Avis: Gearing Up for a Transition Year in Fleet Costs

We look at the seasonally slow 1Q period for Avis as vehicle depreciation faces a return to remote normalcy.

"Enterprise a tougher nut than Hertz to crack..."

A dramatic increase in per unit vehicle costs sets the stage for fresh challenges ahead in car rental as pricey cars from the days of supplier chain stress are set for remarketing and used EV depreciation rates taint some of the new auto tech growth buzz after the latest Hertz beatdown.

The seasonal earnings weakness and losses during 1Q periods is a car rental tradition only broken during crazy periods of used car whipsaws and used car gains, but the net loss for Avis in 1Q24 mirrors bottom line losses in 1Q periods in the 5 years before the COVID 2020 crisis.

Good news includes signals from Hertz and Avis that both are right sizing their fleets to avoid a throwback to the old days of rental pricing pain.

There is every expectation for another very strong travel season ahead during the peak 3Q24 period like the extraordinary 3Q23 volumes.

Today was a celebration for car rental with Avis stock up by 20% (off the intraday peak) after it printed its seasonally low quarterly results after the close last night and had its conference call this morning. The real action takes place during the 3Q24 seasonal peak, and Avis gave a clear and detailed breakdown of the moving parts as costs get reset after protracted fleet cost volatility. The rally today comes after a trailing 1-year return on Avis stock (ticker CAR) of -44% and also -73% in Hertz as of last night’s close. Hertz also rallied today and was up by almost 12% on the day.

We have been in the weeds on Hertz and Avis lately and will be out with more detailed looks at the companies. After too many years toiling in the Hertz documents during past lives, it is astonishing to see how quickly they got themselves into trouble again. That is a story for another day.

True to form, Avis is grinding it out and “getting it done” but the trends are not in their favor in terms of profit margins or balance sheet leverage as the EBITDA line heads for more pressure and leverage will tick higher by year end unless they start paying down some more debt.

