Carvana: Solid EBITDA, but Does Not Cover GAAP Interest

Triple digit positive EBITDA is a good thing, but the theoretical EV multiples being assigned (and in what EBITDA year) assumes a lot of dazzling growth.

Carvana (CNVA) is always an adventure given the disconnect between extraordinarily high financial risk and the outsized, bullish valuation multiple CVNA gets awarded in the equity markets (off a theoretical revenue and earnings line to be seen at some year in the future).

Even if results in 4Q23 and FY 2023 made for good news after a very successful restructuring of its debt with the bondholder group, the record EBITDA line should not turn stepping up onto the curb into an 8-foot high jump since EBITDA is still well short of GAAP interest expense and a bare bones capex program.

The excitement over the dramatic swing in EBITDA and Operating Cash Flow should be tempered by the massive inventory liquidation in a market where CVNA dollar revenues and unit retail sales have declined sharply over 2 years.

The clash of the longs and shorts in equities and the caffeinated meme players has made for great spectator pyrotechnics, but growth stock stories are usually not built around declining volumes and stagnant prices that accompany massive debt burdens and negligible free cash flow for deployment to expansion.

Carvana always makes headlines and sees major moves in its stock around earnings reports. That is especially the case after the ZIRP-era, post-COVID price action of 2021 sent CVNA stock into the stratosphere while a major cash flow bleed came with the inability of EBITDA to get in the zip code of what was soon to be an explosive growth in debt and interest expense. A CVNA financial panic was underway by the end of 2022.

Now we are back to trailing EV multiples of around 47x after a record EBITDA year. If they double EBITDA in 2024 that would still leave EV/EBITDA multiples with a 20-handle depending on the stock price action. There is a reason the price action gets keyed off forward EBITDA projections. The question is “Which year?” and “How much EBITDA?” We look at the process and think “shades of 1999” except we also have 2021 for recent memories.

