset-lite digital players, etc.).

CarMax Auto Finance a cornerstone of the business…

The above chart shows the timeline for interest margins and loan loss provisioning at CarMax Auto Finance (CAF) at interim and the trailing 3 fiscal years. In a sharply rising interest rate environment, the theme of an interest margin squeeze has been a recurring one from the banks to the consumer finance companies. CAF can only raise contract rates so quickly without undermining its core business and further straining affordability and weakening volumes.

Lenders face sharply higher borrowing costs YoY regardless of the funding instruments. That is the case whether in ABS (fixed or floating), revolvers, or other forms of debt issuance. The above interest expense line posting YoY trends for F1Q24 vs. F1Q23 hammers it home since F1Q23 (May 2022 qtr) was the quarter that ZIRP ended.

The tightening cycle was then underway with a vengeance and UST migration was running alongside inflation, leading to more than a few theories around how that would play out for auto demand narrowly and the health of the consumer generally. The rising rates are intrinsically negative for consumer affordability and working capital costs for inventory carry.

The consumer credit cycle is also showing up in the provisioning line above as credit quality erodes and exposure to repossession losses rises. The loss provision line more than doubled from FY 2022 to FY 2023, but the CAF unit remains highly profitable and able to absorb the expected rise in provisioning demands into 2023-2024.

Delinquencies and the “recovery rate” on principal balance after repossessions are disclosed regularly, and the stabilization of used vehicle prices together with very favorable employment trends are among the factors that help ease fears on more material downside in asset quality. We look at asset quality risks further below in a separate chart.

The above chart presents a range of details on loan origination from volume to loan-to-value to credit scores and term length on loans. FY 2023 shows a material decline in volume from the boom year of FY 2022 when supply constraints and low inventories limited the range of options for new cars. The price distortions for used cars were shocking as we covered in the inflation history in our CPI write-ups (see May CPI: The Big 5 Buckets and Add-Ons 6-13-23, Automotive Inflation: More than Meets the Eye 10-17-22).

The prices of used light vehicles – like the volume of used cars and trucks sold – were unsustainably high vs. new cars in FY 2022 and are gradually reverting to more realistic relationships. The new vs. used price differentials had narrowed to uneconomic levels. The supply chains began to open up in FY 2023 and even more so into FY 2024, but the volume of units in F1Q24 show a stabilization of volumes vs. F1Q23. Financing penetration rates of 42% are consistent with prior fiscal years as noted above.

The Loan-to-Values and loan terms (months) are not raising any flags around how KMX operates. A common misperception in the market is that major used car players are selling into the subprime market and taking outsized risks. As detailed in the chart, the average KMX FICO score qualifies as prime. Historically, used car borrower quality in the broader industry is on average quite solid. A significant majority of loans in used car retail financing broadly are prime and near prime quality. The major information vendors (Experian, Cox, etc.) back that up. There is also a long tail of specialty subprime players that post high LTVs and low counterparty quality, but that is not the KMX story. Those players target maximum contract rates.

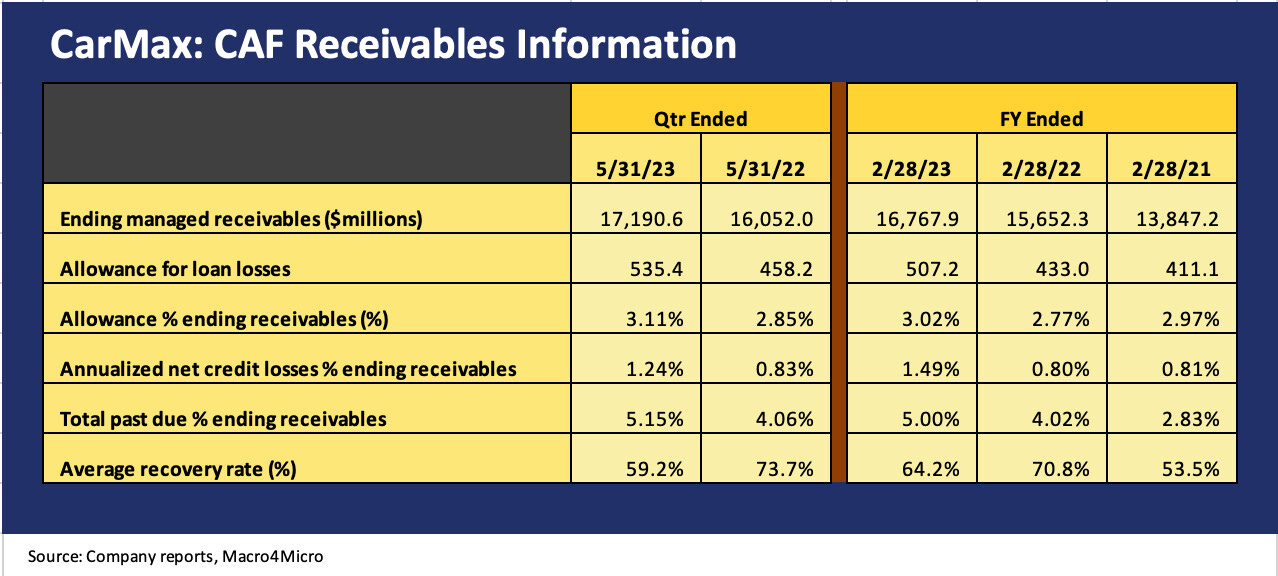

The above chart breaks out more of the managed receivables data including loss reserves and credit loss experience. The used car market is a growing focus for consumer as new cars are less affordable (at times, even less available). In the age of student loans, the consumer preference has turned more toward late model used cars and the ability to “buy more car” as average transaction prices (ATPs) for new light vehicles are in the high $40K range. ATPs for new cars are expected to cross the $50K line.

As noted in the prior chart, KMX targets a higher quality average retail credit customer in its “core” base where expectations are for cumulative losses in the 2% to 2.5% range. The company generally has used third party lenders for riskier credit tiers but increased its allocation to Tier 3 borrowers from 5% to 10% in FY 2022 before lowering it again to 5% near the end of FY 2023. As of the end of FY 2023, Tier 2 and Tier 3 receivables were less than 4% of managed receivables.

FY 2022 and FY 2023 did mark a more aggressive posture in historical context, but KMX is more defensive heading into FY 2024. In its lending operations, the Tier 2 penetration was 20.4% in F1Q24 vs. over 42% for total CAF penetration rates. The Tier 3 penetration was 6.7%. In other words, KMX upped its credit risk appetites the past two years but is pulling back somewhat in FY 2024. The overall portfolio strategy is higher quality as captured in the average FICO scores and history of KMX.

As detailed in the chart, net credit losses are moving higher and the expense provision along with them to bolster the loan loss allowance to 3.11% at F1Q24, or well in excess of the 1.24% annualized loss experience in the May quarter. That loss experience comes after a jump to 1.49% in FY 2023 from 0.8% in FY 2022 and FY 2021.

Delinquencies are also rising with the 5.15% tally in the chart reflecting total delinquencies at May 31, 2023. Of that 5.15% total, the 31-60 day is 2.93%, 1.81% is 61-90 days, and 0.41% greater than 90 days. That translates into 2.22% over 60 days.

Summary…

If you want to understand the used car markets and its various auto retail players, it’s worth looking at CarMax as a bellwether and industry microcosm. That includes where used car inventory meets financing, the trendline in used car sourcing, and who has the financial strength to deal with any cyclical scenario. Of course, it helps if you can point to history across cycles. In the emerging online auto retail space, most of the history is new in contrast to traditional retail. It’s an especially good exercise to look at the concept of omnichannel vs. online.