Footnotes & Flashbacks: State of Yields 3-3-24

We look at a modest UST rally week after a mixed set of econ releases keeps the debate on whether to cut in 1H24 very much alive.

The market saw another mild UST rally as PCE inflation had enough in the mix of numbers to calm nerves but not enough to change the moving parts debate with JOLTS and payroll due this week with some side orders of Services ISM, Powell on the speech circuit, and trade flows among other items.

The UST deltas are still working against the UST bulls YTD but remain materially tighter than the Oct 2023 peaks.

There is still no hiding from the UST inversion across UST curve segments, and we take a closer look at the 2Y to 30Y this week with a long-term history and shorter-term zoom-in.

Spreads widened on the week as HY spreads are materially tighter over the trailing month even as IG is quiet in a tight range with both HY and IG OAS more in line with past credit cycle peaks.

The above chart frames the downshift in UST deltas from the highs of the third week of Oct 2023 through this past week. We plot the curve and the changes across the curve in the embedded box.

The second UST curve delta line details the partial retracement of the UST curve YTD with the 2Y to 30Y shifting around 31 bps higher and delivering a setback for duration returns. The result has been negative for bond benchmarks and ETFs during 2024, but the past week saw a modest UST rally supporting bond returns (see Footnotes & Flashbacks: Asset Returns 3-3-24).

The above chart updates the running moves in the UST curve since March 2022 when ZIRP came to an end. We include a memory box detailing the Fed hikes along the journey. The handicapping drill continues on the timing and magnitude of cuts, and the odds of near term cuts keep declining from where they were earlier in the year.

The above chart plots the UST deltas for the week with sharper moves in 2Y and 3Y with double digits in the 5Y as well in driving a modest bull steepener from the front end.

The above chart offers another angle on the bull flattener since the Oct 19 peak on the 10Y UST. We see a pronounced shift lower from 5Y to 30Y with smaller moves in the 1Y and 2Y UST.

The above chart updates the YTD visual on the UST deltas as the market wrestles with a net positive balance of fundamental economic releases around the consumer sector with consumption supported by higher income and record payroll levels each month even as the overall inflation metrics improve and most notably YoY metrics.

The PCE numbers this past week (see links at bottom) were mixed with MoM not helpful and Services inflation stubborn but with YoY headline PCE and Core PCE both posting 2% handles. Consumers were in check and real DPI and PCE in alignment at lower numbers.

CPI trends ex-Shelter have also been supportive of the lower inflation theme with Shelter (notably Owners’ Equivalent Rent) having more than a few methodology questions worth applying an asterisk. Goods inflation (and deflation) is helping inflation confidence relative to Services in both PCE as well as CPI.

Meanwhile, the manufacturing numbers in releases such as ISM and Durable Goods are not signaling pricing power or strong fundamentals broadly (see Durable Goods: Forced Landing 2-27-24). Manufacturing is not telling a story of contraction either in our view. It goes into the “muddled” bucket.

The above chart breaks out the UST curve and mortgage rates of the housing bubble era and frames those vs. the past week. 2005 was the peak homebuilding year and mid-2006 started to show some signs of RMBS insanity.

We saw the Freddie Mac benchmark 30Y mortgage rate move slightly higher this past week closer to the 7% line and that has continued to be a headwind for affordability. That mortgage pressure has kept existing home sales inventory low and been a blessing for the builders (see Existing Home Sales Jan 2024: High End Climbing, Low End Stagnant 2-22-24). We cover those topics extensively in our housing research and single name work.

The above chart updates the running index YTW for the IG and HY indexes. We break out the long term medians and some key time segments along the trail from the TMT years through this past week. Spreads widened slightly this past week for both IG and HY while the UST shifted modestly lower.

The current 7.86% in HY is well below the pre-crisis median of 9.3% before ZIRP moved the all-in yields materially lower. For IG, the pre-ZIRP median of 6.1% is the more relevant benchmark to frame against the current 5.4%.

The above chart frames current UST curve and IG index yields to end last week with those posted in the credit market peaks of late 1997 and mid-2007. The past week in IG widened modestly to +101 bps and 5.40%.

