Avis: Credit Profile

We look at Avis as travel soars and the peak driving and leisure season is upon us in 3Q23.

A very strong quarter in 2Q23 is still below the booming backdrop of 2022 but dramatically ahead of the historical profit margins generated in the car rental business.

Recent Avis cash flow and earnings are a world apart from its recent history pre-COVID, and Avis had ample room to buy back billions in stock while sustaining leverage metrics that look more like investment grade than US HY.

The real test lies ahead as the next fleet replacement cycles roll into 2024 and the company has its well documented skill in managing fleet costs, framing residual value risk, and remarketing put to the test again (a test it has always passed).

The 2Q23 numbers, like the 2022 and 2021 results, are extraordinarily positive for the financial strength of the car rental companies. Avis has been riding a wave of solid used car demand (even if weakening in 2023) that mitigates residual value risk and drove some outsized gain in 2022. Results also can ride the high volumes of travel that have sustained strong pricing relative to fleet costs.

In this commentary, we take some extra time to look at the analytical framework for car rental since the backdrop will likely be “more normal” in 2024. Avis is now forging ahead in what will be a very strong 3Q23 as the fleet replacement cycles reset the dial for bigger challenges ahead in 2024 as the pandemic aftereffects on fleet management normalize.

Looking back at recent history, the FY 2022 EBITDA margin of over 34% and almost 26% in FY 2021 are outliers by a multiple. From 2012 to 2019, Avis EBITDA margins only cracked double digit margins in 3 of those 8 years, and the EBITDA margins in those 3 years only had a 10% handle. The results in more recent periods are a function of tight fleets in the industry, material pricing power, high travel volumes on the reopening rebound, and very high gains on seasonal sales of fleet.

Used car prices are only recently starting to normalize and the fleet size is getting back into a zone that promises more complex and symmetrical challenges in 2024-2025 in managing pricing, residual value risks, and remarketing strategies. The good news is that Avis has always demonstrated its strengths in these areas.

A quick review of car rental fundamentals…

In prior lives, we would spend way too much time on the car rental names from 2016 to early 2021 as Hertz took the world on a wild ride that started in the fall of 2016 and did not seem to ever stop until the pandemic triggered Chapter 11. With the pandemic, the ride was even crazier as the industry had to deal with a potentially disorderly fleet liquidation backdrop. Fortunately, HTZ and its creditors got the situation under control. Hertz is a separate story for separate commentaries, but HTZ at one point had three CEOs over a few years. Shareholders were unhappy (including the #1 shareholder, Carl Icahn) and bonds were volatile.

In contrast, Avis was a paragon of consistency and stability in a market dominated by three players (Enterprise is by far the #1 player as a private company and Hertz now is #3, dropping down from #2 after Chapter 11). We have not written much on the space on this new platform (see Not Your Father's Hertz 2-7-23, Avis: Cash Flow Boom and the Swing in Car Rental 2-17-23), so we thought we would summarize our checklist for car rental companies:

Fleet trends:

The simple way to look at the car rental companies is that fleet comprise their earnings asset base. The cost of new vehicles has a time horizon from purchase to sale into the marketing channels at a price to be determined later but which you need to estimate and depreciate. The point of fleet downsizing comes with both seasonal turnover and more routine fleet turnover/remarketing.

The ability to estimate the residual value on the sale of a vehicle is crucial as Avis seeks a pricing structure that allows an attractive return on that cash investment in cars (funded by nonrecourse vehicle financing entities). The overall vehicle cost flows into rental pricing strategies by vehicle and location designed to get a healthy margin on those vehicles (and hopefully maximize those margins). In the past two years, the question was how much additional margin could be extracted from a tight market.

This flow of dollars from purchase to sale is how vehicle depreciation ends up a cash expense in how car rental companies are evaluated. In other words, EBITDA for a car rental company includes the vehicle part of “D” as a cash expense (i.e., not added back of you compute EBITDA from the bottom up in the financials). That used to confuse a lot of people when they first picked up car rental names. There is a reason they break out vehicle depreciation separately from non-fleet depreciation in the cash flow statement.

Fleet size, pricing, and unit costs drive the earnings trends. The other part of fleet management is making sure the desire to add more fleet does not depress pricing at a given location or in total. Car rental company “over-fleeting” has in the past been a setback for industry pricing (usually everyone would blame Hertz). All the major car rental companies operate at the major airports, so that part can be challenging. That will get tested again next year. The off-airport locations are less tied to air travel patterns (70% of Avis revenue is from airports). The off-airport share has grown over the decades.