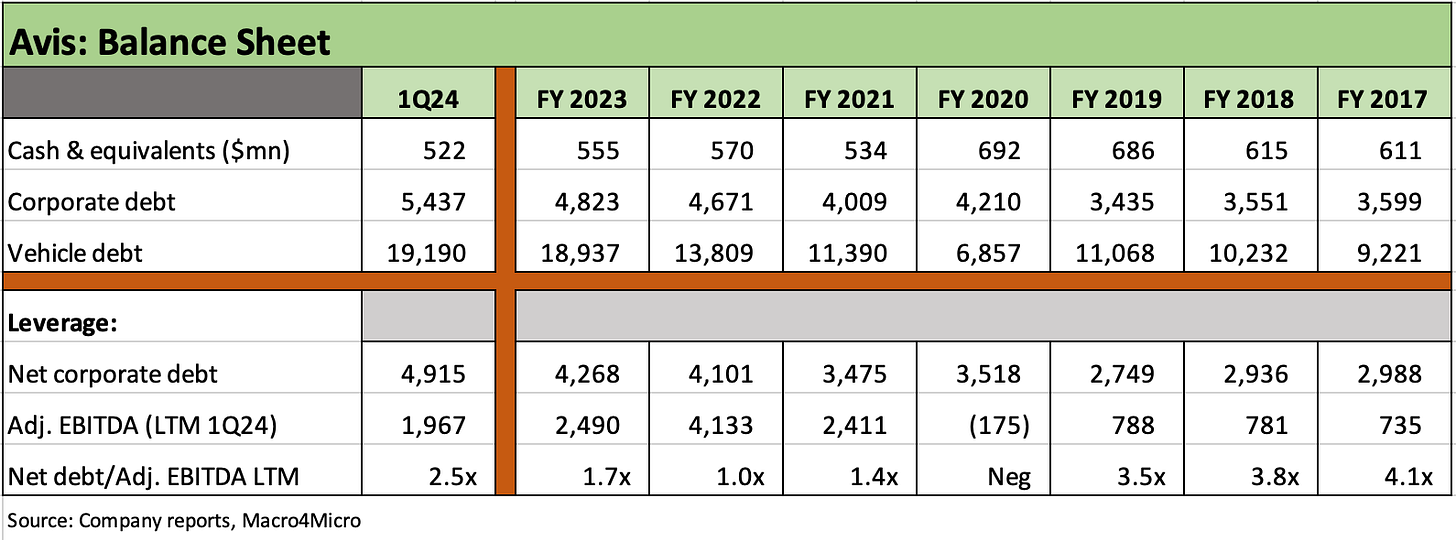

Avis has been active again in the bond markets in 2024 with a €600 million bond deal at the end of Feb 2024. Avis will always be active across the years in the vehicle funding markets whether in ABS, MTNs or in bank lines. With $5.4 bn in corporate debt and $19.2 bn in vehicle debt at 1Q24, Avis is a massive credit counterparty.

Avis has the reputation of being “the one that survived COVID” of the two major public car rental operators in the US behind #1 Enterprise as an investment grade private company. We also see investment grade SIXT of Germany making a push in targeted areas of the US, so there is room for more competitive pressure ahead with Avis posting a record fleet size in 2023.

Margins tell quite a story across the 2022-2023 quarters…

The above chart details the quarterly moves across 2022 and 2023, and into the most recent quarter. While 2020-2021 was a wild experience for Avis, these YoY quarterly comps across the seasonal moves in car rental highlight the dramatic swings in EBITDA margins.

The profit volatility was heavily driven by the turbulence in the vehicle markets from the price of new vehicles through the remarketing stage and how that flows into the exposure of car rental to residual value risk. We cover the “depreciation” X factor in the operating metrics details in a separate chart further below.

We have seen more than our share of weak numbers and bottom-line losses for car rental companies in 1Q periods in the past. That is when volumes are typically lightest, and the car rental fleets are in the fleet building process to peak fleet size by midyear when the travel season accelerates into the dominant earnings quarter of the 3Q period.

As an example of 1Q periods before the wave of COVID-driven used car distortions, we saw net losses for each 1Q period from 1Q15 through 1Q19. The reality in the car rental business is that over half of EBITDA is typically generated in the summer peak travel (and peak driving) period.

The bottom lines of the quarters detailed above from 1Q22 through 1Q24 have seen some impressive distortions and atypical seasonal patterns over the last few years dictated by material changes in the used car markets. That ran from unprecedented used car inflation to what is now mild deflation (see CarMax FY 2024: Secular Neutral? Or Cyclical Gear Shift? 4-16-24).

Vehicle depreciation as a cash expense was an acquired taste to get used to for many investors as Hertz got so much focus during its meltdown in 2020. For those new to car rental quirks, the definition of EBITDA in car rental (including in financing agreements) does not add back vehicle depreciation – only non-vehicle depreciation. That cost of a vehicle needs to generate a healthy return on the price paid net of the proceeds (thus a cash expense).

The above chart breaks out the quarterly segment results with the margins squeezed in the Americas segment by the rise in vehicle costs in both depreciation and financing. We see that the Americas revenue is over 3.5x the International segment.

The range of margin performance has been extraordinary in the post-COVID cycle. In separate commentaries, we will do more detailed lookbacks to the pre-COVID years, but for this quarterly update we will stick with the narrower income statement timeline across quarters.

The margin moves across the quarters from 1Q22 to 1Q24 are heavily influenced by the cost of vehicles, the rate of depreciation, and the ability of Avis to flow that through into pricing (Revenue per Day, RPD). For those new to car rental, it is worth keeping in mind that Avis and Hertz are like two companies in one. The main business is an asset-lite, tech-centric, car rental service operation that rents to drivers in the leisure and corporate customer sectors. The other business is a fleet ownership/funding operation that leases cars to the car rental part of the operation.