That +101 bps OAS to end last week is near the levels seen at the end of June 2007 but is wide to the +93 bps average of 1H04 to 1H07. The 1H07 period averaged +86 bps.

For a memory jogger, the all-time low for IG was +53 bps in Oct 1997 before reaching +70 bps at the end of 1997 and averaging +95 bps for 1997-1998. These spread levels can last based on recent history and the starvation for yield. Asset allocation trends we see in the market favor strong demand for current coupons and new money issuance as refinancing unfolds. The demand side favors resilience in IG spreads barring major market “events.”

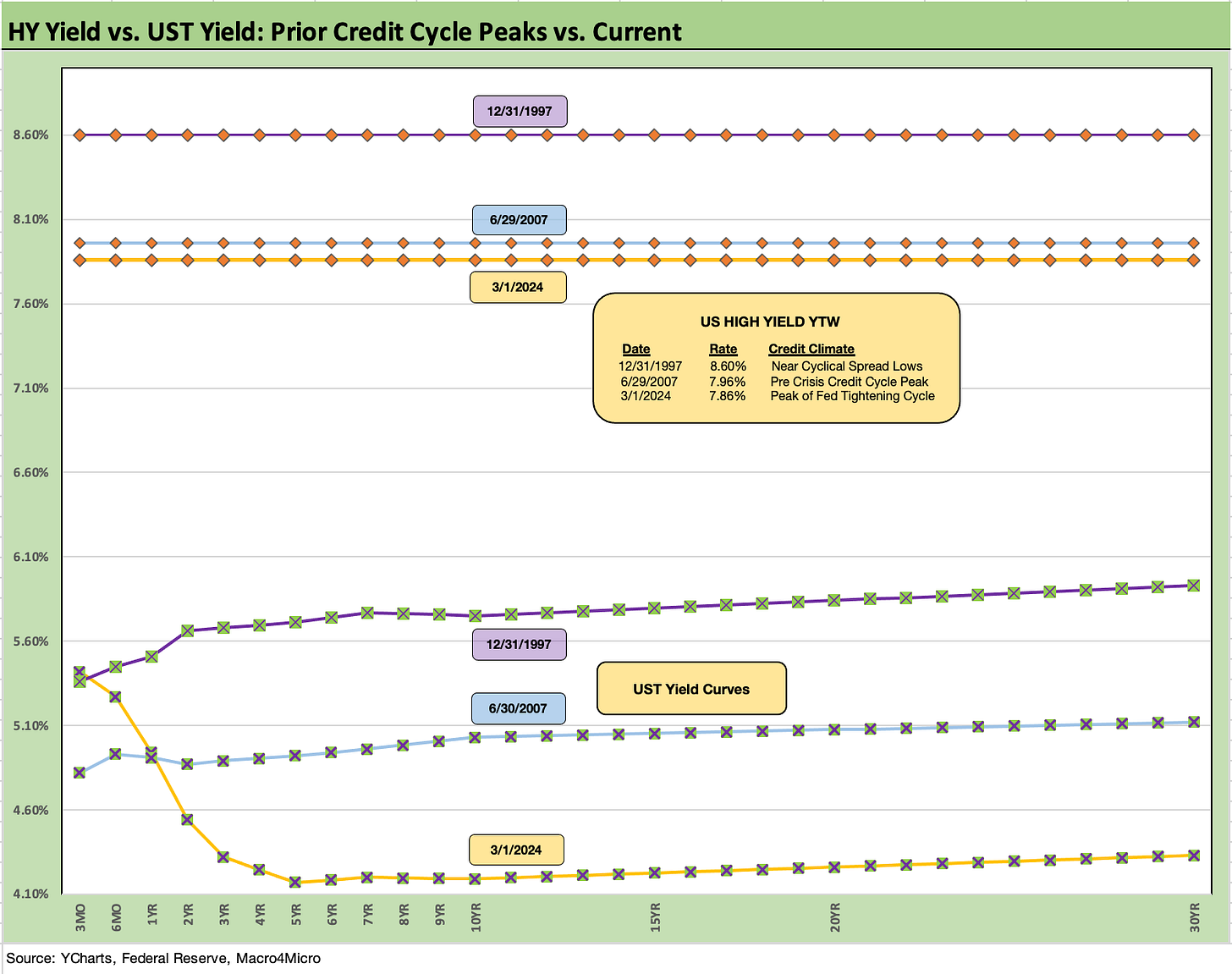

The above chart does the same routine for HY that we did for IG. We frame the recent HY index yield to end last week against the 2007 credit bubble and 1997 credit market peak. Current all-in yields for US HY are lower than 1997 and 2007 on a materially lower UST curve but with spreads wider today than the sub-250 bps lows of June 2007 and Oct 1997.