EBITDA and peer groups for context…

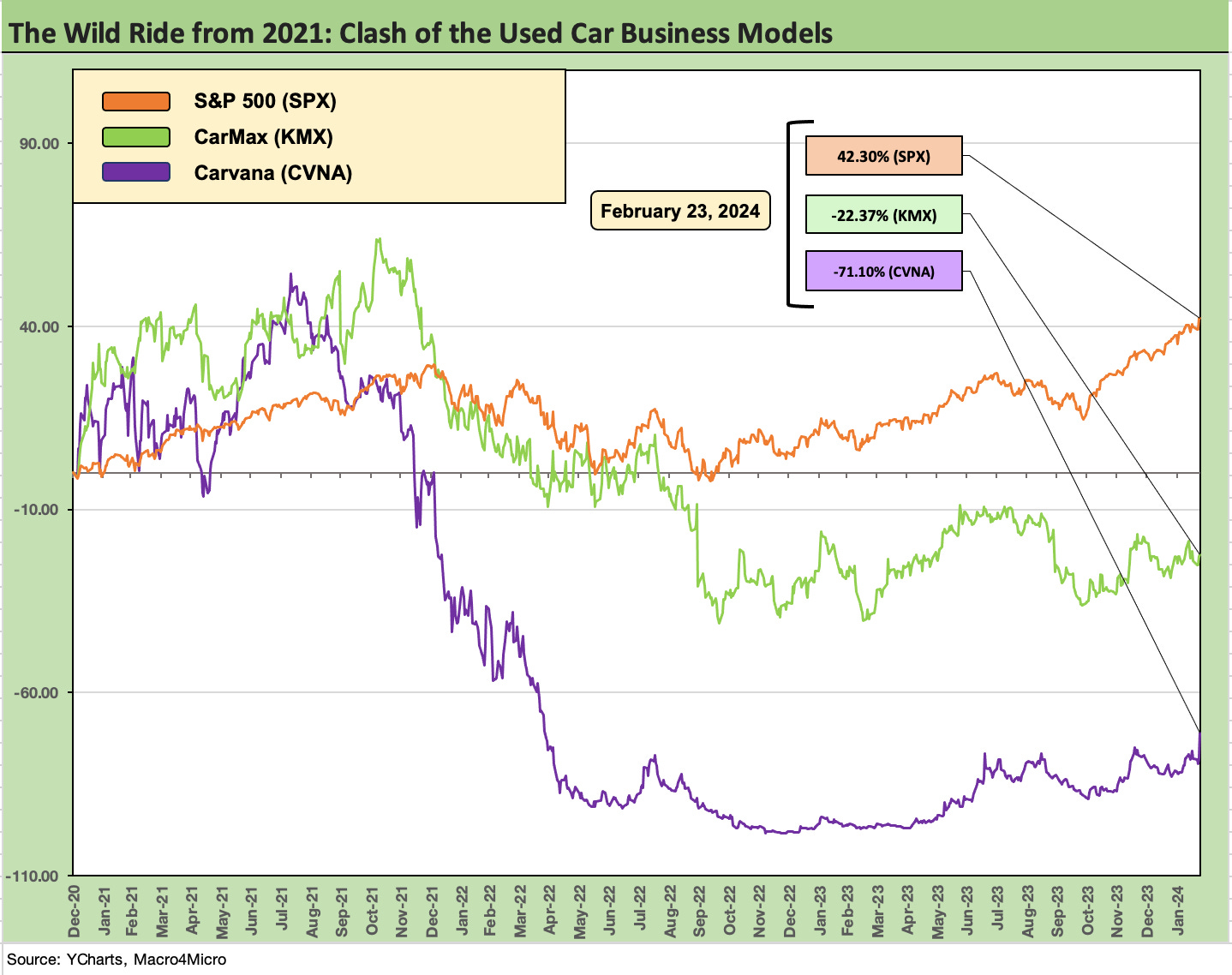

The stock chart at the top plots the S&P 500 and used car leader CarMax vs. CVNA for some context on the ride from 2021, a year that had a lot of similar stories and some other emerging IPOs in auto tech and services (notably used cars).

The impressive jump in CVNA stock after earnings and a +39.7% rise on the week (ended 2-23-24) gets some scale in the time series above. It’s a big move off a small base, but not in the context of the 2021 to 2024 ride.

The time series covers the wild used car years from 2021 across the tightening cycle and into the rally period in growth stocks and tech in 2023 into 2024. A few major used car equities have badly lagged the market and a number of auto services and used car IPOs have taken a beating over those years. We detail those further below near the bottom of the commentary in a time horizon return table.

We cover much of the CVNA background and history in the links at the end of this commentary, but the very short version is that CVNA rode the 2021 tech and growth stock equity bubble into the stratosphere and a peak valuation in the summer of 2021 (the Aug 10, 2021 peak stock price of $370 vs. Friday 2-23-24 close of $69.23). CVNA was in single digits as recently as early May 2023. Now that’s a ride.

Equity market cap as the ticket to borrowing and deleveraging across history…

The valuation of the equity in 2021 had hearkened back to the TMT bubble years with the use of forward valuation methodologies and the outsized multiples assigned based on a set of revenue and profit margin assumptions that don’t always show up on time – and often never do. For CVNA, the peer group of digital retailers faltered badly after their IPOs.

For its part, CVNA took more extreme actions to leverage off its lofty market cap with the use of debt to expand its infrastructure investment with the ADESA asset purchase. The goodwill generated in that transaction was written off in near record time, but CVNA today remains overburdened with the debt from that period even after the bondholder relief deal.

Such equity valuation assumptions as we saw with the TMT era and again in 2021 with CVNA can drive massive market caps that clears obstacles to excessive borrowing on the basis of theoretical net asset protection that the market has assigned. The risk is that revenue shortfalls and excessive debt-financed expansion plans can then meet cash flow shortfalls. That is not a new setback for US HY and CVNA was just the latest glaring example.

The theory now is that CVNA gets a “second act” and can start to realize its operating leverage to the upside and also use that lofty valuation to clean up some more debt with equity issuance. That is now rolling into the bullish debt prices anchored by a bondholder group that sees protection on the downside. The equity valuation is a separate story with a drastically wider range of potential outcomes.

As we have seen across the years, the realization of financial risks can quickly render the overly optimistic EV multiples uneconomic and make the balance sheet a negative for equity valuation. When EV has too much debt in the mix and the multiple is second guessed, things can go badly wrong. The silver lining in excessive, speculative valuation is that opportunities arise to issue equity for debt reduction and investment, and that is an outcome that could bolster the story as well despite dilution risk in 2024.

Ugly balance sheet remains ugly…

In the meantime, the balance sheet metrics are somewhat hideous. The net debt/LTM EBITDA is just under 17x, so that by itself is leverage double the typical EV multiple of a highly profitable public dealer also committing resources to used car retail expansion.