Tech investment:

A big challenge for car rental has been sizing the fleet the right way with the right model mix and in the right locations. An example of what not to do was Hertz, who had a poor mix back in 2015-2016. HTZ paid dearly for that mix, which included too many compacts.

That fleet optimization can prove to be analytics and data intensive, and Avis has been consistent in this area during the transition years of the last cycle. Avis made the investment in such capabilities early and managed it effectively as the industry was rapidly evolving on the tech front both in fleet planning and in customer management (analytics, apps, etc.).

For its part, Hertz was wrestling with integration problems with Dollar Thrifty and was seen as heavily investing but not effectively investing. Avis had been able to navigate the wild swings of the sort seen during the 2017 whipsaw that came on the back of Hertz becoming a case study in fleet mismanagement and poor residual forecasting from 2015 through 2016.

Major fleet rebalancing of the sort executed by Hertz in 2017 can set off a chain reaction that is beyond the scope of this piece, but used car values were roiled, management turnover was had by Hertz, Icahn was not happy, and bonds were volatile as well as stocks. Avis underscored it was a very different kind of operation during that time and came through impressively during that stretch.

With steady investment through that pre-pandemic period, they came out the other side even stronger as they rode this outsized recovery in travel and car rental. Avis very effectively managed the pandemic crisis and parallel need to liquidate large quantities of fleet in 2020. The decline in average fleet from 1Q20 to 1Q21 was -29%. The increase in average fleet from 1Q21 to 1Q22 was an expansion of around 50%.

M&A risk:

Overleveraged bad deals and bad execution was not an Avis problem. It was a Hertz problem even if Avis simply got lucky by missing on the Dollar Thrifty (DTG) deal. HTZ and Avis squared off in a protracted bidding war for DTG (2 years) where the final price soared and HTZ financed it with debt (vs. an original cash stock deal). That used up balance sheet capacity and that came back to haunt Hertz later when they ran out of lien room.

That Dollar Thrifty deal was a great miss for Avis, who purchased Zipcar earlier in a small deal (around $500 mn) that was more about Avis’ tech image and the evolution of mobility services. Zipcar had more cachet than cash flow, and Zipcar was an immaterial contribution to fleet size, revenues, or EBITDA. The disproportionately favorable Avis stock response to the Zipcar deal was not rooted in the Avis income statement, but the deal enhanced the company’s image in the evolving mobility sector. The balance sheet damage was minimal in contrast to the damage Dollar Thrifty would have caused.

Used car remarketing and residual value risk:

This is an area that was of supreme importance for the car rental players as the post-Chapter 11 OEMs (GM, Chrysler) and post-restructuring Ford moved away from program cars after downsizing capacity. The end of most guaranteed depreciation rates in the US for the daily rental operators meant the car rental players had to take new risks. That shift in new fleet purchases increased the demands on the car rental companies to manage the back end of the residual value risk. Simply put, they had to buy better cars at higher average transaction prices and effectively manage residuals. That would flow into real cash losses if they overestimated the used car and light truck values.

That new set of risks in their business required a very different operational approach than the old days. The car rental companies had to build better remarketing channels to dealers and retail and reduce dependence on wholesale channels that had lower net yields. This was well executed by Avis, but the post-pandemic period of 2021-2022 brought a new and positive risk-reward symmetry to Avis as the supply-demand imbalances offered some opportunities to time fleet selling for profit.

Avis booked exceptional gains in 1Q22 and 3Q22 for well over $600 million that pumped up the bottom line. Car rental companies saw a windfall that helped them recover quickly from the COVID damage. In Avis’ case, that included rewarding shareholders with large scale buybacks ($4.8 bn in 2021-2022).

Avis 2Q23 comes in strong…

Below we look at more of the recent financial metrics and how Avis stock has performed head-to-head with Hertz since the Chapter 11 exit in mid-2021. It is no contest. The Avis rally is tied to record high profit margins, massive share buybacks, and a sense that consumer sector strength will not lead to a sudden reversal in leisure travel.

The market also is not seeing a lack of demand for late model used cars even if the market has softened somewhat. The increased supply of new vehicle production in 2023 could ease concerns over excessive new car prices in the 2024 fleet cycle that could get rolled into OEM contracts. The main competitive issue remains the same for the car rental sector – size right and price right and watch costs.

The Avis vs. Hertz stock action detailed below covers the period from the Hertz exit and tells a very favorable story around Avis. We will be looking at Hertz in a separate note.