While it is one consolidated company, when fleet costs rise in vehicle acquisition (purchasing from the OEMs) and interest costs (ABS, MTNs, banks, etc.), those costs need to be recaptured down the chain by the rental service operation with an economic return (profit margin) on that business.

The profit margin challenge will return now as costs normalized and the battle for market share plays out. EBITDA margins for Hertz and Avis were always at a distinct haircut to those at Enterprise, and that gave hope to the legacy Avis and Hertz holders that they would see high teen EBITDA margins – someday. Hertz had forecasted 15% to 18% margins in the pre-COVID period before the margins headed in the other direction well before COVID. Avis also did not get up into that high teen area. The used car valuation boom changed the frame of reference for a few years. The challenge is now back.

Avis in the seasonal slow quarter gears up for a challenging year…

The above metrics chart tells a wild story and notably in per unit fleet costs and in the gross vehicle depreciation line. Depreciation per unit is a function of vehicle acquisition costs, the mix (model segment, price tier etc.) while the total vehicle depreciation line adds in the effect of the total fleet size.

The per unit fleet costs since 1Q22 saw a low of $62 in 1Q22 and $63 in 3Q22, and we just hit a multiyear high in 1Q24 at $317. That could easily reach $325 for the full year. The target range could trend higher to around $350 later in 2024 (2Q24, 3Q24). The 2016 to 2019 range was mid to high $200 range ($295 in 2017), but the vehicles are pricier now and cost of funding higher.

From a cost standpoint, systems and labor are pricier and the risks associated with EVs offer a new element even if that part of the fleet is small. Much of the buzz is fading in terms of grand opportunities for car rental operators. The Hertz misfire did not help.

The post-COVID period eventually flowed into a market with record demand for travel and a shortage of vehicles. The effect was high prices on cars and higher pricing to recapture the cost of those vehicles at healthy profit margins. The consumer demand was so strong relative to the available new car supply that used car prices soared (covered in the inflation headlines along the way) and drove record residuals and high gains-on-sale in the remarketing period.

We will look at that dynamic in a broader commentary on Avis and Hertz separately, but the recent effect now is the used car market is fading and material price differentials are returning to new cars vs. late model used of the same type.

The above chart shows the balance sheet leverage in good shape relative to the old days before COVID, but the running decrease in EBITDA tied to vehicle depreciation and higher vehicle costs (including financing cost flow-through) will start to normalize the EBITDA line and notably in depreciation per unit. That will in turn push leverage higher from the denominator. The days of such low unit costs in depreciation and residual gains will be dropping out of the LTM numbers. We even had vehicle losses in the 1Q24 numbers.

The LTM of $1,967 EBITDA for 1Q24 as of now is down sharply from FY 2023. The company has used a “minimum” of $1 billion in EBITDA as their threshold for what would be unacceptable to dip below. That $1 bn number is still above the pre-COVID run rates. That would imply the corporate debt numbers need to move lower or they need very strong margin performance.

Avis would not be nailed down in Q&A on the “debt reduction vs. stock buyback” tradeoff in 2024. That will come down to how the peak travel period and pricing trends play out as well as the ability to accurately frame residuals.

We saw leverage (Net corporate debt/EBITDA) push down into the 1x-handles but is now back up to 2.5x that we derived (on their earnings call, Avis cited 2.3x pro forma net of the € bond deal and related use of proceeds). Either way, leverage is heading higher with the absence of the material gains on fleet sales across the post-COVID residual value volatility. Looking back to the pre-COVID period, the current 2x-handle leverage remains quite low for “normal” markets.

See also:

CarMax FY 2024: Secular Neutral? Or Cyclical Gear Shift? 4-16-24

Avis: Credit Profile 8-3-23

Avis: Cash Flow Boom and the Swing in Car Rental 2-17-23

Not Your Father's Hertz 2-17-23