The forward-looking numbers are supposed to talk down the leverage fears. CVNA’s rising positive EBITDA at least arms CVNA bulls with some ammo to shoot at the bears. The backward-looking debt/EBITDA numbers and EV multiples vs. reasonable peer groups in auto retail are the counterpoint for the bears. Single digit EV multiples in facility heavy and omnichannel retail are somehow supposed to allow an EV multiple for CVNA that will be triple (at least) using a projected EBITDA line from a few years out. It is easy to be skeptical of this approach.

A valuation crisis of confidence is where the bulls and bears have faced off the last two years, but now CVNA equity is going through a period of radical rebounding that is calling for a new round of EV multiples that disconnects from the main players in used car and new car retailers alike.

The selling point for the company is still the same in that its leadership position in digital used car auto retailing provides material upside for revenues and cash flow and is part of the wave of the future. That means used car prices and used car supply sources at the right margins and rising volume needs to fall into place. It also implies that KMX and the franchise dealers in the peer group stand still and don’t march down the same path and expand digital retail capabilities.

Bondholders, balance sheets, and risk symmetry…

The grim reaper was knocking on the CVNA door at the end of 2022 as negative cash flow and a glaringly obvious inability to service its debt was more a fact than an opinion at that point. When you listened to or read the transcripts from the earnings calls, it was clear enough that management never says die. If confidence was a credit rating, CVNA would be a AAA and not a CCC composite.

That said, it is hard to see a transmission mechanism to a liquidity crisis anytime soon, which was the whole point around the distressed debt exchange. The bondholder group did a masterful job improving risk symmetry, adding more security and asset protection, buying time, and putting management in a box.

The financial viability questions would be an even easier risk to check off with an equity raise and debt reduction exercise. Lower rates and a sustained consumer cycle would obviously help as well in terms of inventory funding costs as well as affordability for the customer.

The chart above looks at a few key lines since 2019 that are worth considering for a company that is making its valuation case as a growth stock:

Total debt is still excessive with Total Debt/EBITDA now up to over 18x, but the EBITDA line has at least set a record this year by being positive and in triple digits.

FY 2023 revenue total in dollars (vs. units) is lower than FY 2022 and FY 2021, so that clouds the growth multiple.

Retail vehicles sales in dollar terms were down by over -26% during 2023 while retail unit sales in FY 2023 are down over -24% lower than in 2022 and lower than 2021.

Wholesale unit sales were down by -19% while wholesale dollar sales are down -4.0%.

Inventory is the lowest it has been since 2020, and OCF was bolstered in FY 2023 by a $711 million vehicle inventory liquidation that drove a major portion of the net cash provided by operating activities.

Total debt is up over 4-fold since 2019 while inventory is up by 1.5x as the debt-funded investment in infrastructure materially changed the nature of the CVNA balance sheet.

Overall, that does not scream “high growth secular buzz.”

The willingness of the bondholder group (a mix of major institutional debt players, hedge funds, and private equity brand names) to get involved in buying CVNA some time allows the company to prove its business model can survive some secular and cyclical question marks around the used car space.

The material relief in cash interest (vs. GAAP interest) and the zero sum game in the face value of debt to support the financial viability and valuation of the company was essentially a bailout to avoid materially worse outcomes for bondholders and a potential Chapter 11.

Bondholders did not make these concessions out of the goodness of their hearts. They improved their risk symmetry on loss exposure, protected themselves from further financial mismanagement and excessive debt-financed strategies by CVNA (although CVNA had effectively lost access to the debt market by that point even if they would not admit it at the time), and undermined the ability of the company to use divide-and-conquer distressed exchange strategies.

Some questions for the valuation debates…

For credit quality, CVNA needs to get back into where Net debt/EBITDA at least is in high single digits, but then the question is how does it fund expansion without more debt at a time when cash interest expense will be snapping back?

Will CVNA seize an opportunity to issue stock to reduce debt with such inflated valuations? (We have seen HY equities rally in the past despite dilution on the merits of lowering financial risk.)

What is the rational and logical frame of reference by business comps for the EV multiples assigned and what year in the future will that valuation use as the key frame of reference? Is the lack of a perfect comp allowing for “make believe” lofty multiples?