The +9 bps OAS widening last week to +332 bps is below the June 2014 lows of +335 bps (6-23-14) but above the Oct 2018 lows of +316 bps (10-3-18). For a read on the sustainability of low spreads, consider the +270 bps average of 2H97 and +298 bps in 1H98. That will tie into the no landing school vs. the recession setbacks that can also be war gamed out (trade wars, oil spike, political stupidity and dysfunction, policy train wrecks, etc.).

We do a more detailed review of HY spread histories in the 2023 recap (see Footnotes & Flashbacks: State of Yields 1-1-24) and in the links below covering quality spread histories.

The above chart plots the long-term 2Y to 30Y slopes. The peak inversion of -117 bps in March 2023 is now down to -21 bps vs. a long-term median that is upward sloping at +127 bps. This UST curve is a long way from normal but also with low absolute levels of rates in the context of prior periods of high inflation and notably during the early 1980s.

The above chart zeroes in on a shorter-term timeline from the start of 2021 as the inflation forces were rattling the pricing cage on shortages, supply-demand dislocations and the lingering effects of tariffs. The shorter timeline from the start of 2021 has a +2 bps median after a peak of +229 bps in March 2021 on the way to an inversion of -117 bps in March 2023.

We wrap with our usual timeline chart that plots the deltas from March 1, 2022. We also include visuals for a peak (10-19-23) when the 10Y UST hit a max and frame that all vs. a Dec 31, 2020 UST curve. The box in the chart breaks out the UST deltas and the bear inversion that played out over time from 3M UST to long dated maturities.

The battle continues over whether the Fed will ease at all in 1H24. We have the mindset that every inflation release (CPI, PPI, PCE) each month is a key one and the same for jobs and important signals on consumption (esp. Retail Sales, Income and Outlays in the PCE release) and the manufacturing sectors (Industrial Production, Durables).

The FOMC meeting this month comes with a fresh round of forecasts and a new dot plot, so the adventure continues. An early spring set of numbers on autos and homebuilding are important signals given the multiplier effects in those industries.

We are working on the historical theory that the FOMC will want to avoid repeating that – as in history. The mid-1970s will loom large in the econ history books. The FOMC does not want to ease prematurely and make a big mistake by needing to retrace their steps. That did not work so well the first time.

See also:

Footnotes & Flashbacks: Asset Returns 3-3-24

Inflation Gut Check Jan 2024: PCE Prices, Income, and Outlays Help the Story 2-29-24

4Q23 GDP: Second Estimate, Moving Parts 2-28-24

Durable Goods: Forced Landing 2-27-24

New Home Sales Jan 2024: Sales Steady, Prices Resilient but Softening 2-26-24

Existing Home Sales Jan 2024: High End Climbing, Low End Stagnant 2-22-24

BB vs. CCC: Quality Spread Differentials, Yield Relationships, Relative Returns 2-20-24

Housing Starts Jan 2024; Slow…Curve Ahead? 2-16-24

Industrial Production: Capacity Utilization Limps Along 2-15-24

Retail Sales Jan 2024: Balancing Act Continues 2-15-24

Jan 2024 CPI: The Big 5, Add-ons, and Favorite “CPI-ex” Indexes 2-13-24

Trade Flows 2023: Trade Partners, Imports/Exports, and Deficits in a Troubled World 2-10-24

Fed Funds vs. PCE Inflation: Peaks and Valleys Across Time 2-7-23

HY vs. IG: Quality Spread Differentials and Comparative Returns 2-6-24

BBB vs. BB: Revisiting the Speculative Grade Divide Differentials 2-5-24

Payroll Jan 2024: Big Swing 2-2-24

Productivity: Takes the Edge off the 4% Handle YoY ECI 2-1-24