Automotive: Comparative Performance for Auto Retail, Auto OEMs, and Suppliers

Excerpt from Footnotes and Flashbacks: Week Ending April 2, 2023

The chart below is the first of three that look at the major automotive subsectors from Auto Retail to the OEMs and the peer group of major suppliers. We line up the companies from highest to lowest total returns during 1Q23.The franchise auto retailers have performed quite well in 1Q23 as production volumes were expected to pick up pace after all the supplier chain problems. Some also took share in used cars back from Carvana and CarMax on the increased trade-in volumes of used cars that come with higher new car sales. Those also feed F&I profits.

The dealers were among the names hit hard this past month after such a heady run over multiple trailing time horizons across 3 months and 6 months. The industry and the investor base are still sorting out the risks in the auto cycle after such a wild period of supplier chain disruptions and the distortions in new vs. used car pricing (see Market Menagerie: The Used Car Microcosm 11-29-22). Used car giant and incumbent player CarMax has been a material underperformer while Carvana has been operating in a world of its own after the plunge in its stock price. CVNA stock was irrationally priced during 2020-2021 (see Carvana: Prisoner’s Dilemma, Used Car Getaway 3-22-23, Carvana: Credit Profile 3-5-23, Carvana: Wax Wheels 12-8-22) and now is bouncing around single digits after a $370 high.

We still see the optimism around franchised dealers as well founded after what in essence was a recession-level volume during the supply chain problems of 2021-2022. The auto dealers will be beneficiaries of record payroll levels and rising wages and the ability to sustain strong numbers in F&I products (finance, insurance, warrantees, etc.) and Parts and Services operations are still supportive.