How does declining retail unit volume, lower dollar revenues, and EBITDA below interest and capex allow for superior forward multiples in valuation vs. financially stronger dealers with their inherent advantages on trade-ins and lease roll-offs as new vehicle unit volumes pick up?

What market share and revenue run rate assumptions will be built into CVNA equity valuations in such a competitive market? (Some are calling for a tripling of market share.)

How can the EV multiple for CVNA be so far above the incumbent in the space (CarMax) who is investing in digital and the buildout of a flexible omnichannel capability while maintaining a strong balance sheet? (See KMX links below.)

How does CVNA deserve an EV multiple at some future date that is triple names such as AutoNation and Lithia among others who are infrastructure rich, growing their used car operations in recent years, and investing in digital?

If this sort of premium will be assigned to a higher mix of digital retail strategy, isn’t it logical for the major dealers and KMX to further accelerate their investment in the same asset and technology initiatives and keep the competitive heat on? Why wouldn’t they fund it from free cash flow in lieu of buybacks if the market is handing out these sorts of multiples to a high (very high) financial risk company?

Where does sourcing of used vehicle supply fit into the picture for the more bullish scenarios on the volume side that are required to drive revenue and cash flow? (Note: Per Unit GPU metrics get a lot of focus in quarterly earnings drills at CVNA but not too much discussion on how they capture volume.)

Do the parts and services operations of dealers or the ability to package certified pre-owned vehicles (CPOs) and the ability to offer extended protection plans and warranty products give omnichannel players with more local and dealer level physical facilities an ingrained advantage in capturing customers?

Will the market be in for a stretch of limited used car supply (less retail lease roll-offs, less rental roll-offs vs. history) that will undermine the ability of CVNA to execute on material top line growth even with superior per unit metrics?

What role will F&I products play with the dealers and KMX in aggressively courting customers at the same time they can bid for supply with the confidence of stronger balance sheets?

How does CVNA’s online offers for used car inventory gain an advantage over CarMax’s instant offer program? Does the strongest balance sheet win, or is that a race to lower margins for the middlemen with franchise dealers holding better cards?

Do franchise dealers have an inherent lead generation advantage in historical knowledge of past customer transactions or through new car shopping leads that allow for late model used car alternatives? Who has the data edge?

Will franchise dealer networks with auto finance and insurance history always have an edge in efficiently targeting customers? Does that advantage grow with more investment in technology and data?

The competition is not standing still…

The asset mix strategies tie back to why CarMax as the used car retail leader and the Big 6 public dealers are all pursuing digital retail initiatives. What the secret sauce is for the optimal relative mix of assets across bricks vs. clicks is not a new debate, but names such as Lithia and Sonic moved aggressively into tech investment and executed in dedicated used car branding initiatives. LAD and SAH saw their stocks struggle vs. AN and PAG. In other words, no one is standing still in this highly fragmented market, and the moving parts keep moving.

When Carvana talks about having 1% share and leader CarMax refers to an over 4% share, that implies a lot of upside growth opportunities. The question is how to get there. KMX is a very good proxy for a major consumer segment (used cars) not only given its breadth as the well-recognized used car leader but also from the company’s presence as a major lender to its customer base through its CarMax Auto Finance unit (CAF).

KMX also boasts the largest market cap in the auto retail space. The CAF data undermines some incorrect assumptions about the credit quality of the typical used car buyer in a world where there is a secular shift toward more drivers buying late model used cars on affordability. Used cars have gone mainstream.

The omnichannel vs. pure play digital debate has been settled. A few pure plays did IPOs and were crushed (e.g. Vroom exiting digital retail). We saw CVNA load up its balance sheet with debt to expand in hard assets and infrastructure, and that settles the strategic debate since you clearly need both supporting physical assets as well as a digital strategy. The asset-heavy can meanwhile keep going digital as they shoot for higher share within regions where they have dealers and other facilities.