Below we look at the breakdown in Avis June quarter numbers as the usual seasonal driving peak quarter is now underway in 3Q23. The outlook remains positive for Avis in terms of sequential revenues and earnings. How that translates into stock price action gets back to the forward-looking consensus on how earnings will track in a more challenging market for managing fleet risk into 2024.

The ability to size the fleet in a period of record high new car transaction prices and then set pricing to recover estimated residual values with a healthy return is where Avis has demonstrated its operating strengths across time. The easy part is presumably over in 2023 after these outsized margins were realized.

That fleet strategy generally ties back into the key drivers of price, volume, and unit costs into 2024’s seasonal peak periods. How the equity markets price those expectations is all over the place right now as evident in the subpar stock performance of Hertz vs. Avis.

Fleet management, business volumes, and leisure travel are all getting favorable guidance right now, but the next travel season seems like a long way off when the next round of cyclical trends are being so vigorously debated with the Fed tightening cycle potentially heading for more of the same.

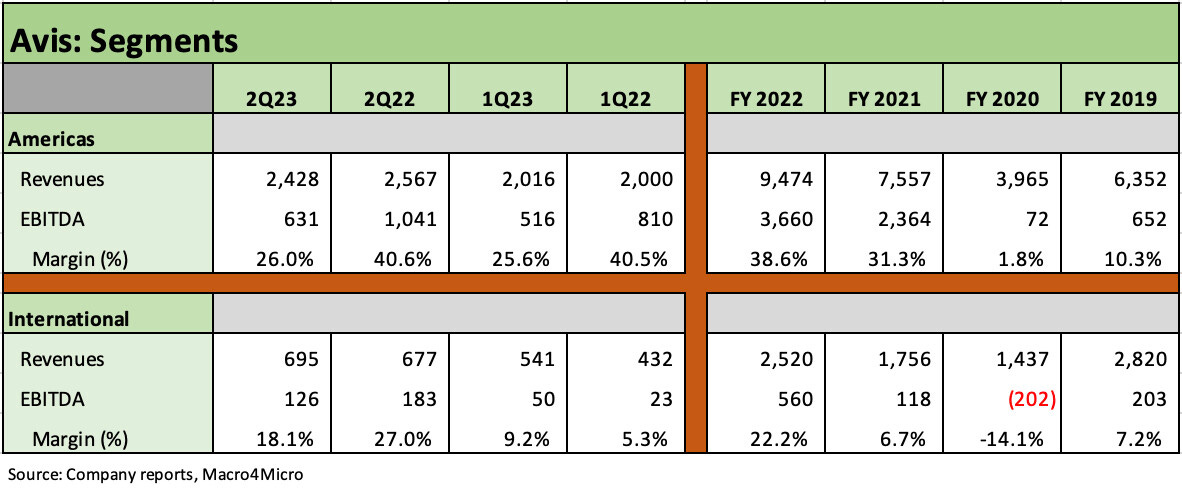

The above chart frames the recent history of profitability at the segment level. The FY 2022 and FY 2021 numbers are benefiting from imbalances that flow into gains in fleet sales in the US operations and strong pricing on large average fleets. The biggest lift in fleets naturally came from 2021 into 2022 as detailed in the operating metrics section below.

For International, the numbers are also strong. As we have covered in our airlines work, the international travel volumes for major carriers such as Delta (see Delta 2Q23: Bellwether Bliss 7-16-23) and United (see United Airlines - Company Comment 7-22-23) have been booming. Pricing power and volume are a formidable combination.

The operating metrics that Avis discloses each quarter frame fleet size and utilization of that fleet and provide measures for volume (rental days) and daily revenue and fleet costs per month. The numbers are impressive even if some fall short of the record year of 2022.

As we have seen with the airlines, travel is booming and leisure revenues are very strong in the peak travel and vacation periods. International travel and more pent-up leisure alongside some recovery in business volumes are positive. The average fleet size of almost 690K at the peak fleet period of 2Q23 is very close to the 684K Avis posted back in 2Q19, the last pandemic free 2Q period. The difference is Avis has much higher margins now.

To underscore some of the upside benefits realized in 2022, the Americas segment saw monthly per unit fleet costs decline to only $10 in 3Q22 and $20 in 1Q22 due to gains on sales of fleet. That is despite chugging along with straight line depreciation on fleet of around $230/month. This is the upside of the price volatility seen in late model used cars. Avis can bank the winnings, reward shareholders, and take care of investment needs. They need to find what normalized EBITDA run rates and fleet size will look like on the other side of the series of big wins. The same is true for stockholders and lenders.