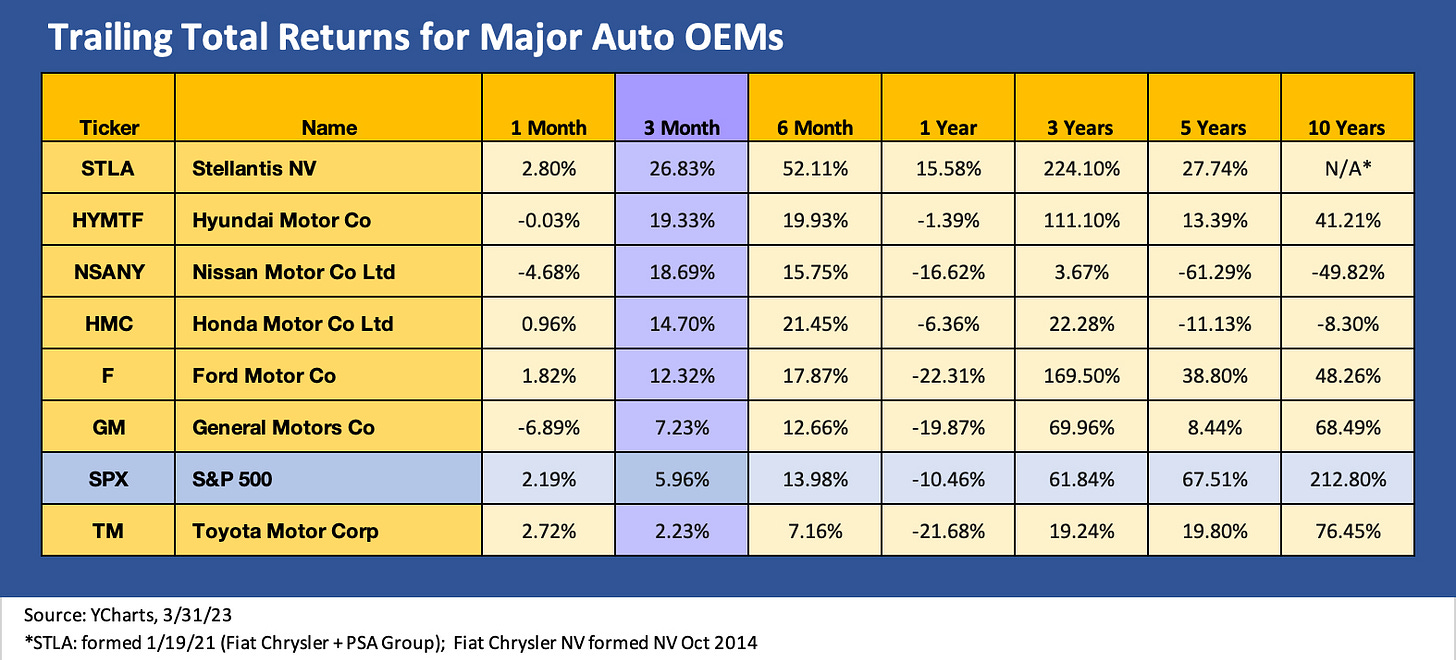

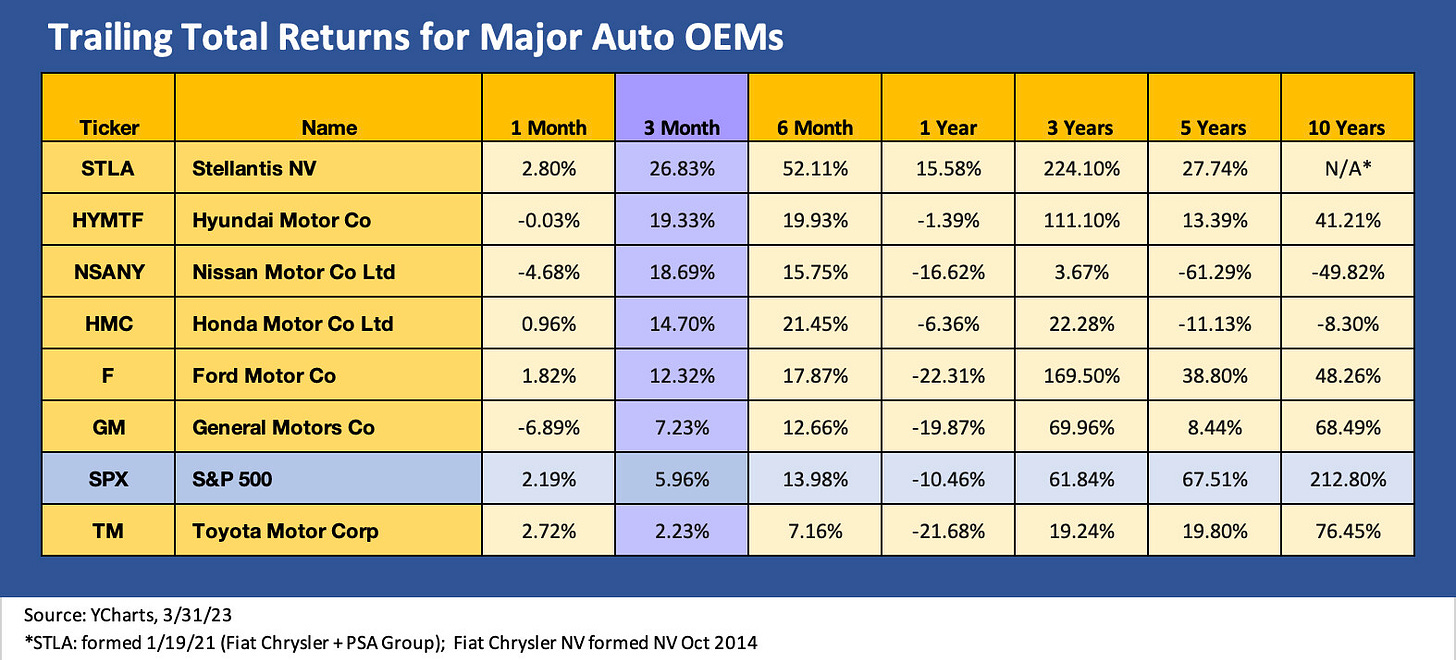

The above chart lines up the major Auto OEMs in descending order of total returns for the 1Q23 period. Autos have been a material outperformer through the first quarter as optimism around jobs, wages, and consumer credit availability for new vehicles. That combines with easing supplier chain stress. That in turn drives optimism on volumes and high average transaction prices. We see only Toyota lagging the S&P 500 in 3-month performance. Stellantis has been the clear outperformer with Hyundai also a solid winner looking back across more time horizons.

There will be a slew of factors to sort through in 2023 from balance sheet questions to the high rate of spending on the process of transitioning from ICE to EVs. Then there is the capex that will not bring profitability from the emerging technologies for some OEMs potentially for years. There will be the material cost question, strategic production planning, and the same supplier chain risks but with higher stakes if geopolitics turn uglier on the China front. The need to do more deep dives on the EV side of the ledger will only become more pressing as those business lines see some more disclosure as we recently saw with Ford.

The above chart shows the peer group of major Auto Suppliers. We line them up in descending order of total return based on 1Q23 performance. These are volume sensitive companies that have struggled through the supplier chain crisis and recession level production rates tied to chips and COVID disruptions. Some could be more adversely affected than others by trade conflict with China (e.g., Aptiv).

The more tech-based higher margin operations run very different risks and financial profiles than more traditional ICE products that could be vulnerable to obsolescence risk over time. To the extent OE suppliers are investing heavily to serve the EV market, the capex demands could clash with the low initial returns and negative cash flow tied to such growth markets.

The analysis of these names cuts across a range of variables from the markets served (e.g., light vehicles vs. commercial vehicles), the OEM customer mix, the relative value added and pricing power of the product mix, and the exposure to emerging technologies and EVs (including who will see volume declines on diminished demand for traditional ICE products). As you look back across 5 years and 10 years, the struggles of some of the issuers are very apparent.

We see some of the usual suspects near the top (Autoliv, BorgWarner, Visteon, Aptiv) and also some traditionally strong players that delivered a bad quarter (Magna). The operating profiles of these companies and their convoluted histories (spin-offs, mergers, post-bankruptcy evolutions, etc.) take a lot of trench work. We will be working on more of them with stand-alone research as the spring selling season unfolds and quarterly earnings season rolls out.