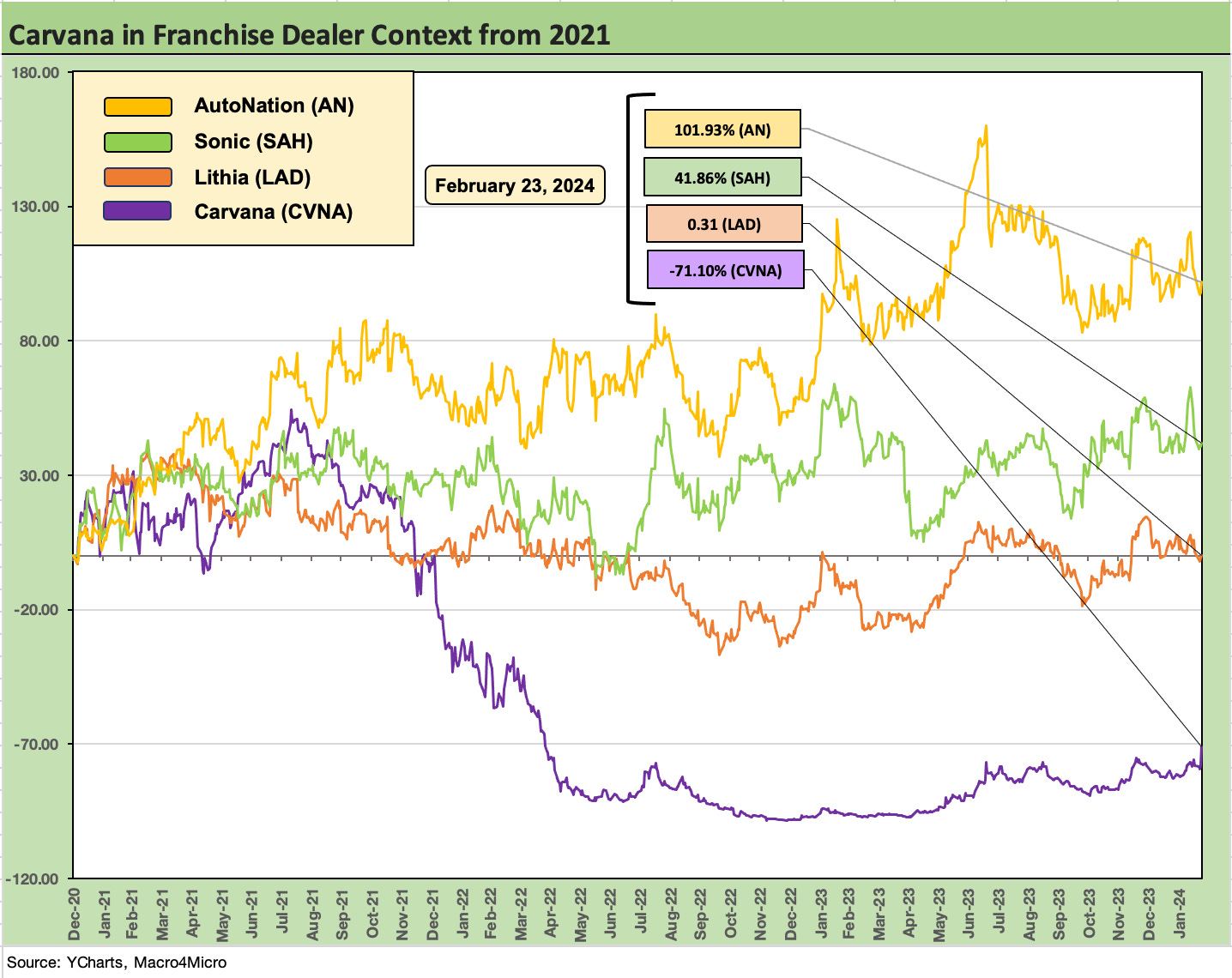

The franchise dealers and their role cannot be underestimated. We look at CVNA stock vs. a sample above. We include LAD and SAH as aggressive used car entrants and AN as a US brand heavy balanced player. We left out PAG since it is heavy in luxury and non-US brands and has major UK operations. We felt this mix told a better story than ABG and GPI. We include them all in a broader peer group stock return review further below.

The dealers piled into used cars since 2020-2022 as more venture money was pouring into used car tech and services before and after COVID. The capital flows showed used cars to be a business with growth potential and one that was encouraged by the dealer’s need for new products and ancillary revenue streams in Finance and Insurance (F&I) products.

The ability to leverage Parts and Services operations with more customers was another twist. F&I and P&S bring higher margins and/or profitable expansion lines for auto retail. Omnichannel was a nice angle on “all of the above” by offering a wider range of alternatives as customer behavior evolves across demographic slices of a growing population (Retirees, Boomers, X, Y, Z, etc.).

