Not Your Father's Hertz

HTZ puts up strong margins for FY22 and 4Q22 but it gets tougher from here on pricing used car risks.

Hertz 4Q22 numbers got cheered by the equity markets, but the fleet management complexities and pricing strategy get tougher from here.

The used car market is taking depreciation back to the bad old days as depreciation per unit spiked in 4Q22 on the used car repricing.

With a starting point of high margins and a more transparent path to the new role HTZ can play in the evolving world of mobility, the optimists have a better case to make even if the blocking and tackling and execution gets even more challenging in 2023.

In the 1981 comedy Arthur, there was an exchange: “Have you ever seen her face...when the light catches it just right? She's really quite beautiful. Of course, you can't depend on that light.”

That is the way many equity holders and bondholders probably feel about Hertz since the Chapter 11 exit. The cleaner cost structure and balance sheet and fresh game clock for its strategy has been running in sync with a spectacular used car rally that helped keep expenses in check and remarketing risks low. The numbers show the friendly market backdrop with high travel, a free-spirited consumer, and the boom in used cars up through the middle of 2022.

The market for used vehicles started to go the other way into deflation mode to wind down the year, so the purchasing costs and fleet turnover process will make for some drama as the travel season picks up (see CPI Wrap for 2022: The Beginning of the End? 1-12-23 and Market Menagerie: The Used Car Microcosm 11-29-22). The fleet turnover questions and costs of new vehicles in a very tight market with near record average transaction prices on new cars does not make for an easy story ahead.

We will follow up in separate pieces on the interplay of new car costs for the fleet with car rental pricing strategies. Securities holders need to respect the ABS cash expense risks of the car rental service operation if it does not accurately estimate the residual values (and vehicle depreciation) on fleet vehicles and have it properly priced into the rental rates the company charges. This was a discussion that came up a lot with Hertz back in 2016 to 2019 before COVID crushed the company.

We can’t cover that topic in detail in a 4Q22 earnings note, but the jump in global depreciation per unit per month from $55 in 4Q21 to $244 per unit in 4Q22 tells a volatile story. The US RAC depreciation per unit per month back in 2017 was $327 (HTZ has now changed segments to an “Americas RAC”), but Americas RAC hit $81 in FY 2021 after $258 in 2020. More on those issues in separate commentaries.