The ability to absorb any downside in used cars comes down to accurately estimating depreciation rates or making adjustments along the way. The overcollateralization in the ABS structures protects the car rental fleet funding entities on the downside of residual values. As new fleet rolls in and out and travel seasons come and go, Avis’ job is to make these estimates as well as it can and size and price the fleet accordingly. They have shown they are good at it.

With solid credit quality and the industry rebuilding years under its belt, the ability to protect the ABS markets with overcollateralization gets that much easier whether it be Letters of Credit, cash, or additional vehicles. Good credit quality keeps the banks on their side in LOC lines.

Avis in travel context…

Below we frame the time horizon returns on a cross-section of travel stocks which include car rental, a bellwether mobility name (Uber), the leading hotel name (Marriott) and a mix of airlines. For airlines, we include the Big 3 global names with their strong international operations as well as the more US-centric majors (LUV, JBLU). We line them up in descending order of YTD total returns. Avis really distinguishes itself looking back across its recovery from the pandemic period and the 3-year and 5-year horizon.

The valuations ran ahead so quickly in 2022 that it was going to be tough to keep up, but the travel group broadly has posted superior returns YTD 2023. Uber was the big winner in 2023 but Avis goes in the expanded winners’ circle as well. As the peak travel period comes to a close in the early fall, life will get more interesting for the travel cycle, which like the overall consumer cycle will be getting revisited at the macro level.

Avis and the balance sheet picture…

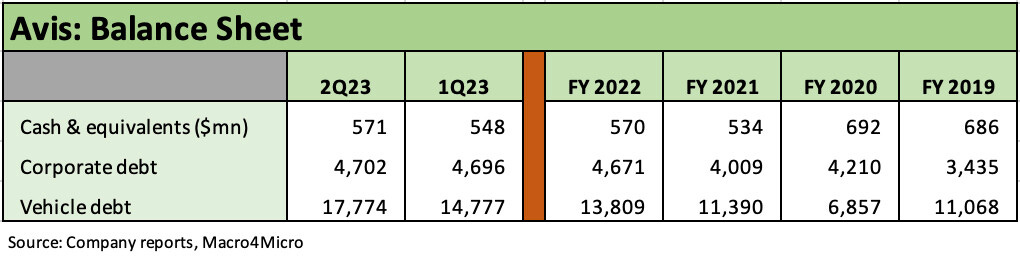

The above chart frames the main moving parts of debt, and the balance sheet is now investment grade caliber if we take the recent EBITDA run rates and margins as a norm. LTM Net Debt/EBITDA of around 1.2x at 2Q23 is impressive even if somewhat distorted by the 2H22 turbocharged results and very strong 1H23 numbers flowing through the current fleet size, pricing, and unit cost structure. These are great numbers even if anomalous in the history of Avis. The EBITDA run rates have allowed for massive stock buybacks of $3.3 bn in FY 2022 and $1.46 bn in FY 2021.

The FY 2022 period saw a 1.0x Net debt/EBITDA by year end after a year when used car pricing and short capacity in the car rental fleet made for a very fortunate confluence of factors to drive a $2.7 billon net income line. That contrasts with a $302 mn in the pre-COVID year of 2019. From 2015 through 2019, the average net income of Avis was just over $260 million. The post-pandemic, post-Hertz Chapter 11 world sees the industry in an all-new zone of profitability.

The vehicle funding structure of over $17.7 bn gets back to the strange aspect of how a car rental operation works as something akin to two companies in one. One company is an asset-lite, tech-centric service company that rents cars. The other company is an asset rich owner of vehicles that funds the purchase and leases them to the service company.

The corporate debt number is the one to factor into equity valuations or credit risk. The vehicle debt is a separate structural analysis. The way to look at the vehicle debt is that the LOC lines from the service company are used to overcollateralize the ABS and get IG ratings on those deals. The rental operator can also use cash to overcollateralize (or more vehicles in some cases). The LOC lines are contingent risk exposures or can be seen as claims risk on the car rental company if the world blows up. That world came close in 2020 when Hertz played chicken with the threat of a disorderly liquidation. That is more a primer for another day.

After this two-year run, Avis is a lower risk core HY exposure. Their ambition is not to be IG, as evidenced by their massive buybacks. They are not trying to replicate the Enterprise model.