Lithia had arguably been the most aggressive and Sonic also relative to its smaller size, and their stocks have struggled vs. the peer group as used cars lost some cachet. All the big dealers and the long tail of private dealers had skin in the game. Yesterday’s used car buyer can be tomorrow’s new car buyer. In the repriced world of new vehicles, the reverse can also be true with the former new car buyer now a used car customer on affordability. The used market is too large to ignore and many of the same demographics and customer targeting technologies apply to both new and used.

As we look back at the wild CVNA stock ride, the upward spiral of 2021 was only trumped by the downward plunge to the doorstep of bankruptcy if they did not cut a debt restructuring deal with the bondholders.

There is a lot going on in the auto sector from supplier chains to OEMs to retail distribution and the channels between (e.g. wholesale auctions). The rise of the electric vehicle (another EV!) affects the full range of industries and flows into trade tension and tariff anxiety ahead. Semiconductors will only grow more important. Those supplier chain issues had and continue to have a direct impact on used car demand and the supply of vehicles to be sourced by dealers across new and late model used.

The chart above shows returns for used car equities including some formerly hot IPOs. The running 3 years did not play out so well in used cars, and some of these business models face plenty of challenges.

The used car business development challenges have been more visible than ever as the dealers expand into the business and affordability remains strained. Lithia has been the most aggressive, and their stock suffered in 2021-2024. Their expansion still has been impressive looking back over 5 years and 10 years, and the dealers remain very healthy, and in the used car game as well as in search of more dealership acquisitions in a private-heavy and family-owned subsector.

Summary

In the end, CVNA is a valuable operating asset with way too much debt and very weak cash flow and profitability relative to its debt. The shorts (and related massive base of short interest) vs. the longs and the love-hate battles over CVNA stock have been picked over across the 2022 freefall from the heights of 2021.

A major problem is that the onerous debt burden is mostly still there despite the material impairment of bondholders (and temporary exit from the HY index and some default ratings from the ratings agencies) on the way to lower debt and additional interim cash interest rate relief from the bondholders as part of the deal (covered in earlier pieces).

The $339 mn in adjusted EBITDA and guide to well over $100 mn in EBITDA in 1Q24 adds to the sense of less financial stress. CVNA now has a window to gain financial viability, but leverage remains off the charts and the EV multiples more of an assumption-driven 1999 TMT flashback keying off rapid assumed growth in revenue and EBITDA.

The assumptions also appear to include no meaningful inroads from CVNA’s major competitors in digital retailing. That has been a priority for much better capitalized entities who can also boast other advantages in used vehicle sourcing, finance, and more alternatives for serving customers.

The downside scenarios for CVNA now would come out of equity holder returns more than bondholders. For negative downside scenarios for bondholders, perhaps there is a thought that CVNA in a worst-case scenario could simply be “Hertz Part Deux” with a bidding war from financial investors as well as strategic buyers working in concert with the bondholder group.

As a reminder, the HTZ CDS auction cleared at a 26-handle before unsecured bondholders later recovered par by the end as the value of the asset base was reassessed. That makes it much easier to sleep at night as a CVNA bondholder than a stockholder. Bondholders are now in a position to sit tight or (per BondCliQ data and ICE) exit in the mid to high 90s.

The devotees in the CVNA equity base run from short squeeze fans to meme-heads to true believers now that the bondholder group pushed off the potential days of financial reckoning. On the equity side, CVNA earnings season used to be a day of excitement for the short sellers’ convention waiting for a shoe to drop.

Now it is more about seeing how out of control the valuation assumptions can get in peer group context. Scary leverage, failure of EBITDA to cover GAAP interest, a big asterisk on governance given the voting control issues, and lower total dollar and total unit sales are on the short list of trying to solve the mystery behind such bullish multiples.

Contributors:

Glenn Reynolds, CFA glenn@macro4micro.com

Kevin Chun, CFA kevin@macro4micro.com

For Carvana, see also:

Carvana: Quick Read, Long Road 11-2-23

Carvana and Uncertain Used Car Dynamics 10-5-23

Carvana: Smoke Signals Get Smokier 6-9-23

Carvana 1Q23: Company Comment 5-4-23

Carvana: Prisoner’s Dilemma, Used Car Getaway 3-22-23

Carvana: Credit Profile 3-5-23

Carvana: Wax Wheels 12-8-22

The Used Car Microcosm: Industry Comment 11-29-22

For CarMax, see also:

Credit Crib Note: CarMax 2-21-24

CarMax: Credit Profile 7-9-23