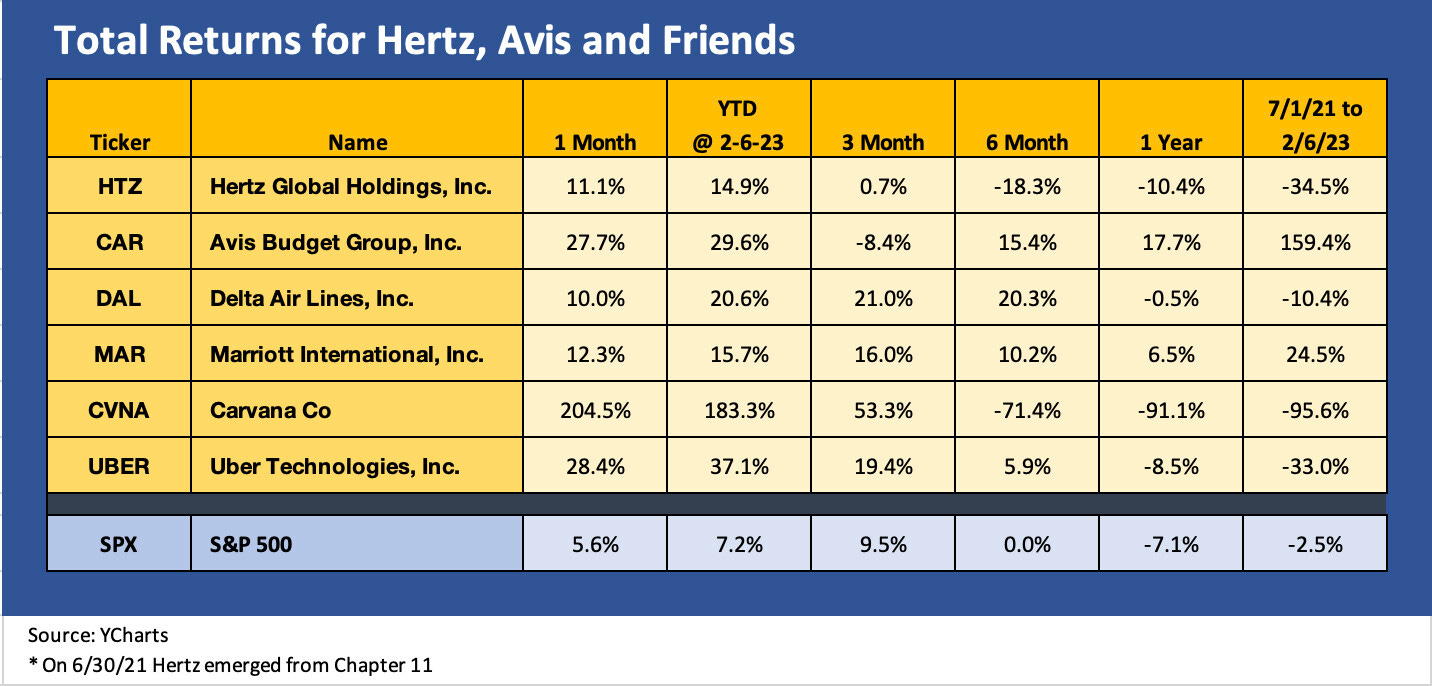

Hertz weighed in with 4Q22 results after its first full calendar year since it emerged from Chapter 11 on 6-30-21. The quarter and year showed a very strong set of numbers that sent the stock up by 7.5% on the day as that rally chipped away at its material underperformance vs. peer Avis since HTZ emerged from bankruptcy. As the chart above shows, those seeking a play on car rental riding the used car rebound and travel boom plunked their money down on Avis.

Avis put up very strong numbers after a stretch of less interruptions and sustained strategic focus. Avis was able to focus on getting their tech advantages further in the lead vs. HTZ. As we have long covered in prior lives on this sector, Enterprise still rules and is on a different plateau at #1. At least now Hertz and Avis have the margins to compete.

Margins look exceptional relative to pre-bankruptcy Hertz, but a bigger test of its pricing and fleet strategy will get tested in 2023 with used car price volatility being the most immediate challenge. The intermediate term plan is to execute on its game plan in EVs and prove that its house is in order (operational, tech, and customer) even when conditions are not as generous as they have been in 2021 and 2022.

HTZ posted adjusted corporate margins of 15% in 4Q22 and are in the zone that HTZ had promised to achieve on investor days of long ago. Those are also the types of margins that would have allowed par recovery on its debt back in Chapter 11. The 27% margin number for the full year 2022 is in a zone above and beyond. The $2.3 billion corporate EBITDA for FY 2022 was a record.

The cleaner start post-Chapter 11 will allow for setbacks as Hertz looks to tap into opportunities in fleet management services and the next generation of EVs. The history of the rental companies being the key means of reaching more consumers will certainly come into play as Hertz has already highlighted with its fleet purchases.

A brief lookback to the high speed COVID period…

Hertz was one of the wilder rides of the COVID era as it saw its Chapter 11 go from a 26 handle price in the CDS auction to a “par plus” recovery for creditors. We had covered Hertz during that strange period and debated the analytical frameworks with a few people along the way. Our take in June 2020 was that the 1L level and 2L bonds were 100% covered. We estimated 50% on the unsecured bonds when the auction was 26+.

For our analysis, we assumed the full layer of unsecured would be equitized and the higher value than the CDS could be reasonably estimated even based on historical peak margins. There was a path to par recovery but only with record margins and a fleet size in line with historical levels. Then the vaccine and reopening rebound sent used car values through the roof, speculative growth stories were in vogue (Carvana was eventually taking a run at having a major OEM market cap). Hertz had a mobility and next gen fleet management “call option” of sorts and off to the races it went.

After one reorganization canceled the stock, the bidding war started and the par plus level and return of value to equity holders made for one of the craziest comebacks from such a deep CDS haircut in such a short time frame. The first quarter of Chapter 11 saw $22 for depreciation per unit per month for Americas RAC during the peak 3Q21 period and $26 in 4Q21 vs. $76 per unit in 2Q21, the last quarter before exit. Those metrics were $278 per unit in 4Q22. Now the hard part begins again. HTZ expects $300 to $320 in 1Q23.

The theories can get tested some more in 2023…

Just framing how Hertz was an asset-lite tech-based service company where vehicle depreciation was a “cash expense” usually got a few people confused who had never really studied the company. The concept of two companies in one – a rental service company and a fleet management company that was not a guarantor – had more than a few shaking their heads.

The analysis went from how Hertz could transform itself from a high cost operation with too much debt from overpriced mergers to being on the front line for so many opportunities as the integrated mobility space evolved and new technologies. Those strategic opportunities would need a lot of infrastructure to market and support such vehicles. You cannot overhaul a massive, embedded ICE fleet and launch waves of EVs on a white board (even if some try), and the Enterprise, Hertz and Avis operators of the world could be valuable in that process.

We will be out with more on Hertz and Avis in later pieces on the companies as we get back into the game, but the bottom line for Hertz since it emerged from bankruptcy at the end of June 2021 is that the stock has been a wild ride but has not been a good one to own relative to Avis, who essentially “schooled” Hertz before and after the dark times in Chapter 11.

Hertz has a lot of moving parts on its balance sheet, but the liability structure is less mystical now after all the focus during the Chapter 11 drama and Hertz’s attempts to hold a gun to its own head (while aiming a bazooka at the cornerstone of the fleet ABS structures) before the warring parties in the restructuring settled into a very successful resolution for bondholders and equity holders alike. The reopening and the vaccine could not have been better timed.